Most academics and institutional investors have long believed that the most persistent complexity in the art of investing in the selection of the most appropriate securities for an optimal portfolio.

This optimal portfolio promises the investor a satisfactory return while maintaining the highest level of risk tolerated by the investor.

However, if you have not been living under a rock, you will have heard the old adage: high risk, high reward. Let us breakdown the budget constraint faced by investors and hopefully answer the question: what is the true process of accessing the economic opportunity cost between a selection of similar investments?

Opportunity costs represent the potential benefits an individual, investor, or business misses out on when choosing one alternative over another.

Because they are unseen, opportunity costs can be and are often easily overlooked. Understanding the potential missed opportunities foregone by choosing one investment over another allows for better decision-making.

In mathematics, they quantify this cost by assuming an individual is faced with a choice between investment A with a (Net Present Value) NPV of 4 and a (Required Internal Return) IRR of 6% & investment B with an NPV of 5 and IRR of 6%.

Both investments provide the investor with positive cash flow or NPV, although investment B will provide an extra unit of return over investment A. Both have an expected rate of return of 6%.

How is the wise investor supposed to make an intelligent choice on which investment to deploy their capital? The easy answer would be to go for the one with a higher NPV as it provides the purchaser with an extra unit of cash flows. But as you know by now this author prefers the difficult answer. (I know, I am a lot of fun at parties)

The reason why the above example is important to any investor to understand is the fact that in your investment journey you are going to be asked to pick between two very similar investment ideas. In a perfect world, you would always be able to purchase both options without hitting a budget constraint, but this is not at all true in reality.

The investor be it big or small has to allocate their limited capital in what seems like a limitless investment universe.

Case Study

For this simple case study, I picked the Utility Sector, with a random selection of companies (We have clearly embraced the 21st Century and the new technological age)

With this selection, I will attempt to mimic the investor who is facing the challenge of picking the optimal common stock, while constrained by a limited amount of capital.

