The cannabis bubble is not yet bursting, but the likelihood that it will go by the time you read this is high. The markets are wobbling hard for a multitude of reasons, but the cannabis sector is reeling because the bellwether cannabis stock, Canopy Growth Corp (WEED.T) is in freefall.

Other companies that exist as comparables to Canopy are following it down, whether they’re well run or not, whether they have nice balance sheets or not.

This is not unhealthy. The cannabis sector has needed an enema for some time. It’s proved much more difficult to get financing for the last year-plus, and a lot of the bigger cannabis companies are built to exist on a steady diet of financing, or die quickly.

Wayland Group (WAYL.C) ran out of financing options and took a death spiral debenture, which appears to have ended both the CEO’s tenure, and the company’s ability to exist without rolling into a blockchain shell for a handful of paper. MedMen (MMEN.C) recently bent itself over and presented its shame for financiers looking to lower their debenture conversion price, in return for just one more quarter of loss covering. CannTrust (TRST.T) was so desperate to present the impression of operational success that it started an illegal drug ring inside its facility, a move that has it now looking at strategic alternatives. Aurora (ACB.T) has debenture struggles looming, Supreme (FIRE.T) just had its wings clipped when long ago in-the-money warrants came to a must-execute moment all at once, combined with the recalibration of an ETF that didn’t seem to register that TRST might cease to exist some day soon.

There’s a lot of mess out there, but it all comes down to one company forcing the issue.

Canopy blew up this bubble. And now it’s Canopy that is popping it.

Back in 2013/2014, when cannabis deals were running rampant on public exchanges, most without any real business plan, management-level knowledge of the cannabis business, or confirmable evidence that they had a chance of one day being licensed, Canopy Growth Corp, or Tweed as it was then, dominated the public markets by understanding a simple premise; the cannabis sector was, at that time, less about making money than it was about raising money.

Get some politically connected folks together (even if only as advisors), take over the lease on a seemingly impressive-looking building (even if it could never actually be useful for the purpose you bought it for), raise money every time your stock is up (even if you have no immediate use for said money), and whenever the market runs out of gas, go buy something expensive and give everyone a big stock lift on the back of the new valuation comparable.

None of this was illegal, or even any shadier than anything else that was going on around it at the time. CEO Bruce Linton simply understood, before many of us did, that his job was to hammer the message that Canopy would be fine because it was the biggest player, and that would let it raise more than anyone else, which would allow it to get bigger still, which would help it raise more still beyond that. It would gobble up others relentlessly. It would pull political strings. It would buy its way out of any trouble encountered. And if it didn’t grow so much weed, or it had to buy weed off others who grew it better, or even if they lost money on every gram sold, it’d be okay.

Canopy would always be bigger later by virtue of it being the biggest now.

And for a long time, that worked. Some of us, of course, would point to all this and yell loudly about how it was wrong and dumb and not the way people should do business, but we contrarians were also completely wrong. Canopy’s way was absolutely the way to do business, at least until a few months ago, when it suddenly wasn’t.

In 2015 and 2016 and 2017, when new rules came down from up high that allowed actual cannabis growing and selling business to be engaged in, those rules only served to provide new metrics to be dominated for Canopy, rather than new ways to actually generate profits.

Gather more patients. Build more square footage. Buy more licenses. Acquire more side hustles.

Nobody did this like Canopy did it:

Mettrum for $430 million. Hiku/Tokyo Smoke for $600 million. Acreage Holdings for $3.4 billion.

In 2016, the Mettrum deal was reported in the Financial Post as “forming a Canadian marijuana mega-company with a patient base that would dominate the Canadian market.” Today, Mettrum doesn’t exist, at least in its original form. That $430m acquisition had so little goodwill by the time they were done being chased by lawyers for spraying pesticide about the place, Canopy changed the company name to Spectrum, a brand now only used to ship soft gel caps to Europe.

The Hiku deal may have been more to grab lifestyle and dispensary brand Tokyo Smoke than a small weed grow in the Okanagan, but Tokyo Smoke is today a small mostly coffee and sometimes cannabis dispensary chain, with no licenses outside of Ontario and Manitoba, that offers little to Canopy’s bottom line, let alone a return on $600m.

And Acreage.. that deal was so hefty, so stupidly large and table-bossing, you’d figure it would have sent Canopy on another run, but it instead had the opposite effect. Despite following his long time playbook, Linton failed to read the room this time and realize investors had begun to favour balance sheets over balancing acts. His high priced gamble on Acreage gave the market the shakes and gave Constellation Brands all the reason they needed to let him go.

