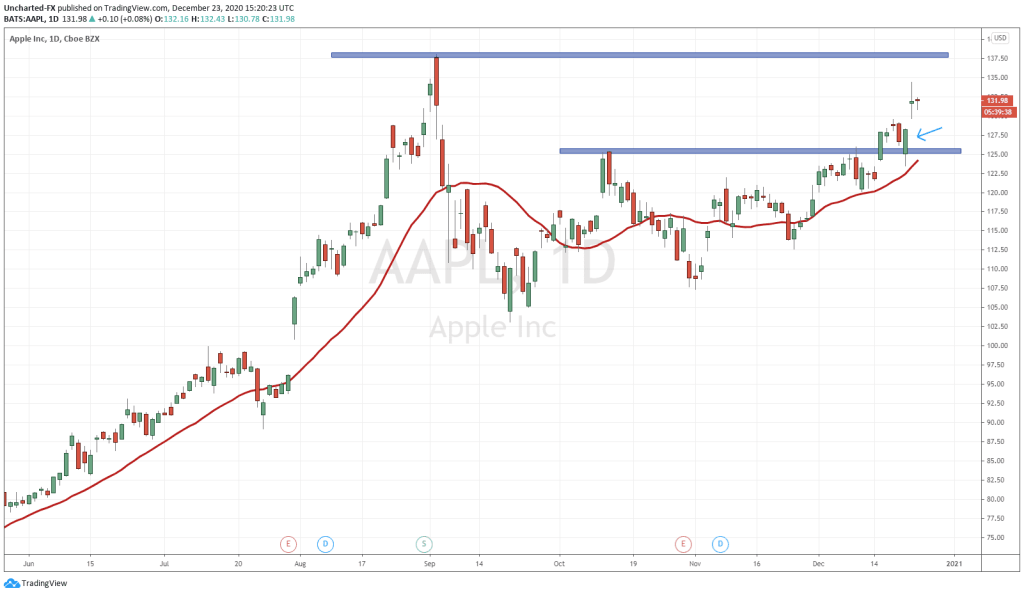

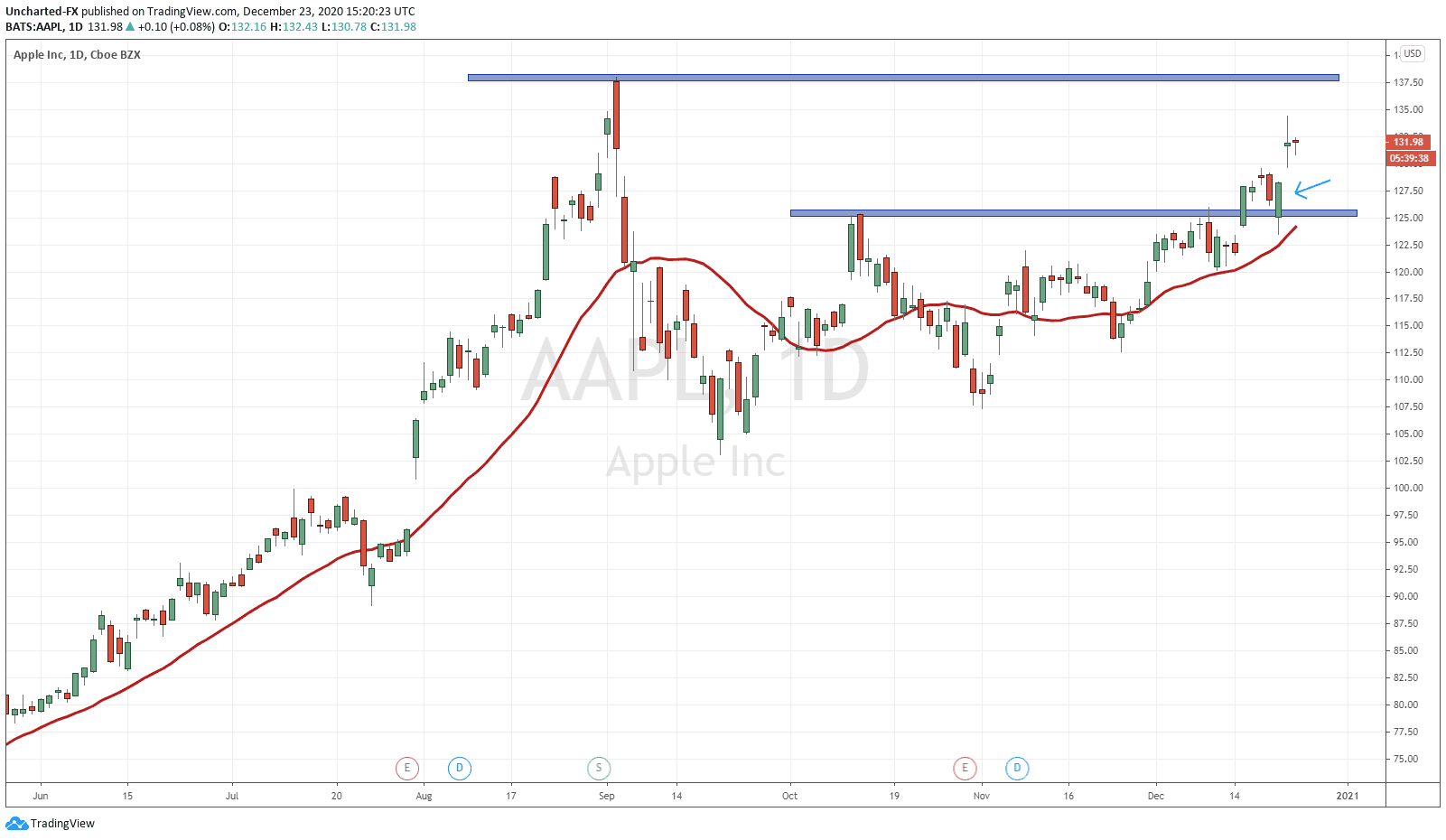

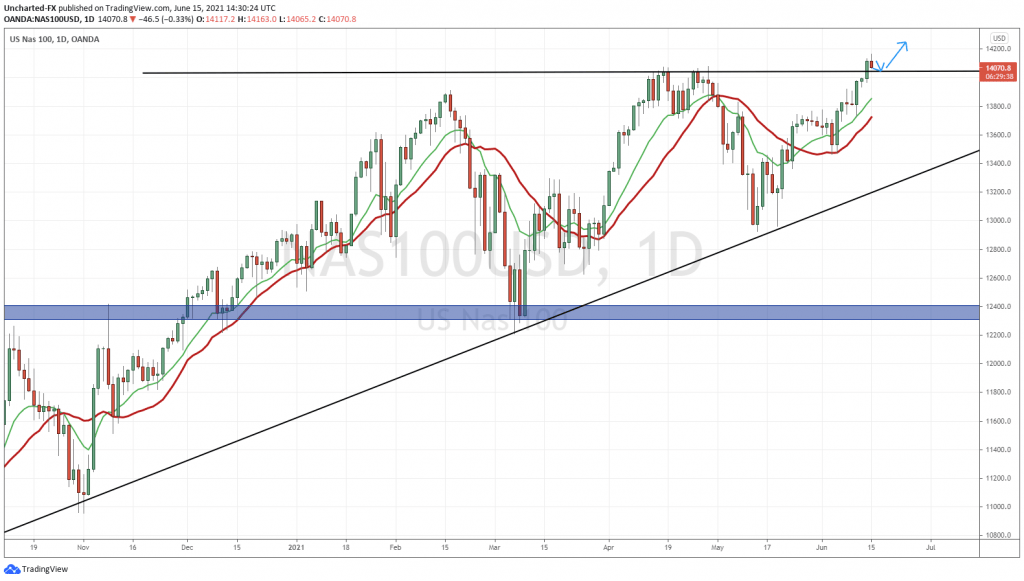

Over on the Equity Guru Discord Trading Room, we have been watching the daily chart of Apple for a breakout above the 125 zone. Let me show you what I mean:

For 10 trading days, Apple (AAPL) tested our resistance zone at 125 but could not breakout. We finally got the breakout on December 15th. Perhaps it had to do with a larger forward guidance for a product, or pricing in the EV statement which came out yesterday. To be honest, as a market structure guy, none of that really mattered. The breakout was incoming.

