Bitcoin’s third halving is due in a matter of days, and the majority of the crypto sphere is holding its breath waiting for it to be over. There’s been lots of speculation on what’s going to happen, citing historical trends from the first two halvings, but the truth is that nobody knows what’s going to happen. Bitcoin wasn’t as widely known, nor had it attracted institutional money, during the first two halvings, and there are some unanswered questions as to what we can expect in the next year when Bitcoin’s block reward goes from 12.5 BTC to 6.25 BTC.

Here are your top five coins by market cap.

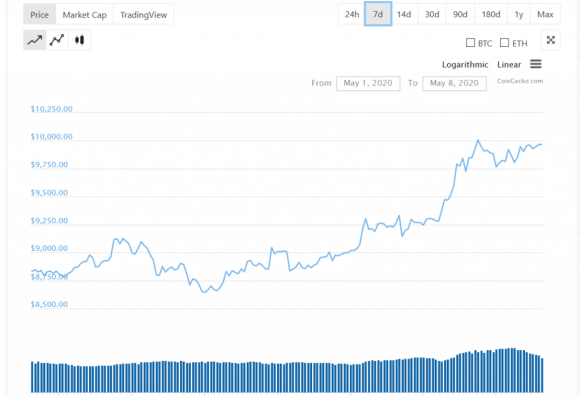

Bitcoin (BTC)

market cap $183,098,614,169

There’s a strong possibility that we could see Bitcoin rising above $10K ahead of its halving. It’s damn close to that mark at the time of writing at $9,972, having risen 15.7% over the past week. We’ve written about the halving quite a bit in these pages in stories leading up to it in the past few months, but for a review, a Bitcoin halving cuts the block reward that miners can expect for processing transactions, thus producing artificial scarcity. The block reward is being chopped from 12.5 to 6.25 bitcoins. It happens roughly every four years, and it’s believed that the next halving is due on May 12.

Also noteworthy is that Bitcoin rose about 1,000% in the year following its first two halvings in 2012 and 2016 respectively.

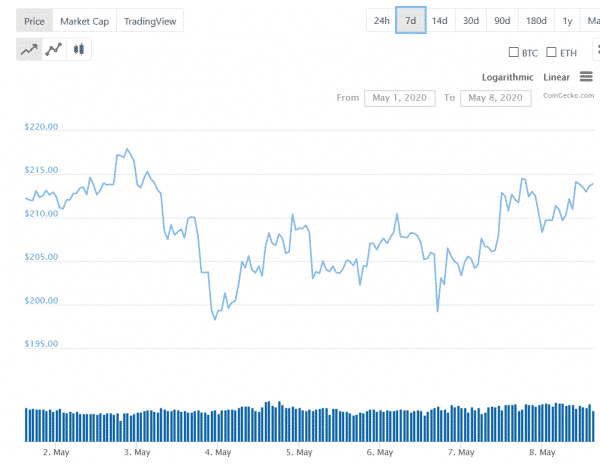

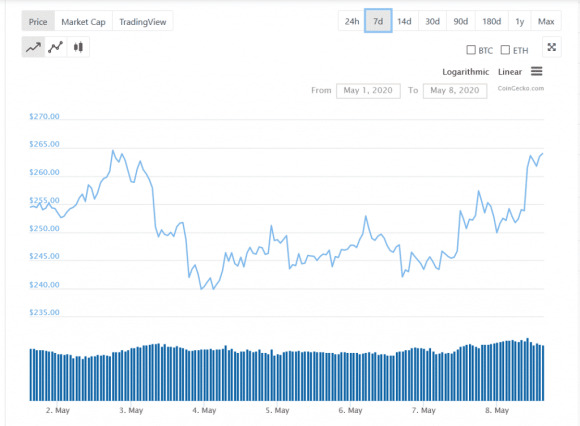

Ethereum (ETH)

market cap $23,691,744,724

According to, the proof of stake aspect of the Ethereum 2.0 network upgrade could be operational as early as July 2020, according to Ben Edginton of Teku, an Ethereum 2.0 client operator who spoke at the Ethereal Virtual Summit today

“Beacon is the beginning of the road. It’s a proof-of-stake chain that sustains itself. It could arrive in weeks to months… But I am 80-90 percent confident it will go live by Q3,” Edgington said.