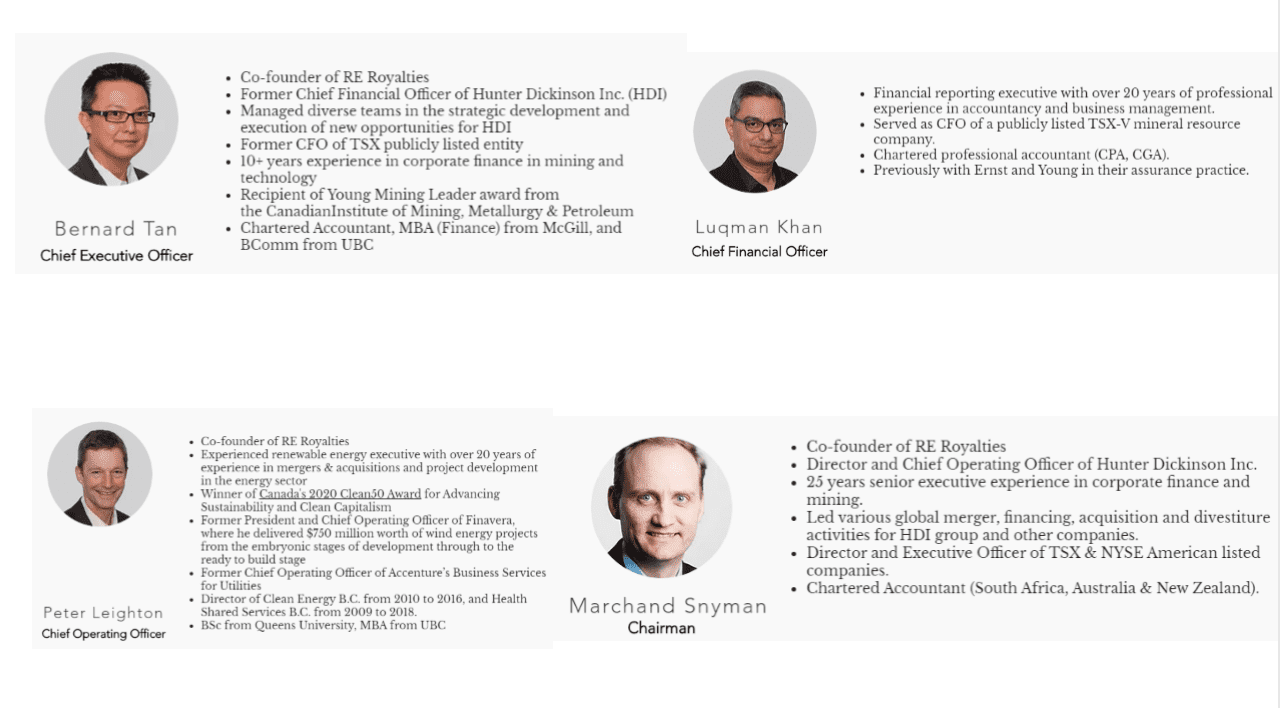

Our first business is RE Royalties. The business provides royalty financing solutions to renewable energy generation and development companies. As of December 31, 2019, it owns a portfolio of 75 royalties from solar, wind, and hydro projects in Canada, Europe, and the United States. The company is based in Vancouver, Canada.

It is a simple business model to understand and the management team has provided us with a great description from their latest reports.

“The Company acquires revenue‐based royalties from renewable energy generation facilities by providing a non‐dilutive royalty financing solution to privately held and publicly traded renewable energy generation and development companies. The Company’s business objectives are to acquire a portfolio of long‐term, stable, and diversified royalty streams from renewable energy generation facilities and to provide shareholders with capital appreciation and a growing, sustainable, long‐term cash distribution.”

