Late last week, Nexus Gold (NXS.V) updated us with a welcome (and unexpected) piece of news out of their flagship McKenzie Gold Project in the Red Lake Mining Camp.

It was unexpected in the sense that we thought the company had already given up everything there was to give regarding recently acquired 1,348.5 hectare Red Lake claim block.

“Additional high-grade historical grab samples previously unknown to the Company and now revealed in the Rimini summary include 142.49 g/t Au, 115.2 g/t Au, 114.57 g/t Au, 93.71 g/t Au, 68.03 g/t Au, 53.01 g/t Au, and 16.65 g/t Au from areas located on McKenzie Island (north block).”

Also, previously unknown to the company, a number of historical drill intercepts were obtained on the southern portion of the claim block, including 7.49 g/t gold (Au) over 8.2 meters, 2.1 g/t Au over 5.5 meters, 15.54 g/t Au over 0.8 meters, and 17.02 g/t Au over 0.5 meters.

There’s more: historical intercepts reported on the northern section of the claim block include 1.89 g/t Au over 1.3 meters, 1.97 g/t Au over 1 meter, 5.56 g/t Au over 0.4 meters, and 2.3 g/t Au over 0.75 meters.

Where did these values come from? Great question.

A previous press release pointed to a fair volume of significant historical grab samples (‘grabs’), most notable: 331.14 (“g/t”) gold (“Au”), 18.02 g/t Au, 212.8 g/t Au, 313 g/t Au, 18.02 g/t Au and 9.37 g/t Au. This news release also contained assays from a small drill program conducted by Cypress Development (CYP.V) back in 2005. The majority of these values were furnished by the previous operators of the project.

This past summer, Nexus conducted its first ground reconnaissance program at McKenzie prompting us to trumpet:

Read: Nexus Gold (NXS.V) tags high-grade gold at McKenzie project, Red Lake Ontario

135.4 g/t Au and 9.3 g/t Au were the highlight numbers from this surface sampling campaign.

Back to your question: “where did these latest high-grade values come from?”

Rimini Exploration, the geological sleuths well known for their work with Great Bear Resources (GBR.V) and the market spurring Dixie discoveries, worked side by side with the Nexus team mapping outcrops, collecting samples, and verifying historical values reported earlier this summer.

Rimini was subsequently contracted by Nexus to put together a comprehensive technical report utilizing ALL available historical data generated on the project.

Contracting Rimini to perform this task was money well spent. The company unearthed a veritable treasure trove of high-grade historical values Nexus was completely unaware of.

Nexus President and CEO, Alex Klenman:

“The additional data received from Rimini gives us a much greater understanding of McKenzie island property will aid us immensely in determining drill targets. The abundance of high-grade historic samples and limited historic drill results clearly indicate there is high-grade mineralization present in multiple locations. Determining drill targets is a priority for us, and we will continue to aggressively push the development of the McKenzie Gold Project forward.”

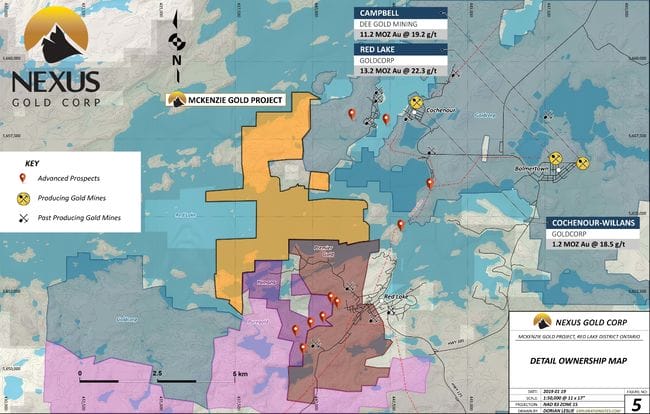

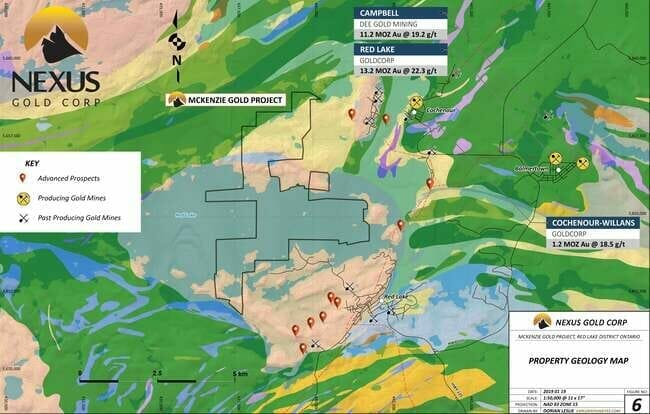

If you study the maps thoroughly, you’ll see that roughly one-half of the McKenzie claim block runs over Red Lake itself.

Rimini’s data compilation summary indicates that little to no exploration has been conducted on the H2O portion of the claim block.

