With the Buffett news now causing a stir in the precious metals market (check out yesterday’s Market Moment Post for more details), I was back to looking for some nice looking metals related charts. We have been on quite the roll with our market structure patterns, and I have just come across another great looking chart.

The chart of Timberline Resources (TBR.V) is displaying all the markers of market structure that I look for. It is a similar pattern to our trades in Gold, GDXJ, GDX, Silver, East Asia Minerals, Pure Gold Mining, Nexus Gold and many others. My regular readers are probably sick of me saying this, but it is true: all markets move in three different ways. That’s it!. Our job as traders/investors is to break down these cycles, and take opportunities when they are presented to us!

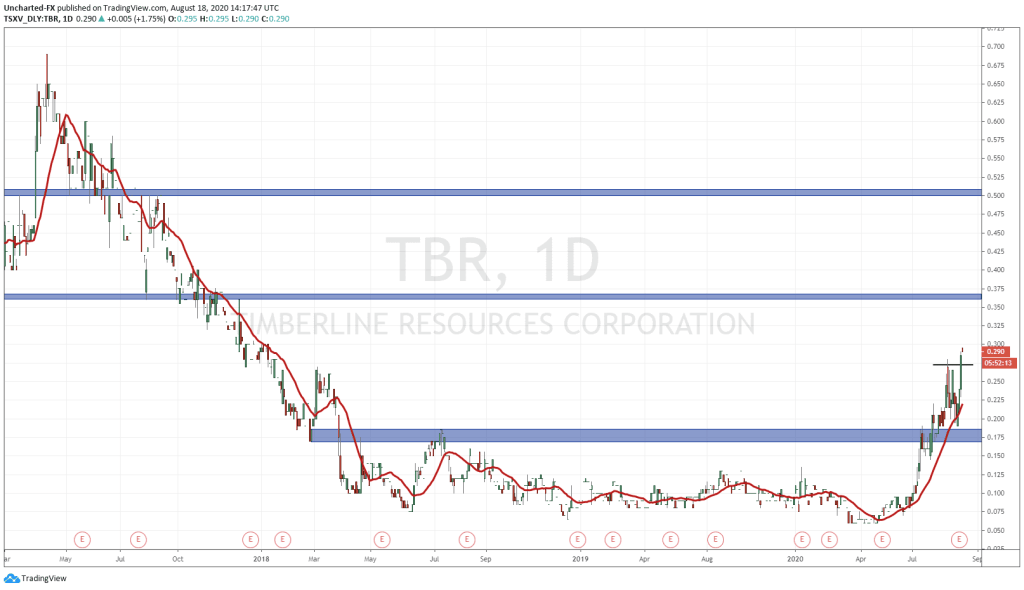

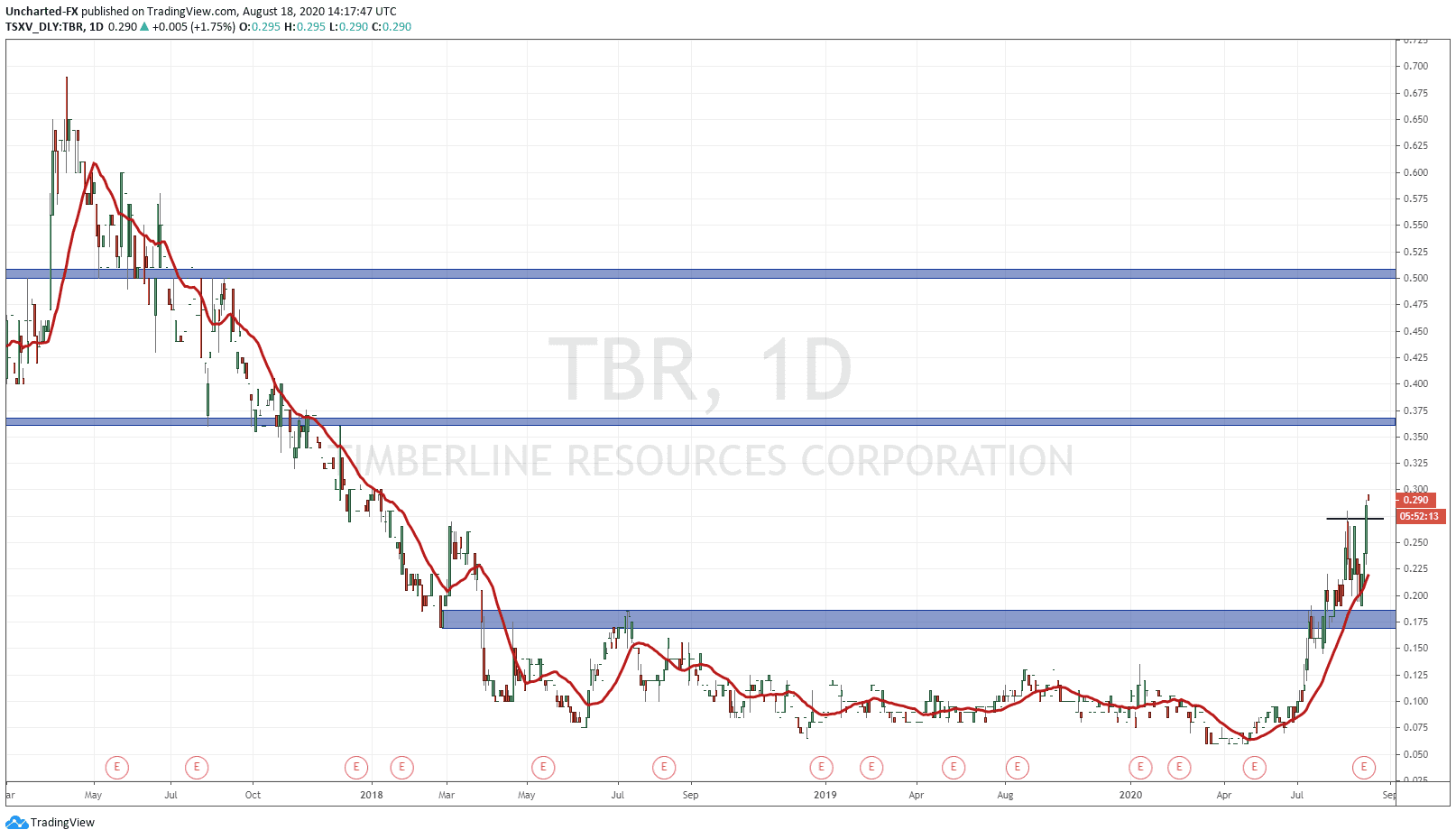

With the chart of TBR, we see a prolonged downtrend to the left with lower highs and lower lows, and then a range/basing pattern. We have been in this range since 2018, and just saw the break out on July 21st, 2020. Remember: the longer the base, the higher the space. With this breakout, we have retested the breakout zone, as is typical and normal of these kinds of moves, and have seen buyers step in to drive prices higher. The retest came on August 13th, 2020 and we have now closed above recent highs! This means our first higher low in the new uptrend is confirmed! TBR can make many more swings higher.

I would now be targeting flip zones (an area that has been both support and resistance) for take profit levels. The first one is around the 0.37-0.39 zone. The next would be around the psychologically important 0.50 zone, and then finally the 0.74 zone. If you were to enter the trade today, you would want to target the latter zones in order to get at least a 1:2 risk vs reward ratio on the trade. Be careful with the volume on this one.

In terms of the fundamentals, from the home page:

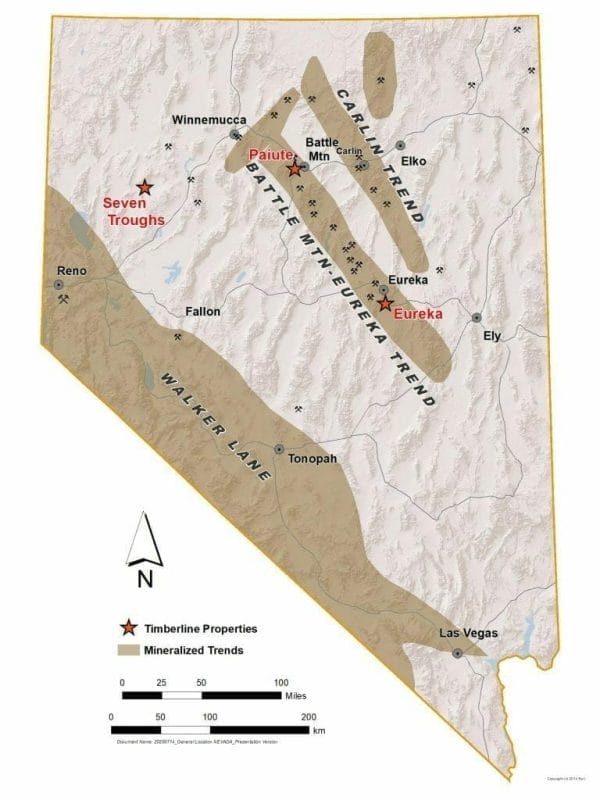

Timberline Resources explores for gold on district scale properties in Nevada.

