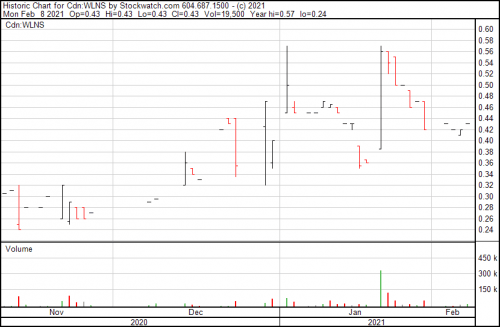

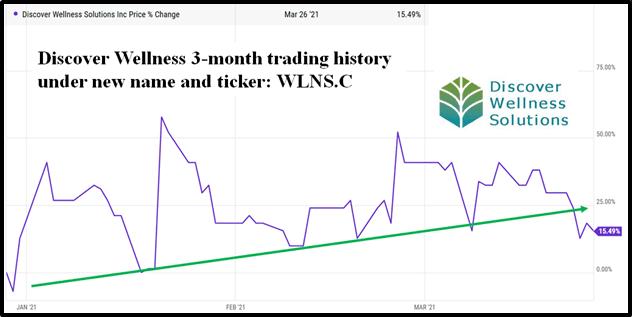

Three months ago, Discover Wellness (WLNS.C) completed a name change, from RMMI, while it announced that it has taken possession of 550,000 kg of high-CBD biomass.

Over the last five years, Hemp’s coveted bi-product CBD has experienced an accelerated consumer adoption-cycle – moving from health fad, to accepted medicine, to mainstream usage.

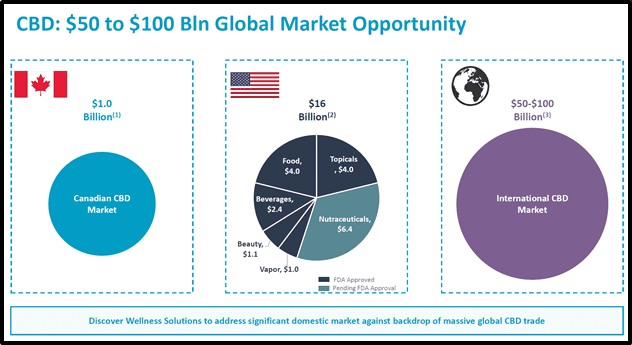

The global cannabidiol market size was valued at USD S2.8 billion in 2020, and will hit $3.5 billion in 2021.

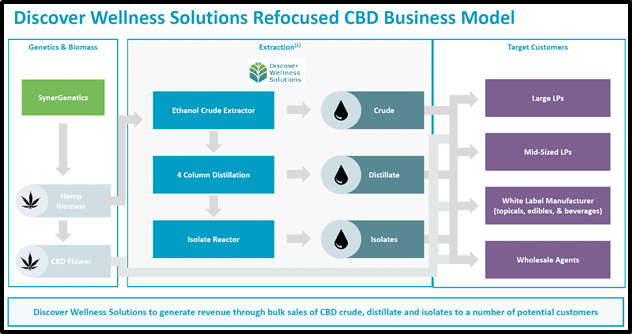

WLNS has also completed a Strategic Alliance agreement with SG, which provides Discover Wellness exclusivity over SG’s high-CBD genetics in Canada and assumption of its hemp CBD flower, biomass and concentrate business globally.

“The contribution of this first 550,000 kg of high-CBD biomass from SG and the completion of the Strategic Alliance agreement is a significant first step in leveraging the combined resources under the Discover Wellness umbrella,” stated Peter Cheung, Interim CEO of WLNS, “This marks a milestone in developing Discover Wellness into the premiere publicly-traded pure-play hemp CBD company with global scope.”

A “pure-play hemp CBD company”?

Is that a good business concept?

What about THC gummy bears?

Helping people get high has indestructible demand drivers – but that business (still) comes with serious regulatory issues.

We look favourably on companies with focused business models – that aren’t vulnerable to political mood swings – and have with a clear pathway to profitability.

In fact, hemp is older than Warren Buffett, older than hula-hoops, older than democracy.

Archeologists in Turkey have found hemp fabric dating back to 8,000 BC. From 1631 to the early 1800s, hemp was legal tender (money) in most of the Americas.

Growing hemp is not like growing tulips, where you can visually inspect it and declare, “that’s a perfect plant.”

One of the big challenges is to simultaneously keep the CBD content high and the THC content low (they tend to creep up together). Many hemp companies have failed at that.

“In the Industrial Hemp Regulations, industrial hemp includes cannabis plants and plant parts, of any variety, that contains 0.3% THC or less in the leaves and flowering heads,” states Health Canada.

“No person can advertise industrial hemp, its derivatives, or any product made from those derivatives to imply that it is psychoactive – meaning that it could affect the mind or the behavior of the person consuming it” – Health Canada

In this March 12, 2021 Rich TV video interview, WLNS Chief Strategy Officer Manish Grigo lays out the master plan sell CBD profitably.

