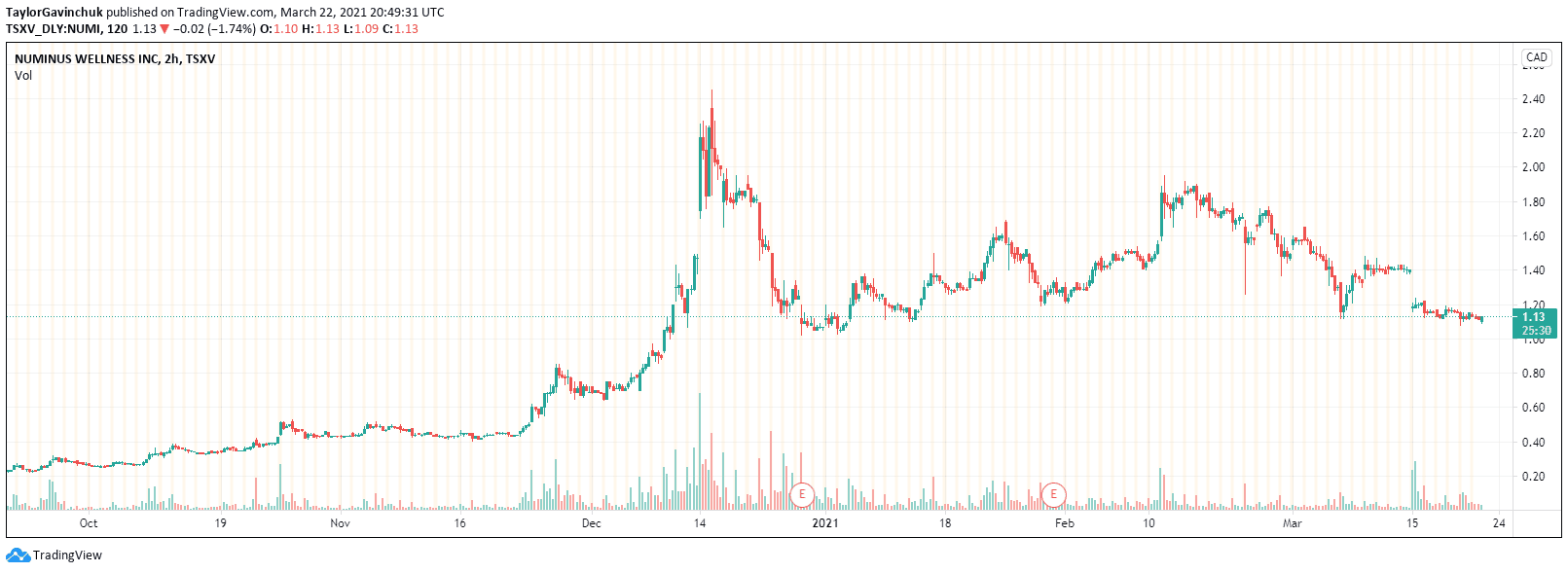

Numinus (NUMI.V) is gaining somewhat of a cult-like following among retail investors.

People see an undervalued company with competitive advantages, and from an ethics standpoint, a company conducting itself a lot better than some of the other bigger players. In a sense they’re a bit like Aphria (APHA.T) in 2017, the third biggest market cap in a speculative Canadian space, a good-guy image, and an army of retails ready to take a bullet.

First, they have cash. Last week Numinus announced the closing of its $40M CAD raise. The bought deal was upsized from $30M CAD to $40M CAD, bringing the company’s current cash position to roughly $65M CAD. They plan on using the proceeds for further clinic acquisitions, purpose-built flagship facilities, and the 7,500 sq/ft Numinus Bioscience lab expansion, which will also add $1.2M CAD in equipment to the operation.