Notice my blue arrow. How price pulled back to retest the breakout zone, now as price support, before continuing higher. My readers are familiar with this aspect of market structure. What was once resistance (price ceiling) becomes new support (price floor), and price tends to almost always pull back to retest the new support. This is the far better approach to trading and investing rather than chasing the ‘fear of missing out’ (FOMO) momentum pop.

As you can see, buyers did step in on the 125 retest, and price has continued higher. Going forward, 125 still remains an important support level. If you want to add more technical jargon to it, it really is a ‘flip zone’ a price area that has been BOTH support and resistance. The most powerful price levels we can work with. To the upside, previous record highs at the 137.50 zone. This is our new resistance. With a stimulus bill still in the talks, and central banks continuing to prop the markets…stocks will continue higher until some sort of black swan event occurs. There really is nowhere else to go for yield.

The big news came out yesterday. Apple is developing an Electric Vehicle (EV). Not any EV, but one with a breakthrough battery technology. In my past article on Tesla, I mentioned the QuantumScape battery breakthrough and a few other companies working on developing a better battery. Seems like Apple joins that list.

This project showcases the ambitions for Apple, and the target for production is 2024, but could be delayed to 2025 due to the pandemic.

The story was an exclusive from Reuters, so let me just quote a few interesting points:

Apple’s goal of building a personal vehicle for the mass market contrasts with rivals such as Alphabet Inc’s Waymo, which has built robo-taxis to carry passengers for a driverless ride-hailing service.

Central to Apple’s strategy is a new battery design that could “radically” reduce the cost of batteries and increase the vehicle’s range, according to a third person who has seen Apple’s battery design.

It remains unclear who would assemble an Apple-branded car, but sources have said they expect the company to rely on a manufacturing partner to build vehicles. And there is still a chance Apple will decide to reduce the scope of its efforts to an autonomous driving system that would be integrated with a car made by a traditional automaker, rather than the iPhone maker selling an Apple-branded car, one of the people added.

Apple has decided to tap outside partners for elements of the system, including lidar sensors, which help self-driving cars get a three-dimensional view of the road.

Apple’s car might feature multiple lidar sensors for scanning different distances, another person said. Some sensors could be derived from Apple’s internally developed lidar units, that person said. Apple’s iPhone 12 Pro and iPad Pro models released this year both feature lidar sensors.

As for the car’s battery, Apple plans to use a unique “monocell” design that bulks up the individual cells in the battery and frees up space inside the battery pack by eliminating pouches and modules that hold battery materials, one of the people said.

Apple’s design means that more active material can be packed inside the battery, giving the car a potentially longer range. Apple is also examining a chemistry for the battery called LFP, or lithium iron phosphate, the person said, which is inherently less likely to overheat and is thus safer than other types of lithium-ion batteries.

This poses an interesting dynamic between Tesla and Apple, both which have incredible brand power with the millenials. Even Tesla detractors and bears say that Tesla could still be seen as a luxury EV. Other major auto manufacturers have the capabilities to outproduce Tesla if they decide to go full into EV. Volkswagen comes to mind.

Being a millenial myself, a lot of people in may age group love Apple’s brand power. They have Apple everything. Iphone, Ipad, Mac, Airpods, heck even Apple TV. A new Apple EV where you can store and connect all your Apple products is going to be immensely popular with my age group and younger. Tesla’s brand power is obvious. Don’t believe me? Look at how quickly their beach shorts and even Tequila sold out. I can see Apple providing a challenge to Tesla’s EV brand power dominance for a certain age group, but in the end, it should come down to who will make the better vehicle.