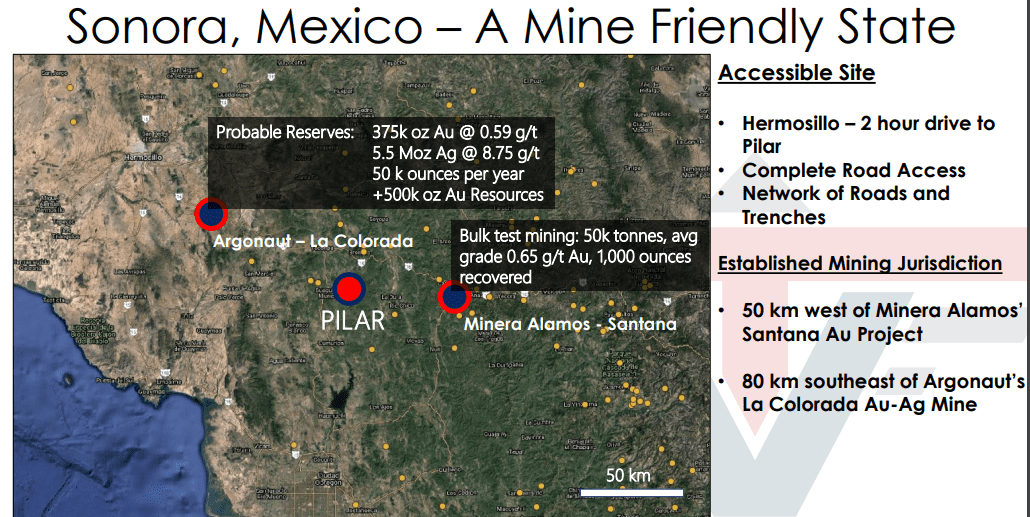

Tocvan’s (TOC.C) flagship Pilar Gold-Silver Project in the mining-friendly Sonora Gold District of Mexico is about to see a dramatic push along the exploration-development curve.

Located within the Sierra Madre Occidental geological province, Pilar is road accessible and positioned roughly 140 kilometers southeast of the city of Hermosillo.

The Sonora Gold District is steeped in the mining culture. The last time I checked it was credited with nearly 37% of Mexico’s annual gold production (the country’s largest Au contributor).

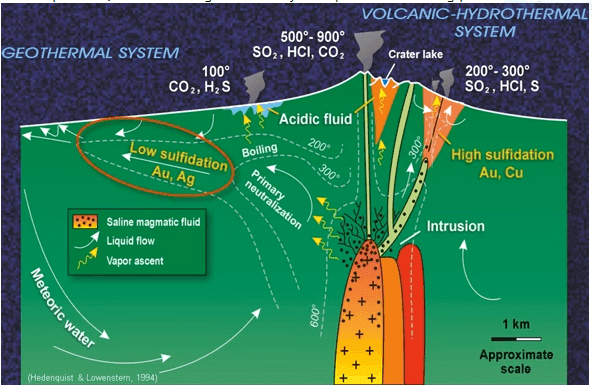

The setting at Pilar is that of a structurally controlled low-sulphidation epithermal deposit hosted in andesite and rhyolite rocks.

The mining world loves (low sulphidation) epithermal deposits due to their (often) shallow and high-grade nature.

