The US Stock Markets have been under pressure this week. The question going forward is whether this is just a pullback? Or is this the beginning of the ‘big one’?

Yesterday was a day which saw the Stock Markets tumble…but only to be bought up. Take a look at some of these daily wicks:

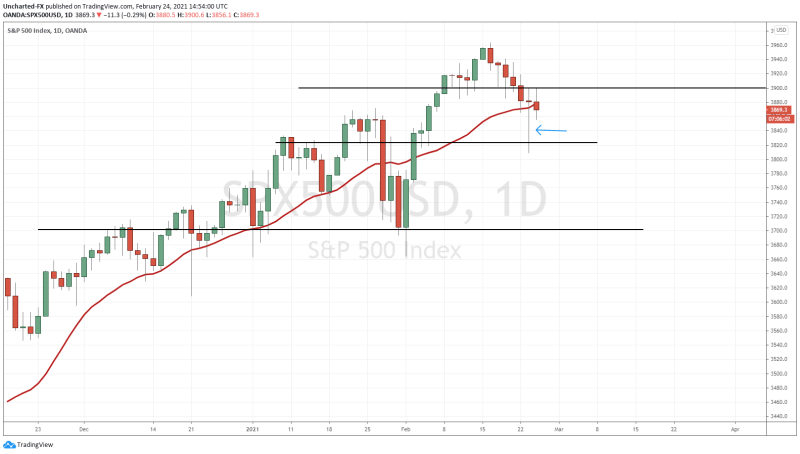

Buyers stepped in on the S&P when it hit our flip zone on the 4 hour chart. Now, the S&P is currently attempting to climb and close back over 3900. If it does this, the downtrend is nullified.

Need to plug in our Discord Trading Room. Members were notified about these reversal patterns last week. Regular Market Moment readers were as well. However, on the Discord chat I can post more levels and charts in real time. If you are not a part of our Discord group, and want to be kept up to date on trading opportunities, you can join by clicking on the Discord icon at the top of the page (among our social media icons).

