Peloton (PTON) was the big market mover yesterday but for the wrong reasons. The stock closed the day down 14.56% from an opening price of $97.75 to a closing price of $82.62. Shedding $4 Billion in market value in a single day of trading.

The cause of this was a recall of Peloton’s TR02 Treadmills, and Tread+ machines. The latter is not sold in Canada. The recall has been issued after reported injuries and the death of a child back in March 18/2021.

“I want to be clear, Peloton made a mistake in our initial response to the Consumer Product Safety Commission’s request that we recall the Tread+,” CEO John Foley said in a statement Wednesday. “We should have engaged more productively with them from the outset. For that, I apologize.”

The recall will affect 5,513 TR02 units purchased in Canada, and 125,000 Tread+ and around 1,050 Tread products in the US.

Peloton stock is set to be another big mover tomorrow. Peloton reported in 2020 revenue of $1.8 billion, up from $915 million a year earlier. The company is set to report earnings after the market close on today.

Some analysts expect earnings to take a hit, but the growth projection is still positive.

“We acknowledge that this recall will likely result in significant near-term one time financial costs and operational disruption, with potential reputational damage,” Truist Securities analyst Youssef Squali said in a note to clients. “Stepping back and looking at the broader picture, however, we believe that the secular growth trends in the home fitness industry remain intact.”

Home fitness trend remains the key. With lockdowns and gyms being closed, people searched for ways and equipment to workout at home. Peloton was one of the darling stocks of 2020. A gainer of 400% for that year, hitting record highs of $171.09, and a market cap of $49 Billion. 2021 is a different story, with the stock down over 45% year to date.

Does this continue? With a recall, will you now start going back to gyms with the vaccine rollout and gyms re-opening? Or do you buy another Peloton product? Their marketing is definitely top tier. I see Peloton commercials on TV and Youtube. Some analysts even attribute this to their success.

“We view this as another sign that Peloton’s voice and platform grew faster than its business, and it is still working to grow into its fame,” BMO Capital Markets analyst Simeon Siegel said in a note to clients. “With a still ~$30 billion market cap … Peloton’s market value looms much larger than its expected results.”

“We believe one can argue more of Peloton’s market value has been created by its marketing department than by its engineers or instructors,” Siegel said.

Technical Tactics

This is where things get interesting. If you are a member of our free Discord trading room, you were given a heads up on this weeks ago. I did not foretell a recall, but the chart was indicating a drop.

