Cathie Wood’s Ark Innovation Fund has been front and center of attention amidst the Nasdaq sell off. Ark is breathing a sigh of relief currently, as the popular ETF rebounds 8% on the back of the Nasdaq’s 425 points, or 3%, pop higher.

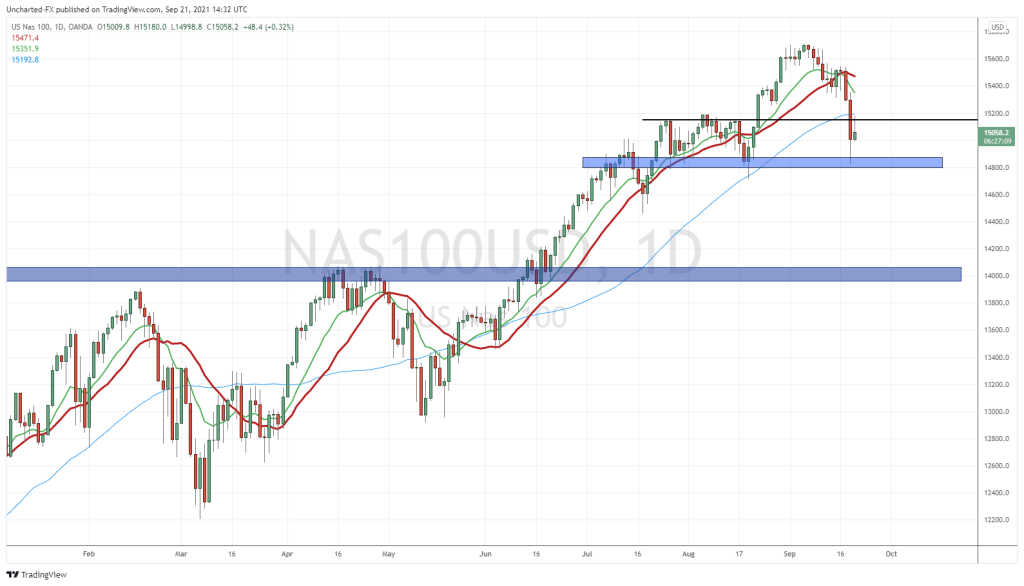

US Stock Markets are popping amid lower bond yields. The 10 year yield was hovering close to 1.60% yesterday and for a few days last week adding more pressure to the equity downside. At time of writing, the 10 year yield is down 4% at 1.537%. Bonds are being purchased, and this is why Billionaire David Tepper is bullish on stocks. He believes that bonds will be purchased at these yields, hence dropping yields which have been weighing in on equities.