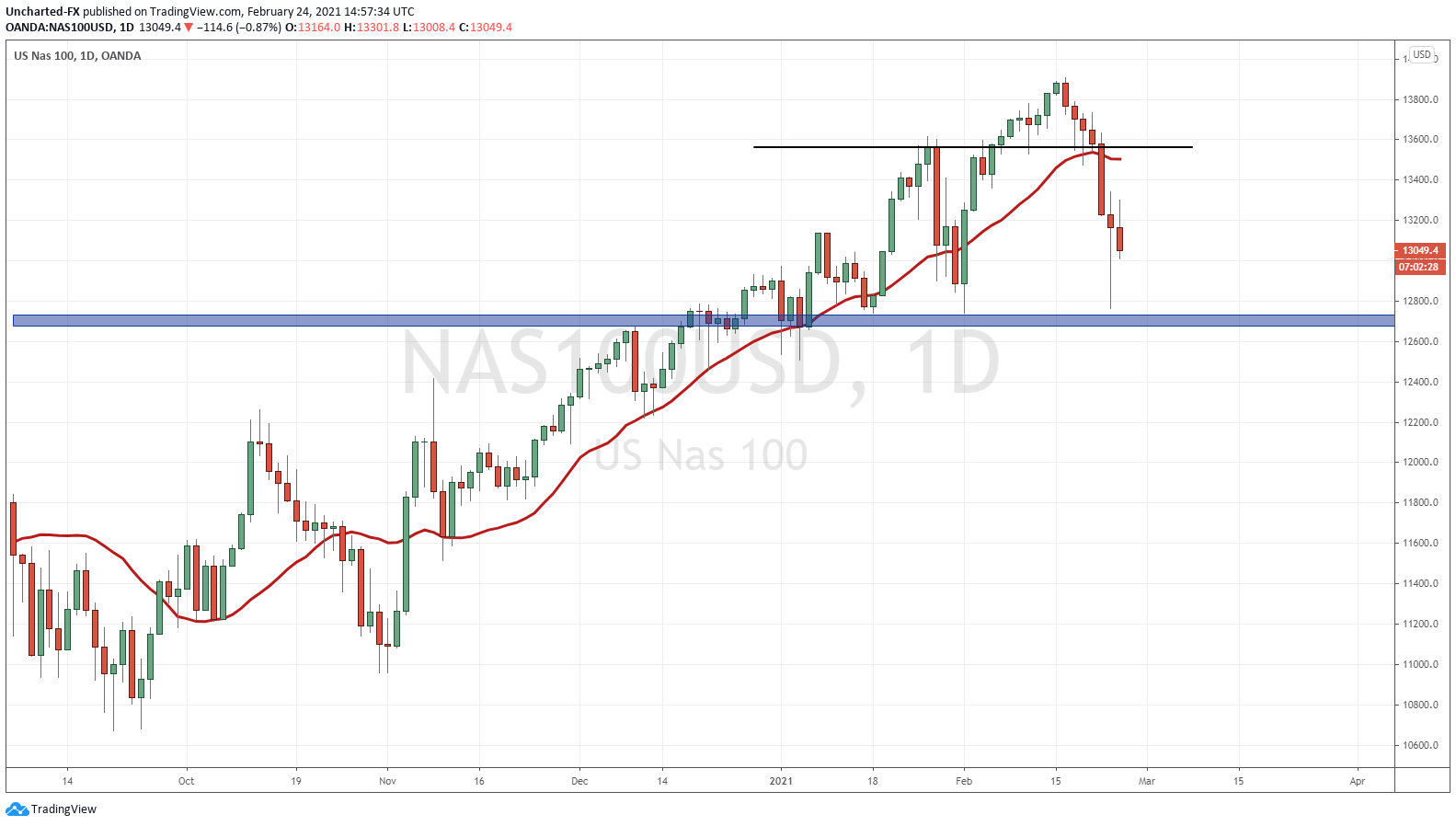

The Nasdaq saw buyers jump in right at the major daily support I mentioned in yesterdays Market Moment post. However, it is still in danger of forming a head and shoulders reversal pattern on the daily chart. If this pattern triggers, The long term bull market would be over.

But once again, look at the daily wick which saw buyers step in strongly.

