We’re number 1! We’re number 1! Yes that’s right! The Bank of Canada (BoC) becomes the first central bank to signal an exit from stimulus, and have begun tapering. Although the Bank of Canada rate decision and press conference does not get as much attention as the Federal Reserve, yesterday’s announcement was big and took the markets and many, including me, by surprise.

These were the major points from the Bank of Canada Interest rate decision:

-Bank of Canada maintains overnight lending rate at 0.25%

-Raises GDP growth target to 6.5% for this year

-Pulls forward interest rate increase guidance to 2nd half 2022

-Reduces bond buying to $3 billion per week

The first part, maintaining overnight lending rates at 0.25% was expected. No surprise there. Even though Bank Governor Tiff Macklem, reassured us that interest rates will be low for a very long time, a revision of policy is in the works.

A strong recovery is expected. Like a stunning 6.5% recovery in the Canadian economy by the end of this year strong. This will occur due to government stimulus, and from consumer demand. The BoC believes there are indications that the underlying foundation of the Canadian economy remained resilient during the pandemic and thus the central bank is scaling back on monetary policy.

In terms of interest rates, a stronger economy hints to inflation which then points to interest rate hikes. The kicker is that interest rates will rise sooner rather than later. Second half of 2022.

“We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the two per cent inflation target is sustainably achieved,” the Bank of Canada said in its Wednesday statement. “Based on the bank’s latest projection, this is now expected to happen some time in the second half of 2022.

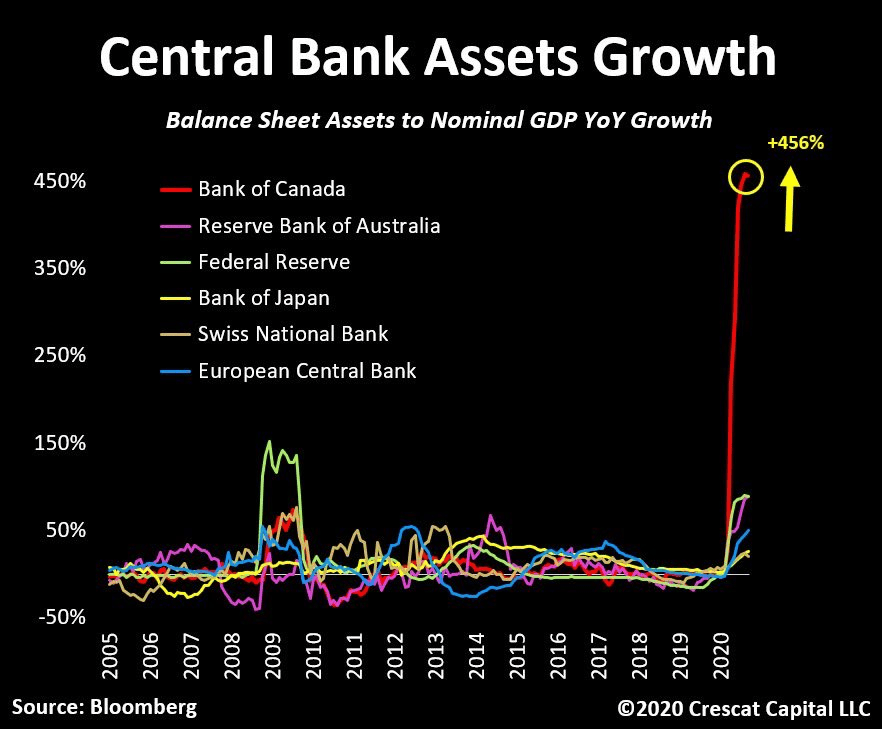

One of the biggest surprise was the tapering, or scaling back, of the bond buying purchasing program from $4 Billion to $3 Billion per week. This caught some analysts off guard because purchasing bonds is a way to keep interest rates suppressed lower. Hinting towards an increased probability of a rate hike next year.

Scaling back bond purchases — this time from $4 billion to $3 billion a week — tends to affect longer-term rates, while a hike in the Bank of Canada’s overnight rate affects variable mortgages and things like lines of credit. While the bank did not officially announce an increase in so many words, ending a commitment to hold rates down was seen by economists and financial reporters as exactly that.

This comes at a time when the Federal Reserve continues to maintain their $120 Billion a month asset purchasing program ($80 Billion going to buy bonds), and just last night, the European Central Bank pledged to keep their purchasing program at 1.85 Trillion Euros ($2.2 Trillion) until March 2022.