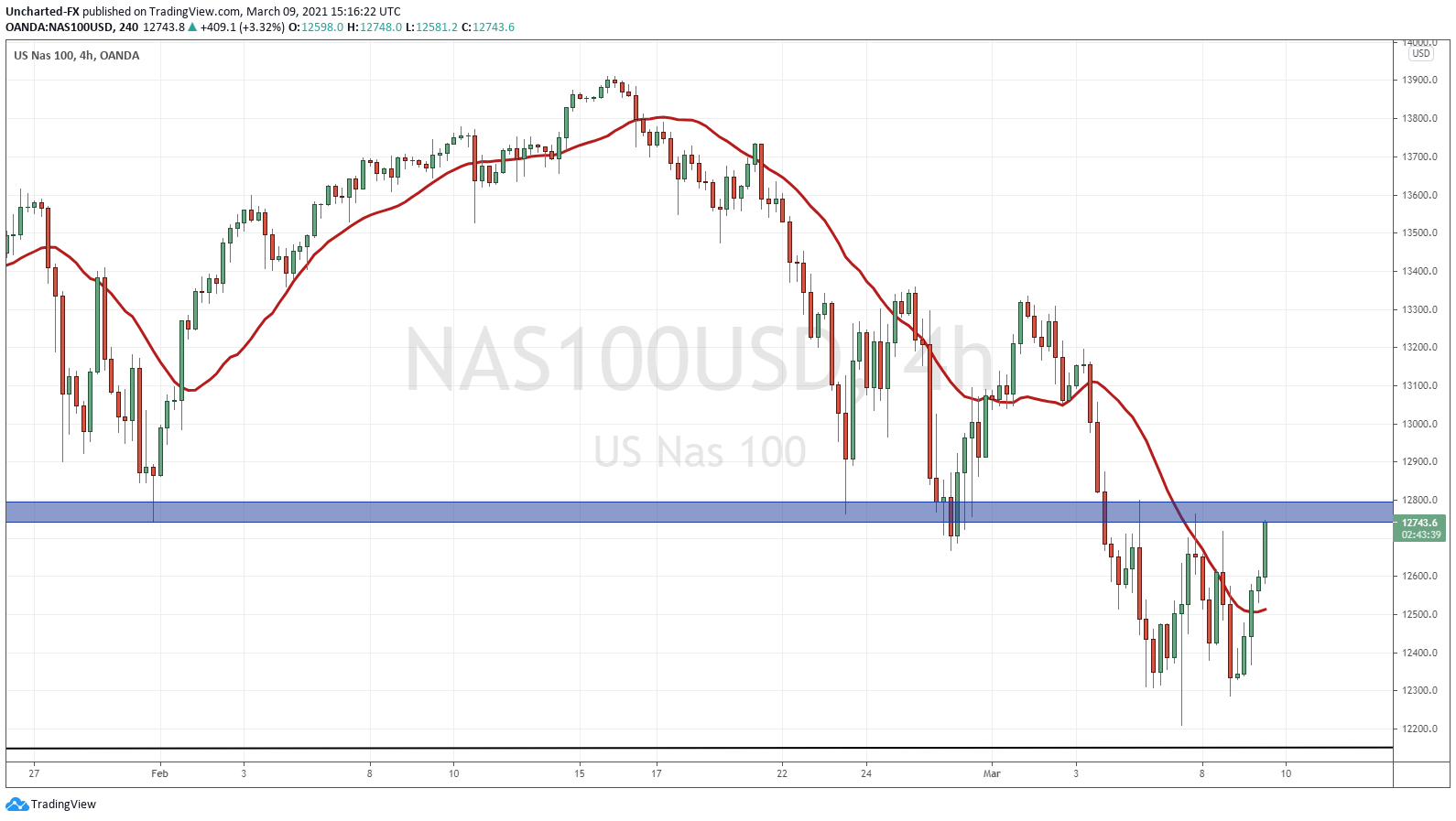

Keeping the Bond market in mind, as well as the impending $1.9 Trillion Stimulus Relief Bill, will the Nasdaq be able to close back above the 12,800 zone? An important zone which we have been watching for days here on Market Moment, as well as over on Equity Guru’s Trading Discord Channel.

Notice the reversal pattern? Yup, it is the Double Bottom pattern. This reversal pattern looks like the letter “W” and occurs at the bottom of a downtrend. The implication is that if the Nasdaq closes back above 12,800, the downtrend would be over.

Watch the Nasdaq as it will have a big impact on Cathie Wood’s Ark Innovation Fund (ARKK). What the Nasdaq does will play a large role in determining whether Ark is in trouble or not.

As mentioned earlier, Cathie Wood has been front and center during the Nasdaq sell off. The big question is this: how does a fund that is all in technology (or disruptive innovation as they put it) hedge when the Nasdaq drops? Many do not think they can hedge, hence why Ark is in trouble if the Nasdaq drops or corrects.

This drop will be Cathie Wood’s and Ark’s first true test. The Nasdaq rebound today is definitely relieving some pressure, but as long as the Nasdaq remains below 12,800, we are not out of the danger zone just yet.

