The stock market has a weird habit of reacting to information in a rapid and uninformed way. This week, Canadian market participants are reacting to an acquisition proposal made by CloudMD, a healthcare software business based in Vancouver. Although this acquisition was announced a few weeks ago, the stock has been in a frenzy ever since.

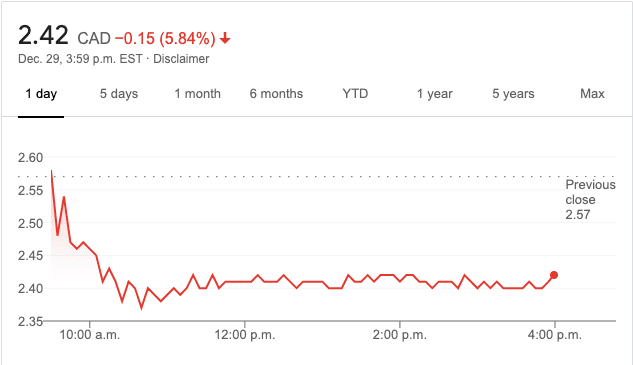

Just before the Christmas holiday, the stock went up +10% on the announcement. And then on December 29th, it was down almost -6% and another -2% today on the same information.

CloudMD Is one of those businesses that has benefited from the biotech frenzied market due to the COVID pandemic(DOC is up over +200% year-to-date whilst the general market is only up +2%). Because of the aforementioned pandemic, everyone seems to have become an expert in the biotech space. To be fair, some of these opinions come from a place of an in-depth understanding of the industry, but a large majority come from investors’ appetite for abnormal gains.

I want to be on the record saying that, I’m not against the stock being up +200%. I actually believe that there is potential in what they do. They are digitizing the delivery of healthcare by providing patients access to all points of their care from their phone, tablet, or desktop computer. The company offers software as a service (“SAAS”) based health technology solutions to medical clinics across Canada and has developed proprietary technology that delivers quality healthcare through the combination of connected primary care clinics, telemedicine, and artificial intelligence (“AI”).

As an investor, you can’t help but speculate on such exponential growth potential in the tech space. Their revenues have grown by a cumulative annual growth rate (“CAGR”) of +100% since 2018. We have seen in the past giants, like Apple(smartphone) & Amazon(retail) coming up through the ranks with small innovations, all the way up the top to disrupting larger industries. And many investors feel the need to be the one who made the big bet when nobody was right. (after all, few remember your wrong bets – only that one that was massively successful)

But investors be warned :

“It is hard to distinguish between being early and being wrong in the heat of the moment.”

Of course, it would be capricious of me to make such a bold statement without supporting my claims. And luckily, we can look at history as an indicator of where we might end up in the near future.

To start off we want to see what this acquisition means for CloudMD. The big question on our minds should be, whether this deployment of capital today will produce an appropriate return in the future. It is easy to assume this fact to be true: why would the management team deploy shareholders’ capital in such a way if not to increase the company’s net worth? However, as always when you take a step back and look at the information in front of you, a clearer picture is presented.

So, the first assumption we make is that the new valuation for DOC will be based on the acquisition of IDYA4. But, management needs to deploy shareholders’ cash in order to properly acquire the said business. The total deal will cost approximately CAD$17,000,000. At the time of this writing, DOC had cash and cash equivalents in the bank of about CAD$33,000,000. Of course, it would be irrational of them to use half of their liquid cash to make this acquisition, so management opted for a more diverse approach.

The management team opted to use USD$3.7 million dollars in cash and USD$6.6 million in stock, and on top of that they had an earn-out of USD$4.4 million (which was then further distributed into 0.44 million in cash and four million in stock )

From this, we can assume that the business will have to lose a total of CAD$17 million in cash and receive identifiable tangible assets in the form of their new acquisition. The net effect would leave the business in a similar financial position.

The question on my mind is how management is able to let go of such a large portion of liquid cash without putting themselves in a working capital deficit- unless this was the plan? This acquisition also raises more concerns when you realize that the business has yet to make cash flows from operations.

