NetCents Technology (NC.C) is forming a German subsidiary to handle their European expansion, and constructed their first banking relationship in Europe to support its growing client base.

After a certain amount of time, every company is going to want to expand across the pond. There’s bigger markets, more countries and a variance in regulatory climates that can be quite suitable for companies involved in nascent or contentious markets—like cryptocurrency and its ancillaries.

“We have created a lot of momentum with our efforts to create business opportunities in the European market. With the recent additions of additional European financial executives to our advisory board, we believe that we will only accelerate momentum from here. With a defined resource on the continent — it will make growth in Europe easier to manage. Our team will be multilingual, and this addition to our footprint will make it easier to pay merchants in euros in a timely and efficient way,” said Clayton Moore, founder and chief executive officer of NetCents Technology.

If you’re not familiar with NetCents, they’re a tech firm that equips businesses with the technology to add cryptocurrency processing into their payment model without exposing themselves unnecessarily to the risk and volatility of the cryptocurrency market.

Perhaps bolstered by their recent successes with the growth of its core merchant base during 2020, the company has decided that having a local presence is required to adequately service the large processing clients it’s since developed in the market.

NetCents subsidiary will support the businesses and sectors it intends to operate within in the market, including:

- Merchant processing;

- Invoicing for subscription-based businesses;

- Merchant services and crypto-banking stack/solution as a white-label offering for commercial banks.

The German banking regulator, Bundesanstalt fur Finanzdienstleistungsaufsicht (BaFin), released guidelines earlier this year for financial institutions involved in cryptocurrency products. NetCents has a white-label solution, which it intends to offer banks interested in giving their clients trading access in cryptocurrency alongside traditional financial products.

“A large part of our investor and business base is already in Europe, and the climate towards adoption is much more favourable across many business verticals in the European market. It only makes sense that we invest in initiatives that are already generating success for us as a company. I look forward to growing our European business aggressively,” said Moore.

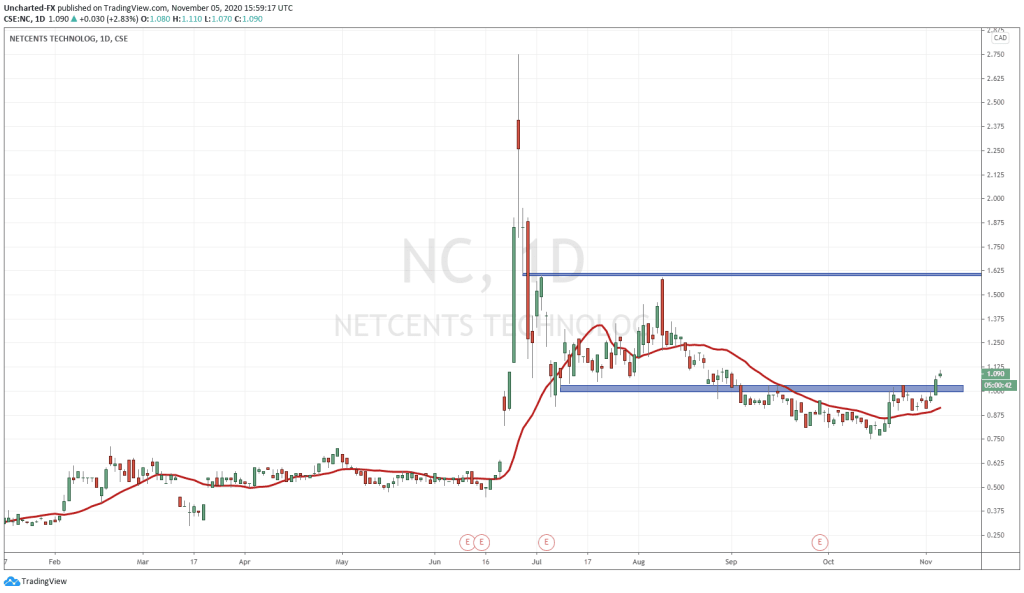

Over the past while, NetCents has done exceptionally well for itself in terms of business expansion, including such things as offering a NetCents cryptocurrency card tied directly to customer’s crypto-wallets and offering chip, pin, magstripe and NFC functionality and a mobile application. It’s shown in the price fluctuations of their chart.

In many ways, after getting their platform onto the automated clearing house to streamline their business in the United States and Canada, looking overseas seemed like the right direction.

“We will be able to process and pay European merchants with the dedicated infrastructure we are putting in place more efficiently. These moves will allow us to provide the daily payment capability for our merchants in euros,” according to Jenn Lowther, chief revenue officer of NetCents Technology.

—Joseph Morton