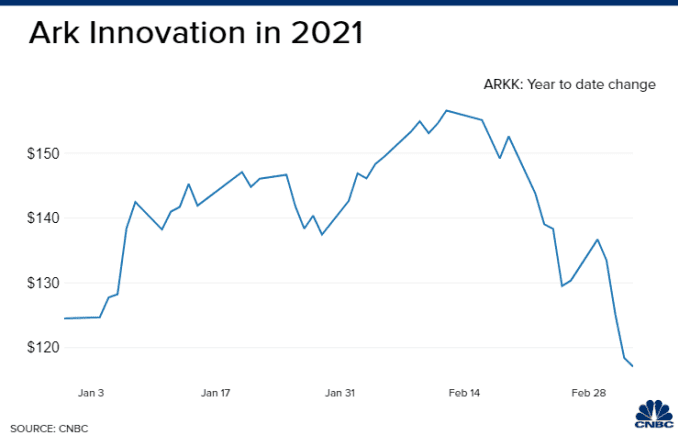

Ark Innovation returned nearly 150% in 2020 and now has more than $17 billion in net assets. However, ARKK is down more than 11% this year amid recent weakness in technology stocks, pressured by rising bond yields.

Cathie Wood is not worried. Here are some comments she made on CNBC’s Closing Bell:

“Right now the market is broadening out and we think in an underlying sense the bull market is strengthening and that will play to our benefit over the longer term,”

“We are getting great opportunities” in the sell-off to buy the pure play names in the funds, said Wood. “When we get opportunities like this to invest in pure plays instead of more mature plays…we will move back into pure plays.”

“We are becoming more and more optimistic about our portfolios in this sell-off,” she added.

“The bull market was broadening out to incorporate value or more cyclical sectors and I thought that was going to be very good news for our strategies longer run. The worst thing that could have happened to us what another tech and telecom bubble where the market narrowed so that only a few groups won,”

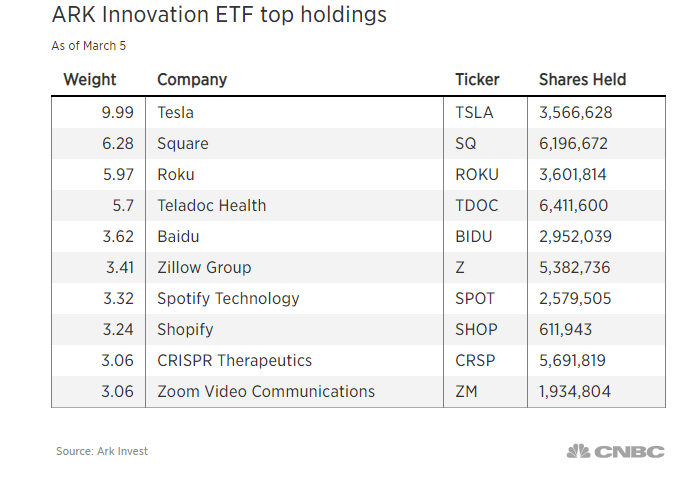

Cathie Wood has been buying the dip. Wood has made big purchases of Tesla, Teladoc, Zoom Video and Palantir. Ark Innovation also scooped up shares of Square, Roku, Zillow and Shopify recently.

Selling more liquid names to buy the “pure” value plays.