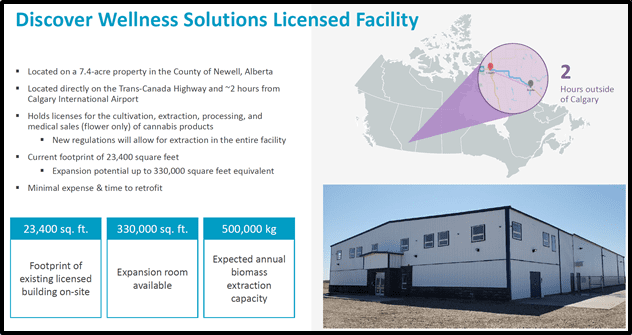

“Our facility can process about 1 million pounds of hemp a year,” Grigo told Rich TV, “It’s a new facility allows us to learn from other people’s mistakes”.

“The SG partnership gives us access to High CBD Strain hemp, which translates to higher yield when you put it through the processing facility,” added Grigo, “High CBD content biomass entails lower cost of extraction which means we can process it faster at a cheaper cost.”

On March 18, 2021 Discover Wellness updated its shareholders on the progress of this young company.

Highlights – Fiscal Year Ended December 31, 2020

- In June 2020 the Company made a strategic shift towards hemp and production of high quality and high purity CBD products. Essentially, the Company undertook a strategic shift in its business model away from capital intensive cannabis cultivation to focus on processing and extraction of hemp biomass into CBD concentrates.

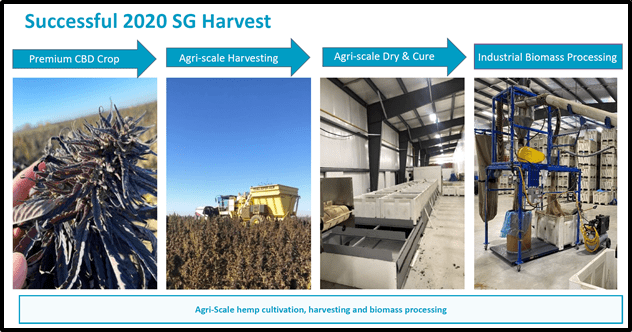

- In October 2020, the Company entered into strategic alliance and hemp purchase agreement with SG, a leading plant genetics technology company that develops novel hemp strains with high-CBD content and other hemp-derived cannabinoid cultivars.

- In December 2020, the Company closed a $2.7 Million Private Placement at $0.20/ share to progress the buildout of the expansion area in the Company’s 23,400 square foot extraction and processing facility and for general corporate and working capital purposes.

- Near the end of the year SG delivered 550,000 lbs of hemp which resulted in working capital savings of over $5MM.

- The shareholders approved the name change to Discover Wellness Solutions Inc. to better reflect the Company’s focus on the non psychoactive space.

In February 2021 WLNS received a license to sell Industrial Hemp which significantly reduces regulatory overheads and fits well with the cost leadership strategy.

In March 2021, signed an MOU with Quad Play to enter Thailand’s deregulating hemp extract market. This business relationship serves as a beachhead for Discover Wellness to gain access to the Asian hemp-infused market which is expected to grow to over $5.8 billion by 2024.

Discover Wellness’ initial contribution secures a toehold equity stake of 4% in Quad Play with the option to acquire control of QP once regulations in Thailand allows for control by foreign companies.

“We view this arrangement as a first step for Discover Wellness’ global distribution strategy into the fast-growing food and beverage markets of Asia, a potential $5.8 billion market by 2024 according to Prohibition Partners,” stated Cheung, “We are excited to be working with QP as our exclusive partner and leverage their deep relationships with traditional consumer packaged goods companies within Thailand and the broader Asian market.”

“Quad Play is a Thai cannabis and hemp play aiming at complete vertical integration,” reported Equity Guru’s Joseph Morton, “They’re involved in developing genetics, cultivation, extraction, tech and production of products for food, beverage and health for the domestic market.

“Their subsidiary Jai Sai owns two medical clinics and will act as one of the main distribution channels for QP and Discover’s products,” added Morton.

Key points from the MOU

- QP to become the exclusive supplier of DWS seeds in Thailand.

- The agreement will be subject to an initial order of 20,000 seeds.

- QP to pre-purchase 200,0000 seeds (value of US$200,000) for 4,000 shares in QP that represents a 4% equity interest on a fully diluted basis in QP (“Equity Interest”). The Pre-Purchase and Equity Interest is subject to a successful Trial Order.

- After the initial 200,000 seeds, QP to pay on a per seed basis and Discover Wellness has the option to convert those amounts into additional equity of QP to a maximum allowed under foreign ownership rules currently at 33%.

- Discover Wellness shall have the ROFR to acquire control of QP once regulations in Thailand allows for control by foreign companies.

As farmers have converted fields from corn to hemp, the price of CBD has been falling – while the demand rises.

“The global cannabidiol market size is expected to reach USD 13.4 billion by 2028,” states ResearchAndMarkets, “The market is expected to expand at a CAGR of 21.2% from 2021 to 2028”.

The customers for WLNS’ product will be there.

For Discover Wellness to make a profit, it needs to operate efficiently.

When the 4X scalable Alberta 23,400 square foot extraction and processing facility cranks up, we’ll have hard data to measure WLNS’ efficiency.

In the meantime, this small, young company appears to be doing every right.

- Lukas Kane

Full Disclosure: Discover Wellness is an Equity Guru marketing client.