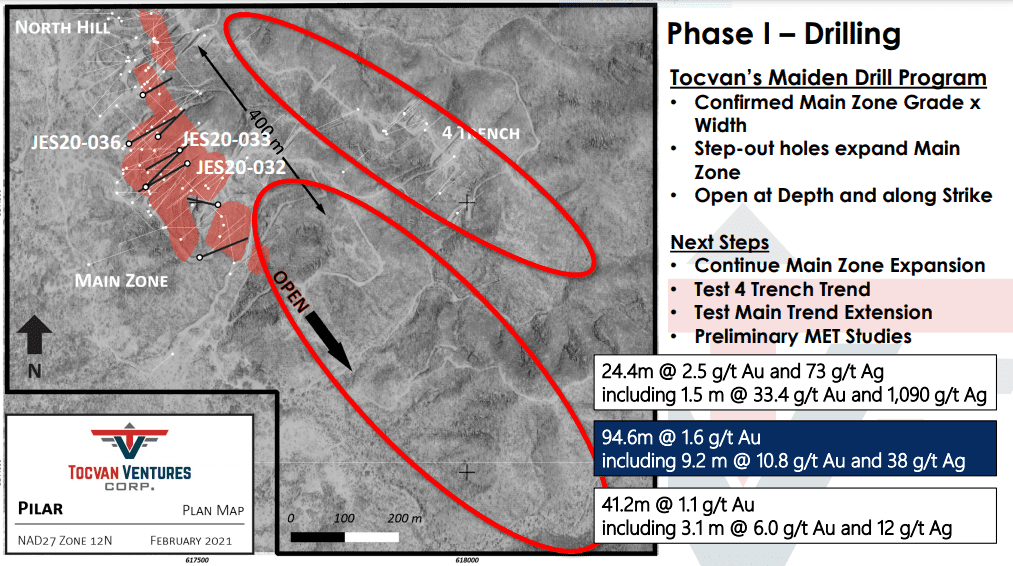

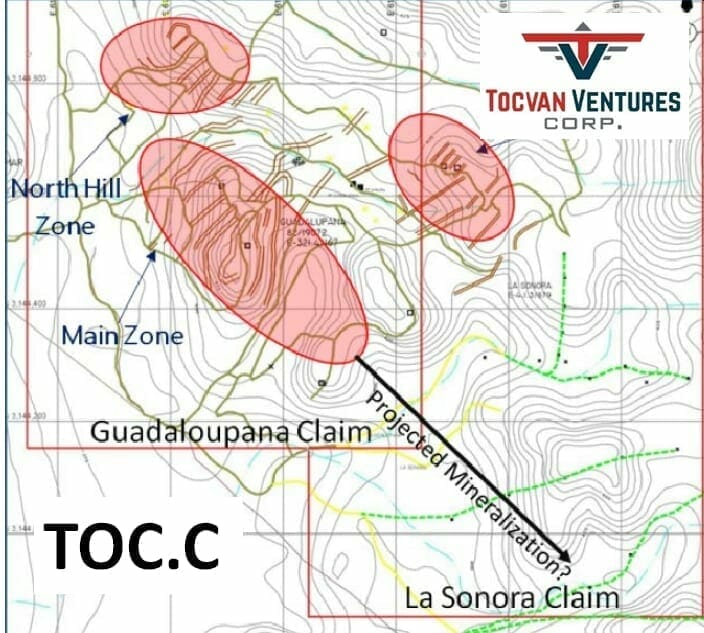

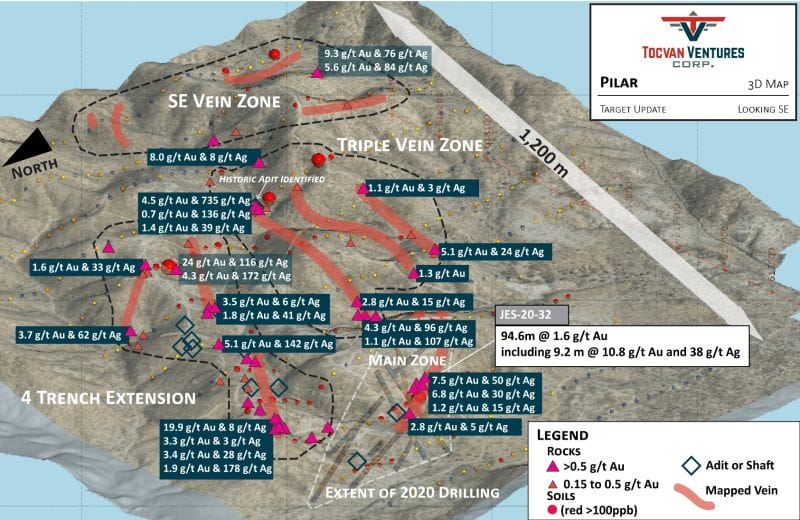

Three distinct zones of mineralization have been defined on the Pilar property to date—the Main Zone, North Hill, and 4 Trench.

