Hut 8 Mining (HUT.T) is only just now trying to raise $7.5 million to upgrade their existing mining equipment with more efficient chips, and the halving happened last month.

A quick glance at their financials gives us that they had over $1 million in cash as of March, and haven’t done much since. Now ASIC rigs, along with the rest of the equipment required to effectively run a Bitcoin mining operation the size of Hut 8’s in 2020 is going to cost considerably more than $1 million, so the raise is necessary, but what’s baffling is why they waited for so long to upgrade.

“The proceeds from this Offering will enable Hut 8 to upgrade a portion of its mining fleet by procuring and installing the most competitive and efficient chips available on the market from third-party suppliers, thereby maintaining the company’s global leadership position in bitcoin mining. The modular and interoperable nature of our BlockBox mining fleet, combined with extensive testing undertaken to ensure compatibility with these new chips, makes Hut 8 well prepared for this upgrade,” said Jimmy Vaiopoulos, Hut 8’s interim CEO.

Hut 8’s name is a clever nod to a pivotal point in cryptographic history, wherein Alan Turing and his band of merry mathematicians cracked the German enigma code, allowing the allies a tactical advantage over Hitler and his wolf pack of killer submarines. But if the original Hut 8 had have taken an extra few months to upgrade their equipment, we’d all be speaking German right now.

Hut 8 dug themselves into a hole in many ways. Back when Bitcoin was surging, it’s not an insensible idea to focus specifically on mining because at the time it’s quick and easy cash as long as the equipment and the electricity you’re using continues to be sufficient.

But there’s got to be a realization that these gains are going to be short term, and will be subject to fluctuations in fortune—either through external sources like volatility and the conditions in China—or inherent, like the fluctuating hashrate or halving. The first set—fluctuations and Chinese mining market conditions—aren’t anything that Hut could have controlled, nor really is the hashrate, but the halving is baked into the code. Anyone who pays attention to Bitcoin knows the halving is due any 210,000 blocks, or roughly every four years.

You’d think a company whose bread and butter is Bitcoin would know that.

The time for deliberation as to whether or not they were going to stay in the market is not two months after the halving, but six-to-eight months before it. There are a lot of variables that can happen in six-to-eight months, but if your only source of income is through Bitcoin, then you had better be damn well prepared to continue to do business during the interim period where Bitcoin’s block reward is halved, and the price adjusts.

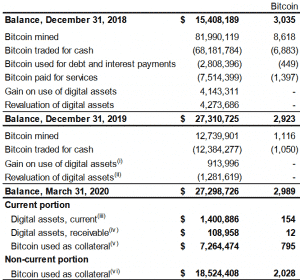

For context, this is what a Bitcoin balance sheet looks like, pre-halving:

What you won’t see there are Ethereum, Bitcoin Cash, Tether, Ripple or any of the other altcoins covering the shortfalls they’re going to suffer from not being on time to the Bitcoin halving party. This is a Bitcoin only farm, and their equipment as of right now will not be sufficient to keep pace with these numbers for next quarter.

The offering is scheduled to close on or about June 25, 2020, and is subject to certain conditions including, but not limited to, the receipt of all necessary approvals including the approval of the Toronto Stock Exchange. After that, they need to source, buy and install the machines, and only then will they begin to compete.

Someone clearly fell asleep at the wheel. Given the new post-halving reality, the next few months should be make-or-break for this company.

—Joseph Morton