The Company has noted from the regional data that a number of northerly trending geophysical trends extend within the lake itself. The company is viewing these trends as potential faults or breaks within the Dome Stock. Preliminary review of lake sediment sampling conducted on the property in 1989 indicates coincidental anomalous gold geochemical values occurring. Historical values obtained from the analysis of +150 mesh screened lake sediment samples returned values of 0.159 ounce-per-ton (5.45 g/t) Au, 0.154 ounce per ton (5.28 g/t) Au, and 0.116 once per ton (3.98 g/t) Au. The Company now intends to conduct more exploration activity within the lake-bound portion of the project area to determine the prospectivity of a large underexplored section of the property.

Warren Robb, VP Exploration:

“The team at Rimini have done a great job for us. We identified some new areas and trends that we weren’t aware of and we look forward to getting more detailed follow up completed in the near term.”

Nexus now has a nice (meaty) headstart to what could develop into another Red Lake discovery story.

2019…

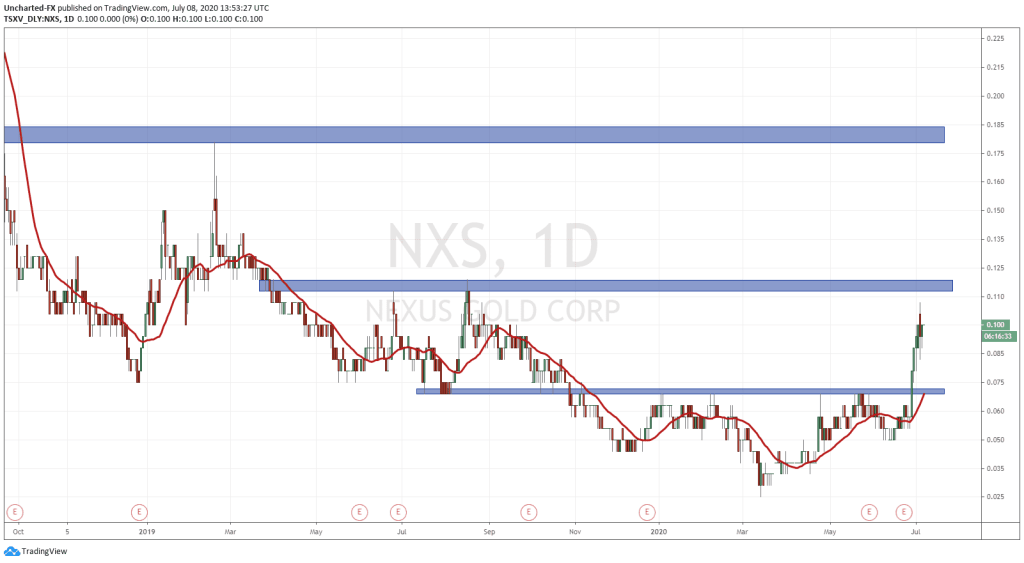

2019 wasn’t a drill year for the company. Even though gold telegraphed its compelling upside potential, the vast majority of the smaller exploration companies, like Nexus, failed to catch a bid. I’m certain that will change in the coming months.

The company decided to delay drilling until the market backdrop improved.

But Klenman didn’t just sit on his treasury. He scoured the project landscape and picked up a boatload of properties on extremely friendly terms. He intends to monetize one or more of these projects via the prospect generator biz-model, or sell them outright.

Let’s face it: exploration can be a veritable black hole for cash, particularly in the pre-discovery phase of development. It took 76 drill holes, at a cost of $80.00 to $100.00 per meter (in 1980 dollars), before economic mineralization was tagged at Hemlo. For Eskay Creek, it took 109 holes at a much steeper cost per meter.

A couple hundred thousand dollars of annual revenue generated from one or more projects will go a long way towards defraying https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative costs. This will help create a more self-sustaining exploration company, one where shareholder dilution is reduced as flagship assets like McKenzie are pushed further along the development curve.

