If you had suggested to me this time last year that bitcoin was going to enjoy breakout success, and bust through it’s all time high by December of the following year, I would have wondered what you were smoking and where I could get some. It was trading at around $7,000 and struggling against a $10K resistance point and the rate that it had been growing didn’t even prime the pump for a double, let alone nearly triple in a year. But even as strange as 2019 was nobody could have predicted the almost Lovecraftian weirdness that was 2020.

Watching the professionals try to predict Bitcoin’s movements through their obscure chart magic is kind of fun, but ultimately I don’t have much faith in it. You can watch a company grow through their chart. Company does something that draws investment and the stock price goes up—they do a private placement to make cash—which they use to reinvest, and produce a better, stronger, more plentiful product. For something like a cryptocurrency, which runs or sleeps based on pure sentiment, influenced by a myriad of different global phenomenon and only a handful of hardcoded supply changes that happen once every four years, pinpointing the reasons gets a little hazy.

Okay. A lot hazy.

Companies that have sprung up in some capacity around Bitcoin (and the altcoins) can be watched with more of an objective, traditional measure. And it’s to these we turn today. Their course and trajectory through the year can be measured and their features speculated on, and as such, here are three companies doing the right things at the right time to find their way through the escalating weirdness that is life in the 21st century.

Success in cryptocurrency mining is all about overhead management. There are two main factors that go into securing solid overhead for a cryptocurrency company to be “good enough,” but for a truly excellent mining operation, there needs to be a fallback or escape plan in case the bread-and-butter mining operation needs to go on hiatus.

They are:

- Low cost electricity.

- Quality equipment.

- A diverse amount of coin mining options.

I wrote earlier in the year that Hive Blockchain Technologies (HIVE.V) was enduring what in hockey parlance we call a rebuilding year. Well, their rebuilding year is over and now their fortunes are starting to gear towards success. First, they meet all three of the above named criteria.

Beyond the costs for the ASIC, GPU (or CPU, I guess) rigs themselves, there’s electricity costs for both running and cooling the rigs. Especially for ASIC rigs. ASIC stands for application-specific integrated circuit and it’s when a device is set to one specifically application—and if we’re talking about mining Bitcoin, then it’s always ASIC. Nothing else will provide the power required anymore. Plenty of other coins use an ASIC setup as well, but most of them can still use high end graphics cards (GPU) or computer processing power (CPU.)

Hive has made deals in Iceland, Sweden and Quebec for cheap, subsidized electricity. When their ASIC rigs get hot they don’t have to go to any fancy, expensive lengths like air conditioning or immersion tanks, instead they can expose their server room to the cold winds of la belle province. That’s half of your electricity bill right there. The machinery itself helps as well. It’s mostly S19 antminers, which are up to date, and produce competitively and reliably.

But plenty of other companies have this in spades. Cryptostar (CSTAR.C) has operations in Quebec, and they’re busy mining Bitcoin with up-to-date machinery. They have enjoyed some success, but what sets Hive Blockchain aside from CSTAR and others isn’t just that they mine Bitcoin, but they mine other coins as well, and specifically Ethereum and at scale. It’s not just a project they do on the side—their entire setup in Sweden is loaded down with GPU-rigs working night and day to mine Ethereum.

Because Hive knows what’s coming down the pipe. Vitalik Buterin, the Canadian-born maven behind the Ethereum blockchain, rolled out his Ethereum 2.0 phase zero earlier this month. One of the biggest changes that came along with such is the change in the consensus mechanism from Proof-of-Work (which is why companies require entire fields worth of ASIC rigs) to Proof-of-Stake, which requires considerably less electricity to operate, but for whom the ability to close the block is predicated on an algorithm which privileges the largest stake holders. Hence, they’ve been mining like crazy to build up a huge stake pool to be first in line when it comes time to stake Ethereum.

Ethereum, which I might add, is the second largest cryptocurrency by market cap, and trading at a little over $600 right now. Ethereum 2.0 is just getting started. There hasn’t been any word of whether or not Hive will take advantage of some of the functionality of Ethereum, but that doesn’t mean that it isn’t an option for the future.

- Generated income from digital currency mining of $13.0-million, an increase of 8.2 per cent year over year;

- Generated gross mining margin (1) of $9.2-million, or 71 per cent of income from digital currencies;

- Mining output of newly minted digital currencies:

- 32,800 Ethereum;

- 88,300 Ethereum Classic;

- 89 Bitcoin;

- Generated adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) (1) of $10.6-million, a significant increase from a loss of $4.6-million a year earlier;

- Generated net income of $9.2-million for the period, or three cents per share, compared with a loss of $11.5-million, or four cents per share, last year;

- Net cash less loans payables of $1.7-million plus digital currencies assets of $10.7-million, as at Sept. 30, 2020;

- Working capital was $20.9-million as at Sept. 30, 2020.

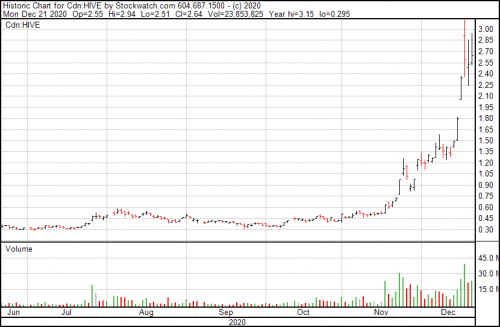

Now let’s have a look at the chart:

Success kind of speaks for itself, doesn’t it?

—Joseph Morton