RE Royalties Team

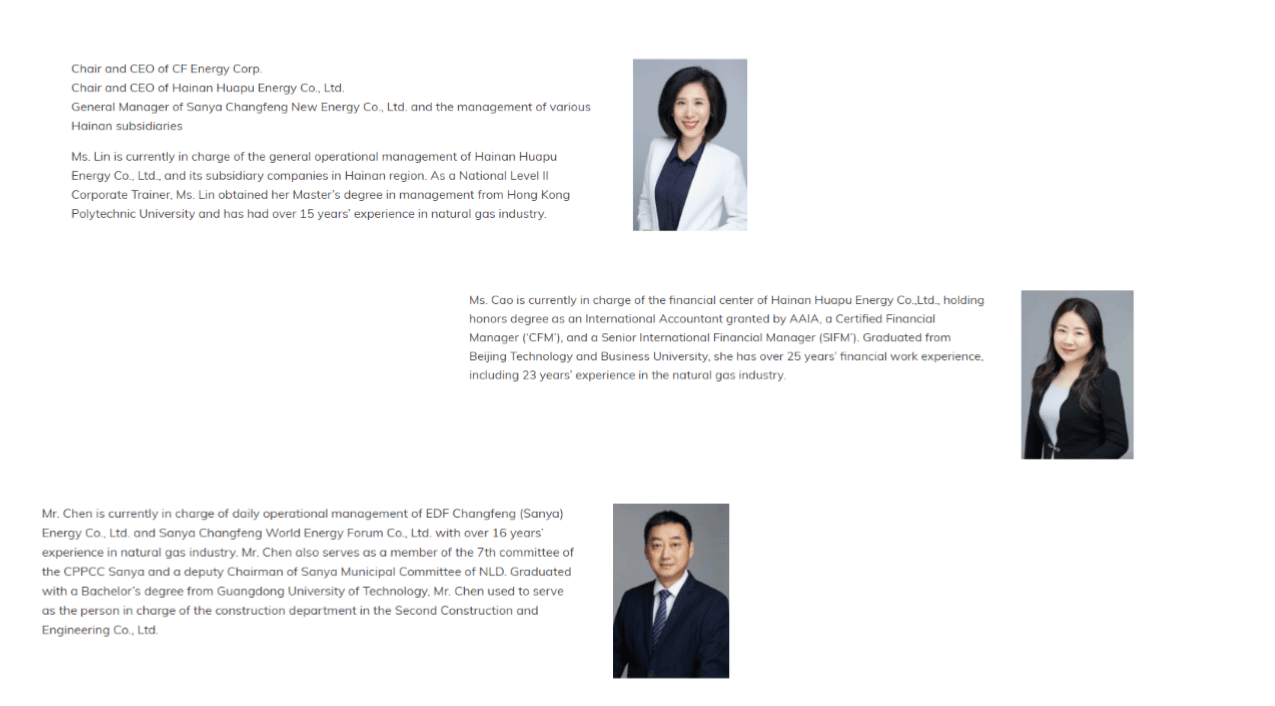

Our Second Business is CF Energy Corp. CF Energy operates as an integrated energy provider and natural gas distribution company in the People’s Republic of China. This business is directly involved with utility production and of our selected companies is the most traditional corporate structure. The only snafu is that majority of the tangible assets are in the People’s Republic of China although the head office is in Canada.

CF Energy Team

Management for CF has also provided us with a simple explanation of their corporate strategy.

“Our existing business model comprises four main segments: (i) Pipeline natural gas (“PNG”) sales and liquified natural gas (“LNG”) supply distribution sales; (ii) Vehicle refueling; (iii) Natural gas direct transmission; and (iv) Renewable and smart energy/Integrated smart energy. Segments (i), (ii) and (iii) have been operational with the remaining segment (iv) is currently under development.”

