I will be completely honest. I am bullish on BlackBerry. There I said it.

Back in the first week of December 2020, I posted a Market Moment titled, “Why I am Buying Blackberry Stock for the First Time”. In it, I gave my fundamental and technical case for buying the stock. For those who followed me along for this ride, congratulations. BlackBerry has soared over 25% this week, and at current time of writing, has gapped up over 3%.

The fundamental case remains the same. The QNX system and its application specifically for autonomous vehicles will be big. We all know about the Amazon Web Services deal, which caused the stock to surge back in November. However, there are some rumours of a deal with NIO and maybe even with Apple down the line with their 2024-2025 Electric Vehicle. Only rumours.

BlackBerry is known for its cybersecurity. This trend will continue. In fact, the Nasdaq put out an article regarding BlackBerry being an emerging big data company.

The main catalyst for the recent price action has been BlackBerry selling 30 mobile phone patents to Chinese giant Huawei. A nice 8% popper on shares the day this was announced. Another story was Facebook and BlackBerry dropping an ongoing dispute related to patent infringement. If this continued, it would have put some strain on BlackBerry’s financials, so this was seen by the markets as positive news.

But I want to direct your attention to something not picked up by the financial media. In my past BlackBerry article, one of my bullish cases had to do with the retail trader. Do not discredit the retail traders who are using their stimulus and government checks to invest or day trade the markets. We have seen what the Robinhood crowd can do to Tesla. I think a case can be made for BlackBerry to enter the scopes of these type of traders. Why? Mainly because it is still cheap. But there is another group to watch for, and that is the reddit community. WallStreetBets (WSB) is a large community and is THE place to go for many new and millenial traders/investors. If you take a look at the posts, BlackBerry is in many of them. One of the members of our Discord channel told me that BlackBerry has been mentioned on the WSB Discord channel more than 1,000 times in the past week. The retail crowd have their eyes set on BlackBerry. This crowd has been instrumental in creating short squeezes in Tesla and most recently, Gamestop (GME). They have done the same with BlackBerry, and we may just be getting started.

So what happens next? First of all, I am approaching BlackBerry as a long term investment. I think the big stories and catalysts are yet to come. People who are holding the stock as a trade might see things differently.

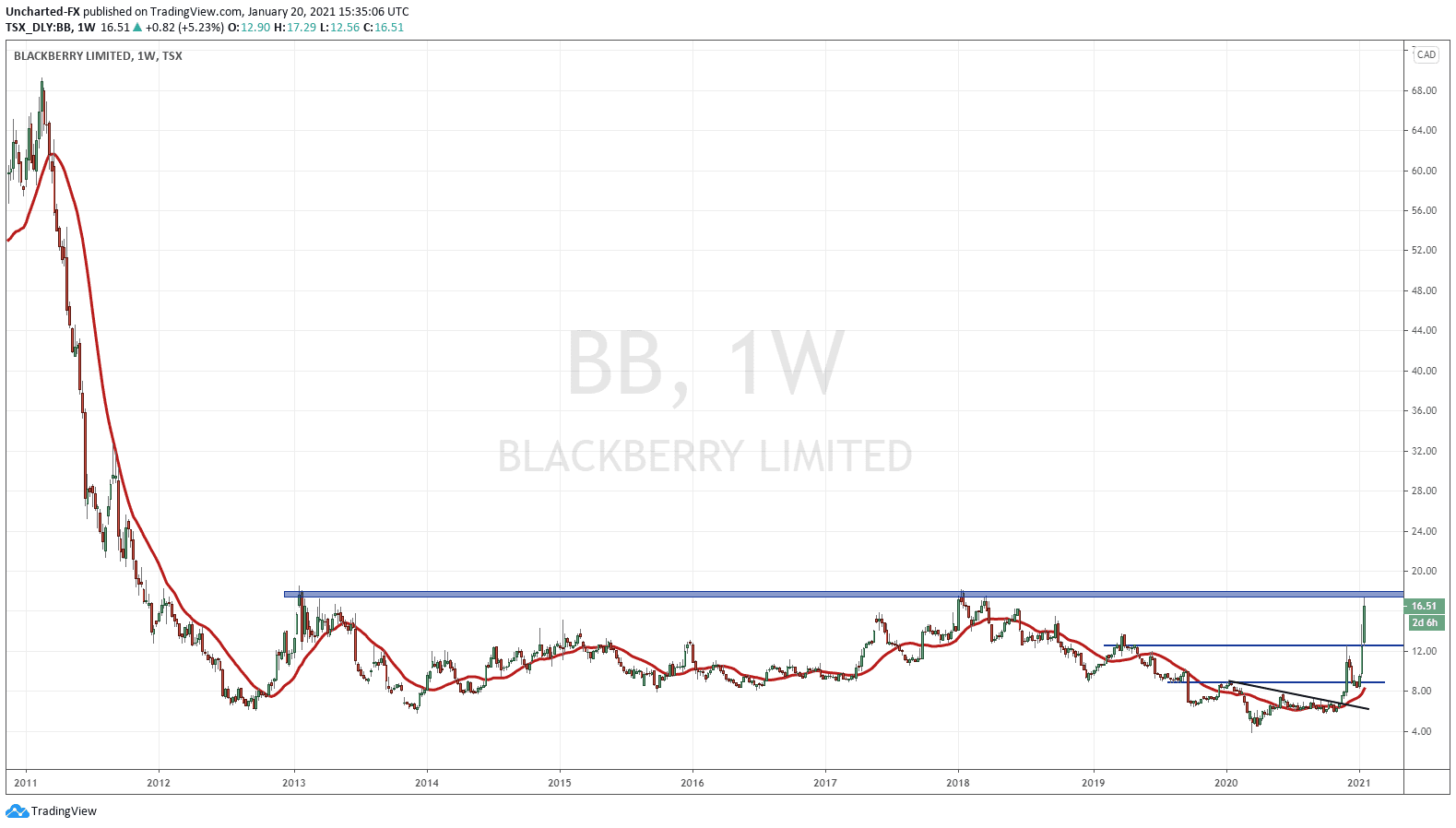

Above is the weekly chart of BlackBerry on the TSX exchange. We have hit a MAJOR resistance zone at 17.90-18.00. Expect profit taking. What this would do is create a pullback. Technically, BlackBerry remains in an uptrend as long as price stays above 8.50. That is the higher low we are working with. However, only one higher low has been made, and I expect two in an uptrend.

If price retraces, I expect buyers to step in around the 12.00 zone. It has been a major flip zone (an area that has been both support and resistance). The bounce from here would give us a second higher low in this uptrend, meaning we eventually break above 17.90-18.00 and make new EIGHT year highs.

To be honest, there is a lot of room to the upside on this breakout. We do not see new resistance until 30.00 and then over 40.00.

This will all depend on BlackBerry turning things around, and if the market believes it and sees it. The company seems to be stepping away from the mobile phone space to focus on cybersecurity and the internet of all things. QNX and its applications are very exciting. Over 175 million cars on the road use it today, and this is set to grow. Very exciting times for this Canadian company.