TO BE SURE, LINTON BEING FIRED WAS NECESSARY AND GOOD.

I mean, come on, the growth-at-all-costs model was so plain to see, he even put the word ‘Growth’ in the company name.

When the oral history of Canopy is one day told, we’ll learn all sorts of things that will make us go ‘oof’, but right now replacement CEO Mark Zekulin is doing something that should have been done years ago, and may take years to complete: He’s redesigning Canopy as a real company, that gives two shits about profit and loss.

That’s a TOUGH ACT, because Canopy wasn’t designed to make a profit.

Bruce Linton was great at raising money and leading the sector and convincing everyone that things that couldn’t make a profit were worth billions, but when it came to integrating a massive number of grow facilities, licenses, teams, brands, SKUs, and national markets, and bringing in more money than he was spending, Bruce was found wanting. When the valuations got too top heavy and couldn’t be supported by the real business, when the acquisitions came with prices the market could no longer justify, and when the financings came with warrants Constellation would insist be re-priced lower, to protect their bottom line at the expense of Canopy’s, it just became too much for a market to bear.

A billion dollar quarterly loss ensued, and thank god it did because it Linton had been left at the wheel for another few quarters, turning the company around may have proved easier than solving climate change.

How did it get like this?

There were a lot of justifications offered about this along the way.

For new investors, the refrain was always, “Canopy is going to be huge!“, ignoring the fact that, as it relates to market cap anyway, it already was. A $20 billion valuation so far out of whack with earnings that it was a running joke among stock commentators, even now, crushed down as it has been to just $10 billion at the time of writing, Canopy remains vastly overpriced based on what it actually earns.

For older investors, the refrain was, “Canopy is the biggest company, so it must be the safest and thus I shall put my RRSP into it,” without any exploration done to see if their product was something someone might buy twice, or if their balance sheet could survive a sector downturn, or if they could, just one time, bring in more than they were spending for a quarter. This is the kind of thinking that keeps Bombardier alive, even though it sucks relentlessly, quarter after quarter.

For institutional investors, the big size of Canopy also beckoned. ETFs loaded up on it, which made the stock run more. Big brokers financed acquisitions and raises at expensive prices, taking their 7% finder’s fee happily. And Canada’s big banks, once they’d been convinced they should play in the cannabis space, elected to sit in Canopy’s gigantic, loaded, very leaky boat rather than take a step aside from the crowd and find folks who were building actual profitable businesses.

And for the big investors, in this case Constellation Brands (STZ.NYSE), the justification was the deal itself, built as it was to cost less than the market cap rise for both companies that would result. Which it did.

Until it didn’t.

Canopy Growth’s machinations brought massive valuation rises to the North American weed markets. It was responsible for hundreds of billions in market cap creation, both for itself and those around it. Canopy was the figurative rising tide that lifted all boats. It has been a godsend.

Other assisted, of course – Aurora chased, Aphria cut corners, CannTrust blew through those corners with a chainsaw it then turned on itself.

But Canopy is the cannabis industry. Canopy built this. And now Canopy is the reason it is imploding.

By all means, blame them for the good, blame them for the bad, but understand your own role in this mess.

If your cannabis portfolio is hurting right now, it’ll be no solace to point out that this mess has been coming for a while. With the rules of rational markets long tossed out the window in the cannabis space, complaining that your cannabis stock is down today is like complaining your Pets.com investment was halved a few days before the dot.com collapse. You’ve had a good run, if you didn’t know to pull the chord when you were up 15x, you were just being greedy.

I went largely into cash, selling most of my weed investments, in February of this year, and did so publicly. I’ve grabbed at some bargains here and there, but my position has been largely unchanged from then, when I said (again and again) that this was now The Balance Sheet Era, and anything that couldn’t march the road to actual profitability was due to die hard.

Of course, I’m not protected from the crappy markets. I’m still sitting on some deals that are under trade halts and some crazy low-priced deals that have since gone crazy lower still. Even the prepared can be caught unprepared if the hurricane is blowing hard enough, and this one, she’s a puffing.

Sadly, everyone in the cannabis universe will be exposed to the implosion happening at Canopy now, and small issues will receive a bigger negative impact.

Big issues? They might become crises.

Aphria-owned Broken Coast just had a fire at its facility that, best case scenario, might see them destroying crops and having to not just repair rooms, but demonstrate to Health Canada that the entire facility is clean before it can operate again.

