The race for which firm gets rewarded with the first bitcoin ETF is on, with Grayscale Bitcoin Trust (GBTC.Q) announcing their intention to turn themselves into an ETF on Friday.

We’ve heard all of this before, though.

The prospects of a Bitcoin ETF date back years, and there have been multiple instances where individuals and companies have posed the notion to the Securities and Exchange commission and for one reason or another been shut down cold.

First, though, a little education.

What’s an ETF?

ETF is stands for exchange traded fund. Normally, it’s a series of companies with shared commonalities packed together on one ticket. Think of it like a UFC fight card. Your headliner is the draw, but they are supplemented by a number of midcard options that may or may not be strong enough to sustain interest. In this case said interest is price fluctuations and monetary gain.

Theoretically, you want everyone on the card to perform well, but if someone fails you’ve likely got a few goods fights to keep morale high. Obviously, things can and do regularly go downhill depending on a number of different factors, but if you’re looking for a quicky investment opportunity without the necessity of spending a lot of your time watching each individual performer, then ETF’s aren’t a bad option.

The most popular ETFs in the United States replicate the S&P Index, the total market index, the NASDAQ index, the price of gold, the “growth” stocks in the Russell, or the index of the largest tech companies.

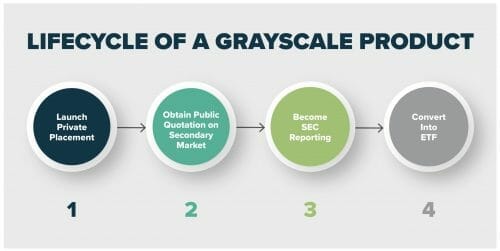

This wouldn’t be the case with a Bitcoin ETF—at least not yet. There’s only one asset under consideration. This prospective ETF would provide investors with exposure to the asset class while mitigating the risks associated with ownership, which is basically what Grayscale (and companies with a related business model) have always done. Except now GBTC has indicated their intent towards transforming all of their SEC reporting trusts into ETFs after the SEC gives the nod to a BTC ETF, but we’re not there yet.

Here’s a list of what they’re into:

Grayscale’s single-asset investment products provide exposure to Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Ethereum Classic (ETC), Horizen (ZEN), Litecoin (LTC), Stellar Lumens (XLM), and Zcash (ZEC). Additionally, Grayscale’s diversified investment product, Grayscale® Digital Large Cap Fund, provides exposure to top digital currencies by market capitalization.

And how they intend to do it:

But there’s still a ways to go before any of this becomes a reality.

The sordid history

As an aside, this information only applies to the United States. The Toronto Stock Exchange has offered the Purpose Bitcoin ETF (BTCC.B.T) since February of 2021, and two other ETFs. Purpose Bitcoin, if you’re wondering, pulled in $1.2 billion in assets in its first two months.

Here’s a short timeline of progress to a BTC ETF.

- Grayscale launches a bid in 2016 for the first BTC ETF and gets rejected by the SEC.

- In 2017, Cameron and Tyler Winklevoss of Gemini Investments try their luck with the SEC and get shot down. The reason? Bitcoin is traded on largely unregulated exchanges, leaving it susceptible to fraud and manipulation. In terms of reasons, they weren’t wrong at the time.

- Cboe Global Markets, which first offered bitcoin futures, tried to get the SEC onboard with ETFs. No dice.

- VanEck and SolidX, a fintech company with their fingers in the bitcoin space, announced they were attempting to get the SEC to agree to something called the VanEck SolidX Bitcoin Trust ETF in 2018. It’d be open to institutional investors with an opening price of $200,000.

- VanEck applies again in 2020, followed by Valkyrie Digital Assets in January 2021, NYDIG and WisdomTree.

- Fidelity investments has thrown in on the idea of a BTC ETF.

- Finally, Grayscale Bitcoin Trust indicated earlier this week they would flip over and become an ETF.

What would change?

First, Grayscale would no longer be charging a 2% management fee and investors won’t have to wait six months to sell or trade their issues once the Bitcoin ETF makes an appearance. Given the price of Bitcoin and its well recognized volatility—that could be a severe benefit. It would also open the door to a wider investment pool, and probably end up lending some of that sweet credibility to cryptocurrency in general as an asset class.

If it were created today, the Grayscale Bitcoin ETF would be the world’s second largest commodity ETF, behind the $57 SPDR Gold Trust, and would be the third-most liquid commodity ETF in weekly trading volume, with SPDR Gold Trust and iShares Silver Trust being larger.

The question remains as to whether or not an ETF, which would join the ranks of futures contracts and other instruments, would lend the asset the legitimacy is needs to effectively be considered part of the mainstream rather than the niche nerd hobby it’s considered now.

—Joseph Morton