The next milestone in Ethereum’s 2.0 roadmap is phase 1, which includes the implementation of sharding, and creating 64 shards with a data capacity of 500 kb each.

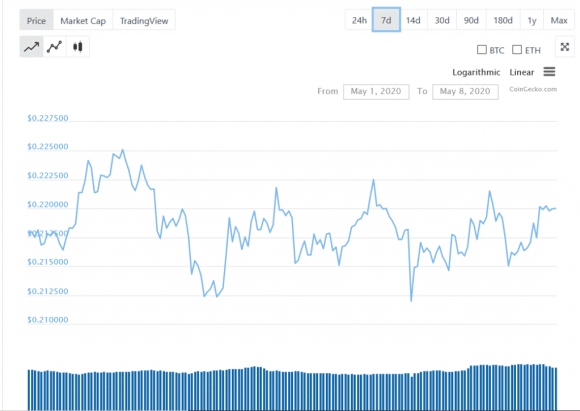

Ripple/XRP

market cap $9,700,204,092

The majority of XRP transactions are empty, says report.

An interesting report issued by Cornell University has pinpointed that the majority of the transactions on the XRP blockchain are valueless. In many cases they’re either used for spam or for airdropping worthless tokens.

“Our analysis reveals that only a small fraction of the transactions are used for value transfer purposes. In particular, 95% of the transactions on EOS were triggered by the airdrop of a currently valueless token; on Tezos, 82% of throughput was used for maintaining consensus; and only 2% of transactions on the XRP ledger lead to value transfers,” according to the paper’s abstract.

The authors of the paper—Imperial College London PhD student Daniel Perez, University College London researcher Jiahua Xu and Brave chief scientist Benjamin Livshits—tracked different transaction types on the above blockchains, noting their purpose and value. The authors conclude that while the above chains process a lot of throughput, the majority of it may be essentially useless.

XRP transactions are also used to trick exchanges. XRP is unique in that it can show transactions that have been paid in part, unlike other blockchains where you either have a transaction or you don’t. This means there are two different “amount received” parameters and if the exchange uses the wrong one, they might credit a trader’s account with far more XRP than they sent to the exchange.

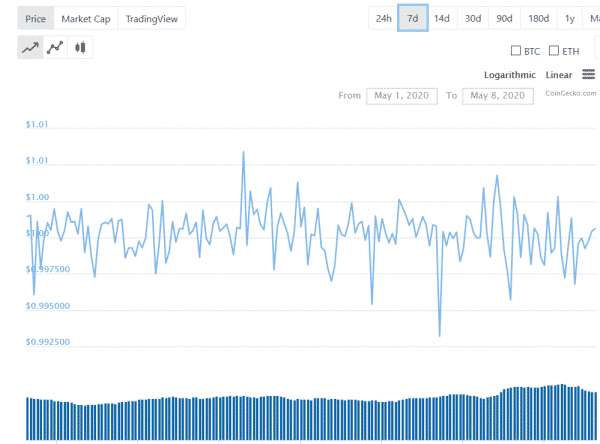

Tether

market cap $8,171,253,605

Over 20,000 shops and enterprises in Venezuela will reportedly start accepting crypto by June 1. This news was made available as part of an effort to drive crypto adoption in the hyperinflation-stricken country.

Over 20,000 shops in Venezuela will start accepting cryptocurrency in June. Hyperinflation has effectively ruined the native currency of the country, having hit 10 million percent at some point last year. Inflation has since slowed, but crypto still remains a much more stable medium of exchange, according to local reports.

Panama-based cryptocurrency gateway startup Cryptobuyer announced a partnership with Venezuelan company Mega Soft, which processes payments for thousands of local business via its “Merchant saver” platform. The platform will now accept Bitcoin, Ether, Dash, Litecoin and Tether.

Bitcoin Cash

market cap $4,855,000,652

Bitcoin Cash has recorded a largely inconsistent recovery period of the past few weeks, and while it seemed like it was going to recover all of its losses, it’s lost all market momentum since the middle of April. You can’t necessarily see it in this chart, which shows it trending mostly upward with the rest of the recent lift on the wind of Bitcoin’s halving, the token’s general trend has been downward, and effectively half of its late February high of $495.

—Joseph Morton