If you don’t invest in resource companies because you’re concerned they do harm to the planet, I wonder where you think the metals in your Tesla are going to come from going forward. In recent years, any shift in thinking towards making other sectors more green has come with a definite up-front need for ores to make the new way of working possible.

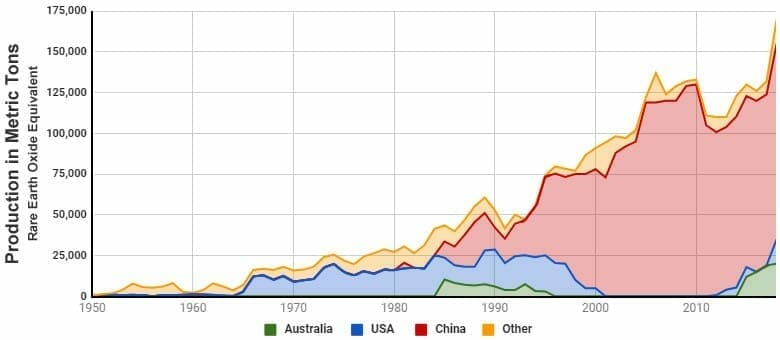

Rare earths, once a darling of the markets, are in short supply what with enormous growth in the need for rechargeable batteries, from wind and solar power needs to electronics and electric automobiles, even the military.

The big problem with rare earths is you find them produced in places where Chinese is the local language.

Which is well and good if you have a factory located in China. It’s not so hot if you need to lock down a North American supply that won’t be affected by adverse trading relations or price gouging..

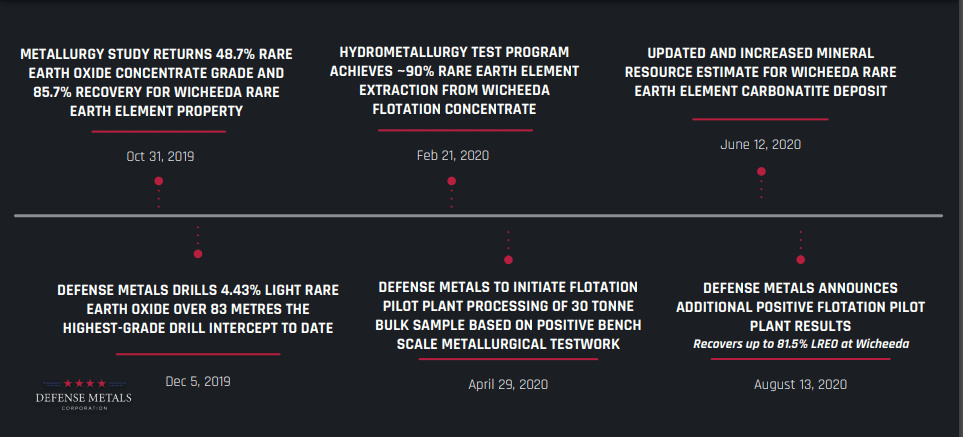

Defense Metals (DEFN.V) isn’t producing rare earths right now, but few are. If you look over their timeline over the last year, what’s clear is they’re working on it. No knowledgeable independent observer would suggest they could have done more over the last year to advance their project and, as things stand, they just keep hitting good results on their exploration, and adding elements that would be needed to move to production.

If you want intense detail on the propert they’re working or the data they’re getting from their work, feel free to check out Greg Nolan’s work on the technical end. I’m not a technical guy. I’m a ‘show your work’ guy, and DEFN is showing a lot.

Defense Metals is pushing its wholly-owned Wicheeda REE project further along the development curve… aggressively. This 1,708-hectare chunk of REE-rich terra firma is located in the mining-friendly region of Prince George, B.C. It’s easily accessed by a well-maintained forestry road and all the necessary infrastructure a mining company could ever want is but a chip shot away. This Whicheeda resource is high-grade.

I’ll add to the above – they’re genuinely the cheapest clients we have. Nobody grinds us more on our fees than DEFN’s team, which you’ve got to respect, especially in a time of free-spending promo teams.

While there are definitiely other companies out there that are cheapskates, DEFN actually does promote itself, but in a sustainable, steady manner that shows long term share price growth over the last year, limited spending on anything that won’t advance the project, and no trouble finding investors to bring them financing as needed.

While gold explorers come and go, bouncing off the roof and floor as the prevailing winds toss them about, DEFN is less a trade than it is an investment. Their team just keeps delivering real news that serves as share price upswing fuel, and that steady service of information keeps shareholders from selling, because nobody wants to watch them knock out more good results three days after you cashed in.

Journalist’s note: I don’t have big news to drop on you to merit this story being on the front page. In fact, I’m writing about them now not because there’s news out today, but because there’s been so fucking much news for months that I don’t even check the share price anymore. Sure, it may have a down day here and there but, over the long haul, DEFN just keeps going steadily up, regardless of what competitors are doing, and regardless of what rare earth prices are doing.

If the chart above doesn’t impress you because there are no two-bagger days, you’re clearly new. Not everything is a trade. Sometimes you just buy in and go to bed.

My thinking: They’re going to get this thing to production. Because if their plan was to run the company as a bog standard pump and dump, they appear to have neglected the whole ‘dump’ element for the past year.

Respect to those who do the work. And to those who double my investment over nine months.

— Chris Parry

FULL DISCLOSURE: Defense Metals is an Equity.Guru marketing client, and we’ve purchased stock in the company several times.