Martin Drakeley, the municipality’s manager of fire and bylaw services, said all told, five trucks and a crew of at least 24 firefighters spent roughly five hours at the site — the last hour or so was spent retrieving employee’s personal effects.

“We couldn’t allow any of the workers in the building due to the smoke concerns because it was quite toxic,” Drakeley explained.

That’s not good.

It might even be terrible.

Toxicity concerns didn’t emerge until the firefighters started coming out of the building covered in a foreign material.

“They were coated in a black soot, which is unusual, especially the darkness of it,” Drakeley said. “They have a protective barrier on the wall when they are doing the drying and it doesn’t allow the moisture, I believe, to get behind it and when it burns obviously it wasn’t hot enough to do complete combustion and there was a lot of unburnt products of combustion that were in the room so once we saw them coming out and they were dark with all the soot, we knew we had some kind of special product in there.”

This will not be a small thing.

While such an event would, usually, mean a bit of a road bump for the stock, today, in the midst of peril across the sector, will it cast a bigger shadow on Aphria than it otherwise would have?

Let’s go deeper: It’s not just existing public companies that are being dragged down in the cannabis slump, it’s companies that have yet to go public. File this as the first ‘mining company scheduled to switch to weed that has decided, fuck it, we’re going back to mining.’

PLATINEX PROVIDES CORPORATE UPDATE

Platinex Inc. has provided an update regarding the status of the proposed acquisition of InLove Corp., intended change of business (COB) and amendment of previously announced proposed private placement terms.

James Trusler, interim chief executive officer of Platinex, commented: “The board of directors of Platinex has decided not to proceed with the proposed change of business to become a cannabis issuer and go back to its roots and continue operating as a mining issuer. As a consequence the proposed acquisition of InLove Corp. was terminated. It was a pleasure to work with Mr. Shapiro in the effort to complete the acquisition and we wish him well in his endeavours as he continues to build his company.”

Lest you think this was a deal not overly advanced, that could be easily undone, there are others that will also need to be undone. Or wound-up.

This move is, indeed, a big move.

The company continues to hold a 51-per-cent interest in Oregon-based Intergalatic Foods LLC (IGF) and a royalty interest in Dave’s Space Cakes LLC (DSC) and is exploring various options to preserve value through a sale or a wind-up of these entities.

At this time, the company does not intend to pursue further projects in the cannabis space.

That deal was for 60 million shares. Upon announcing the deal was dead and removing their trade halt, Platinex shares dumped to $0.02, good for a $1.9 million market cap.

Optimists will point to the big dog at the table, Constellation Brands, which is watching its own stock price tumble because of its Canopy investment, and surely isn’t going to watch that investment be shredded without a fight, as evidence that things can actually turn around soon.

But ‘supporting Canopy and helping it thrive’ may not be their preferred option.

The Globe and Mail reports in its Tuesday, Aug. 27, edition that Constellation Brands said Monday it expects to record a loss of about $54.8-million (U.S.) in its current quarter from its billion-dollar investment in Canopy Growth. A Reuters dispatch to The Globe reports that Canopy chief executive officer Mark Zekulin said earlier this month the weed producer needs another three to five years to turn a profit.

Understand what you’re seeing here, people. This is a company warning you not just of next quarter’s dire financial state, but of the next ten-plus quarters. They don’t do that if they think profitability is right around the corner. They’re pre-conditioning you to sadness.

[contextly_sidebar id=”AeuvTW7MicZdCDb8QMrxGOAa0A1a4UqU”]How long will Constellation watch their massive investment, which is already about 30% down, continue to shred? Can they hang more than a quarter or two?

And this from the bellwether of the Canadian cannabis space.

The problem with a troublesome company like Canopy being seen as a bellwether is, it lead many to wonder, “If they can’t make a profit, who can?”

This is why your portfolio is red today, and probably will be tomorrow. And may be for a while yet. Because the casual investor – the retail investor – is scared and tapping out. And they’re right to do so.

It’s time for a long overdue reckoning.

Thankfully, you should be stepping out with a nice profit under your belt… right?

No?

Look man, we’ve talked about this before. We told you back in early 2018 just days before everything croaked in cannabis, we told you when cobalt was too heavy, and when the cannabis laws were going to change that everything would fall and not rise, we told you when TGOD hit $7 and was going to $9 that you should take your win and wait for it to fall back and get back in, and we’ve told you again and again that when the gods grant you profits, YOU TAKE THEM.

