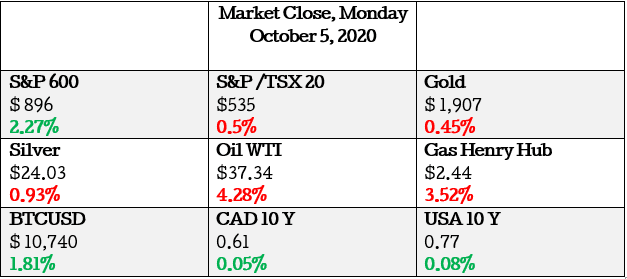

Hey Investors, today was a pretty slow day for the general market, and here is a quick wrap up of how the indexes did:

- S&P 600 (USA Small Caps) up by 2.27% and S&P 500(USA Large Caps) by 1.79% for the day

- S&P/TSX 20(CAD Small Cap) up by 0.5% and the S&P/TSX 60 (CAD Large Cap) down by 1.16% intraday

The secret to investing is that there is no secret. There is only the majesty of simplicity.

Market Movers

Today we the judges have picked: Vision Lithium (VLI.V) as the “most attractive common stock”

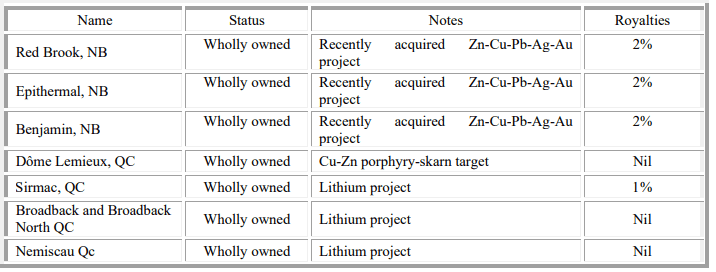

- Business Summary: Vision Lithium Inc. and its subsidiary Pioneer Resources Inc. (the “Company”) are exploration companies with activities in Canada. The exploration sites are in the provinces of Québec and New Brunswick in Canada.

The business has 3 projects that focus on lithium, and the rest of the projects are key commodities like gold and copper. Many exploration enterprises have pivoted the majority of their capital to extract this precious mineral because it is one of the most cost-effective minerals to mine and demand for it is high.

Of the 3 projects with lithium, only 1 has a royalty(1%) that needs to be paid to the partner. This means if Vision is able to find and extract lithium with quality of 99.5% at about 100 T from their Sirmac project they would gross(after extraction costs) revenue of $574,300 and need to pay $5,743 to their strategic partner. (it goes without saying these are all assumptions. )

When it comes to analyzing the mining sector it is important to look at who is “demanding” the resources and the abundance & quality of the resources themselves. Recently(Lithium)we have gone through this sector and have realized that lithium has these main factors ;

- the demand is coming from battery manufacturers who are trying to create rechargeable batteries as the global economy becomes more electric, companies like Tesla(TSLA.NAS)

- lithium is one of the cheapest forms of battery cell chemicals that allow us to extract the highest amount of energy per cell with the lowest density per cell. Making it both cost-efficient and energy-efficient.

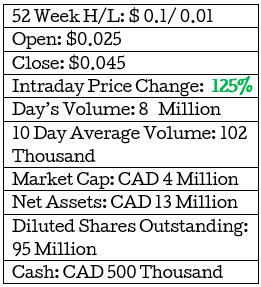

The Investor now has the challenge of trying to figure out how much this business actually worth. Especially after the stock has gone up by 125%

Challenges

- the business has not extracted anything and has no revenues, meaning we are not able to use a standard measure of valuation such as capitalizing the dividends the investor would receive over the life of the asset.

- the exploration and mining sector very cyclical and stock prices have a strong correlation to the spot prices of commodities

Advantages

- the business has to publish annual and quarterly reports. These reports have management discussions, revenue, and operating performance, and the books as of the publishing day showing key assets and payables.