What are my thoughts on all of this?

There have been a few analysts predicting this because of RISING Oil prices. Canada still is mainly a commodity exporter, and rising Oil prices would put pressure on the BoC to hike interest rates. My readers know that I have hypothesized that central banks may mask inflation from money printing with rising oil prices.

The big uncertainty is whether another Covid wave forces more lockdowns even with vaccinations. This is not something to scoff at since we have seen fresh lockdowns in parts of Europe, a new state of emergency in Japan, and have heard today that India got a record 300,000 virus infections in one day.

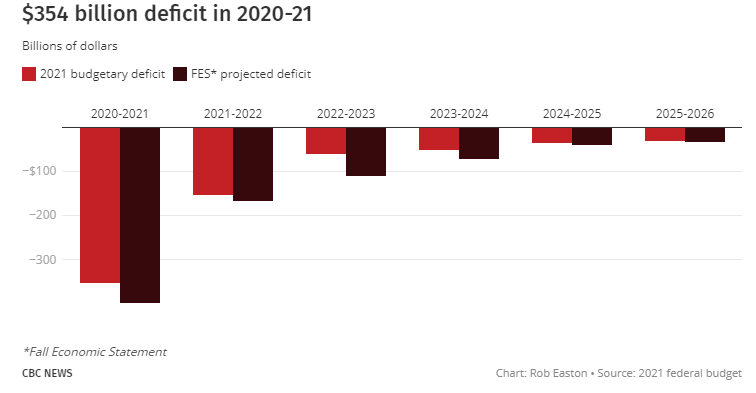

The big kicker for me is the government fiscal policies. The newly unveiled Federal Budget has many people worrying about the future of the country. Increased taxes to pay it off.

The first federal budget document in two years is enormous — at 739 pages — and staggering in scope. It reveals that, over the past year, Canada ran up a deficit of $354.2 billion and plans to follow that up next year with a reduced deficit of $154.7 billion that is supposed to gradually decline to $30.7 billion in 2025-26.

While massive, the deficit came in lower than the federal government’s $381.6 billion prediction in the Fall Economic Statement. The PBO estimated the deficit for the 2020-21 fiscal year would be $363.4 billion, while the C.D. Howe Institute forecast it at $388.7 billion.

The budget predicts federal debt will hit 51.2 per cent of GDP in 2021/22 before sliding back to 49.2 per cent of GDP by 2025/26 — lower than the $381.6 billion forecast in the Fall Economic Statement but still enough to push the country $686.1 billion further into debt between now and 2025/26.

So I ask again: Can we hike interest rates knowing the government will have a large deficit? Are we now like Europe and Japan where interest rates cannot be raised because government will have issues servicing the debt?

I don’t want to spoil the party, but I think Interest rates remain lower for a long time.