You couldn’t look at this weed market in January and say it was making any sense, and you sure as hell couldn’t look at it in March and believe that could continue, so we told you we were getting out. I know for sure, from some of the correspondence I’ve seen, that some of you followed that move.

Sure, we missed some upward movement in the weeks immediate after, and some cynics bragged in April that we were missing out on a small spike, but we’ve also missed all of the downward shift.

Just on WEED alone, if you sold in February and bought today, you’re getting twice the stock you started with.

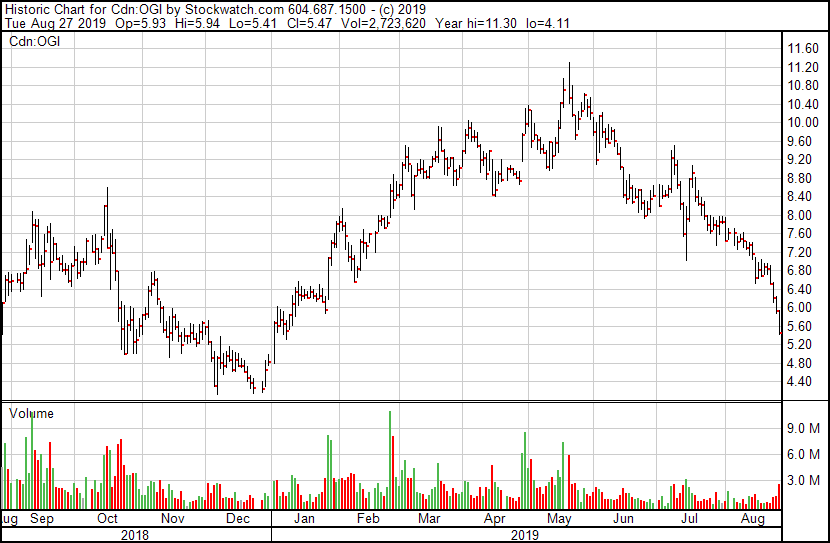

Check out Organigram, who we have no problem saying is running their ship well right now. OGI is a GOOD COMPANY with good operators and no immediate peril, and yet:

Devastation.

Here’s Khiron (KHRN.C). Nothing wrong with their operation, but the money is bleeding all over the sector, which means if you got out in February, you’re getting 3x the shares for your money today.

And you may well get 4x if you wait another week.

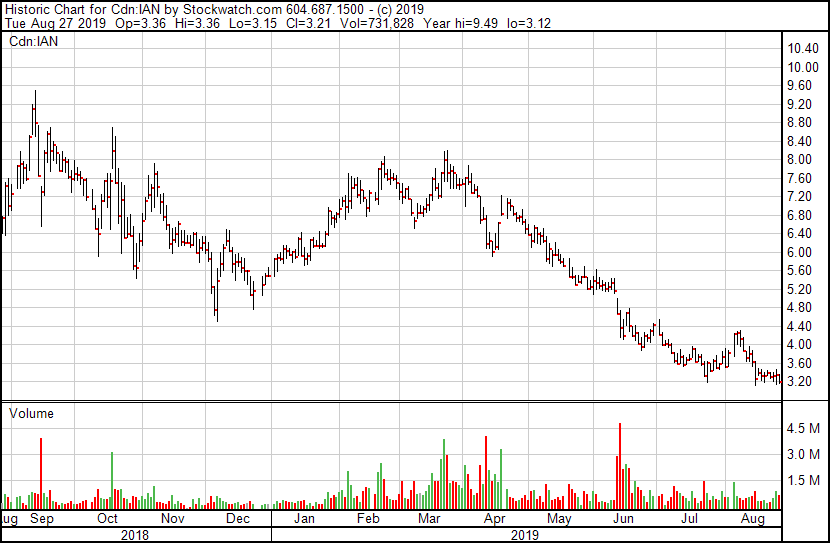

iAnthus (IAN.C), which has had a few hiccups of late, but is still the same company it was when it was flying in March. Only real difference? The market is eating dirt. There will be a moment to get back in on this stock. But this moment may not be it.

MedMen (MMEN.C) is a total gong show. In order to get their hands on $30m of credit they needed to survive the quarter, they adjusted their loan facility to put underwater debentures back at water level. In essence, they did what Canopy did with Constellation, which led to a $1 billion quarterly loss for WEED.

I’ll say it again, as I’ve been saying for the last year – MedMen will not survive. At some point, the guys keeping it alive will pull the plug and take the furniture.

