Street cred

MindMed (MMED.NEO) announced last fall it was applying to be listed on the Nasdaq Exchange. MindMed would be the first Canadian psychedelics company listed on a major US stock exchange. Compass Pathways (CMPS.Q) was the only psychedelics company listed on the Nasdaq back in 2020.

MindMed is currently listed on Canada’s new NEO exchange, an exchange that prides itself on scrupulous regulations to weed out shady companies and trading strategies. While this a step up from some other Canadian exchanges, an uplisting to the Nasdaq would add a whole other dimension of credibility onto the company.

American investors without access to the NEO exchange are left with only one option – the OTC. Seasoned investors and sector enthusiasts aren’t usually deterred by this, they understand the end game. MindMed has big plans and the OTC is just a ladder to get to somewhere higher.

But, newer retail investors may not see it like that, those who only want to stick with the safe bet. They think of Aerotyne International when you say ‘over the counter exchange.’

If getting low-risk retail investors isn’t super sexy, Wall Street definitely is. A Nasdaq listing brings out the big guns. Compass Pathway’s 2020 Nasdaq IPO is proof Wall Street investors will bet on drugs that are federally illegal. The company’s stock jumped 71% on its first day of trading. MindMed could be round 2.

Another opportunity for those with FOMO, or, those who went in on Compass as well and saw enough gains to be thirsty again.

Requirements

The Nasdaq Exchange is the second-largest equities exchange in the world by market cap of shares traded. These companies represented $13.85 trillion in combined market cap as of May 2020, compared with $21 trillion for the New York Stock Exchange (NYSE). The Nasdaq earns around $2.5B USD in revenue per year through listing fees and market services.

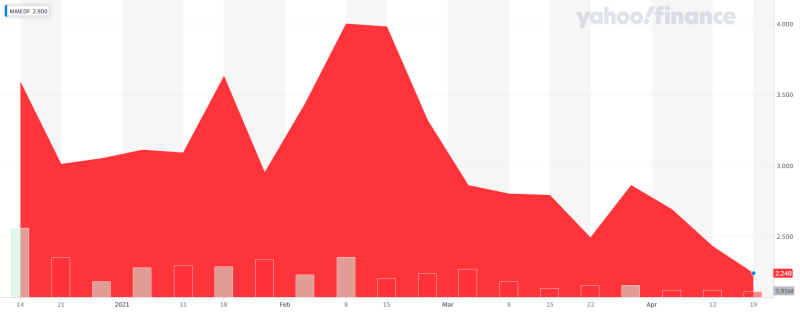

Nasdaq also has a $4.00 USD minimum bid price requirement to weed out penny stocks, MindMed is currently trading at $2.24 USD. There are exemptions for some companies which allow $2.00-$3.00 share prices. Investors are hopeful MindMed will meet them. Even if they do, the process can take 5-6 weeks for review.

There have been talks around the company doing a reverse split as a worst-case scenario. A split would increase MindMed’s share price by rolling back the number of shares outstanding and making them more valuable. $4 USD share price would make their application much more of a lock. That being said, Investors are not psyched about this option as a split is usually a sign of weakness or desperation, it could be bad PR for a company and set an ugly precedent for accomplishing company goals.

But, a reverse split isn’t dilutive so shareholder value would be unaffected, the market cap stays the same. A subsequent equity raise after the reverse-split would be dilutive.

MindMed listed on the OTC exchange in March 2020, meaning it will be eligible to be uplisted as companies need to be listed on a lower exchange for at least one year.

Nasdaq also requires a company to have at least $4M USD in assets, with MindMed’s $205M CAD cash on hand they are well within the requirements. The exchange also requires a stock to trade above $2.00 USD for 90 consecutive trading days on a lower exchange like the OTC. A milestone MindMed passed last week.

The delisting process is set in motion when a company trades for 30 consecutive business days below the $2 USD threshold. Falling below the minimum required share price, or market capitalization is one of the major factors triggering a delisting.

On March 30th the company filed its F10 security registration form with the SEC. If accepted, this would allow the company to sell shares on the Nasdaq exchange.

Some MindMed investors have grown impatient with waiting, they have also watched their stock drop quite a bit as of late. Investor forums are piling up with those same questions you always see in new and emerging markets – ‘why is the stock down?’

If this is a question you are asking as an investor, it might be an indicator that you aren’t quite ready. But even for more experienced investors, if MindMed pulls a Sean Dollinger and either bungles the process, or doesn’t get in there will be quite a fallout. A Nasdaq listing was at one point priced-in, but with a 22% drop recently that’s arguably worn off.

If all else fails they have Kevin O’Leary in their corner, so if anyone is going to aggressively push this thing to new heights via an exchange uplisting, he seems like the kind of guy I would want cracking skulls and taking names.

18-MC

Beyond the Nasdaq listing, MindMed has stayed busy. There is a lot here to be excited about.

The company’s founding asset is 18-MC, a non-hallucinogenic version of ibogaine, a psychedelic that has been used in West Africa for hundreds of years. MindMed is preparing a phase two study targeting opioid withdrawal and opioid use disorder.

The company has also acquired a 10-year exclusive rights contract to eight clinical trials exploring how LSD could help treat several mental health issues. MindMed recently acquired digital health company HealthMode, which will give the company the ability to perform remote clinical trials through wearable technology.

The preliminary data from the 18-MC Phase 1 study has shown that the drug is safe and well-tolerated at the doses tested to date, and no serious adverse events have been reported. MindMed is moving into phase 2 which is set to begin this year. If 18-MC is the breakthrough drug many are anticipating, this thing has a lot of room to run.

Thanks for using my meme! Lol.