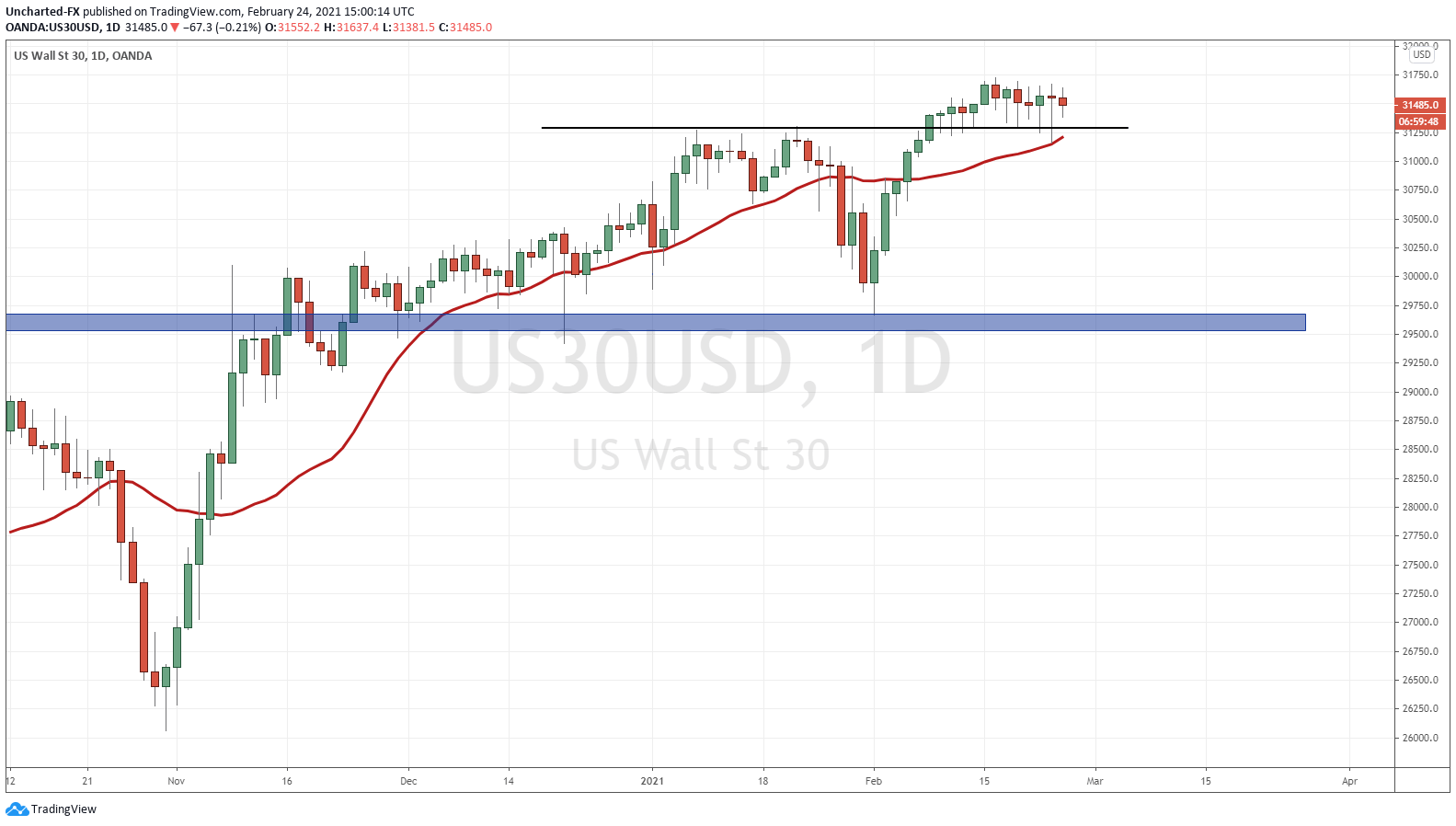

I finally want to show you the curious chart of the Dow Jones. The Dow has not had a volatile drop like the S&P and the Nasdaq. Largely due to Chevron, Disney, Boeing and American Express which by the way, is on the verge of breaking out into record highs.

Notice how the Dow has just ranged for 12 trading days. It really has not caught much momentum after breaking out. Keep your eye on this, because if the stock markets continue to fall, then the Dow would be a great short to take. Has some catching up to do.

