If you guys can’t spot a bubble by now, what day in February did you start trading exactly?

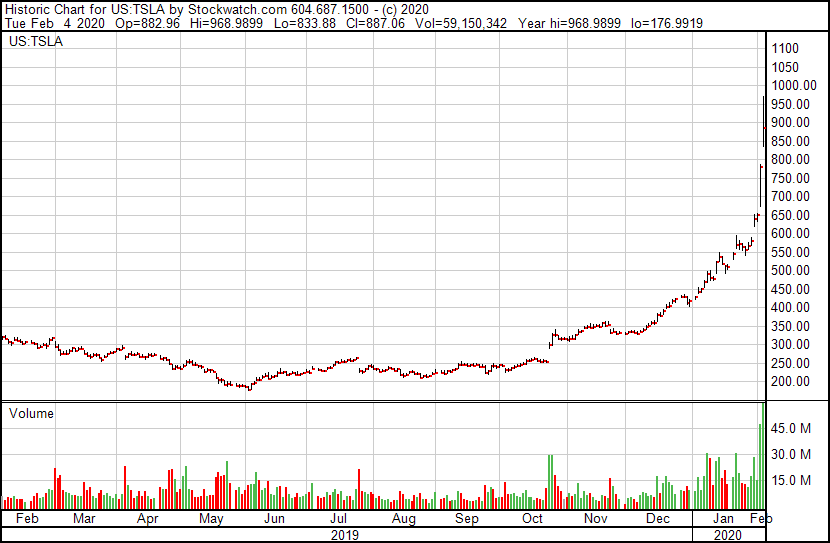

Tesla (TSLA.Q) stock has been on a nutty run lately, climbing from the $200 range in October to $969 yesterday.

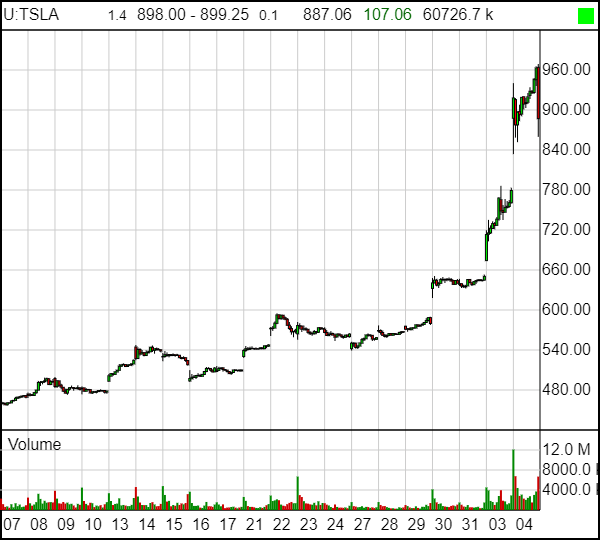

Or, rather ‘..to $969, 15 minutes before the end of trading today.’

Because in that last quarter hour, hell was unleashed.

That, right there, is called ‘retail investors getting punched in the dick.’

Here’s the longer timeline:

The carnage has continued today, with consistent selling bringing the stock down to $754 at the time of writing.

This was always going to happen once Tesla left $650. The daily jumps at the open were red flag #1 that someone was priming the pump.

Red flag #2 on that stupid big bubble was market cap.

Tesla has a market cap at the end of yesterday’s trading of $140 billion.

- Ford (F.NYSE) has a market cap of $34 billion.

- GM (GM.NYSE) has a market cap of $48 billion.

- BMW has a market cap of $51 billion.

Those three combined make for a total value of $133 billion, which is still $7 billion cheaper than Tesla was, even after it lost 10% of its value in 15 minutes.

This valuation might make sense if Tesla was killing everyone in the sales game, but it’s not. Tesla sold 367,000 cars worldwide in 2019, which is great for a young company.

But Ford sold 1.3 million in Europe alone last year. It sells 2,000,000+ vehicles in the US annually. GM sold 2.8 million vehicles in the US last year, and VW sold 6.2 million globally. They put Tesla in the shade where it matters.

Tesla has admittedly had improved financials and largely stopped its cash drain, that it was at one point famous for, and enthusiasts do love the brand while non-consumers aspire to it, but it’s not so profitable and desirable that it can make its gobsmacking valuation seem reasonable.

$969 per share was always going to be bananas. Frankly, $400 per share is bonkers and it’s a long way from there.

Red flag #3 was the speed in which TSLA stock has appreciated of late. You can’t see this and not think it’s too much, too hard.

I mean, come on, tulip fans.

$400? Fine.

$500? Okay.

$600? If you must.

But rocketing from $600 to 50% higher in a week? Exactly how many Teslas do you think are selling in February?

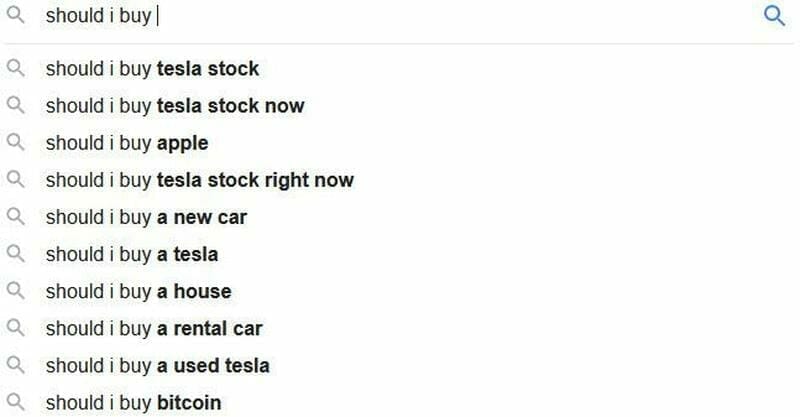

ZeroHedge found something that confirms the gormless bagholder impact on TSLA stock when they typed into Google the words “should I buy” and this is what words autofilled:

Don’t chase, children. The car is just starting to roll, end over end.

— Chris Parry

FULL DISCLOSURE: No horse in the race, though an ex-employee managed to short TSLA at $280 a few months back and insisted right up until we walked him out the door that it was going to pay off any time now… Good job, Kyle.