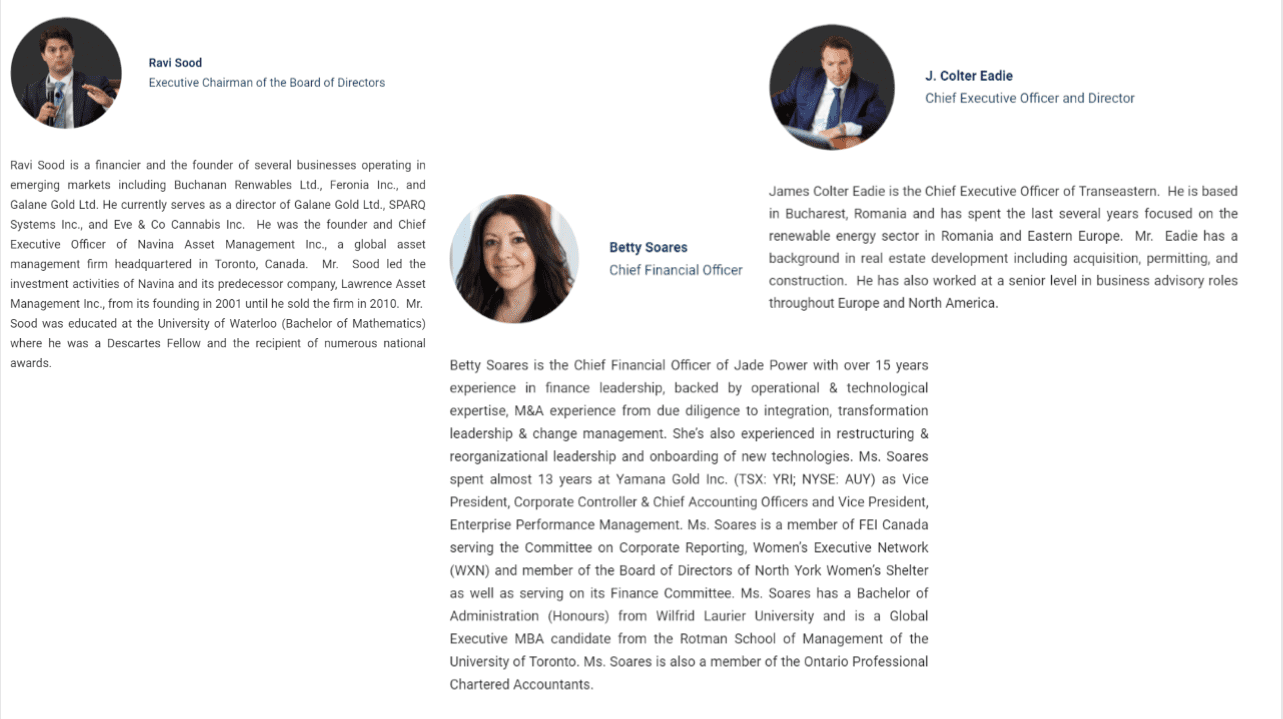

Finally, we have Jade Power Trust engaging in the renewable energy business in primarily Romania, other European countries, and internationally. The company generates and sells electricity to electricity buyers in Romania. It owns and operates three hydroelectric facilities, two photovoltaic solar power production plants, and two wind projects.

“The Trust’s strategic plan for building value for holders of Units (“Unitholders”) is to invest in high-quality renewable power production facilities that generate sustainable cash flows and provide attractive risk-adjusted returns on invested capital. The amount of electricity generated by the Trust’s operating facilities is dependent on the availability of water flows, wind regimes, and solar irradiation. Lower-than-expected resources in any given year could have an impact on the Trust’s revenues and hence on its profitability and working capital position.”

