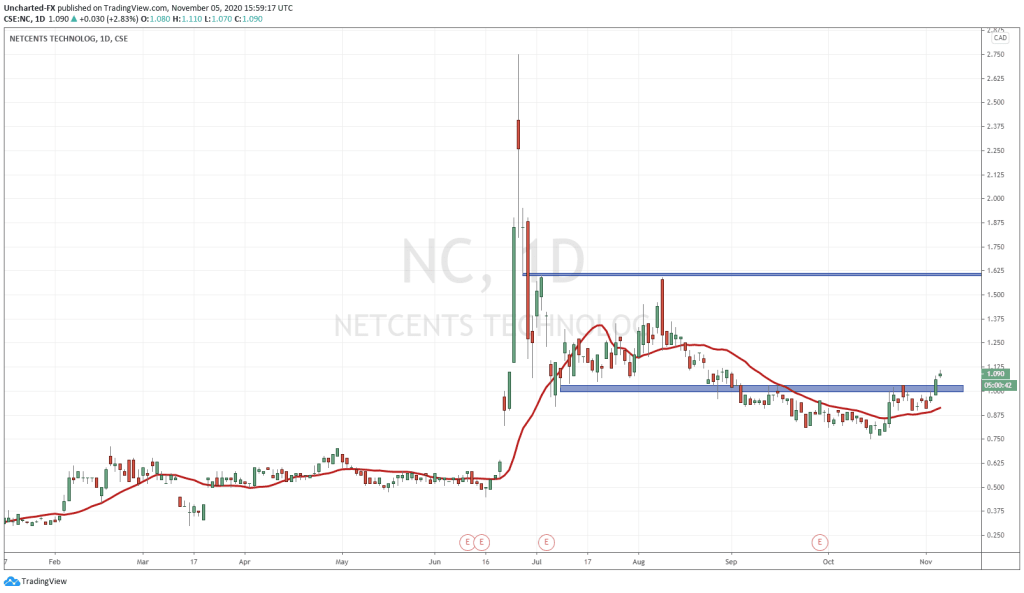

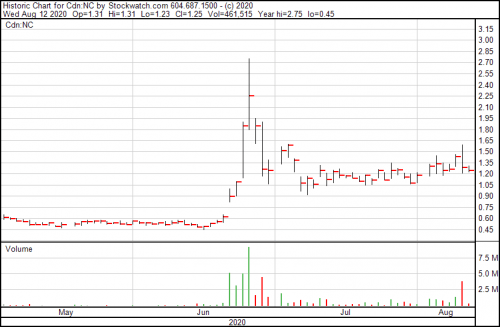

Netcents Technologies (NC.C) has been riding a wave of good fortune over the past few weeks, having quadrupled in price from the $0.30 range in March to where they are now at $1.25.

They owe this sudden windfall to the attention they’ve been getting from big name financial institutions like VISA, including joining their fast-track program yesterday.

“By joining Visa’s Fast Track program, exciting FinTech’s like NetCents gain unprecedented access to Visa experts, technology and resources. Fast Track lets us provide new resources that rapidly growing companies need to scale with efficiency,” said Terry Angelos, senior vice-president and global head of Fintech, Visa.

Netcents will be able to expedite the process of integrating with Visa courtesy of the fast track program, giving them the ability to take advantage of the reach, capabilities and security that the company’s global payment network, VisaNet, offers.

Now NetCents can spread their good fortune out to others as they roll out their Visa card to its North American users and expand into other markets. The company was originally ready to offer their card to Canadian users only, but chose to expand their reach with the opportunity to work with Visa.

“Ever since we pivoted NetCents in 2017 towards cryptocurrency transactions, our mission has been to create efficiency in the financial transaction industry. Having a direct relationship with Visa allows us to have the most streamlined and cost-effective system to blend the capabilities of cryptocurrency and the Visa platform. We’re looking forward to a long and fruitful collaboration,” said Clayton Moore, founder and chief executive officer of NetCents Technology.