The Reason Stock Markets are Under Pressure

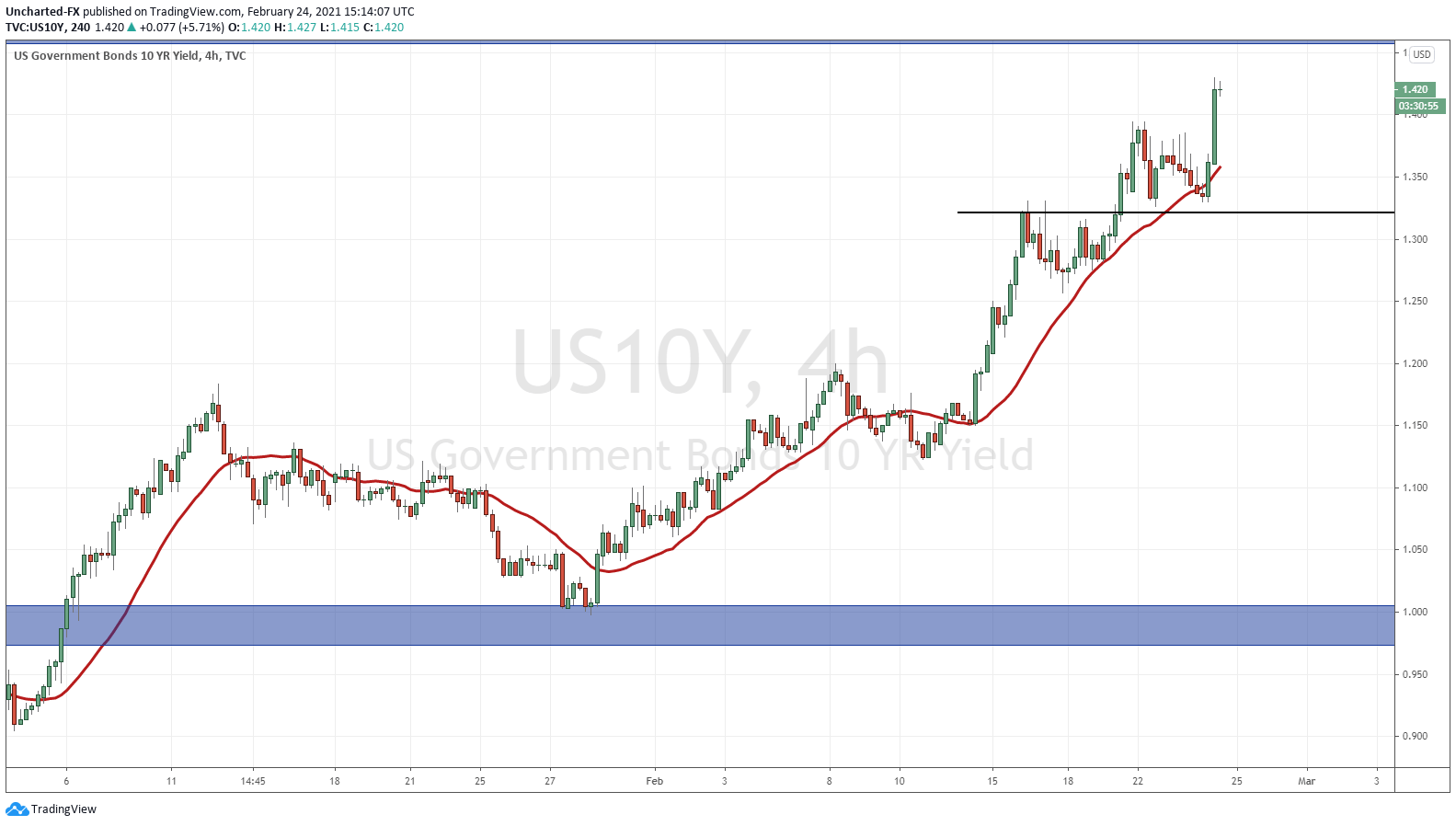

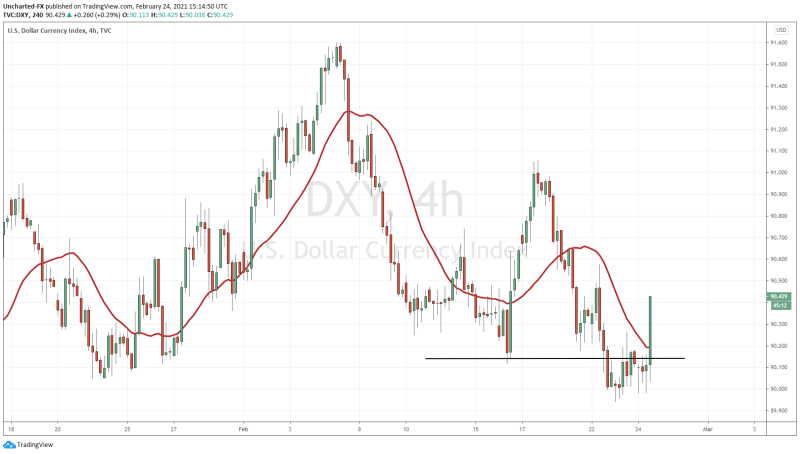

Readers of Market Moment know what we were looking at to determine whether Markets remain under pressure: the combination of the 10 year yield and the US Dollar. This was discussed in last weeks Market Moment post titled “Is the Stock Market Going to Crash”.

