Two days ago, Zenabis Global (ZENA.T) formed an agreement with a Canadian beverage company, which will supply them the inputs required for Zenabis to enter into the edibles market in October.

But with an uncertain future for the cannabis industry, spearheaded by cannabis-giant Canopy Growth’s (WEED.T) latest stock-price swan dive, it makes one wonder whether it might be time to batten down the hatches and the coming storm.

“This agreement puts Zenabis in a strong position to compete in the cannabis-infused beverage market once these products are legalized in Canada later this year. The Canadian market for these beverages is estimated to be worth $529-million, so the ability to infuse cannabis in beverages; without affecting their taste, smell or appearance; strengthens Zenabis’ position relative to the many other companies planning to commercialize similar products,” said Andrew Grieve, chief executive officer of Zenabis.

Grieve’s overly optimistic tone here may be shortsighted, and a more balanced response might include something about entering into the cannabis beverage market if they’re still financially healthy enough in December.

This company’s still raising funds and developing like the bubble isn’t about to burst, and there’s still money to be made in cannabis. Which is all well and good, we suppose, because the only way past the sleepy-bearish post-bubble market is through.

But as revenues begin to dry up and the $87.7 million worth in obligations on their balance sheet come due, and the debentures and warrants mature in the next few quarters, there’s going to come a reckoning.

Recently, ZENA took out a $25 million loan in secured debt financing, raising their secured debt load to $50 million.

The loan includes a yearly interest rate of 14%, which is roughly another $7 million they’ll pay this year, and it matures in June 30, 2020. R.C. Morris Capital management, the lender, also gets another $25 million from a 5% structuring fee, coming out to $2.5 million.

Here’s what the company is using it for:

“These developments ensure we have a surplus of capital to complete the expansion of our facilities to achieve an annual design capacity of 143,200 kg of dried cannabis and become cashflow positive upon completion of our current capital program. In addition, we note that Zenabis does not intend to raise incremental debt financing, raise convertible debt, or issue incremental equity capital in order to pursue the expansion of our cultivation capacity. Instead, the next priority of Zenabis is the replacement of the Senior Debt and the Convertible Notes with standard bank financing,” Grieve said.”

Here’s what equity.guru’s own Ethan Reyes had to say:

Here’s the problem: Zenabis has a god-awful quick ratio, a neat little metric used to establish whether or not a company can cover its liabilities.

A good quick ratio would be twice as much cash, short term receivables and other liquid assets to total liabilities.

But Zenabis has $8.6M in cash, $1.6M in short term investments and $18M in accounts receivable as of Q2 2019. Anyone who has ever owned a business before will tell you that classifying accounts receivable as a ‘liquid asset’ is laughable, but we’ll throw it in there.

As for liabilities, Zenabis has $176.3M in total. Sure, Zenabis just took on an additional $25M cash, but we can just add that onto their liabilities!

This company would still be in trouble even if the market weren’t riding a downhill slope, but after the unforeseen aftereffects of the soon-to-be burst bubble come rolling over them, they’re going to be in a far worse position.

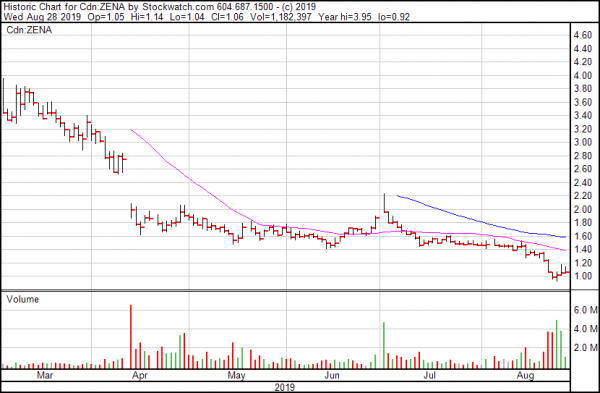

Here’s their chart. You could ski off that slope.

If you look at some of the other charts from other better managed weedcos in the space, they begin to look awfully familiar.

Here’s Organigram’s Holdings (OGI.T).

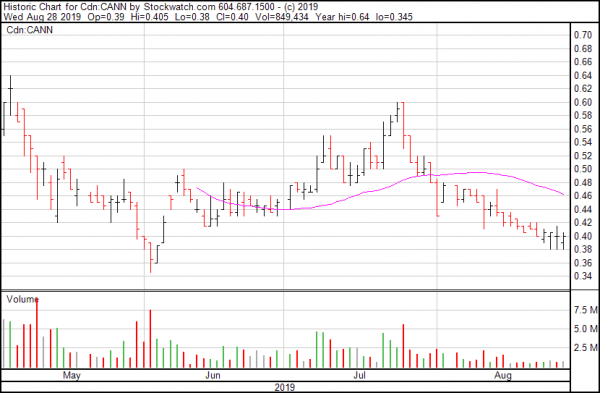

How about Heritage Cannabis (CANN.C)?

And Chemesis International (CSI.V)?

But there’s still hope. Cannabis edibles, including the beverage market, go live in October, and after Health Canada’s three month hold on new products while they get their ducks in a row, they’ll start showing up on shelves.

Definitely. Maybe. Maybe not?

That three month period between October and December is for the proposed companies to pitch Health Canada their products, and each product is still subject to approval from the agency. That’s another mile of red tape that some companies are likely going to be buckle under. Cue shortage. Cue revenue-losses. Cue broken promises. Cue disaffected investors.

After that, who knows what delightful twists and turns a legal cannabis edibles and beverage market will bring? Especially considering that user-education isn’t exactly a strong suit for either the private or public sector, and this new product carries with it some considerable health risks for those who aren’t sufficiently educated.

Unfortunately, we’ve been here before. It was called 2018.

But hey, let’s not worry about the future. Here’s what Zenabis is up to right now:

- With construction and licensing at Zenabis Atholville largely complete, Zenabis is now focusing on construction and licensing of Zenabis Langley. Zenabis Langley construction continues to be on track with prior guidance, with Zenabis’ total annual cultivation capacity expected to increase to 143,200 kg of dried cannabis on completion of licensing at Zenabis Langley.

- Cultivation output in July 2019 was 1,238 kg of dried cannabis, which represents a 46.2% outperformance relative to original design capacity (the Performance Ratio1) and a 12.9% outperformance relative to revised design capacity 2.

- Cultivation output of 1,238 kg of dried cannabis was 2.1% greater than Zenabis’ revised forecast output (as updated on August 6, 2019) of 1,212 kg of dried cannabis.

It all seems kind of like polishing brass on the Titanic knowing what’s coming, doesn’t it?

—Joseph Morton

Full Disclosure: Chemesis International is an equity.guru marketing client.