Distribution is king, a reality Dionymed Brands (DYME.C) became intimately familiar with after parting ways with a successful technology platform that helped earn it USD$2.9 million in monthly revenue.

Eaze, one of the many upstart California tech plays, facilitates the delivery of cannabis from dispensary to patient, leading one to wonder what Dionymed was thinking when it severed ties to one of the few profitable arms of its business.

Imagine is the Hudson Bay Company decided to sever ties with seasoned sailors, instead shipping furs across the Atlantic in the charge of their undersecretaries.

Cannacord Genuity downgraded its estimates on Dionymed after news of the company’s decision to pursue in-house delivery platforms, and rightly so.

Now, we all make mistakes from time to time. I remember one of my first business ventures was financing passenger gargantuan cruise lines between Southampton and New York City.

Now, we all make mistakes from time to time. I remember one of my first business ventures was financing passenger gargantuan cruise lines between Southampton and New York City.

The next time an engineer calls a liner unsinkable, I’ll give him a cauliflower ear! Let’s hope dirigibles encounter fewer ice bergs along the way.

But, I digress.

It’s all rather cloak and dagger, at least according to DionyMed, which alleges Eaze is skirting U.S. federal law by shifting credit card payments processed through the Eaze app offshore:

Eaze also conspired—and continues to conspire—to deceive and defraud banks and Payment Card Companies. To ensure that the payments sent back to the retailers (and by extension,Eaze) are not flagged by Payment Card Companies or other financial institutions, Eaze ensures that they are transferred between and among various overseas entities, converted from U.S. dollars into euros, and then returned to the United States in euros from an entity based in Gibraltar called “Spinwild” with which none of the retailers has ever actually done business.

Elizabeth Ashford, an Eaze spokesperson, called the suit a “thinly-veiled attempt by publicly traded Canadian company DionyMed to gain an advantage through litigation, prop up their failing stock price, and publicize their new delivery platform,” during an interview with mashable.com.

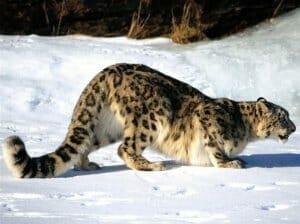

Dear reader, I would like to be perfectly frank with you, even if your name isn’t Frank, an allowance I hope you’ll indulge me. DionyMed is a company poised to pounce like the mighty panther, an animal I have encountered in plurality on my many African safaris.

Above is DYME’s stock chart. To some it may evoke hopelessness, or anger. Some might look upon it and say: ‘Heavens, the company is in shambles and has lost all confidence from its investors.’

Instead of focusing on that hogwash, I invite you to look at the graceful, downward slope of the company’s stock price. Quite feline, is it not?

Do you see the resemblance with the snow leopard, adroitly positioned for your convenience?

Does this comparison not engender confidence and awe in one of mother nature’s most fearsome killing machines?

While readying to pounce, animals in the felidae subset often lower themselves, reducing their profile and coiling their powerful muscles.

DionyMed knows that their is no greater engineer than nature herself, and has decided to adopt a cat-like pose. They are now lower to the ground and less visible than at any point in history!

Flow Capital Corp. has commenced legal proceedings against Dionymed Brands Inc. as DionyMed is in default under the company’s royalty agreement. The claim is for the minimum sum of $2,698,116 which is made up of the investment balance, past-due royalty payments and late payment fees.

The company’s investment in Dionymed is $1-million and there can be no assurance that the company will recover any portion of its investment.

–Flow Capital

The company just announced the resignation of its CEO and COO. Soon, the company will assuredly have nowhere to go but up. And that, dear reader, can only be a good thing, no?

–Mr. Millionaire