Eureka is a Carlin-type gold project with historic open pit-heap leach production, and high-grade underground mining. The district scale property holds a NI43-101 gold resource which is open to expansion in all directions. Our primary exploration target is a multi-million oz gold deposit associated with recently recognized high-grade mineralization.

Our Paiute project targets discovery of gold in structure (fault)-related zone(s) or where associated with granitic intrusions similar to the nearby Lone Tree or Phoenix mines, respectively.

Our third project, Seven Troughs, is a low-sulphidation epithermal-type gold-silver deposit. Historic pre-World War II mining produced gold and silver at approximately 1 oz per ton Au, and 4 oz per ton Ag from narrow, high-grade veins. The target on this early-stage project is a bonanza-style gold-silver deposit representing on-trend and depth extension of historic mining.

Also in recent news, Timberline Resources has announced a $3.7 Million Private Placement raising funds for drill programs for Q3/Q4 2020, and Crescat Capital subscribing to $1.8 Million of the offering:

August 13, 2020 – Timberline Resources Corporation has arranged a non-brokered private placement offering of up to US$3,700,000 of Units of the Company at a price of US$0.11 per Unit solely to persons or institutions who qualify as accredited investors (the “Offering”) under Rule 506(b) of Regulation D promulgated by the SEC under the Securities Act of 1933, as amended (the “Securities Act”). The Offering is subject to approval by the TSX Venture Exchange.

Each Unit consists of one share of common stock of the Company and one common share purchase warrant (each a “Warrant”), with each Warrant exercisable to acquire an additional share of common stock of the Company at a price of US$0.20 per share until the warrant expiration date of August 15, 2023.

Crescat Capital has agreed to subscribe to US$1,800,000 of the offering. Crescat is a global macro asset management firm headquartered in Denver, CO. The firm recently launched a friendly activist precious metals mining fund. “We are excited about the exploration and development potential of Timberline’s impressive collection of Nevada properties”, said Crescat’s founder and CIO, Kevin Smith.