To summarize the article very quickly: when the 10 year yield spikes, it is indicating money is LEAVING the bond market. Using the asset allocation model, we can assume that money is flowing into stocks, although some argue that money now flows to commodities or cryptos since they are relatively cheaper compared to US stocks. But we did not see that initially. We saw money running into the US Dollar. The safe haven currency.

When we see this combo of the ten year yield spiking rapidly, and the US Dollar rising, it does not bode well for stocks. At time of writing, the US stock markets are under pressure. Take a look at the 10 year and the Dollar:

The fact that the yields are rising is of importance because the 10 year is the benchmark for US mortgages and loans. It is hinting to the fact that interest rates will be rising.

This is where things get really interesting.

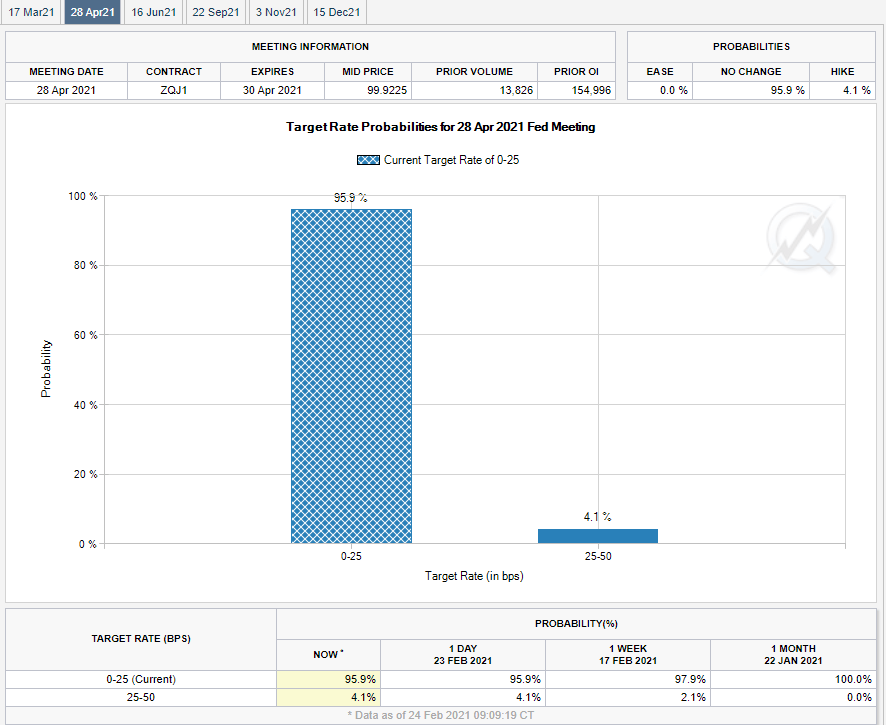

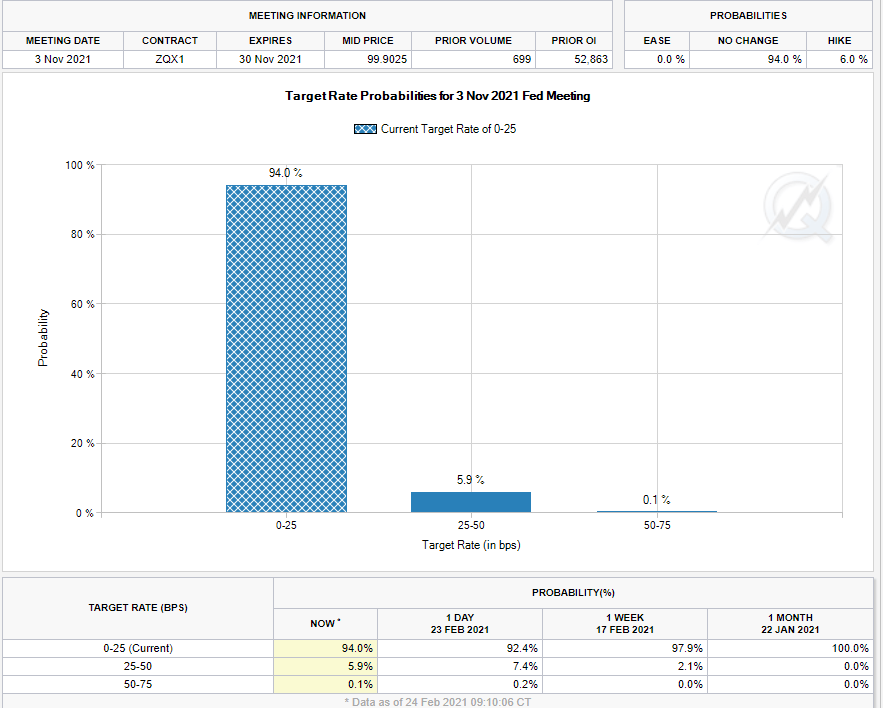

I want to show you the CME group Feds Futures. The Fed watch tool with the graphs I am about to show you below can be found here.

These are the contracts for April and November 2021. As you can see, traders are beginning to price in Interest rate HIKES. But the real story lies somewhere else.

Note how the probability of rising rates is about 4.1% and then increasing to 5.9%. Well, yesterday, the Fed Funds futures were pricing in a probability close to 10% for rates to be higher in Fall 2021. This is what the Stock Market was nervous about. Why? The market is expecting inflation due to all the money printing, and the way to cooldown inflation has been to raise interest rates.

However, these probabilities for rate hikes have dropped because of one man:

Cometh the moment, cometh the man.

Fed chair Jerome Powell gave his testimonial to congress yesterday, and is continuing to do so today. You bet the script was written to ensure he sounds dovish as possible. His job was to reassure the market that interest rates will not be rising. In fact, the Fed has said in the past that rates will not be raised until at least 2024. The quote of “we are not even thinking about thinking of raising interest rates”.