Why reading the published reports and understanding the economics of the business are important?

Today is your lucky day, I have taken the tedious task of reading the reports away from your to-do list and feel after looking through them that the most important statement in them is the one below :

“The Company does not have any producing property. Recovery of the cost of mining assets is subject to the discovery of economically recoverable reserves, the Company’s ability to obtain the financing required to pursue exploration and development of its properties, and profitable future production or the proceeds from the sale of its properties. Companies must periodically obtain new funds in order to pursue their activities. While it has always succeeded in doing so to date, there can be no assurance that it will continue to do so in the future.”

We will now go through this one statement from their reports and come up with a value. We can also assume during this analysis we are a wealthy and rational entrepreneur with a nest egg of $10,000,000 after tax burning a hole in our pocket and ready to be deployed in your next project.

“The Company does not have any producing property”

The business is yet to actually generate any turnover or revenue. This can be very troubling if this trend is to persist. The business needs to generate money for it to be a worthwhile investment and to be profitable for its shareholders.

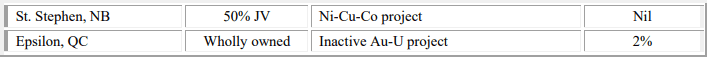

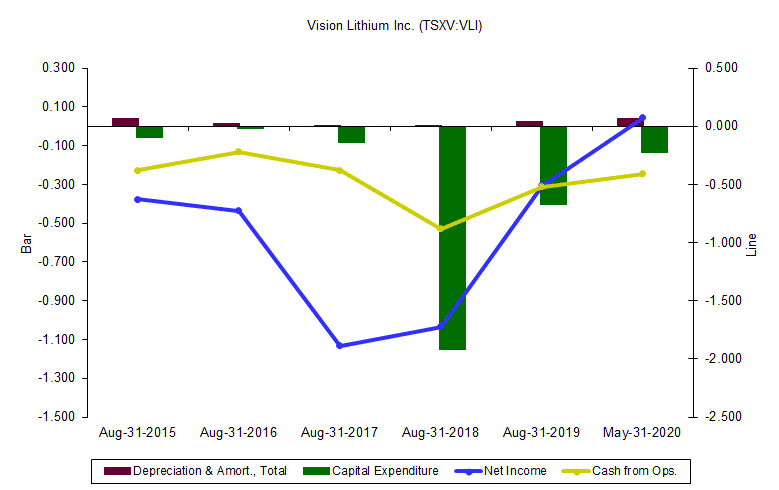

The chart below shows a 5-year trend of the Net Income ( this is the earnings talked about by all financial pundit, it is one of the most popular measures of profitability.)

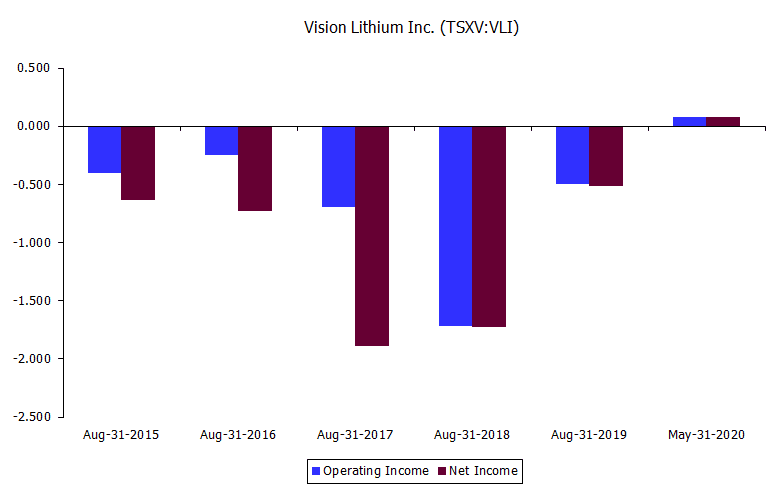

As an entrepreneur, we know the biggest cost of running a business is the management team, especially those who pay themselves with shareholders cash through share-based compensation that is short term. knowing this we quickly take a look at the breakdown of the operating expenses of the business and notice that management & other employee expenses are the largest expense about 50% of the adjusted expenses of $165,281, which is line with the historical trend and can always be lowered by cost management.

