It seems that Elon Musk has moved from Dogecoin to Bitcoin, as Tesla buys $1.5 Billion worth of Bitcoin. Some are saying this is ‘influencer’ status, almost akin to the WallStreetBets (WSB) crew and their short squeezes. When Musk, or Papa Musk as the WSB and the new retail traders call him, tweeted about Dogecoin, a whole meme was created. He is one of us, say the new retail traders.

This pump into Dogecoin has seen the price of the cryptocurrency move over 900% in just over two weeks of trading. Other celebrities such as Snoop Dogg and Gene Simmons have posted about Doge (and now Bitcoin), harkening back to the days of the first crypto mania where celebs and big names named drop coins they were buying.

In this Market Moment, I will go over my thoughts on this purchase, why it is not surprising, and what comes next.

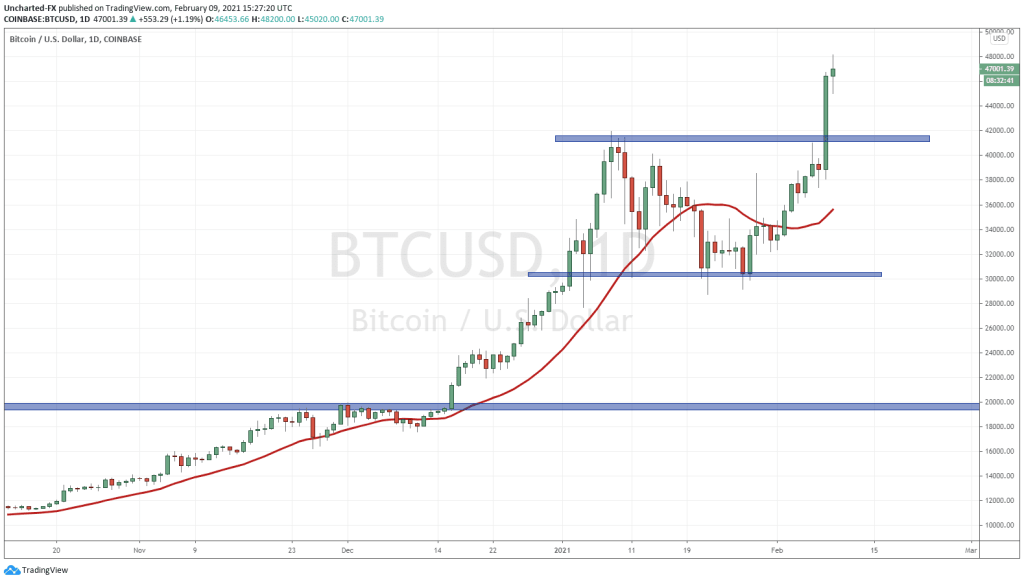

Let’s start with the Bitcoin chart.

First of all keep in mind that Ethereum is also making record highs. Bitcoin has broken out and is making new record highs, with many traders aiming for that all important $50,000 zone. Going forward, the $41,000 zone will be support, and do not be surprised if price pulls back to retest this before continuing higher. If price does break and close below 41k, then we will have to assess the sentiment then, but technically, it would be a big damper in momentum.

I think it is also important to show this graph: Tesla’s Research and Development Expenses.

Tesla’s $1.5 Billion purchase of Bitcoin is more than their annual Research and Development expenses of 2020 which came in at around $1.49 Billion. Not being taken very well by the Tesla bears, who say that the money should have been used to expand production lines so Tesla could focus on their business: producing cars.

The financial media is saying that Elon Musk and Tesla are buying Bitcoin because they plan on accepting the cryptocurrency as payment for vehicles. Sure. But I think there is something much bigger here.

My longtime readers are not surprised by current market events. I have been saying that stock markets will continue to move higher due to the chase for yield. As the real economy dies, the stock market will continue higher. This will occur until some sort of black swan event occurs, or when the central banks decide to pull the plug.

And we must talk about the central banks, particularly the Federal Reserve. Once again, my readers know that the Fed cannot allow markets to fall. Asset purchasing programs will continue, and will get larger. There will be more money printing. Crazy monetary and fiscal policy will continue. It cannot stop and will not stop.

My readers are familiar with the currency war. All central banks want a weaker currency to boost inflation and exports to revive their economies. We have seen this currency war take center stage between the Federal Reserve and European Central Bank. With the Dollar weakening, the Euro has appreciated. Not something the Europeans want when their economy is based on exports. More money printing has not worked to bring the Euro down. Their next step is to cut rates deeper into the negative since they are already in negative rates. The central banks of England and Australia have tried to hold off from negative rates by issuing micro rate cuts, or a rate cut less than 25 basis points. The Bank of England is expected to go into negative territory sometime this year.

Why do I bring this up? Because I believe this currency war is the KEY for the rise in cryptocurrency. It is a way to get out of fiat currency. We know what policies are coming from the central banks and our governments. More money printing. With the amount of debt issued to combat the pandemic, it must be managed with low interest rates and a weaker currency.

Perhaps the purchase of Bitcoin by Elon Musk and Tesla had a lot to do with this:

The decline in the US Dollar. Putting together the things I said about the currency war, it is likely the Dollar continues to weaken and maintain this downtrend.

Many were caught up with Tesla purchasing Bitcoin for payments, but let’s take a closer look at their SEC filing.

“In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity,” Tesla said in the filing.

“As part of the policy, which was duly approved by the Audit Committee of our Board of Directors, we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future,” the company added in the filing.

To me this screams “we don’t want to hold excess US Dollars when we know central bank and government policies will weaken it further”. This is the move out of fiat, going back to my reason for holding cryptocurrency and gold, and why they will continue higher.

Note the fact that Tesla also mentioned Gold bullion and Gold ETFs. Does Elon Musk and Tesla start diversifying their Dollars into Gold next? If I am correct on this being a move out of fiat, then I expect this will be the case…and might even be the trigger for my 180% move, as the technicals are still holding and the bull market remains intact.

Billionaires such as Ray Dalio, Stanley Druckenmiller, and Sam Zell have explained why they are bullish Gold for the future. Dalio using the term “Cash is Trash”. But maybe the Gold market needs someone like an Elon Musk to bring some retail and younger eyes to the precious metal.

In terms of more corporations diversifying out of US Dollars and into cryptos, I would not be surprised to see the list grow. Rumors are that Apple dips into Bitcoin next, but more reliable reports are indicating it will be Larry Ellison and Oracle that does so next.