Technical Tactics

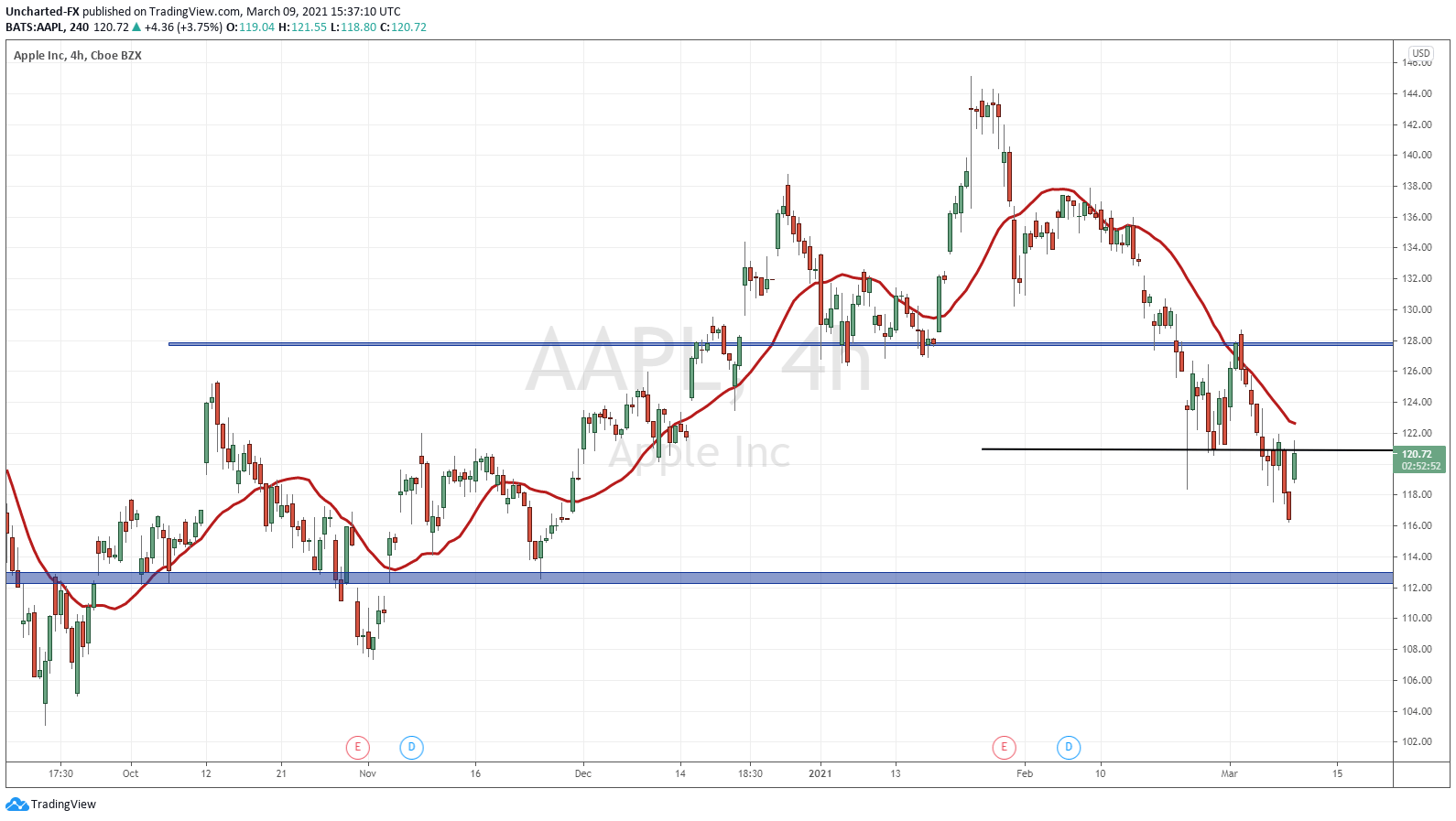

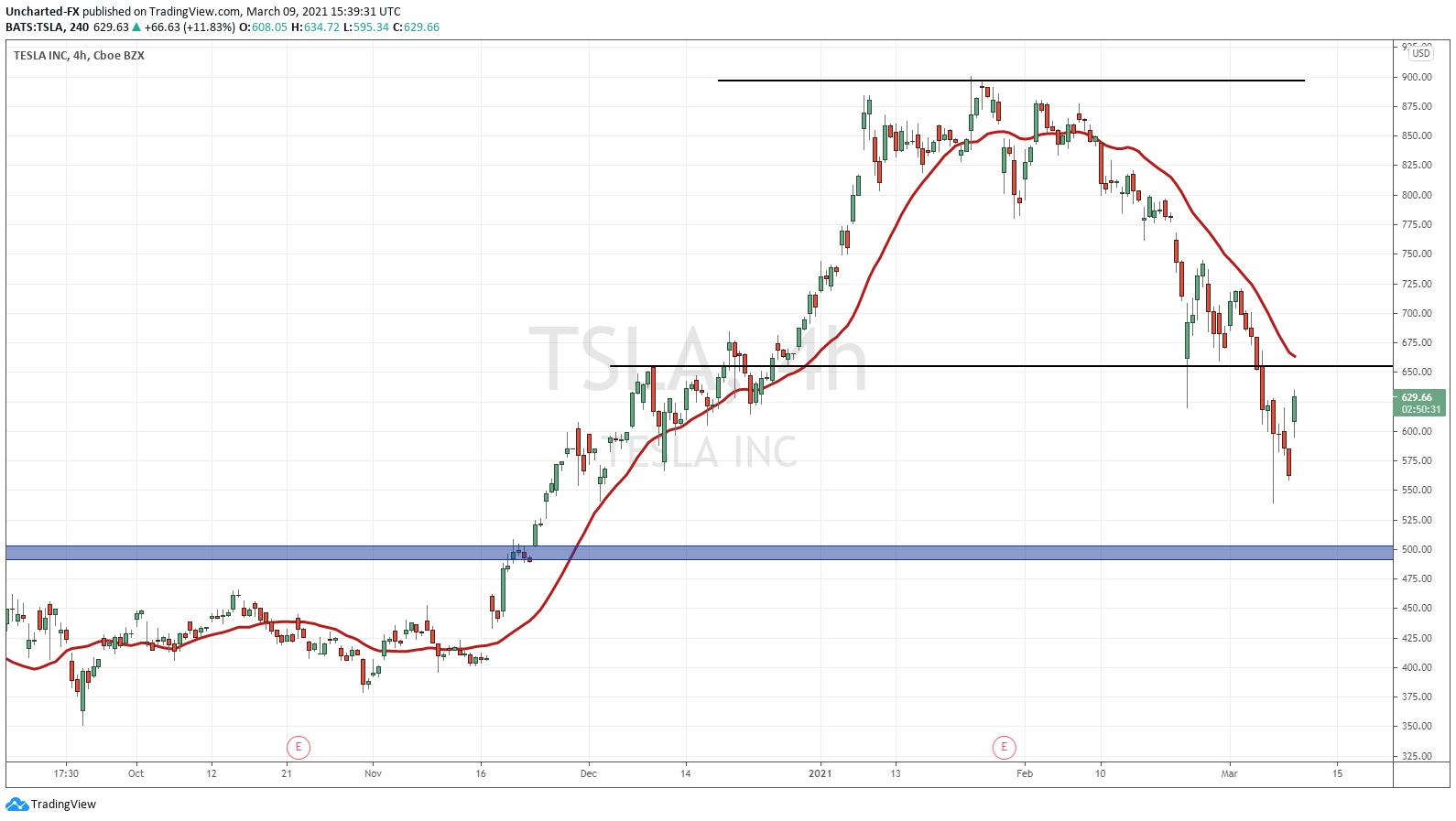

When we talk about the Nasdaq, we need to discuss two major names: Tesla (TSLA) and Apple (AAPL). Both of these companies drive the Nasdaq. In recent posts, I have spoken about downside targets on both of them. Let’s take a look at the charts to see how the Nasdaq rebound has affected them.

Apple is up over 3% on the day, but is seeing some selling at the $121 zone. It is where the breakdown occurred, so technically this is a resistance level. The downtrend is really over once we climb back above the $128 zone. Still long ways to go. $112 is still the downside target if the Nasdaq creates one more leg down.

Tesla is a big mover today with a gain of 11%! But let’s not get too excited just yet. Tesla must climb back over $650 to show any signs of a downtrend reversal. I find the media does a good job in hyping single day price action, but does not look at the bigger picture and trend. We are smarter than that. $500 is still our downside target if the Nasdaq forms another leg down.

Why else do I mention these two companies? Well particularly Tesla…

Tesla makes nearly 10% of the Ark Innovation Funds holdings. Watch what TSLA does, and you will have a pretty good understanding where ARKK moves.

Let’s end this off by looking at ARKK.