The market is a mess and you should be largely in cash right now, if you weren’t already, because it will not be a three day slump.

To paraphrase the 300, “This will not be over quickly. You will not enjoy this.”

Tilray now -91% from its high of $300.00

— Hipster (@Hipster_Trader) August 27, 2019

But that doesn’t mean you can’t find bargain buy-ins along the way.

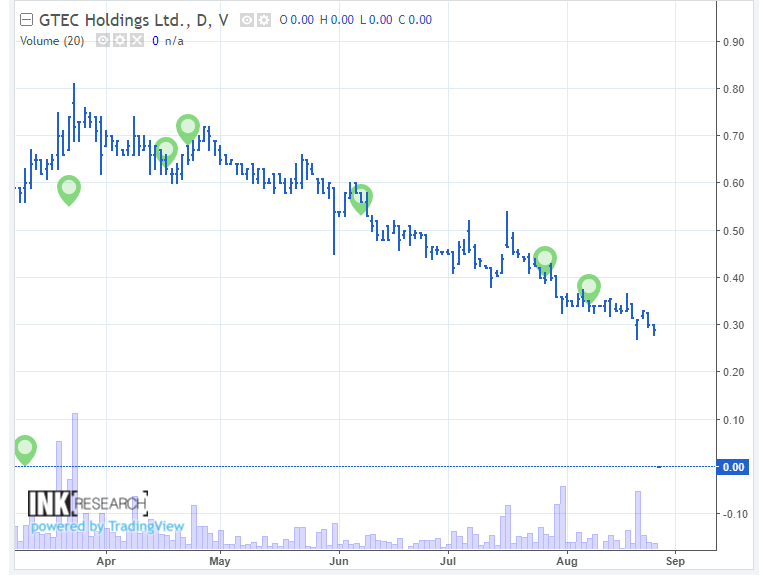

Hell, I’ve been in and out of Supreme, I’m buying GTEC as it’s down to a $30m market cap right now with three licenses, I made money on C21 by getting out when it was mid-spike, lost money on iAnthus by getting greedy and hanging too long, I’m even eyeing Eureka 93 and thinking ‘is it low enough yet?’ (The answer is no, btw, hold the line)

In short, when everyone else is suffering you need to be cashed up and ready to turn their tears into bargains.

“Gee it sure is a shame you lost half your money on Organigram, buddy. Why don’t I just toss you a little cash and get you out of that?”

TIME TO MAKE SOME HARD DECISIONS:

This is an important moment. You, or the person you trust with your financial decision making, need to plot a course for the coming weeks.

Option 1: You stay long, watch your stock fall and your value dwindle, comfortable in the belief the wind will turn soon and you’ll be right there when it does. This is a brave move, a belief that others like you have had enough and will start buying stock ASAP.

2: You sell up and hit the lifeboats, believing things will get worse before they get better and your cash needs to be protected from further losses until some distant point when bargains will be aplenty.

There is no third option. A halfsies sell/buy strategy will be more trouble than it’s worth.

My thinking is, as it has been for most of this year, you need to play defense and protect what you have. Do not go quietly. Do not watch your money recede because you didn’t want to cede a loss, or didn’t want to feel like a traitor, or didn’t want to admit you made a bad call.

Take a serious look at your portfolio and understand that, while you’ll rarely see a collapse coming before it hurts, you’ll almost always see a floor forming before it really rakes off.

[contextly_sidebar id=”BoUWtNu4kD60M927OhTfGOgqfLuXJMW7″]Your sell will not devastate your favourite company, nor will it be seen as some karmic betrayal that will come back to haunt you. It’s just a trade. If you bought at $12, and it went to $48, and it’s now down to $32, take that win. Don’t look at the high, look at the buy-in, and look at where the chart looks like it’s going next.

Because you’re a little guy, you get to do that. You don’t have many advantages in the stock market game, but the ability to exit quickly is one. If Constellation gets out of the Canopy business, it crushes that stock. It will take a lot of machinations and PR and risk and lawyers and negotiations for them to get the opportunity you have right now – to escape at your leisure.

If you think Canopy is going to come back with a cunning plan, and will once again shoot for the $50 range, and that such a thing might happen any day now, then by all means hold and accrue and walk bravely into the cannon fire.

I just don’t think that’s likely. And it appears Canopy’s CEO doesn’t think that’s likely.

