After the price war on oil, futures contracts expiring on Tuesday hit the negative territory on Monday. But where’s the actual oil?

Quite literally, the ocean.

At least one in ten supertankers around the world is currently serving as a floating oil storage facility, according to Saudi officials. Without buyers, they’re literally stranded at sea. Around 80 of 750 total oil tankers in the world are being currently used to store oil.

Over the past week, the total oil being stored at seas rose by 21 million barrels to 147.6 million barrels in the week to April 19. OPEC+ members are now considering cutting production as soon as possible, as opposed to waiting for the “official cut” that won’t kick in until next month.

The carnage in the oil markets finally spilled over to the equities markets as indices opened sharply lower and continued to close the day in the red. The Dow fell 2.7%, to 23018.88, while the S&P 500 dropped 3.1%, to close at 2736.56.

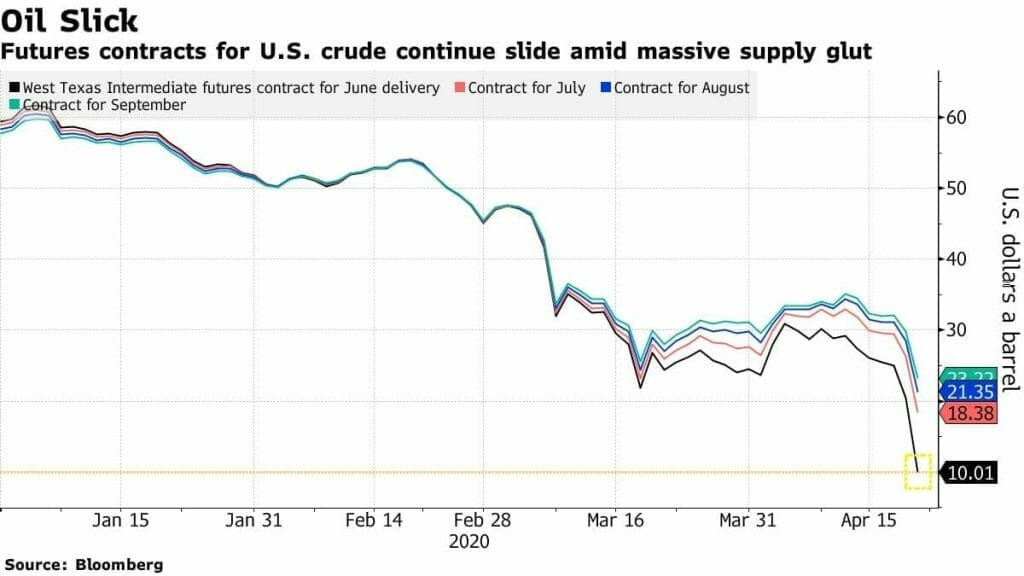

Brent crude plummeted 24% to $19.33 a barrel, its lowest level since 2002, while barrels of West Texas Intermediate crude to be delivered in June plunged 43% to $11.57 a barrel – the lowest in 21 years.

Remember the contract that went negative yesterday? That expired (settled) today at $10.01/barrel.

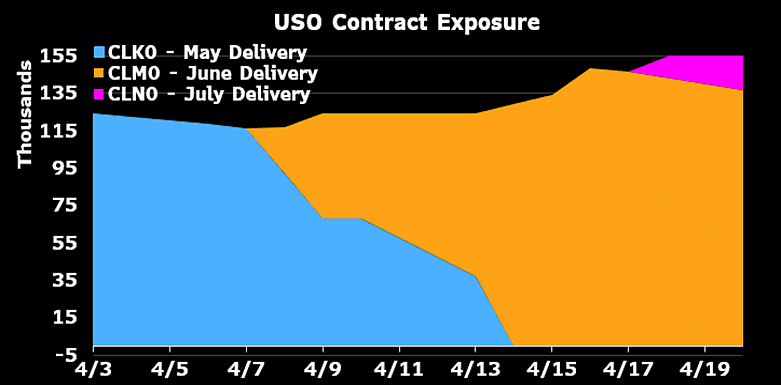

One of the things we spoke of earlier was the role of the USO ETF in the entire shebang. In short, the ETF had a massive position, nearly 25% of all outstanding contracts expiring on Tuesday. It “rolled over” the position to the next month.

But the worst may not be over. Let’s look at how the ETF works.