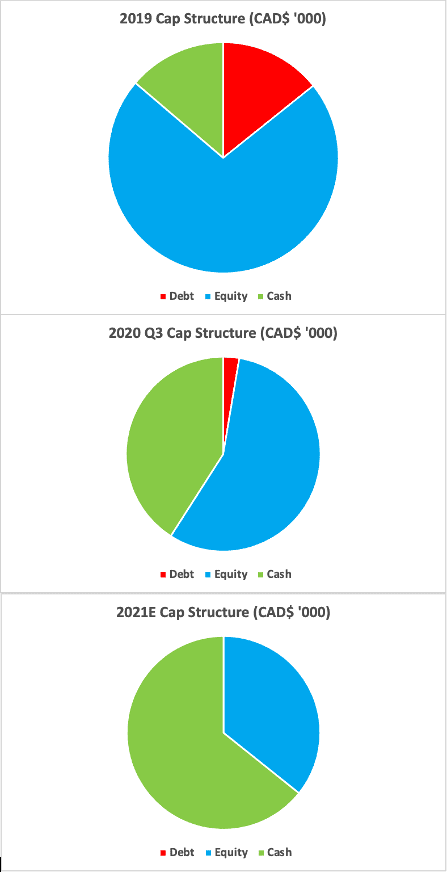

To finance most of the working capital, the business has issued debt and equity securities. The debt burden has grown by 58% since 2018 and the equity has grown by 173%. The shares outstanding including the shares issued for the acquisition went from 46 million in 2018 to 193 million in 2020. From this, it’s pretty obvious most of the value for DOC is from their book value or expected liquidation value. As of their recent financials, they have a book value of $0.40 per share. This book value figure is expected to grow by 4% (this growth rate is approximate of the consensus by analysts in the Canadian market ) over the next six years.

Now that we have a rough book value (distinct from the liquidation value ), we have a starting point for our valuation. We can assume before adjustments for market conditions, that the business would sell for $0.40 per share if it was to close down as of the last balance sheet date.

But the valuation doesn’t end there. Since DOC is making an acquisition, they are obviously assuming that this new segment will produce revenues for them increasing their sales over time. To keep this article short and concise, we won’t go through all those assumptions, but I’ll take a look at what the new numbers do for the valuation.

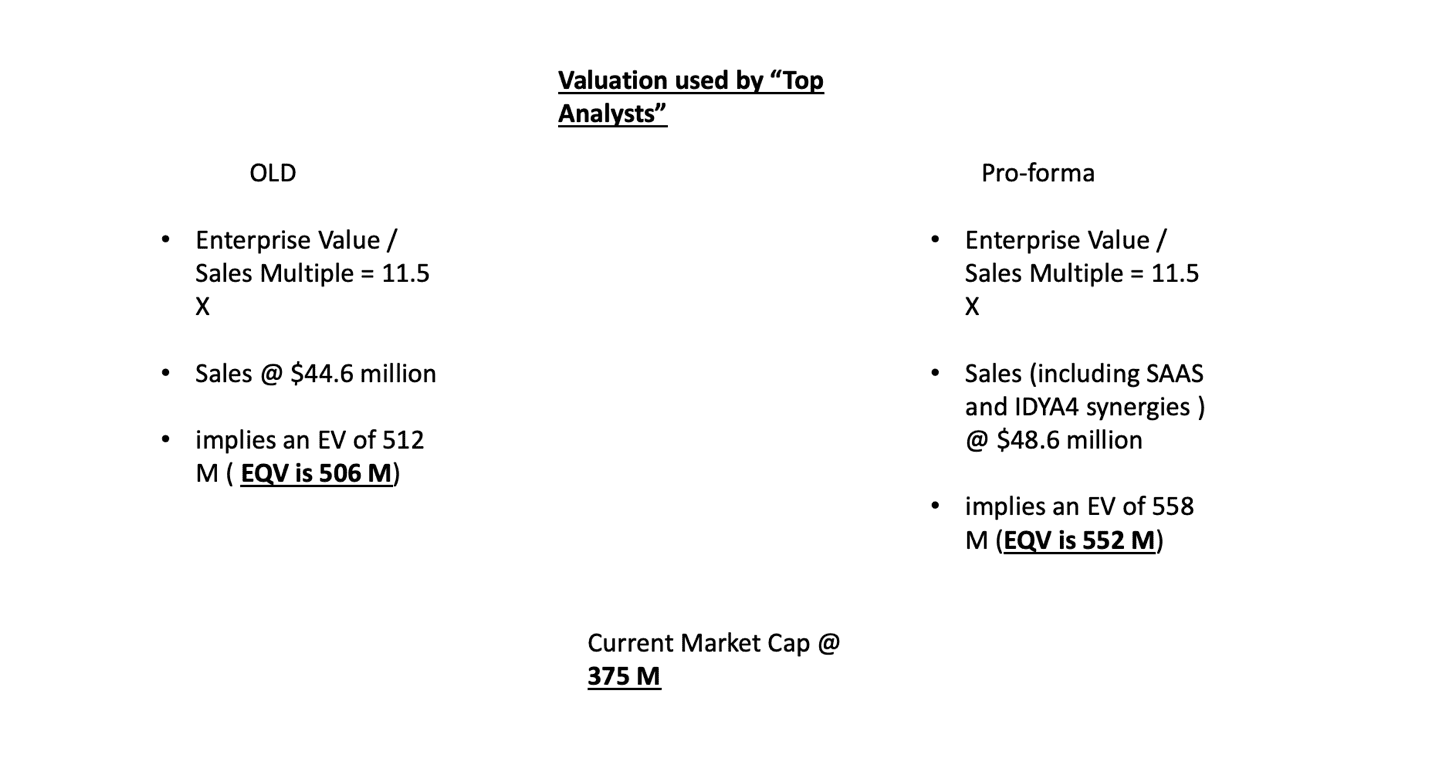

After making all necessary adjustments assuming that the synergies do work in DOC’s favor, their projected annual sales revenue of CAD$44 million will turn CAD$48 million in 2021. And using the standard enterprise value to sales multiple at an average of 11 X, the business has a net worth of about 552 million. With the business currently trading at 375 million, the market is selling this business at a 32% discount.