Jade Power Trust

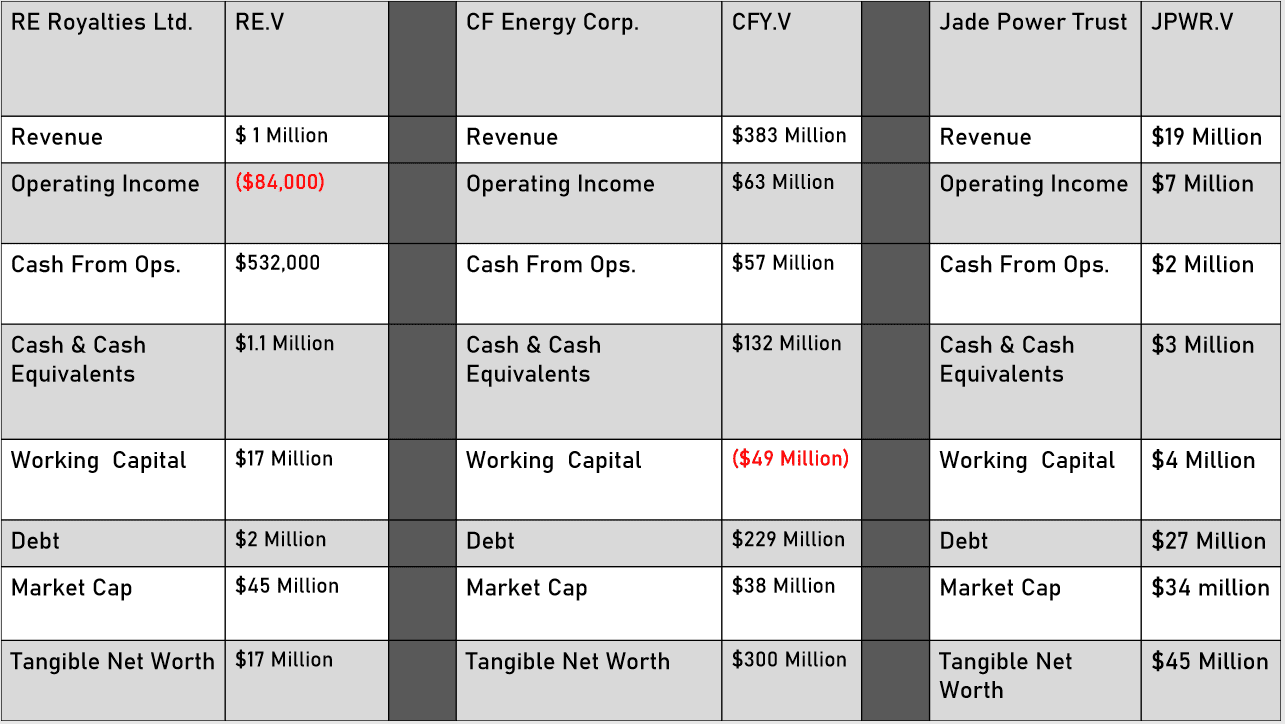

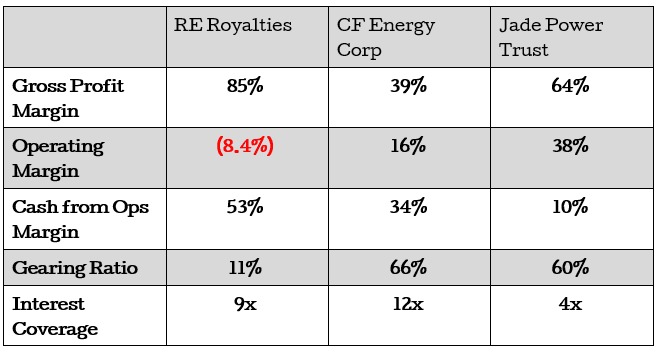

Having briefly looked at what each business does and who is in charge we can look at some of the quantitative measures of efficiency used by the investment community. These measures seek to address the question of profitability and quality of an investment idea.

To do this we can simply compare the three companies since they do operate in the same industry. We will take a look at profitability, operational efficiency, and their ability to pay for all obligations.

As is common in financial circles the ‘best’ measures of profitability are the gross profit margin & operating margins due to their popularity we will focus on them. The cardinal rule is that the higher the margins the higher the profitability and this applies to both gross margin and operating margins.

RE has the highest gross margins of the three firms coming in at 85%. This means RE keeps 85 cents of every dollar of revenue it generates, which is very high for a firm in general let alone a utility. This is probably because of the royalty structure they have set up where they are not directly exposed to the costs of running the utility company. Their operating margins are negative and can be an indication that the royalty structure comes with its operational difficulties and might be expensive to run. These extra costs could be in the form of legal fees or audit fees paid to third parties.

RE generates a large sum of cash that it has to redeploy in new investments to continue to be competitive in the industry. It produces a cash from operations margin of 53% which is really high and would only be possible for a business that does not need a large working capital position. The business uses very moderate debt and is able to pay off its interest payments 9 times from its normal earnings before tax and interest.

Jade, on the other hand, is a trust and instead of issuing shares, it has units which it legally has to distribute a certain stipulated amount of its profits as dividends/distributions to its unitholders. It is directly invested in the assets of the utility sector and has a gross margin of 64%. Surprisingly they also produce a profit after paying their staff and other indirect costs. Jade has the highest operational efficiency and could potentially generate a lot of cash for its unitholders. With a 34% cash from operations position and interest coverage of 12 times we know they have enough money to pay of their debts and redeploy money into capital projects.

CF is the simplest of the three corporate structures to understand and appreciate. It has a gross margin of 39% and operating margins of 16%. Since it is a traditional utility business it is the only one of the three that is directly invested in utility assets and issues shares. It also has low cash from operations position because of the heavy depreciation and working capital adjustments that can be a drag on cash. Thus it has a relatively lower interest coverage ratio of just 4 times normal earnings.

