1933 Industries (TGIF.C) announced that they’re ready to begin manufacturing their line of CBD wellness products, and debuted their subsidiary, Alternative Medicine Association’s, branded THC products for the first time for the California dispensary market.

The company’s post-Nevada story began in August with a management agreement with licensed cultivator Green Spectrum. The company has since established both cultivation and extraction capabilities for their AMA-branded products, and for Blonde Cannabis, their luxury brand.

“California represents a growth opportunity for 1933 Industries and for our brand partners. The Golden State is a trendsetter when it comes to cannabis brands and we are positioning ourselves to gain market share by working with our local cultivation partners and by bringing our manufacturing expertise to this competitive market,” said Chris Rebentisch, CEO of 1933 Industries CEO.

According to market intelligence and consumer research firms BDS Analytics and Arcview Market Research, California is the place to be to make money in an otherwise slumping cannabis market.

The State of California legalized recreational cannabis in November 2016, and sales in California within two years represented about 24%, or $2.5 billion of legal sales in the United States. Meanwhile, the sales for Colorado, Washington and Oregon combined represented approximately 30% of U.S. sales.

They’re on track to post a record $3.1 billion in licensed cannabis sales in 2019, and has projected growth of 19% compound annual growth rate (CAGR) to $7.2 billion in 2024. That’s 40% larger than the entire country of Canada, and 253% larger than Colorado, which comes in a distant second within the United States.

“We are developing strategies to compete for market share across the state. We will be offering a diversified portfolio of THC products, encompassing flower and concentrates for both the AMA and BlondeGreen Spectrum brands, as well as California-compliant CBD products. We have secured a distribution license and we will be expanding our distribution networks for our suite of products, for our licensed partners and for any company that seeks white labelling and distribution into the California market,” Rebentisch said.

1933 Industries Los Angeles-based shared manufacturing and distribution space doubles their previous existing shared square footage to 20,000 square feet, and their California facility serves as the company’s main distribution hub for deliveries across the state. The company had a successful trial run of 30,000 units, and now full spectrum CBD Canna Hemp products will roll out to dispensaries no later than later this month when the products are finished their final round of required lab testing.

Product offerings will include:

- relief and recovery creams,

- elixirs,

- lotions,

- capsules,

- vape pens and cartridges

The company is anticipating their first California facility harvest during the first week of February and the second harvest in the following week. They expect monthly harvests to bring 100 pounds of flower for its Blonde and AMA brands, as well as consistent supply for concentrates.

“We know that in this industry, quality will prevail and every ingredient that goes into making our products is highly scrutinized for product efficiency, effect and overall consumer experience. Our standards go far beyond what is expected in the industry and being strategically positioned in high growth states such as Nevada, California and Colorado allows us to execute our growth strategy quickly and efficiently,” said Rebentisch.

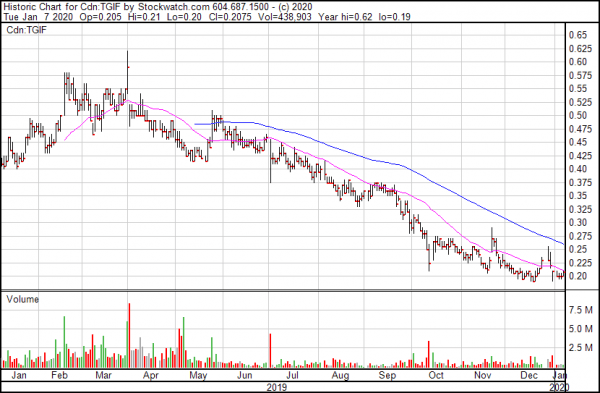

1933’s chart is deceptively negative. Deceptively, we say, because this isn’t a company that’s been paying much attention nor worrying about what the market’s doing. Instead they’re too busy with their California build-out, and their consistent, steady expansion.

Here’s something from an earlier story where we covered 1933’s position at the end of the year.

- Strong balance sheet with a cash position of $17.6 million, a robust increase of 245% over the previous year of $5.1 million, allows the Company to fund capital projects, service its debenture payments and continue to grow its operations

- Working capital was $22.5 million, compared to $11.0 million at July 31, 2018, representing an increase of 105%

- 44% year over year increase in revenue, totaling $18.1 million, with a gross margin of $5.3 million.

That shows growth and development despite a slumping market. Maybe right now isn’t the right time to get into cannabis, but when the dust clears, it’s companies with a solid cash position that are focused on development that are going to survive the ordeals to come.

—Joseph Morton

Full Disclosure: 1933 Industries is an equity.guru marketing client.