WallStreetBets targeted Short Squeezes was the story last week, and it will continue to be the story for this week. Last week on Thursday, I posted about the Silver short squeeze. In that article, I spoke about Silver breaking out and holding support on the daily chart. This support zone came in at the $24.75-25.00 zone.

Over the weekend, Silver Short Squeeze was trending on twitter. Zerohedge spoke about how there was even a run on physical Silver bullion in the United States.

Over on the Equity Guru Discord Trading Room, we patiently awaited the opening on Silver futures as many of us were positioned on the breakout last week. Silver opened strong with a nice move over $28, and you will see why this zone is very important in a minute. Nice plays and those who took the trade are in the money. At time of writing, Silver is up over 8% for the day (taking into account the opening of the futures yesterday as well).

As Zerohedge describes…it has been nuts:

following a coordinated campaign to buy both silver ETFs in the paper realm and precious metals in the physical, which over the weekend which left virtually US precious metals retailer with little to no physical inventory, silver has finally exploded higher following in the footsteps of other “most-shorted” names, and it was last trading just around $30/ounce, soaring by 11.5% – its biggest one-day jump since Sept 16, 2008 – the day Lehman filed for bankruptcy. And, if silver closes here, it would be the highest price since early 2013.

The euphoria in the metal spilled over to various silver minter, with U.S.-listed peers soaring in the pre-market trading:

First Majestic +33%,

McEwen Mining +25%,

Hecla Mining +23%,

Coeur Mining +21%,

Pan American Silver +16%,

Wheaton Precious +12%European silver miners also soared on Monday led by Fresnillo, which rose as much as 17%, most since March; other exposed miners rise: Polymetal +6%, Hochschild Mining +17%. Elsewhere, China Silver Group Ltd. rose as much as 63% in Hong Kong, while Australia’s Silver Mines Ltd. gained as much as 49%.

Before I begin looking at Silver on the technicals, I want to point out two things:

- The chatter is that the WallStreetBets crowd may not pursue the Silver short squeeze with much gusto anymore since Melvin Capital, the hedge fund they are wrecking with the Gamestop (GME) short squeeze, has a large SLV long position.

- Knowing point #1, I say do not fear. Regular readers know I am a Silver and Gold bull due to the macro environment we are in. There is a confidence crisis approaching in governments, central banks and the fiat money. Historically, this is when precious metals do the best. If you have read my previous work, you know the currency market is the large market to watch. Every central bank is attempting to weaken their currency. It is a race to the bottom. More money printing and negative rates (deeper negative rates for some) are coming. The US Dollar is key to this.

Oh and just looking at any commodity index chart such as the Bloomberg Commodity Index, commodities are relatively cheap. With all the fiscal and monetary policy coming to combat the pandemic, hard assets are where many will choose to be.

You can read some of my previous posts on Silver to understand why I am bullish for the metal regardless of a WallStreetBets squeeze or not. This is the breakout on Silver I called and we still have held, and finally, my longer term targets for Silver.

Now onto the chart:

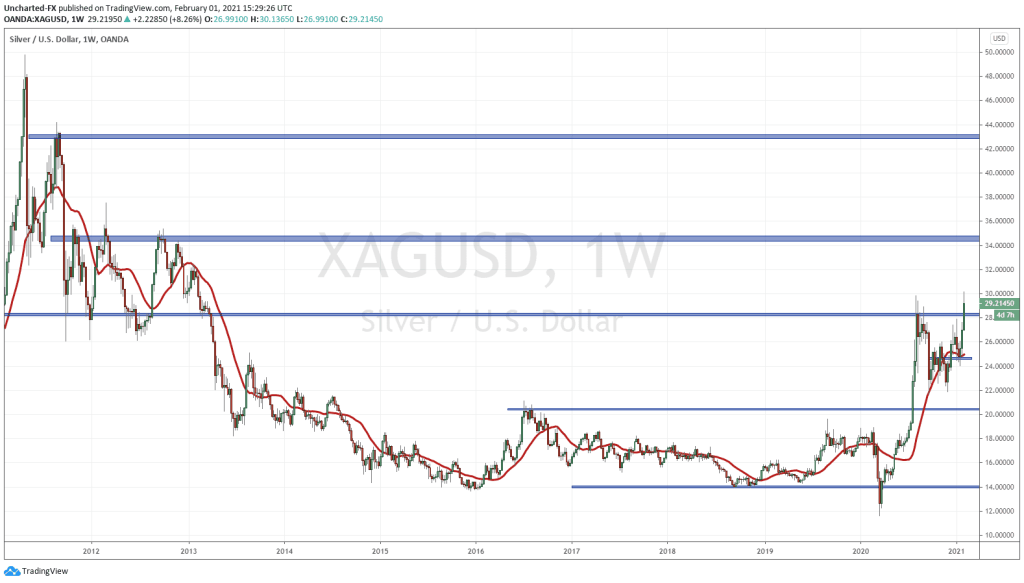

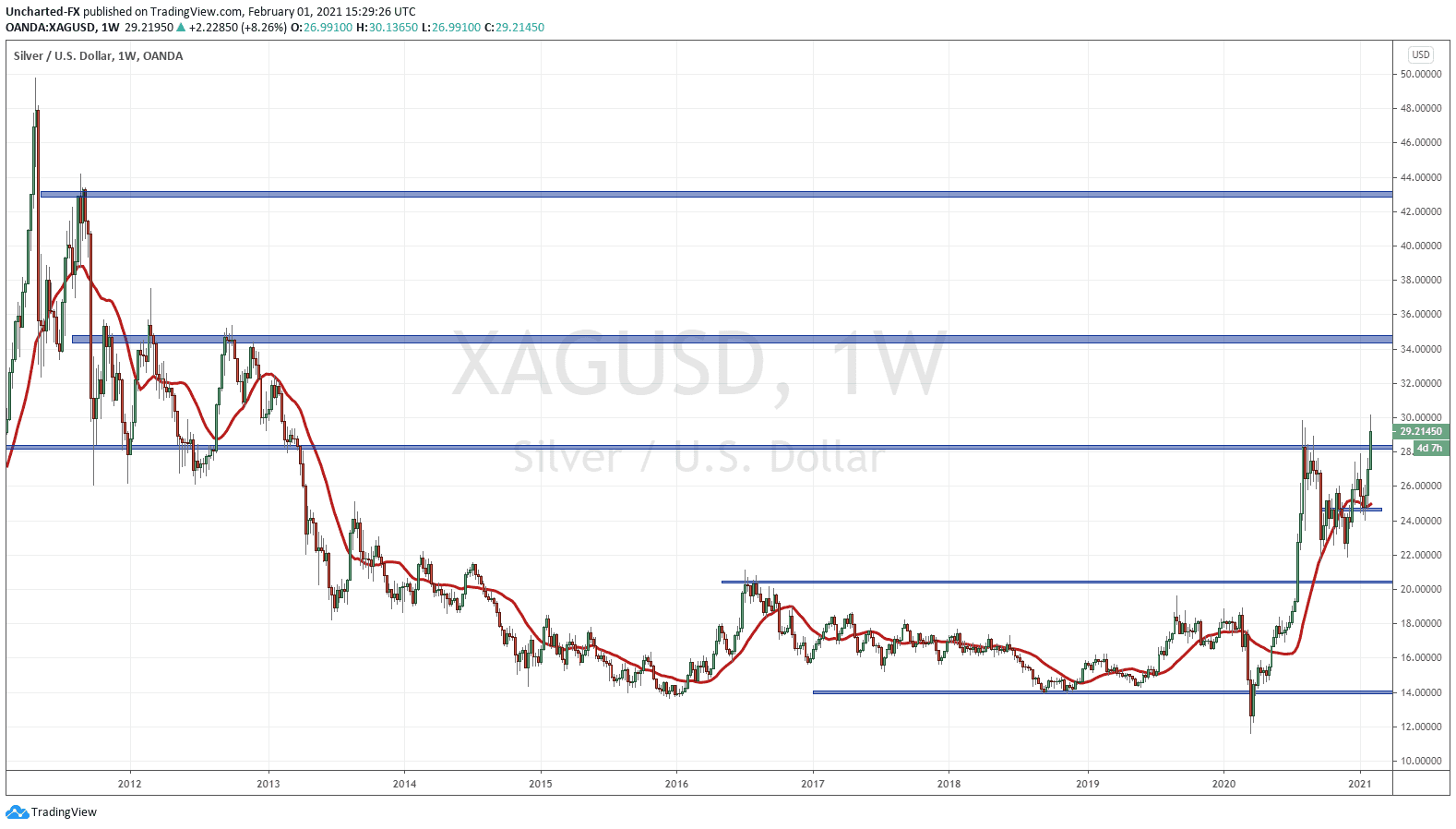

For this, I want to go up to the weekly chart. This timeframe is great to map out long term moves for swing trading ie: holding a position for more than a day.

Let’s go over the targets to the upside first. The first point of interest will be $34.50, a price we have not seen since 2012! Going forward, if we break above that, the next zone would be the $43 zone and then finally, targeting previous record highs and then making new record highs. The previous record high resistance zone is self explanatory, but why $34.50? This is a major flip zone. An area that has been BOTH support (price floor) and resistance (price ceiling). Very important zones for any chart, and these are where we target breakouts and take profit zones.

Knowing this, where we are currently should have caught your attention. Yes, we are breaking out above a very important flip zone which adds even more excitement to this Silver Short Squeeze!

What we want to see is a weekly candle close above $28.50 by the end of this week for sustained momentum going forward. We can go down to the daily chart for entries and retests in case prices sell off and pullback to this $28.50 zone. On another note, the $30.00 is one of interest too. This number is providing some short term resistance currently and for a good reason. It is a whole number and yes, we have not seen $30 Silver since 2012!

In summary, it is an exciting time to be a Silver bull. Even if the WallStreetBets crew does not participate whole heartedly, a close above $28.50 on the weekly chart will bring in the technical traders and the algo’s. I like the fundamentals and the technicals. For now, let’s us watch to see if buyers step in at $28.50 this week.