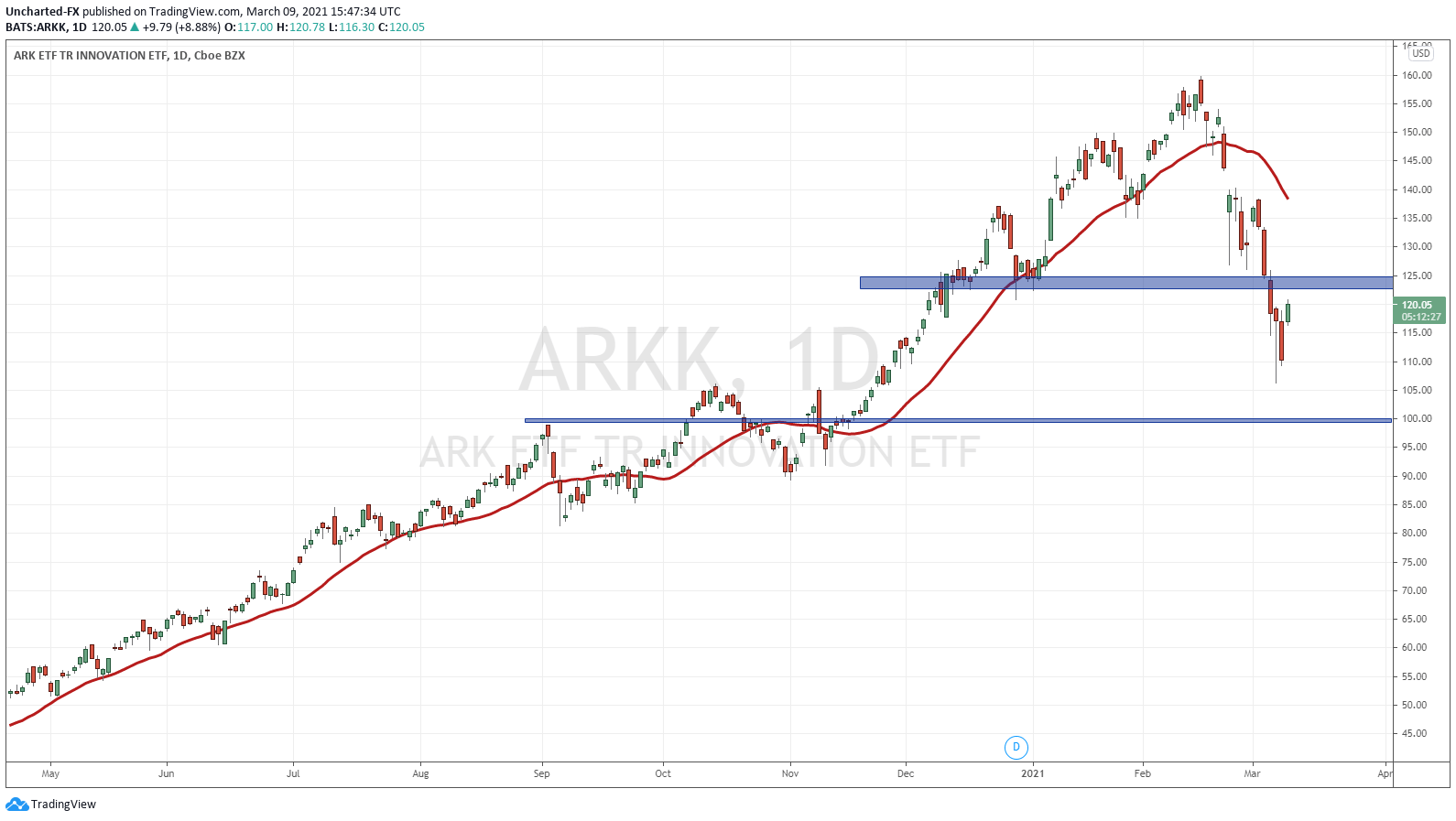

This is a chart that I would love to short purely on technicals. The break below $125 has triggered a reversal pattern, AND closed below a higher low for those that are technically inclined.

ARKK is not out of the danger zone. A close above $125 is required for us to comfortably say that Cathie Wood and Ark have survived this ordeal. If not, I can see another leg lower to the major $100 zone. If that breaks as well, we are targeting $75.

This would mean that markets tumble lower, and perhaps, on the back of bond yields rising higher. This would set up for the Fed to initiate some sort of Yield Curve Control in their mid March meeting and press conference.