And if that’s not likely at Canopy, is it likely at Aurora, or Aphria, or CannTrust? Is it likely at Organigram, which we really like from a management perspective but that is being bled out by a scared market?

I know, some you guys are a bit confused now, because I take money from a lot of cannabis companies to talk about them and present their opportunity to you, and telling you to protect your ass and not buy them for a while goes counter to what you expect from someone in my position.

But the reason those companies trust me to tell their story is because you understand we won’t sell you short and bullshit you. If we say nice things about a company, it means something if, at other times, we’ve said ‘don’t buy it right now, it’s not the time, no refunds.’

I see a lot of deals out there currently. Look at what’s happening to Chemisis (CSI.C), a company that’s doing all the things they said they would and held really strong through much of the 2019 downturn.

That’s almost 2/3 down in a month. Not on news, not on some failure, just on prevailing winds.

But should you buy it right now?

No way. If you like it, and want to own it, and think it’s cheap, that’s all good. But it’s dropping ten cents a day, and in all likelihood might be cheaper tomorrow. If someone out there is going to give you their stock cheaper tomorrow than you’ll get it today, let it bleed a little, then hold the damn thing for years.

GTEC Holdings (GTEC.C): Receiving license after license, now into their full sales phase, working the levers on a deal to take what we thiiiink is the old Hiku facility Canopy wants to unload, that will come nice and cheap if they can find decent financing options… and the stock price is flooring out.

It’s so damn cheap despite the operators clearly doing good work – should you buy it?

$GTEC $GTEC.V $GGTFF still remains my largest holding. The company has executed on every milestone. Market showing no love. Is the bleeding done…. I think so. @nort604 has done nothing but outwork any CEO in this industry. Backing this until the end. Just look at insider buying

— John Fahmy (@1JohnFahmy1) August 28, 2019

I like John, and I’m with him on his ride or die here, but that doesn’t mean I’d tell you to join us. Not yet. Maybe not tomorrow. Maybe not next week.

When I go in for more, I’m going in for a LOT more, but there’s potentially more downside over the coming days, so maybe I’ll just linger for a bit.

Meanwhile, John mentioned insider buying at GTEC. He’s not wrong.

That’s the CEO putting his money in there, right alongside mine, not on ‘special options issues’ but just scooping up cheap stock on the market.

Worth noting, however: he’s not buying today, or yesterday, because though I’m sure he’d love to prop up his stock and floor that thing out, he’s not an idiot. If someone wants to sell your stock cheaply, it’s not always the move to fight them on it. Sometimes you just need to let the bleeding happen and come in hot when it’s done.

If you’re looking for advice on how to deal with this downturn, that’s pretty much it. Don’t float down river. Get out, dry off, and wait.

Because the real money in the stock market isn’t in private placements or sweet insider options or figuring out what the Parallax Momentum Average will be when congealed with the Thundercat Curve as the Robert Smith Hair formation kicks in…

I maintain, if I posted a random stock chart and told everyone to “respect the Gutenberg Crossover, Cheeto Throwback looming, don’t get caught out on the Diane Keaton Average,” I’d get at least 10 likes from chartheads and two people replying, “TRUTH.”

— Chris Parry ™ (@ChrisParry) August 26, 2019

The real money on the markets is made by those who are cashed up when it all hits bottom.

— Chris Parry

FULL DISCLOSURE: GTEC, Supreme, Khiron, and Chemesis are Equity.Guru clients, iAnthus and C21 have been previously and may at some point be again. The author may buy or sell stocks mentioned at any time.

So Chris, you feeling there still may be an historical run Sept to Dec as you stated before? What are your thoughts?

Yeah, but it might get deep into September. To me, the obvious catalyst left, since revs aren’t doing it and profits are small, is acquisitions. Some companies are getting damn cheap, and that will see a buying frenzy at some point.

But maybe not for a bit.

If HC pulls TRST license it will tank the market as well I feel. Waiting for that shoe to fall…or not.

Chris, the omission of Eureka 93 from the discussion is notable – it’s got to be one of those stories that has actually resulted in the biggest drop in percentage terms and fits the theme of your story well. Viz. a hyped-up story with grand plans that rode its valuation on the back of the Canopy-driven bubble – and now the emperor has no clothes (ie inept mgmt with no idea how to execute)

It’s included in the story. It’ll be interesting over the next few weeks to watch.

First off l’ll buy your Cano pee spin but Aphria’s B.C. was a huge load as they resume shipping next week.Also why do all Journalists become experts on just about everything.