Spoiler: Today, DionyMed Brands (DYME.C) released news it was taking on additional debt to…pay off its other debt to Gotham Green Partners and laying off one-third of its workforce in a totally unrelated matter.

Foreword: Buckle in, folks, because the following story featuring DYME is not for newcomers to the capital markets.

Chapter one: DionyMed, for the uninitiated, is a multi-state operator in the U.S. cannabis market. The company’s humble beginnings can be traced back to a reverse takeover (RTO) of Sixonine Ventures in late 2018.

For those who don’t know, an RTO is a skeezy way to list on the public markets in Canada. The United States does not allow companies to list publicly in this manner, with direct listings and initial public offerings (IPOs) being the only path available.

In an RTO, a company like DYME will find a shell that is publicly listed. In this case, that shell was Sixonine. This company is referred to as a ‘shell’ because it’s a garbage company with no prospects to its name except its ticker.

So DionyMed buys enough shares of Tekashi Sixonine to become a majority shareholder. Then, and this is where it gets tricky, DionyMed’s management exchanges the shares in their own company for shares of the shell. It also sells its own assets to the shell.

The best way to think of this is to imagine flaying the skin off someone roughly your size, sewing a human gimp suit, putting it on and using your victim’s costco membership to get Kirkland jeans in bulk.

Chapter two: So DYME dons its human gimp suit and goes about its business. Of course, it changes its name from Sixonine to DionyMed because it doesn’t want to assume Sixonine’s life, it just wants the Costco card.

Then it goes about signing bullshit deals left right and centre.

On Dec. 13, 2019 for example, the company acquired HomeTown Heart, a direct-to-consumer delivery platform in California. Basically, it’s a weed delivery service.

The purchase price of $18-million (U.S.) comprises approximately $6-million (U.S.) paid upon closing of the transaction and a performance based earnout of up to $12-million (U.S.), to be paid in a combination of cash and stock.

The company then got into a bizarre legal battle with Eaze Technologies, a competitor in the space, over allegations Eaze was moving payments made on its app through the U.K. and Cyprus as a way of skirting U.S. law.

But Eaze says it doesn’t even process payments. Either way, here is what Cannacord thought of DYME ditching Eaze for it’s own proprietary service:

Canaccord Genuity dropped its estimates on a cannabis company called DionyMed Brands (CSE: DYME) (HMDEF), blaming the company’s decision to no longer use the Eaze delivery service software. Analyst Bobby Burleson said, “Deliveries made through Eaze in San Francisco and Oakland were providing approximately $2.9 million in revenues per month to DYME at an approximate 8% EBITDA margin.”

Then the company is late on its 2018 financials and does some other deals like signing a distribution agreement with a chocolatier, all the while burning through shareholder equity.

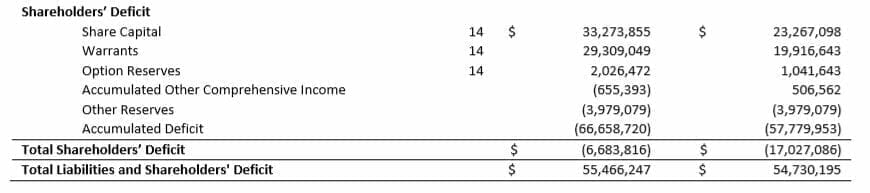

Check this out from their latest financial statement:

I have never, ever, ever seen a “Shareholders’ Deficit” line on a financial statement before. Really nuts.

Chapter three: On August 1, 2019, DYME announced it had issued a USD$2M convertible note to Gotham Green Partners (GGP) for “corporate purposes.”

By this point, the company has less than the USD$1.57M in cash it reported at the end of Q2.

Today, the company published a statement which said GGP “issued a request for repayment of its outstanding balance of $2.2-million (U.S.) representing the credit advance made on July 30, 2019, plus accrued and unpaid interest.

So what does DYME do? What any sane corporate entity would, of course! They take out a new credit card to pay off the old one.

Dionymed Brands Inc. has received additional investment from its senior secured investor of $3.2-million (U.S.) and has reorganized its business to right size the company.

Excellent. Except for the fact that this new $3.2 million is part of a total loan of $19.2M which carries an interest rate of LIBOR plus 12% plus an anniversary fee–that’s a new one–of 2.5%.

DYME has also restructured its employee count from 299 to 199, and there’s also this little nugget about the new loan from the release: “While the credit facility is currently in default, the senior lender has agreed to make additional advances to the company.”

In short, the company has some serious upcoming problems, namely with cash.

Besides just having kicked its debt problem down the road, the company has $9.1M in debentures left on the books. The conversion price is CAD$2.06 and they’re currently at $0.27 with less than a year to get there before the maturity date.

No cash, share price tanking and a debenture in the oven. Too many mouths to feed and no dough.

Good thing they bought that chocolatier.

–Ethan Reyes

Equity.guru will continue updating the story so check back in!

Fun, always enjoying to read. PS they still do reverse mergers down here.