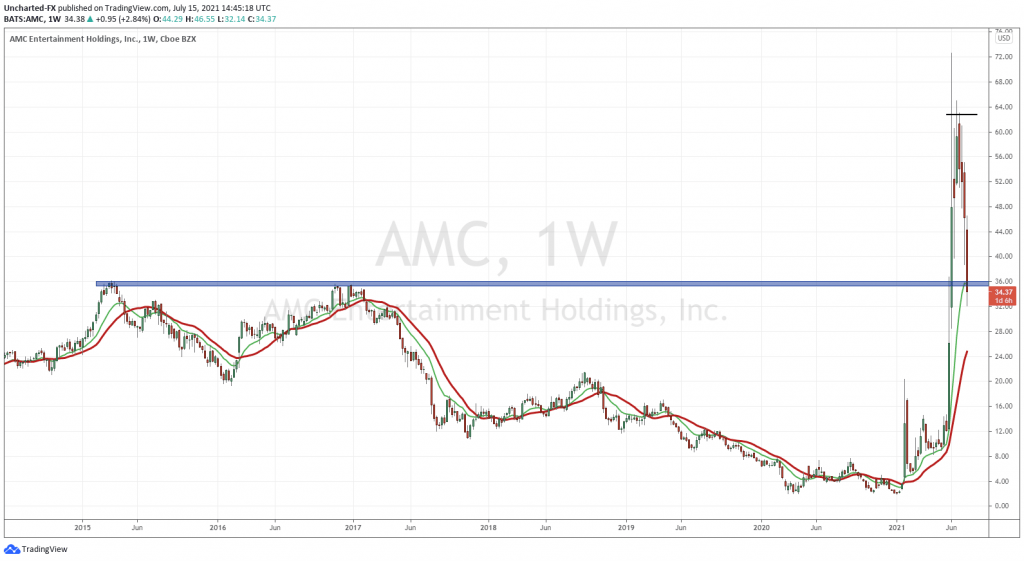

In my last writing about GameStop, we came to the implicit conclusion that the stock might be overvalued, or better said overbought. But today we have a lesson in why it is very difficult to hold a short position.

For those who aren’t too familiar with the Wall Street parlance, a short position is when an investor makes a bet that the stock of company ABC is overvalued and is due for a reduction in price. This investor borrows shares from the broker or other investors to implement this investment strategy, sells it at the share price then – and is therefore on the line to get the shares needed to give back to the lender. If the short-seller is right, they’ll be buying those shares back at a lower price than at their sell-price. If they’re wrong and the share price grows, they’ll be making a loss on the difference between the higher price vs their sale upon the return to the lender.

Sounds simple enough! But it should be warned that implementing this is very difficult and can be very costly to the investor.

OK, so where do we start? Valuation of course!

I have done the reader the favor of going through a simple valuation for GME. Luckily, we had numbers for 2020 and guidance for 2021. I assumed that GME would be able to produce its historical cash flows in perpetuity over 10 years and capitalize this with an appropriate risk-free interest rate.

These are pretty standard assumptions in financial valuation and gives us a conservative fair value of between $23.60 to $30 per share. As I am writing this, GMEs’ stock was trading at $43.03 per share, implying that it might be trading in “overbought” territory.

We’re not the only ones who have come to this conclusion.

Andrew Left, a popular short seller, was supposed to go through a presentation of his thesis on why GameStop is overvalued and is going to go back down to $20 per share. Sadly, he wasn’t able to do so because his account was allegedly hacked. On that news, GME’s stock traded up 9.95% for the day.

While Andrew Left wasn’t able to live-stream his rationale, he did a feature on Benzinga a popular YouTube channel dedicated to the ‘hot topic in the markets’. ( I have attached a snippet from his appearance below)

In this interview, he states his reasons were that :

- those who are buying the stock today are not investing and are instead speculating

- the underlying business is not doing well

- the stock was a bargain at $5 a share a year ago but is now too hot to handle

- he understands why stocks like Tesla go up the way they did, and it was because of the story behind the company. But he doesn’t believe that GameStop has the same story.

I’ve obviously paraphrased a bit, but for those who are more interested, the video above is a quick look into what he presented later on.

OK, we now know that our theory is sound. We know this because a popular short seller who does deep research in his companies before he opens a position is backing our own theory. Does this mean it’s time to execute the short ourselves? The simple answer here is no, short selling is very tricky and is never a 100% bet.

In economics, short selling is a bet that is said to have an asymmetric return probability structure. This means that the buyer of a short position has a capped return and infinite potential for loss. This is pretty obvious because a stock cannot go below $0. The tricky part is when your bet is wrong, and the stock continues to go up, which in theory can be infinite.

So how should an investor weigh their odds on such a bet? The best technique known to identify a short squeeze is by looking at what the numbers are actually telling you. We can use two well-known ratios, the first being the days to cover ratio, which is a measure of how many days it would take short sellers to cover their positions compared to the average daily volume. Usually, when this number is higher, there are greater chances of a short squeeze.