Technical Tactics

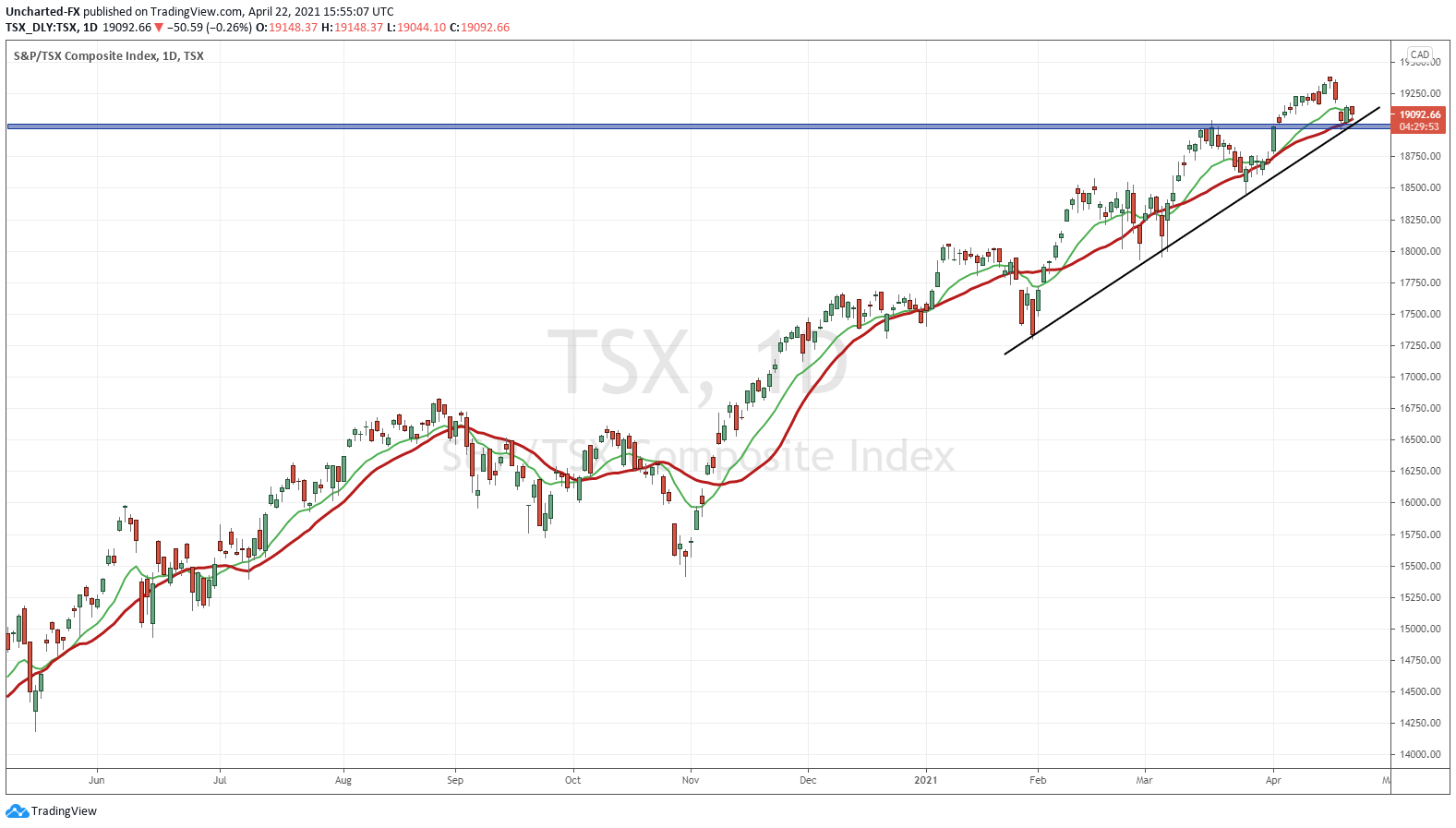

The TSX actually gained and managed to close green yesterday. Is this because it is testing a previous breakout zone as support? Or is it because the market is not putting much confidence in the BoC’s tapering and outlook of interest rates hike? With all the debt out there, I personally think it is the latter.

The uptrend maintains, and until the TSX breaks below the uptrend line and support around 19,000, more upside is in the cards.