Let’s say you’re an investor but don’t want to trade futures contracts because you think that the instrument is too leveraged, you’d have to deal with the physical settlement, and in general, you might not know enough about futures to take the risks involved.

However, you might still want exposure to the oil sector or want to take advantage of the swings in oil prices without buying the stocks of the companies that produce it. Your options are to invest in a less risky alternative for the same returns: buy individual stocks of oil companies, or buy an ETF, which invests in the stocks of US oil companies.

In both these conditions, your exposure to the returns in oil is indirect. You’re exposed to the percentage change in the prices of the stock prices of these companies, not the direct percentage change in the prices of oil.

Lucky for you, there’s an ETF that tracks the price of physical barrels and tracks a basket of front end futures contracts.

$USO is this. As an ETF, it is traded like a stock, but it is not one. It’s a specific financial instrument that tracks the daily price movements of WTI light, sweet crude oil. It’s designed in a way to reflect the daily changes in percentage terms of its shares’ net asset value to reflect the daily changes in percentage terms of the spot price of light, sweet crude that will be delivered to Cushing, Oklahoma, as measured by the futures contracts.

Its mandate was to only invest in the front-month contracts and always roll over the position close to expiry because it gave investors the exposure to the same percentage returns found in the volatile futures markets for physical oil, without the investors in the ETF having to bear the risk of trading futures.

So essentially, it’s the problem of the people who run and manage the $USO ETF to settle or rolling contracts.

Here’s the important bit: they recently announced that they would be rolling over some of their futures contracts to months further than the next month.

It means under ideal circumstances, the ETF should have only had exposure to the futures contracts expiring in May, but now it also has some exposure to contracts expiring in June or later.

According to the SEC filing:

The foregoing may impact the performance of USO. In addition, as a result of these changes, USO may not be able to meet its investment objective, which is for the daily percentage changes in the NAV per share to reflect the daily percentage changes of the spot price of light, sweet crude oil, as measured by the daily percentage changes in the price of Benchmark Oil Futures Contract, plus interest earned on USO’s collateral holdings, less USO’s expenses.

It means the door for the possibility of the ETF price (which is traded like a stock) to go negative has been bust open.

This is still an unlikely possibility that it will happen, primarily because contracts expiring in the coming months haven’t gone negative just yet, so the ETF has enough exposure to continue to roll over their position to contracts due in the future.

Except the thing is – if you’re actively managing an instrument that was supposed to get you passive returns – you’re basically running a hedge fund that trades oil contracts due out in the future. You’re also probably the unluckiest hedge fund, because you can only trade those specific instruments, i.e. futures, and are not legally entitled to say, liquidate your entire position and buy the stocks of oil companies instead.

More bad news: the ETF isn’t FDIC insured. It means your money isn’t protected by any type of insurance, so no bailouts in case things turn sour. Again, this is still VERY much an unlikely possibility, but it is a possibility nonetheless.

Meanwhile, popular brokerage platform Interactive Brokers announced that it induced an $80M loss on Monday because of oil prices going negative. Why did the broker bear the cost? Well, because the broker, in part, bears the liability for allowing you to trade the instrument through it.

You see, the contracts have to be settled. So even though your losses can be a lot more than the total initial capital invested, someone has to bear the cost while you find a way to pay the broker back. That’s what happened to these guys.

Also, the world’s largest futures and derivatives exchange – CME – announced that it would be changing the options pricing model to the Bachelier pricing model, which will allow for options to be traded that have negative strike prices.

It basically means that the exchanges are fundamentally changing the math of the way these contracts were priced to allow for a possibility where traders and investors can speculate for negative oil prices.

Now, funds will have to fundamentally change and/or alter their risk management models to incorporate for the change in the way these instruments are or could be traded in the future.

The reality: markets saw unusual options activity as traders bet on options contracts for the price of oil futures in June to trade as low as $0.50/barrel. It means speculators are already eyeing the possibility that what happened close to the date of expiry in April, could also happen in May.

In Canada, the glut in oil has spilled over to other markets in provinces that have built their entire economies around the commodity. Example: real estate in Calgary, Alberta. Over 20% of the office spaces are currently vacant, and this could easily trigger a cycle of falling rents, declining values, and wealth erosion. Couple that with oil firms likely laying off individuals, the outlook could turn bleak rather quickly.