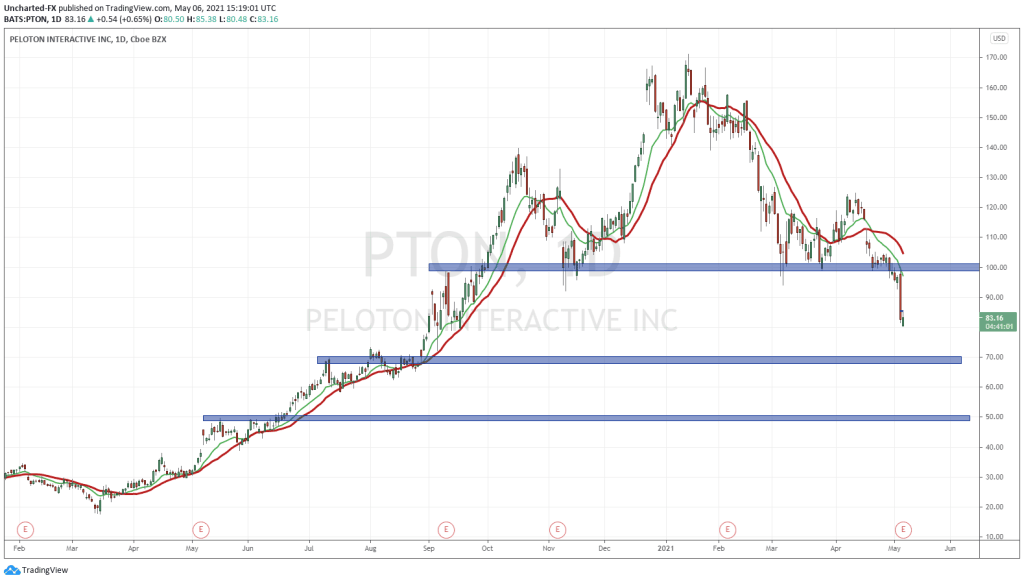

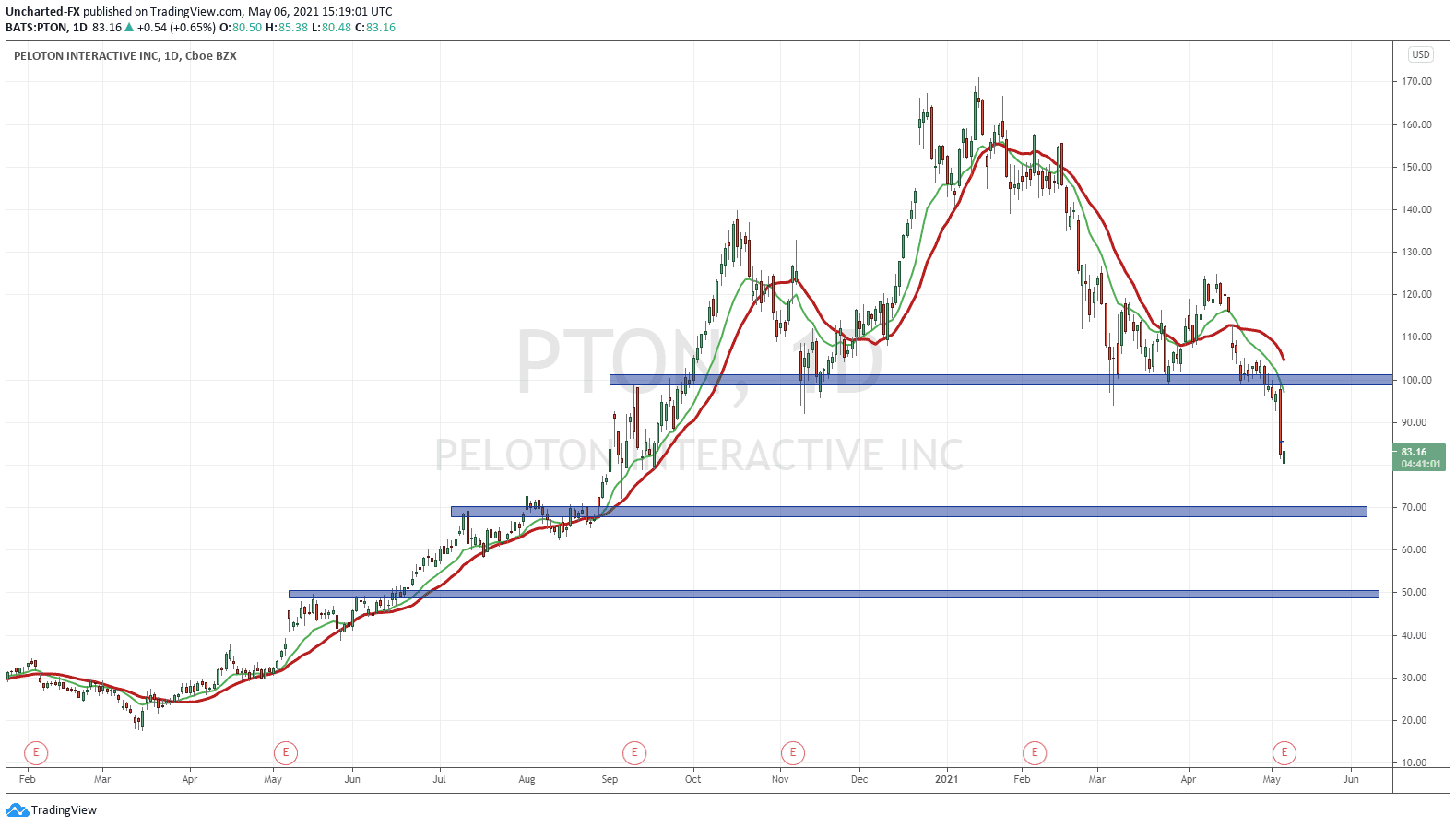

A broad head and shoulders pattern, with the neckline, or support, at the psychologically important $100 level. We did break down below it a few days BEFORE the recall announcement. Price remained below $100 before tanking on the news. Meets all the requirements of a typical breakdown and retest continuation.

In order for the downtrend to nullify, we would NEED to close back above $100. Otherwise…it’s not looking too good for PTON on a technical standing.

My support target to the downside is $70.00. If that level breaks, then $50.00 becomes the next support. There is some interim support here at $79.80, where we just bounced from, but I like targeting flip zones. These are areas which have been both support and resistance in the past. If you have a tough time finding these zones, change your chart to a line chart and just find points that have the most touches. Three or more touches is what I look for.