PS. A shorts squeeze is a rapid increase in the price of a stock, primarily due to technical factors in the market rather than underlying fundamentals. A short squeeze can occur when there is a lack of supply(shares available for sale) and an excess of demand for the stock due to short-sellers covering their positions.

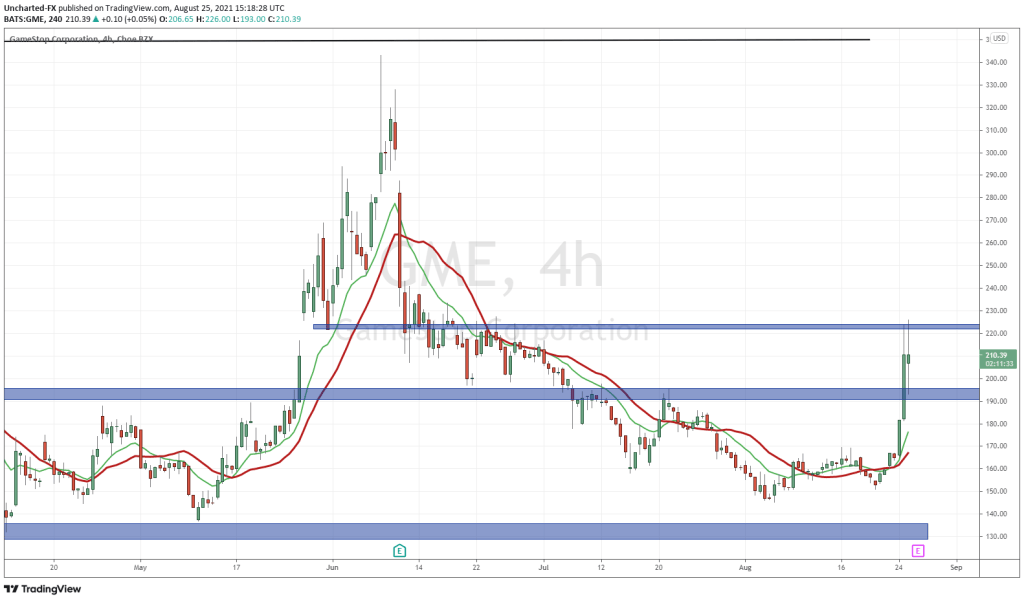

So, for example, in January 2021 GME has a total of 71.2 million shares being held as shorts and a daily average volume of 15,000,000 shares. This implies that the days to cover ratio is equal to 5. To know if this is high or low, we have to compare with the previous month’s numbers. Doing the same thing we did earlier, we find that in the previous month the days to cover ratio was closer to 4. There’s obviously an increase in the short interest, meaning more investors are betting that the stock is going to go down.

The second ratio we can look at is the short-interest ratio. This can be calculated by taking the same 71.2 million shares being held as shorts and dividing by the total outstanding shares of the company (69 million ), this gives us a short interest ratio of 102% compared to 100% last month.

Logically this makes very little sense. It essentially means there are more short positions open in the market compared to the shares that are actually publicly available for trading. This part takes some intuition, but it means that there is an oversubscription of short-sellers in GME and usually this leads to a short squeeze. Think of a game of musical chairs.

This means that the shares for GME are bullish(expected to increase in price) due to the potential of a short squeeze.

So even though we know that the company’s stock is overvalued, and the underlying business is not doing well, it’s very difficult to execute a short position without losing out. This just goes to show you why in the short run, the fundamentals of the business can mean absolutely nothing to the stock price but over time a stock reflects the soundness of its fundamental business.

It’s best to quote the Dean of Wall Street here, as he is more experienced in these Special Situations and he states that :

“In the short run, a market is a voting machine but in the long run, it is a weighing machine.”

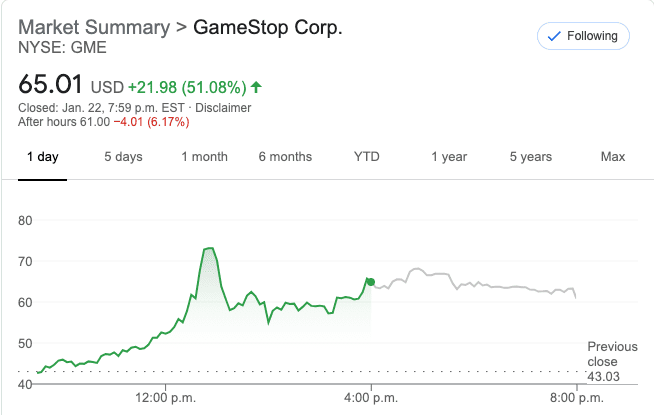

Update: This just happened (Friday January 22, 2021)

On the back of his appearance on YouTube yesterday, where he shared more of his short thesis, today GME’s stock ran up by 51% reaching a market high of above $70.00 per share compared to the closing price yesterday of $43.00 per share.

Short Sellers today

Update (Monday, January 25, 2021)

Update (Monday, January 25, 2021)

The market just hit a new high today touching $144 dollars per share. What does this say about the buying power implicit with options contracts?

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.