But lately, the inflation fears have been mentioned by some Fed members, and the financial media has been shoving it in our faces. The market was spooked.

In his testimony, Jerome Powell mentioned how Inflation is still “soft” and the Federal Reserve is committed to its current policy.

![]()

![]()

![]()

The inflation comments was what I was watching for given the action in the Bond markets, and Powell said:

“The economy is a long way from our employment and inflation goals, and it is likely to take some time for substantial further progress to be achieved,”

Basically that interest rates will not RISE for a long time, and inflation is not an issue. Although some of us may disagree.

A large crux of the issue was the fact that the media and the Fed has said that the economy is recovering, and the vaccine being rolled out backs this up. Sort of gave the market the impression that the Fed’s asset purchasing program would end, and perhaps interest rates would begin to rise. Not yet. The real economy still remains pretty much dead, and we still see hundreds of thousands of Americans file for first time unemployment claims with the Jobless data which comes out every Thursday. The real economy is not getting better, and we may not even have bottomed out.

In summary, Jerome Powell was successful in easing the markets fears. He reassured the market that interest rates will not be rising for a very long time. This means the stock market will continue to be the place to go for yield. As long as the Fed has the markets back, the dips will continued to be bought (BTFD- Buy The F***ing Dip!)

As noted earlier, the Fed Funds futures were pricing in a 10% chance of a rate hike during the Fall. Something nobody was really expecting, and that probability spooked the markets. This has dropped by half, and will probably drop even further after Powell’s second day of testimony. Expect future Fed meetings to be dovish in tone. Personally, I will be watching for a potential increase in the asset purchasing program specifically as a way to buy bonds to drop the 10 year yield. Something the media will call “yield curve control”.