Numinus Wellness (NUMI.V) leapfrogs past milestones for MDMA assisted therapies

They are in a unique position, holding a Controlled Drugs and Substances license issued by Health Canada allows the possession, production, assembly, sale, export, and delivery for a wide variety of psychedelic compounds like Psilocybin, Psilocin, Ketamine, LSD, DMT, Mescaline, and DMT. They have more than started the process, completing their first mushroom extraction back in November. This isn’t their only future revenue stream. Several psychedelics are hedging on one specific angle of a business model to work out big. On the other hand, Numinus is trying a few different things.

Mindspace

Numinus is currently generating revenue through ketamine-assisted treatment centers with their original location in Vancouver, Canada, and the recent acquisition of Montreal-based Mindspace Wellbeing, a network of ketamine clinics operating in Montreal serving approximately 1,400 clients. I have previously written about the profitability of these clinics from the perspective of Novamind (NM.CN) and Field Trip (FTRP.CN).

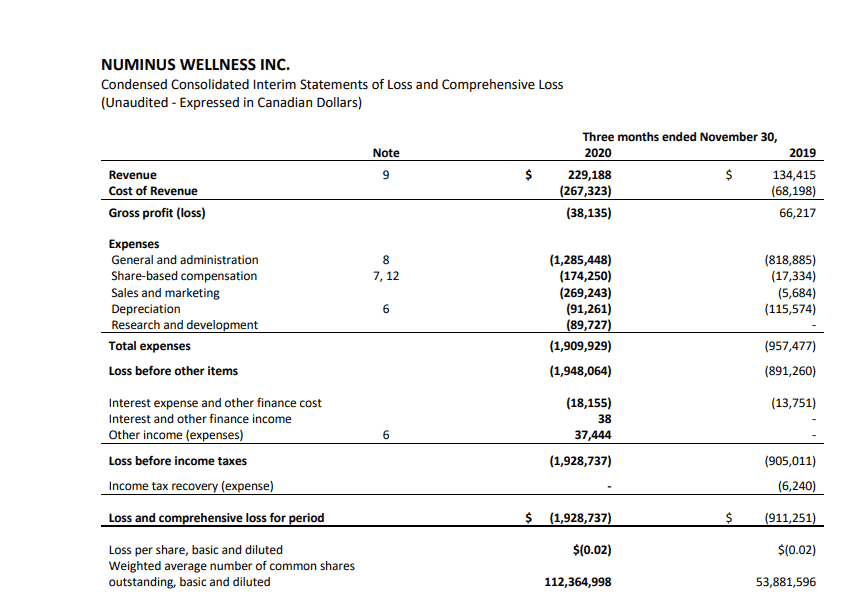

Here is a glimpse of their revenue numbers pre-clinic purchase. These will obviously increase drastically as clinics are accounted for.

According to Numinus, the clinics generated an average of 25% year-over-year growth over the past five years, including $1.7M CAD in revenue generation over the past twelve months that is anticipated to grow with the newly launched ketamine-assisted therapy program.

Numinus Wellness (NUMI.V) secures expansion into Quebec with Mindspace Psychology Services

Numinus also gains credibility by being the only other psychedelic company in the newly created Horizon’s PSYK ETF which comes close to Compass Pathways (CMPS.Q) or MindMed (MMED.NE). And with a market cap of $192M CAD, investors feel Numinus is significantly undervalued, relative to Compass and MindMed.

Having a dedicated base of retail investors is key for buying dips and controlling big swings. The more diversified your base, the sturdier the floor will be. I am usually all for going against the trends, especially in investing. But with an emerging sector like psychedelics, the trend hasn’t really taken off enough yet where the big players are too overvalued.

It’s too early to follow conventional wisdom.

Keeping good company

Ethical investing is a growing phenomenon, people want to feel good about where they are putting their money and what that money is doing. Numinis has lined itself up with some credible partnerships which add even more credibility to the company.

Numinus has an ongoing partnership with Multidisciplinary Association for Psychedelic Studies (MAPS) for MDMA-assisted therapy trials.