These mineralized zones and structural features follow a NW-SE trend.

Over 19,200 meters of drilling—both historic and recent—have probed Pilar’s subsurface layers to date.

Highlights from a Phase-1 RC drilling campaign—all step-outs from historic drilling at the Main Zone—include:

- Hole JES-20-32 – 94.6 meters @ 1.6 g/t Au (including 9.2 meters @ 10.8 g/t Au and 38 g/t Ag);

- Hole JES-20-33 – 41.2 meters @ 1.1 g/t Au (including 3.1 meters @ 6.0g/t Au and 12 g/t Ag);

- Hole JES-20-36 – 24.4 meters @ 2.5 g/t Au and 73 g/t Ag (including 1.5 meters @ 33.4 g/t Au and 1,090 g/t Ag);

- (all lengths are drilled thicknesses)

These are some weighty hits, especially when you consider that the mineralization was encountered at shallow depths (Hole JES-20-32 was tagged at 57.9 meters).

Speaking to these Phase-1 results, Tocvan CEO Derek Wood:

“We are excited to announce the results for our first drill program at Pilar. Today’s results confirm the impressive gold and silver mineralization at Pilar is open for expansion. Planning is well underway for our next phase of drilling that will continue to expand the areas of known mineralization and test other property-wide targets, drilling deeper and farther out from our established Main Zone.”

Highlights from 17,700 meters of historic (core & RC drilling) include:

- 61.0 meters @ 0.8 g/t Au;

- 16.5 meters @ 53.5g/t Au and 53 g/t Ag;

- 13.0 meters @ 9.6 g/t Au;

- 9.0 meters @ 10.2 g/t Au and 46 g/t Ag.

“Soil and Rock sampling results from undrilled areas indicate mineralization extends towards the southeast from the Main Zone and 4-Trench Zone. Recent Surface exploration has defined three new target areas: Triple Vein Zone, SE Vein Zone and 4 Trench Extension.”

Pushing further along the curve

As the Company prepares to launch a Phase-2 drilling campaign, the application of good science—additional geochemical groundwork—is laying a more comprehensive foundation from which the drilling sequence priority will be assigned.

On April 6th, Tocvan dropped the following headline:

Here, the Company reported results from a recent surface sampling program, one designed to further home-in and prioritize targets for this next campaign…

The aim of the program was to advance key targets with no previous mapping or detailed sampling to drill ready status for a Phase II drill program scheduled to begin in April. A total of 207 rock chip samples were collected covering the entire property.

Sampling at the new Triple Vein Zone target (top center, map below) lit up with 4.5 g/t Au with 735 g/t Ag and 4.3 g/t Au with 96 g/t Ag, establishing over 400 meters of strike.

Triple Vein Zone rock chip sample highlights:

- 4.5 g/t Au and 735 g/t Ag, channel sample of quartz vein in previously unmapped artisanal working;

- 8.0 g/t Au and 8 g/t Ag, channel sample of oxidized brecciated andesite;

- 4.3 g/t Au and 96 g/t Ag, channel sample of oxidized brecciated andesite;

- 5.1 g/t Au and 24 g/t Ag, channel sample of vein in previously unmapped artisanal working;

- 2.8 g/t Au and 15 g/t Ag, channel sample of silicified brecciated andesite 3-meters thick.

Sampling along the 4 Trench Extension (lower left, above map) was highlighted by 19.9 g/t Au with 8 g/t Ag and 5.1 g/t Au with 142 g/t Ag over a trend greater than 600-meters.

4-Trench Extension rock chip sample highlights:

- 19.9 g/t Au and 8 g/t Ag, channel sample, andesite dyke with quartz;

- 5.1 g/t Au and 142 g/t Ag, grab float sample along vein strike;

- 3.7 g/t Au and 62 g/t Ag, grab float sample along vein strike;

- 3.4 g/t Au and 28 g/t Ag, channel sample of oxidized quartz vein;

- 1.9 g/t Au and 178 g/t Ag, channel sample of oxidized quartz vein.

Note the scale on the map above (the grey arrow, top right). The mineralization at Pilar is pervasive, spread out over an (increasingly) large area.

