The Very Good Food Company (VERY.C) finished a bought deal prospectus offering of 6,555,000 company units at $1.30 a unit, and brought in $8,521,500, including the full exercise of underwriter, Canaccord Genuity’s overallotment option.

The company intends to use the proceeds from the offering to pursue an expansion to the United States, for continued investment in its product portfolio through research and development and potential accretive acquisitions within the plant-based sector, as well as for general corporate purposes.

The company is going to use the money raised for their expansion efforts into the United States, research and development and for any potential acquisitions within the plant-based sector.

“We are delighted with the closing of this oversubscribed financing, which will support key components of our growth strategy such as expanding our operations into the United States to access a very large and growing market for plant-based foods. We look forward to updating our shareholders as we progress into the next phase of our growth objectives,” said Mitchell Scott, chief executive officer.

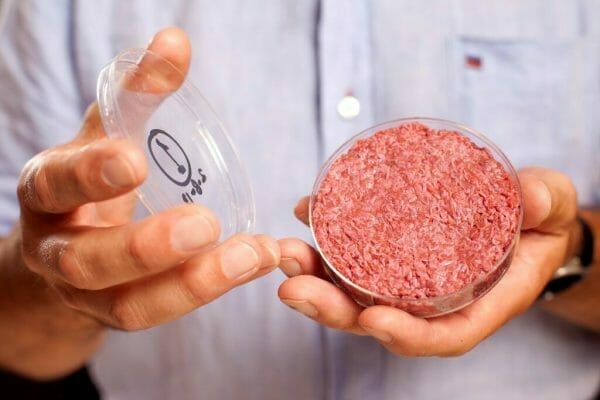

The Very Good Company deals in plant-based food technology. They design, develop, produce and distribute and sell a plant-based meat and other food alternatives with the stated mission to make products that are delicious and nutritious. They have one core product on the market called The Very Good Butchers brand.

Each unit included one common share in the company’s capital, and one half of one warrant, with each warrant giving the holder the option to another common share at $2 until Feb. 7, 2022.

The company also intends to complete a small private placement to accommodate investors who were unable to participate in the oversubscribed offering. The placement will consist of us to 88,500 units, and will have the same pricing and terms as this offering, except there will be a hold period of four months and one day from issuance. The company expects to close the private placement by the middle of August.

—Joseph Morton