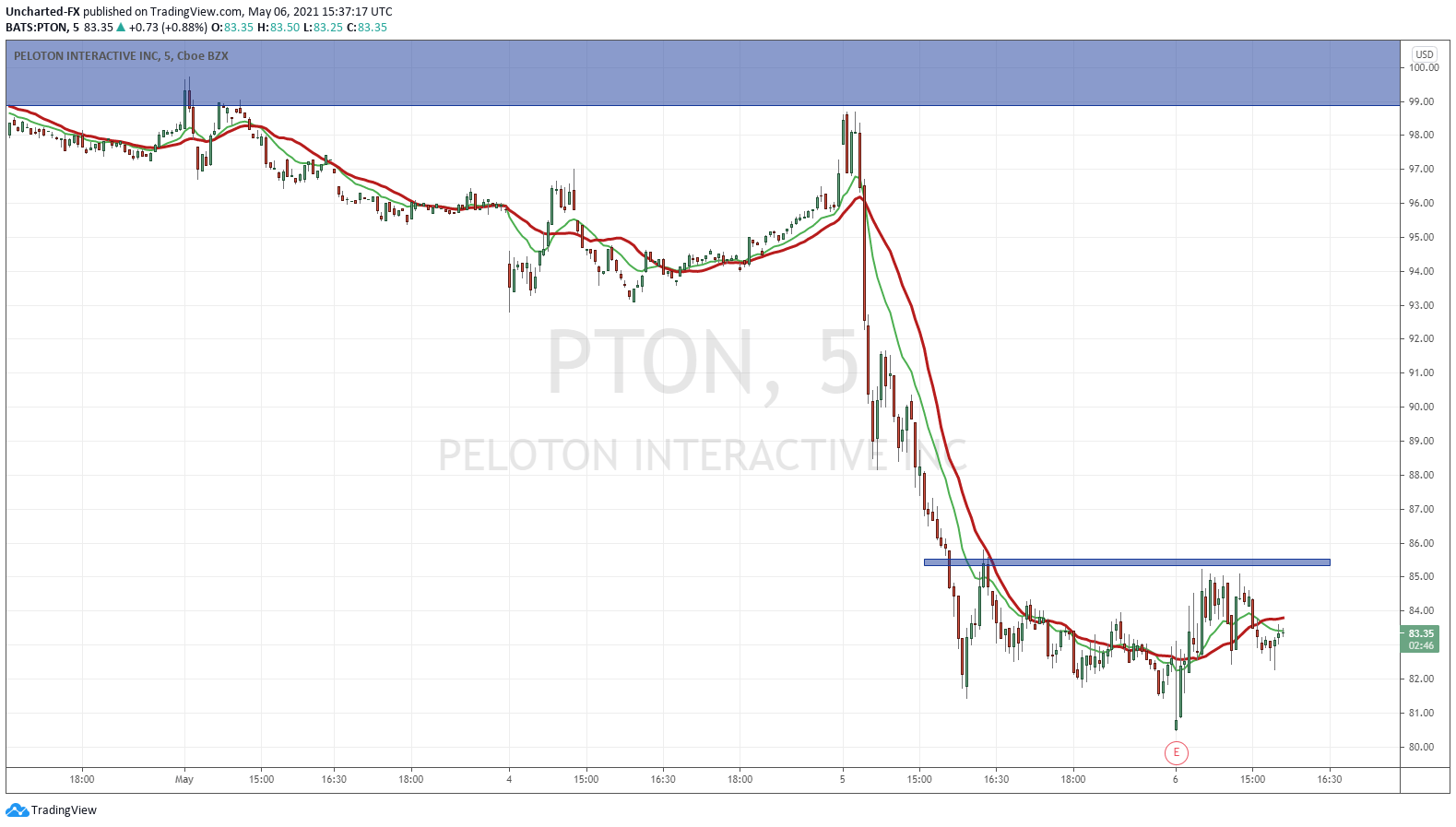

With earnings coming out, PTON stock will see some wild volatility. Especially with the market pricing in forward guidance due to the recalls. An earnings surprise may cause the stock to pop, and funnily enough, the intraday price action is showing signs of a bounce.

We seem to be bottoming around $81-85. Building a nice base for a potential launch higher. We want to break and close above $85.50 (my blue level drawn) for this move to trigger.

Once again, this is just an intraday trade. The daily chart shows the long term trend. $100 is still the key level. Any pop higher can potentially be sold off to create a lower high on the daily chart. This is expected in downtrend moves as nothing just moves up or down in a straight line.