Graph Blockchain’s (GBLC.C) latest foray into the world of cryptocurrency alt-mining has taken them to Cardano’s native token, ADA, which they’ve sunk a heavy load of cash into to stake it.

The cash amount is $300,000, and as far as business models for cryptocurrency go taking a good position in Cardano isn’t a bad option. The company will provide more information on their Cardano purchase as the project develops.

“We are exceptionally excited to be deploying funds into our second token purchase. We anticipate that we will be making further purchases shortly to further tokenize our cash position and diversify our growing crypto portfolio,” said Paul Haber, CEO of Graph Blockchain.

The recent spate of diversification comes due to Graph’s stated belief that 2021 carries with it significant potential for smart contract platforms involving mass adoption on decentralized blockchains. The company believes Cardano is the blockchain option most capable of doing this, and they’re partly right. Decentralized finance (DeFi) is generally found on the Ethereum blockchain, but Cardano, and to a smaller extent the Binance Smart Chain come in a close second and third. Increasingly, though, developers have been bailing out from Ethereum’s smart contracts options because of the high cost of gas, which accounts for the rise in Cardano’s fortunes of late.

Cardano: The Ethereum Killer?

If you’re going to get your developer hat on in the DeFi ecosystem, your first pricetag is buying the coin. In terms of raw finances, it’s a no-brainer: Cardano is presenting trading at $1.22 and Ethereum is trading at $1,840.51. ADA’s network fees are also considerably lower than ETH’s—making it cheaper to continue to do business in Cardano’s ecosystem than on Ethereum.

Cardano is open-source and decentralized blockchain designed for peer-to-peer transactions. It comes with a layered architecture perfect for smart contracts, which enables an adaptable and scaleable platform without any compromises to security. It uses a modified Proof-of-Stake (PoS) consensus mechanism called Oroboros, which gives the network its scalability, and represents a significant departure from the Proof-of-Work (PoW) protocol that Ethereum (and Bitcoin) uses. Since Ethereum is only in the process of making the switch from PoW to PoS, you could say that ADA has a head start here.

Here’s a helpful youtube clip giving a detailed comparison between ETH and ADA:

The Scaling of the Oroboros and the Hydra

Every new coin getting involved in the DeFi ecosystem necessarily needs to be answer the question of how well it scales, and preferably better than the existing coins. Cardano uses their own proprietary Ouroboros Praos version of PoS as we’ve already stated, but they’ve been also working on an extra protocol called Hydra, which will sit on top of that to increase scalability.

Hydra is a second layer solution that sits atop the cardano protocol and speeds it. Simulations show that each hydra head can handle approximately 1,000 transactions per second presently, but it’s possible to boost it by adding more heads. Therefore, if we had 1,000 heads, we’d have 1,000,000 transactions per second. Charles  Hoskinson, Cardano’s founder, indicated that the model works with Cardano and makes it possible to shard the stakes space without having to shard the ledger itself.

Hoskinson, Cardano’s founder, indicated that the model works with Cardano and makes it possible to shard the stakes space without having to shard the ledger itself.

Sharding is basically spread out the consensus seeking operation of the blockchain to multiple different nodes. This is an earlier version of what Vitalik Buterin has promised to do with Ethereum, and while this isn’t exactly to ETH 2.0’s scale (although the 1,000 head example, while outlandish, would be much more) it’s still substantial enough to make ADA a potential ETH killer if it works.

The Five Eras of Cardano

Byron

The first era of Cardano started in September 2017. It’s named after Lord Byron—who is Ada Lovelace’s father. You see where they’re going with this. Charles Hoskinson has a fascination with 19th Century intellectuals, as you’ll see.

The Byron stage included buying and selling of ADA on a federated network powered by the Ouroboros protocol. Basically, bare bones at this stage.

Shelley

Named more after Mary Shelley than her poet husband, Percy Bysshe Shelley, it marked the transition to decentralization. The Shelley mainet went live on July 29, 2020, bringing in proof-of-stake for Cardano and offering rewards to stakers. The Shelley era introduced network participation for hodlers, and therefore more nodes under their control.

The Mary Shelley recognition was because this is when the network achieved fully autonomy—like Frankenstein’s monster. Decently clever.

Goguen

The Goguen era is basically where they are right now. It’s named after the computer scientist Joseph Goguen, and will introduce more technical capacity in terms of native supported tokens, including NFTs, smart contract functionality, and development tools to give the laymen a chance to write their own smart contracts. Also, increased interoperability with other existing smart contracts, regardless of what language it was written in.

You could theoretically take your ETH written smart contract (in solidity—Ethereum’s language) and transfer it to ADA.

Basho

The Basho era, ETA unknown, will optimize the network, helping it scale and become more interoperable. Basho is named after Japanese poet Matuso Bashõ, and will introduce two core developments for scalability:

- Firstly, it will introduce sidechains that will be used as a sharding mechanism to scale the network capacity further without affecting its security.

- Secondly, it will launch accounting styles that run parallel to Cardano’s UTXO model, thereby fostering greater interoperability.

Voltaire

Last we have Voltaire—named after the 17th century French poet, writer, and philosopher, which will usher in the best of all worlds (with less irony than in Voltaire’s Candide we hope) by helping it mature in terms of sustainability and decentralization. It will introduce a voting and treasury system and let participants use their stakes and voting rights to steer future development.

Graph Blockchain into DeFi?

The company is keeping quiet about the purpose behind the acquisition—except the base suggestion of collecting enough ADA to take a dominant staking position. Dropping the cash they have will get them a leg-up on the competition in that arena. But it would only make sense to offer access in the future should Goguen increase ADA’s capabilities, and Voltaire democratize the processes involved.

We’ll have to wait and see.

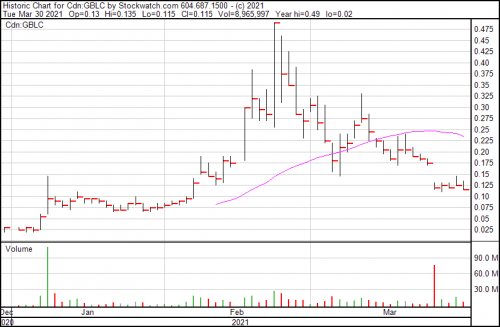

Graph Blockchain is down a penny, and closed at $0.115 today.

—Joseph Morton

Thanks for the article, sir.

I have to check out how many outstanding shares they have..

Datametrex owns 25% of this company, they must know something I don’t.