The Multidisciplinary Association for Psychedelic Studies (MAPS) was granted Breakthrough Therapy Designation in August 2017 for its MDMA-assisted psychotherapy clinical trial studying the treatment of PTSD. In MAPS’ phase II clinical trials it was found that the benefits of MDMA-assisted psychotherapy for PTSD extended at least 12 months after the treatment. These trials have shown that MDMA can reduce fear and defensiveness, enhance communication and introspection, and increase empathy and compassion, enhancing the therapeutic process for people suffering from PTSD. In a long-term follow-up study, it was found that 67% of participants no longer qualified for a PTSD diagnosis. MAPS’ phase III clinical trials are expected to be completed in 2022, with FDA approval possible as early as 2023. Breakthroughs like this are why MAPS are at the forefront of the psychedelics industry. Having your company aligned with OG’s from the 80’s is a really smart move by Numinus.

Numinus will be using natural compounds instead of synthetic, which worries some over the lack of opportunity to patent novel drugs and compounds, a big selling point to other companies in the space.

In an interview last week Numinis CSO Sharan Sidhu said Numinus will not patent any IP that makes psychedelics inaccessible. This is the opposite approach Compass Pathways (CMPS.Q) has taken as they seek to patent the entire psychedelic therapy process, including comfortable furniture and listening to music. It’s safe to say Numinus lines up more with MAPS’ initiatives.

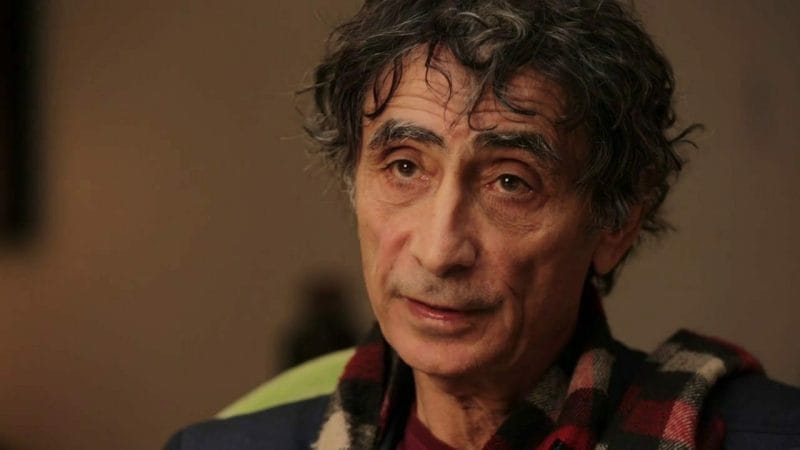

Popular author and speaker Dr. Gabor Maté sits on their board as well. Maté is known around the world for his work in addictions, mental health, and trauma healing. Based in Vancouver’s infamous drug hotspot the Downtown East Side Dr. Maté has worked on the front lines of providing mental services to those who need it most. Dr. Maté has also been a psychedelic drug advocate for years, he has run several retreats in South America.

“At the core of every addiction is an emptiness based in abject fear. The addict dreads and abhors the present moment; she bends feverishly only toward the next time, the moment when her brain, infused with her drug of choice, will briefly experience itself as liberated from the burden of the past and the fear of the future—the two elements that make the present intolerable. Many of us resemble the drug addict in our ineffectual efforts to fill in the spiritual black hole, the void at the center, where we have lost touch with our souls, our spirit—with those sources of meaning and value that are not contingent or fleeting. Our consumerist, acquisition-, action-, and image-mad culture only serves to deepen the hole, leaving us emptier than before. – Dr. Gabor Maté, In the Realm of Hungry Ghosts

I saw Dr. Maté speak back in 2013 at a conference in Vancouver, Canada, and read his book ‘In the Realm Of Hungry Ghosts’ when I was in Mexico a couple of years ago. He also has several of his talks on YouTube. Anyone looking to learn more about personal addictions, societal addictions, trauma, and healing should take a look at his work. For a company diving into mental health and addictions, Dr. Mate is an extremely valuable and recognizable voice. His writing reveals his inherent knowledge of the mission Numinus is on.

With a diverse business model based on clinics, R&D, a state-of-the-art lab, and a first-mover advantage with their Health Canada license it makes sense why this company is so popular among retails, and of course, that cheap stock.