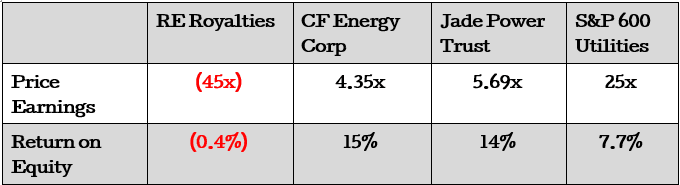

Knowing what we get in the purchase of the three companies now we can take look at what we pay for when we buy their stocks. To avoid going into the difficult art of valuing securities we can look at the Price to Earnings ratio as a metric of how much of each dollar of earning we will pay per share. The lower the P/E ratio the cheaper the stock and vise vera. Now that we established a metric for the price we pay we need a benchmark to know if the stock is overvalued or undervalued. For this, we can use the S&P 600 utility index and a cross-sectional comparison between the three firms.

The Index is comprised of common stocks of U.S. utility companies. These companies are principally engaged in providing either energy, water, or natural gas utilities. These companies may include companies that generate and supply electricity, including electricity wholesalers; distribute natural gas to customers; and provide water to customers, as well as dealing with associated wastewater.

Having established that we notice something very troubling with the P/E of RE. RE has a negative 44 price to earnings number, meaning you pay $44 per share for $(1) of earnings and these earnings will grow at (0.4%) using a return on equity(ROE) as our assumed IRR. Compared to the S&P 600 utility index with a P/E of 25x and an ROE of 7% this is obviously a grossly high amount to pay for a business that is not generating any earnings. RE is also relatively highly-priced compared to CF(with a P/E of 4x growing at an IRR of 15%) and Jade (with a P/E of 5x and an IRR of 14%).

It goes without saying that this valuation technique has been simplified. To truly assess the value of a stock the reader needs to assess the economics of the business they are analyzing and forecast the cash that the reader can take out of the business factoring in the purchasing power of money over time. This model can be time-consuming but will usually give the investor a better estimate of the economic value of a business.

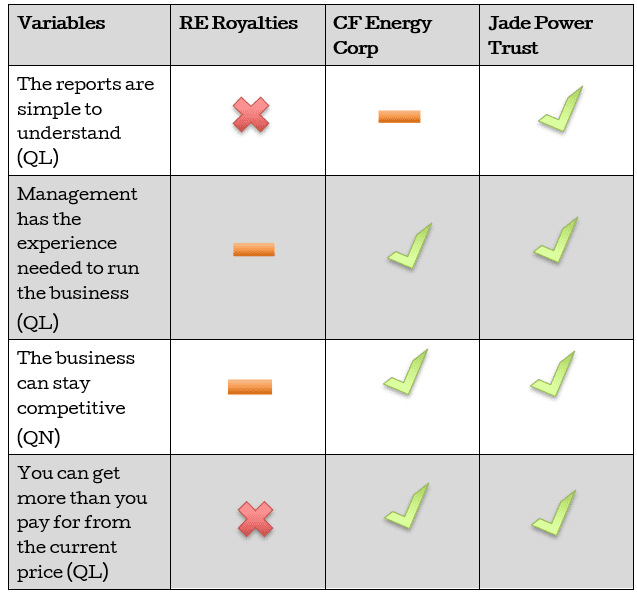

Having done all this it’s important to note that the investment process has merely begun. Investing is a negative art where you eliminate what is not needed and what remains are the winners. Usually, your filters leave you with one or two firms to analyze but it is not uncommon to be left with no investment ideas.

We have summarised our findings in the table below and we now have the opportunity cost dilemma. Which of all our investment options are best for our portfolio:

RE Royalty which generates a cash flow of $523,000 and has a return on equity of (0.4)%, CF Energy Corp which generates a cash flow of $57 Million and has a return on equity of 15% or Jade Power Trust which generates a cash flow of $2 Million and has a return on equity of 14%?

This is an open-ended question that is subjective and the ‘right’ answer is up to the risk appetite and investing experience of the reader.

P.S: This final answer should not come as a surprise, as mentioned above the author does prefer the more complicated answers.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!