Brodie Sutherland, Tocvan’s VP of Exploration:

“The results released today confirm the new vein corridors recently identified by mapping are mineralized and carry similar grade to our Main Zone. Our next phase of drilling will begin later this month. Not only do we have follow-up work to continue at our Main Zone with the recent surface exploration results we have no shortage of targets to test, especially along the 4 Trench Extension and the new Triple Vein Zone.”

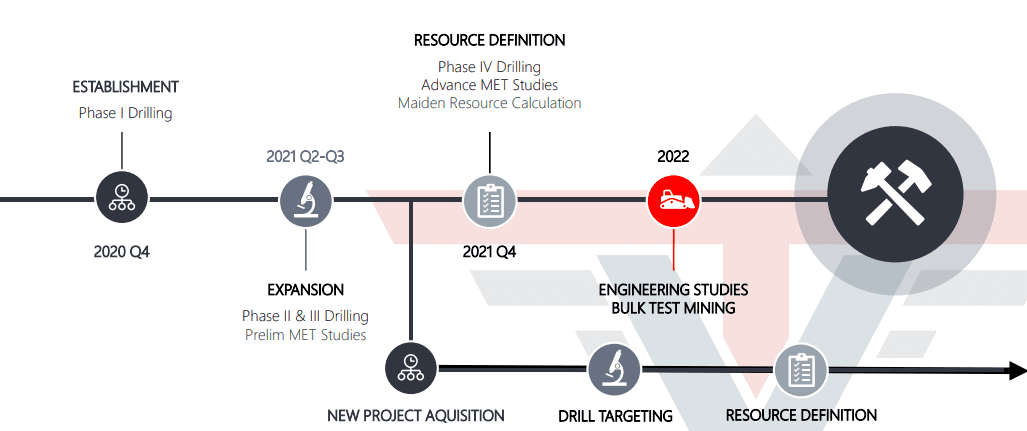

The following image, pulled from the Company’s pitch deck (slide 13), offers an approximate timeline as Pilar is pushed further along the curve.

Without a doubt, drill hole assays will be the hot item over the next few months as the Company mobilizes a drill rig to Pilar in the coming days. But If you examine the above slide you’ll see Prelim Met Studies scheduled for Q2 and Q3 of 2021.

Without a doubt, drill hole assays will be the hot item over the next few months as the Company mobilizes a drill rig to Pilar in the coming days. But If you examine the above slide you’ll see Prelim Met Studies scheduled for Q2 and Q3 of 2021.

The one aspect of project development that can trump all others—just ask any seasoned CEO in this arena—is metallurgy.

“What is metallurgy and why is it important?” you ask… Fair question.

Metallurgy is the science (some prefer the word ‘art’) of extracting valuable metals from their ores and modifying said metals for their intended use.

Preliminary (Bottle Roll) metallurgical testing of the mineralization encountered in Pilar’s subsurface stratum shows a recovery rate of 92.2% for Au and 28.7% Ag over 72 hours (from a head assay grading 1.5 g/t Au and 6.0 g/t Ag).

“During a bottle roll test, prepared ore is gently agitated in a cyanide lixiviant or leaching solution. Oxygen levels, alkalinity, acid consumption and other parameters are monitored and strictly controlled throughout the test. Test results provide information on expected recovery rates and reagent costs.”

The market will be watching closely for these met-test results.

Final thoughts

When I first conducted my due diligence on this company last spring—Tocvan (TOC.C) pushing its Pilar Gold-Silver Project aggressively along the curve—it immediately became apparent that a tight cap structure is a core value with this pro-crew.

Guard-dogging a tight share structure exposes early shareholders to significantly greater price trajectory if (when) exploration success is realized.

Tocvan currently has 24.3 million shares outstanding (28.5M fully diluted) and a market cap of $17.27M based on its recent $0.62 closing price.

The next headline out of the Company should be the announcement that a rig has rolled off the flatbed and is spinning on the first of many high-priority drill targets.

We stand to watch.

END

—Greg Nolan

Full disclosure: Tocvan is an Equity Guru marketing client.