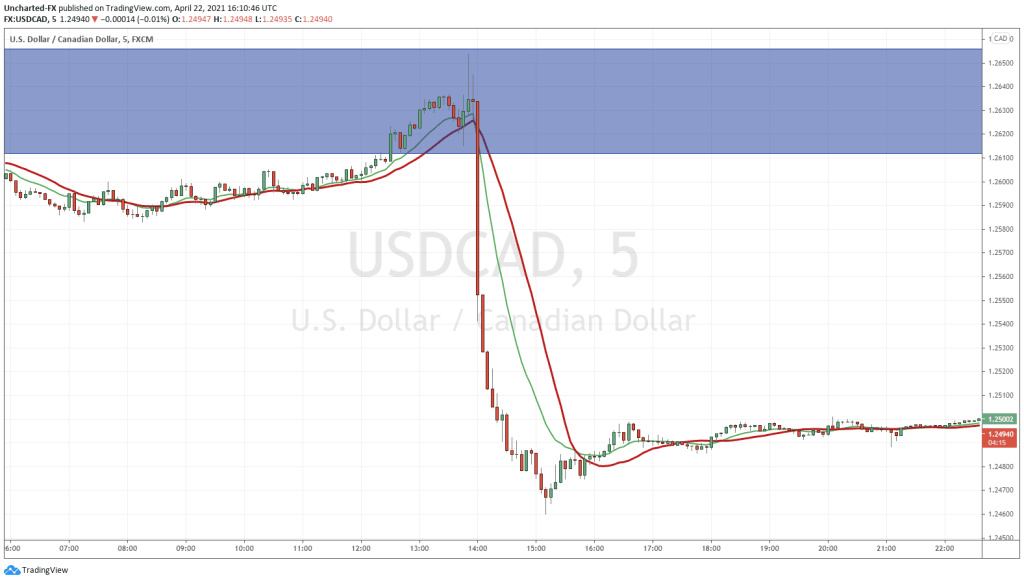

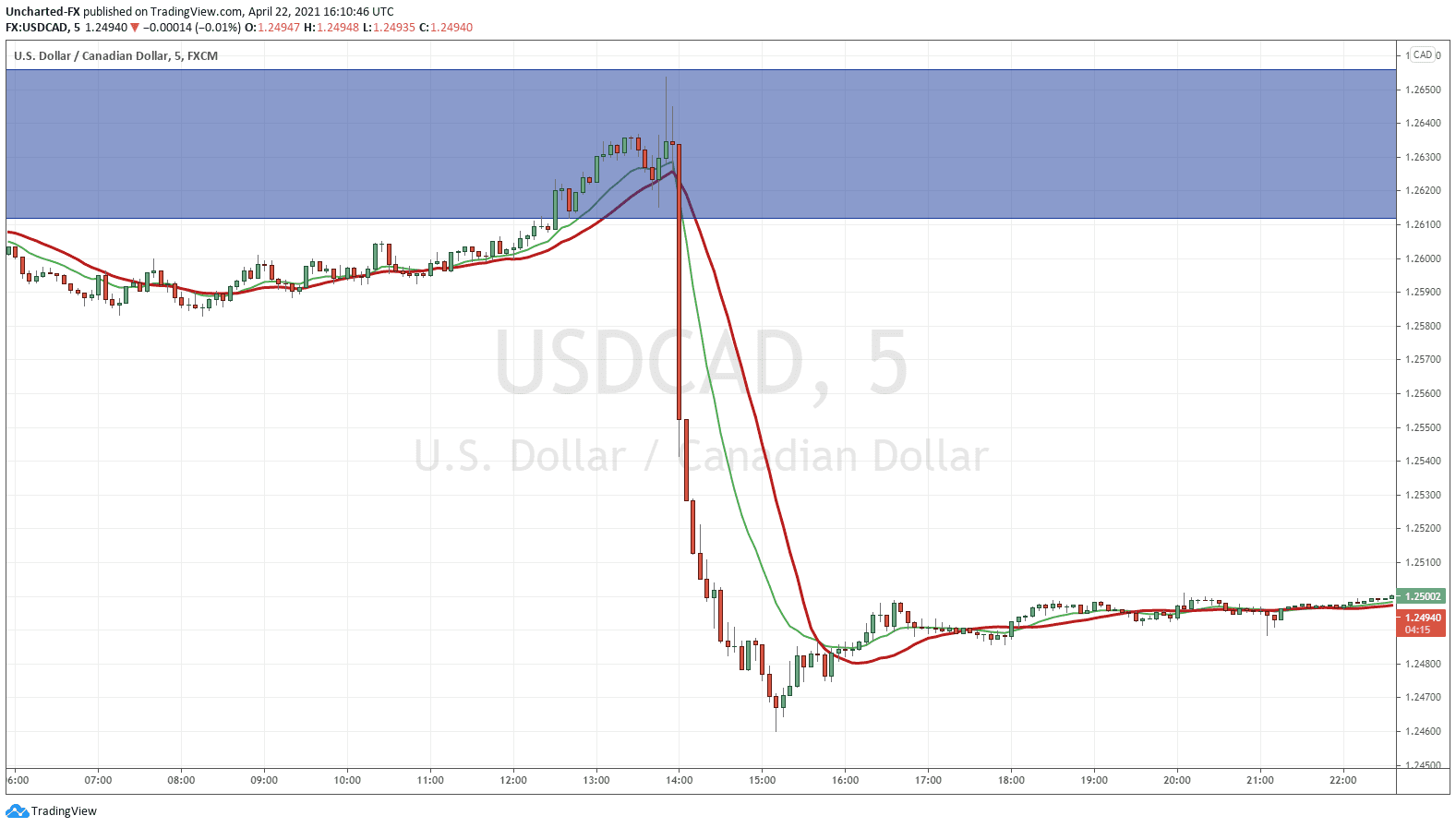

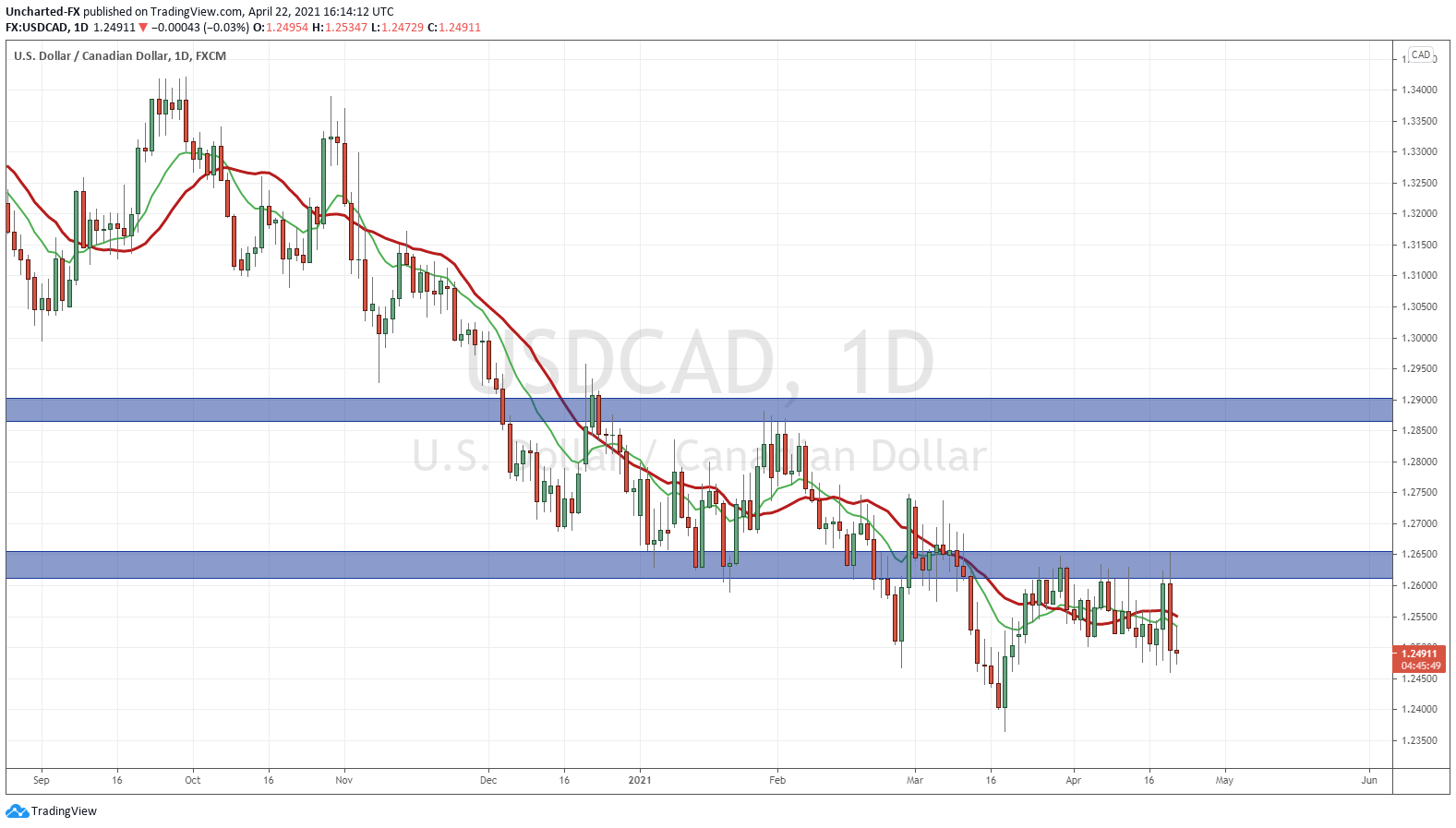

If you want to determine if Central Bank announcements surprised investors, the currency or Forex markets, are the best gauge.

The USDCAD fell (Canadian Loonie appreciating or strengthening against the US Dollar) from 1.2640 to 1.2460 in almost less than 1 hour. Money running into the Loonie after Macklem’s Hawkish statements and probabilities of a rate hike increase. Remember, this is what you expect to see. A higher interest rate is supposed to attract money flows to the currency.

Zooming out on the Loonie, we see it dropped after testing a resistance (price ceiling) zone at the 1.2650 zone. No more momentum today. We would expect more Loonie strength if the BoC is the first central bank to taper.

I have spoken about the currency war going on between the central banks. All want a weaker currency to boost exports and inflation. When all central banks are undertaking this policy, which currency would you rather hold?