The flagship assets

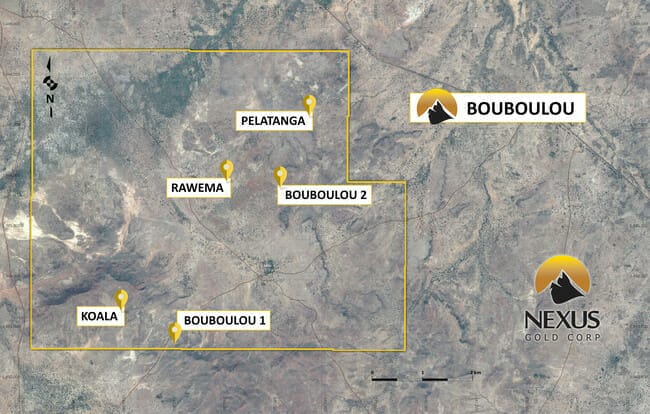

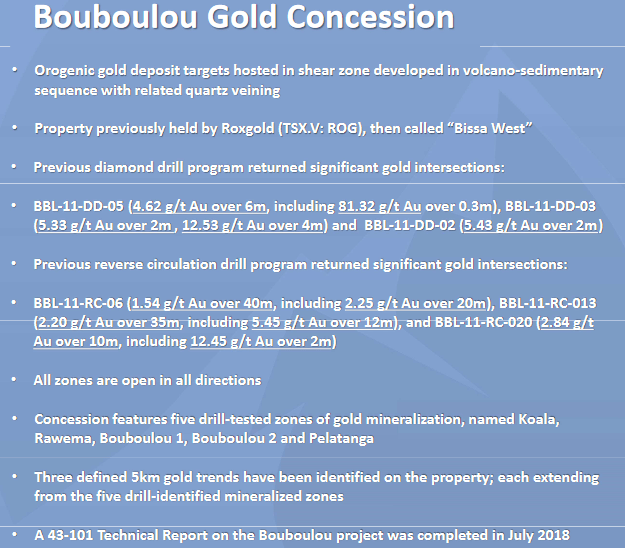

Based on what I know about the company, its flagship projects are Bouboulou (Burkina Faso, West Africa), Dakouli (also Burkina Faso) and McKenzie, but not necessarily in that order.

The Bouboulou Gold Concession is the most advanced of the three.

We should hear news out of the Bouboulou camp in the not-too-distant future as some form of partnership agreement could be in the works.

Bouboulou will require a serious drilling program—up to 30 diamond drill holes.

This is the company’s best shot at a NI 43-101 resource over the next 8 to 12 months.

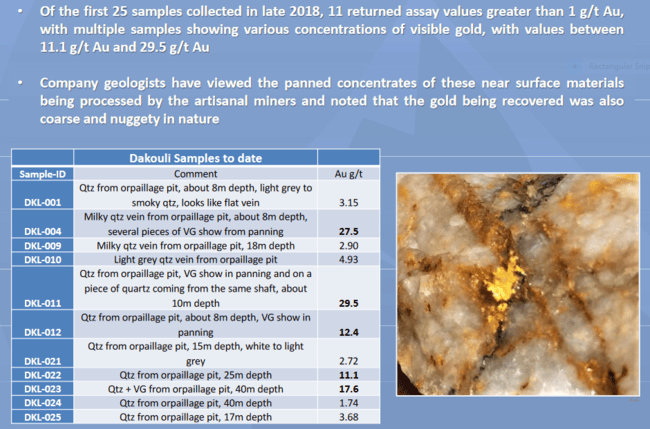

The Dakouli 2 Property is a compelling project.

Longtime shareholders will remember that the Niangouela Gold Concession is what first put Nexus on the map. Highlights included a chip sample that assayed 2,950 g/t Au and a diamond drill hit in the first round of drilling that tagged an impressive 26.69 g/t gold over 4.85 meters. The second round of drilling returned average grades. The third round of drilling was a miss (welcome to the junior exploration arena).

After analyzing the results from these first three drilling campaigns, the company believes the real potential in the area lies further south, at Dakouli.

Warren Robb, Nexus VP of exploration had his sights set on Dakouli from the get-go. But the project wasn’t immediately available. For those unfamiliar with Robb, he was Roxgold’s chief geologist in 2012 where he supervised exploration on the Bissa West and Yaramoko gold projects.

Robb knows his Burkina Faso rocks.

At the time, artisanal miners had been exploiting the Dakouli veins for roughly 200 meters of strike, to a depth of 30 to 40 meters.

It took 1.5 years for Nexus to acquire the project after making a direct application to the mining ministry in Burkina Faso.

Today, these artisanal miners are working a strike of roughly 400 meters, going down 90 to 100 meters.

Nexus believes that the high-grade veins encountered on the Niangouela concession emanate from Dakouli.

Artisanal activity at Dakouli validates the theory.

It’s possible that the real guts of the system lie there, and that the veins splay as they travel north onto Niangouela ground.

The artisanal miners, after doubling the strike length of these veins and going down even deeper, demonstrate that it’s a mature system. Its orientation, its depth, its grade—these are the questions that only the truth machine (drill rig) can answer.

Recent sampling at Dakouli has generated some extraordinary surface values of high grade, nuggety visible gold (20 to 30 g/t).

The company is looking to launch a 1,000 to 2,000-meter reverse circulation (RC) drilling program in November.

That’s what this recent raise is all about…

Nexus Gold Raises $475,000 in Initial Tranche of Private Placement

RC drilling costs run roughly $80.00 to $100.00 per meter in Burkina Faso (diamond drilling runs roughly $300.00 per meter). For this first phase of drilling, the company will likely mobilize an RC rig to the project.

Summarizing this one…

Nexus will be drilling Dakouli in a few weeks with results expected later this year or early next. By then, they’ll be firming up a plan to drill McKenzie in Q1 or early Q2 of 2020. In the meantime, we should hear more about Bouboulou and the prospect of moving that project forward.

With an additional six properties in the company’s project pipeline, Nexus has a lot of irons in the fire.

We stand to watch.

END

—Greg Nolan

Full disclosure: Nexus is an Equity Guru marketing client.