The entrepreneur adjusted the expenses by $345,768 which is a contra expense that adds back to the expenses and reduces the true expenses. This “contra expense ” is called provision for compensation and is very extraordinary and should not be included in normalized expenses hence the adjusted figure.

Now we know how much it costs to run the business in normal times, but the entrepreneur is also aware that earnings and cash actually generated by the business are two different things.

The entrepreneur generates the chart above and notices how much it costs to maintain the assets and that it’s reported earning might be positive on May 31 2020 but the reality is it costs them a lot to keep the lights on. The business will need to raise additional financing not only to manage operating expenses but to invest in machinery and equipment that helps the firm stay competitive. Management also makes note of this by saying :

“Recovery of the cost of mining assets is subject to the discovery of economically recoverable reserves, the Company’s ability to obtain the financing required to pursue exploration and development of its properties, and profitable future production or the proceeds from the sale of its properties. Companies must periodically obtain new funds in order to pursue their activities.”

“Companies must periodically obtain new funds in order to pursue their activities. While it has always succeeded in doing so to date, there can be no assurance that it will continue to do so in the future.”

The management team has acknowledged the economic climate due to COVID is tricky to navigate and would be difficult to find new ones through into their projects. The entrepreneur being the capitalist they are, realize there is an opportunity to deploy the 10 million dollars accruing 1% or so in the bank in a firm that could be very profitable.

The entrepreneur knows that the business is not generating any cash from operations and has not been able to extract any resources so the best approach to appraise the enterprise is by looking at its net tangible unlevered assets.

The readers’ reaction to “net tangible unlevered assets”

The readers’ reaction to “net tangible unlevered assets”

Simply put this is the value of the assets left over after the liabilities and debts of the business has been fully paid off. (Deep Breath)

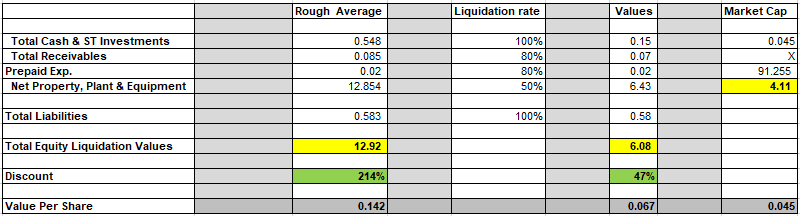

Now that the entrepreneur is trying to value the business they look at

- Cash and Short term investments which can usually be sold at 100% of their book value because of how marketable and saleable they are

- Also looks at other short-term assets like Accounts receivable and prepaid taxes which can usually be sold for about 80% of their value to factoring companies.

- Then the key assets like the machinery and mines that are owned by the business are hard to sell and most buyers in a recession will purchase them at a discount of about 50% because the seller needs a quick transaction of cash, know as a fire sale.

- And then look at all the liabilities that have to be paid off in full and subtract them from all other assets.

The calculations done by this entrepreneur can be found in the table below.

The entrepreneur from their analysis belives after all adjustments are made and debts are paid off the value of this business would be around $6 million and currently the market price is valuing the business at $4 million. It the entrepreneur is to deploy their $ 10 million after-tax their total cost would be about $6 – 7 million meaning they managed to buy the business for a 32% discount. (it goes without saying these are all assumptions. )

For the individual investor who does not have $10 million burning a hole in their pocket, each share would be worth $0.045 but the true economic value of the assets would be $0.067. In the investment world, this is known as an asset play.

But again, this is merely a guess. The reality of the beauty contest is that if every stock is somebody’s favorite, then every price should be viewed with skepticism.

HAPPY HUNTING!