Khiron Life Sciences (KHRN.V) is expanding its cosmeceutical portfolio in Colombia after local authorities approved the company’s application to sell three more CBD wellness products.

For Khrion, this means new revenue opportunities in a market that has fully embraced its product line. As some of you may know by now, Khiron is still the only Colombian cannabis company making money off legal sales.

If that’s not enough, consider that Khiron is well ahead of so-called industry titans Canopy Growth (WEED.T) and Aurora Cannabis (ACB.T) in Latin America. The big boys like to talk up a big game in the region, but they have yet to match KHRN.V where it really matters: revenue.

In an official press release, Khiron announced Wednesday that it has received approval from Colombia’s health agency to begin selling three additional Kuida CBD wellness products. By Q4 of this year, Kuida will have a total of ten products available on Colombian shelves.

A little backstory on Kuida: The Khiron brand is the first in Colombia to develop cosmeceutical products derived from CBD (at least, it’s the first legal company to do so). Kuida skincare products are designed to prevent signs of aging and provide greater hydration, as well as other benefits you can read about here.

You can also use it to “protect yourself from free radicals.” I don’t know what that means.

Alvaro Torres, CEO and director of Khiron, says Kuida has allowed his company to build a large retail presence across the country, which should make the addition of three new CBD wellness products good for business.

“The first-to-market strategy for Kuida has allowed us to establish a large retail partner network we can now build on with this expanded product line. Our educational and experiential programs have helped consumers integrate Kuida CBD products into their daily beauty regimen, and with these newly approved products, we are now positioned to further increase our revenue and market reach in Colombia.”

–Alvaro Torres

Latin America is primed for CBD wellness explosion

Separating cannabis from its black-market roots is hard enough here in Canada, but it’s even more challenging in Latin America. The continent was ground zero for the decades long drug war that sparked unspeakable violence.

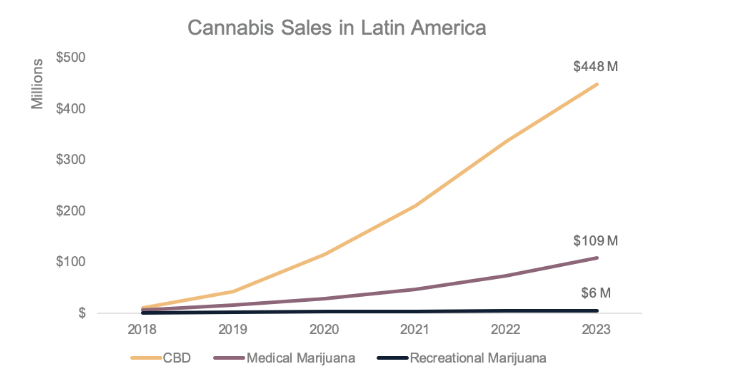

Governments in the region are finally taking concerted steps to create a legal market for cannabis and CBD products, but industry participation remains limited for now. Based on the data we do have, our best estimate for legal marijuana sales in the region is way below $100 million, according to Brightfield Group. That number should approach $450 million in the next four years as the cannabis landscape evolves.

As Brightfield Group notes, CBD wellness products “provide a welcoming alternative for countries with a high level of stigma towards marijuana and the importation of non-psychoactive oils avoids a competition with or diversion to the illicit market.”

Brightfield not only mentioned Colombia as one of the prime growth markets for CBD wellness products, it singled out Khiron for its first-mover advantage. The research group noted additional opportunities for CBD in the region will come via nutraceuticals and topicals, which are already available in Colombia.

KHRN.V stock update

KHRN.V declined sharply on Wednesday, a symptom of low-volume trading on the TSXV. The stock has been extremely volatile over the past five days, reaching a high of CAD$1.74 before correcting all the way back down to sub-$1.30 levels.

At current values, KHRN.V has a total market capitalization of $143.5 million.

The stock is down 18% year-to-date and is trading at only a fraction of its 52-week high. Such trends are characteristic of the boom-and-bust nature of marijuana investments, especially since the bursting of the bubble that Canopy created.

Even in this environment, Khiron offers value as an established marijuana company with a strong track record on the medical side. As we wrote before, medical cannabis producers tend to have access to bigger markets without as many regulatory constraints as recreational growers. For these reasons, it might be a good idea to keep tabs on KHRN.V moving forward.

–Sam Bourgi

Full disclosure: Khiron Life Sciences is an equity.guru marketing client.