Now we have a range of between $0.40 and $3.60 as the true worth for DOC. Personally speaking, this range is a little too wide to make a purchase at today’s valuation. If I was to give a precise conclusion, I would say the stock is fairly valued at today’s current market price of $2.30.

The new valuation comes with certain risks that might heavily reduce intrinsic value. The main ones that I see are :

- A shortage of medical physicians in Canada, which may affect DOC’s ability to hire an adequate number of physicians and other health care practitioners to support the company’s growth plans

- Business concentration by region. The business is mainly focused on British Columbia, and this sort of market concentration can adversely affect the company’s operations in the province if significant changes happen provincially

- Foreign Exchange rates. DOC is a Canadian business and is currently buying a US-based clinic. Fluctuations in the FX rates between the Canadian and US dollar could impact the company’s revenues and margins if proper hedging techniques are not utilized by the corporate finance team.

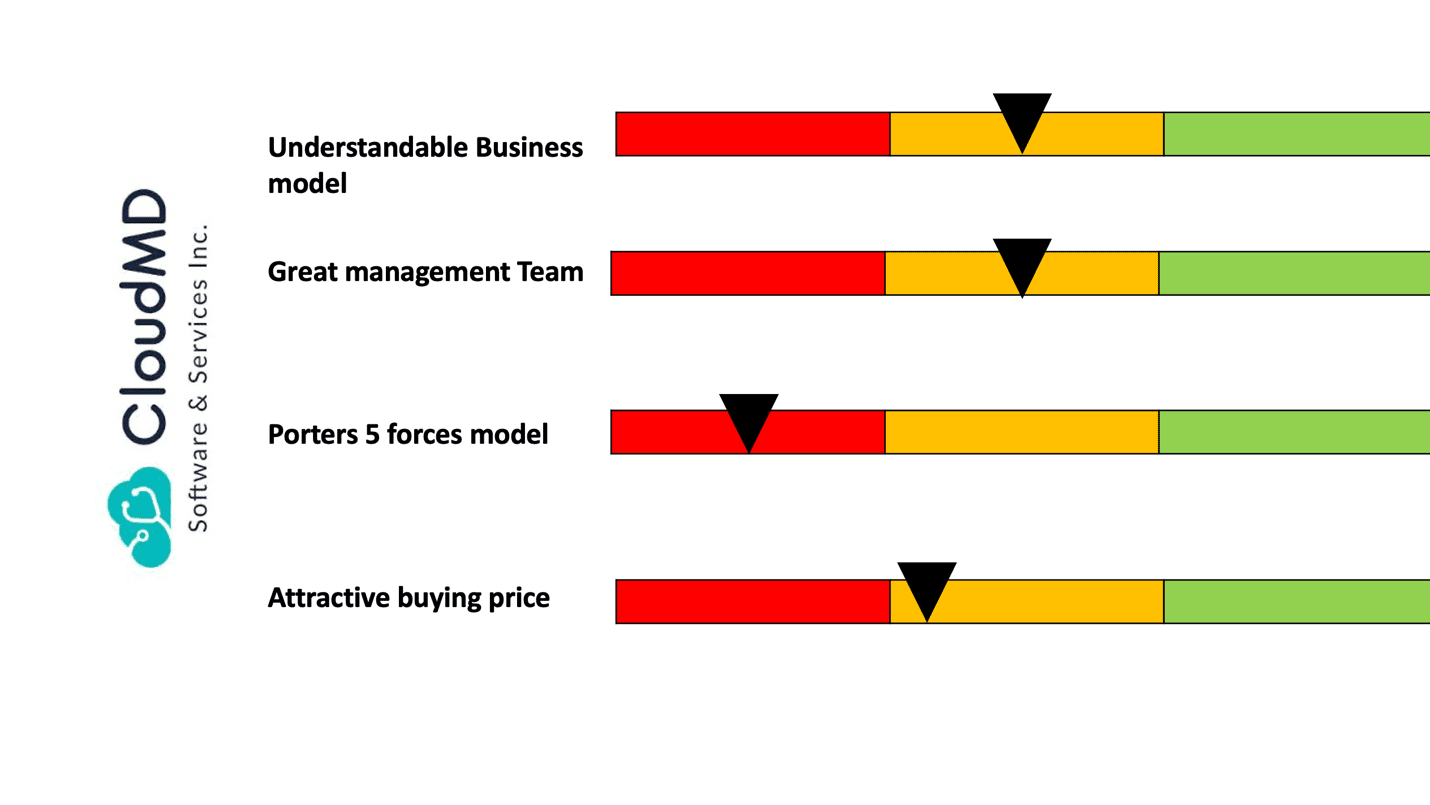

Below is a great visual summary of our analysis and shows how subjective the investment analysis process can be.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.