Another benefit that NetCents cardholders have over, say those using crypto.com’s card system or that from Bitpay, is that they won’t have to preload any cryptocurrency onto their card. Normally, you run the risk of losing out on the price fluctuations as a transaction needs to wait for the block to close to make the transition. NetCents card and wallet are connected, allowing cardholders to draw on the crypto in their wallets. This lets the company complete a signal credit card transaction across multiple cryptocurrencies.

Stumbling blocks

NetCents has designed their interface to both look and feel like all traditional merchant payment programs. No more weird complex charts, peculiar number schemes, and obscure crypto-specific definitions. Once onboarded, the notion continues, merchants are more likely to embrace cryptocurrency payments.

The learning curve is one of the largest stumbling blocks for mass-crypto adoption. It takes a certain type of personality to dredge the bottom of the internet for the YouTube clips of Andreas Antonopolous and other such personalities explaining why Bitcoin (and other cryptocurrencies) are going to revolutionize the way we do business. Most of those folks usually can’t be bothered to charge their way through a white paper, with all the cross referencing of terms required, and then stumble their way through the due diligence required to pick an exchange.

Admittedly, it’s a steep curve and not for the easily bored. It’s why cryptocurrency enthusiasts are usually the partially-crazy ideologically inclined crowd—equal parts John Galt wannabe and unibomber with a hint of unwashed nerd living in his mother’s basement—but that’s changing.

Those folks are still there, gobbling up a fortune in smaller altcoins like candy and riding them hard on social media, but they’re being joined by folks that could be colloquially called ‘the average investor.’ That’s because of companies like NetCents, which have looked at exchanges and other means of investing in cryptocurrency and figured out that if crypto’s ever going to make it, they need to ease off on the complexity.

That’s Netcents wheelhouse and it shows in their chart.

Another contributor to NetCents good fortune has been their growth in volume. The company exceeded $4 million in monthly processing in July, 2020, which is 100% more than their previously reported volume in February.

The growth in transaction volume was the direct result of NetCents continuing efforts to grow its business-to-business (B2B) transaction flow. Now the company is drawing from a new market segment by supporting larger transactions, which could easily lift the average transaction size.

“This growth in B2B is a clear indicator of a maturing business — using crypto for small consumer purchases has a novelty to it, for sure, but now we are seeing large businesses embrace crypto as part of their process, it is a very revealing trend. We are confident that this trend will continue, and that businesses will adopt cryptopayments permanently as part of their workflow. We can save businesses a lot of money by facilitating cross-border and cross-currency transactions. We are finding that once a customer is on-boarded, they find that their hesitation around working with cryptocurrencies was completely unfounded,” said Moore.

The transaction volume growth mirrors that of the growth in cryptowallets worldwide, as of June, 2020, over 50 million wallets have been created. The milestone represents a 25% growth year over year, and the company contends that many of these wallets have been made for the purpose of transactions, rather than as instruments for building a fortune purely on investment or trading.

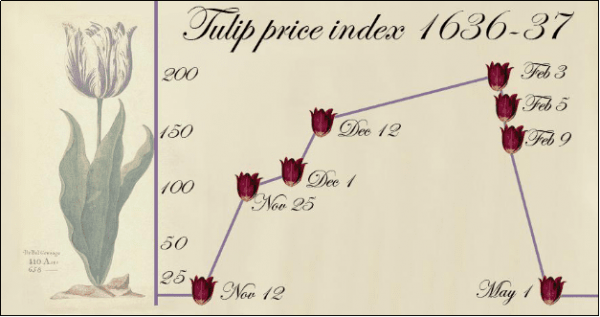

There’s also the rise in Bitcoin and cryptocurrencies to be considered. When Bitcoin jumps, the altcoins say how high while flying, and Bitcoin has been enjoying a considerable bull run over the past year. When Bitcoin and the alts go for a run, it’s almost guaranteed that there are companies out there, like NetCents and their investors, who will look for a way to get their slice of the pie.

—Joseph Morton