Global markets are in a state of flux. General indices – common stocks of all shapes n colors – are testing downside support levels. Gold is catching a very decent bid – no surprise there. Silver too. Crude oil is under pressure. Base metals like copper are also under pressure due to the threat of a global economic slowdown, the recent collapse in US-China trade talks and Trump’s latest tariff salvos directed all things Chinese.

Meanwhile, serially successful contrarians like Gianni Kovacevic, CopperBank Resources’ (CBK.CN) CEO, are taking a long hard look at the copper landscape and projects that may go on the auction block. He’s already assembled a portfolio, a land bank if you will, of world-class projects heavily leveraged to the copper price. The reason? Copper’s properties and supply/demand dynamics make it a stand-out among all other metals.

During a recent Cambridge House presentation, Kovacevic laid it all out, drafting the blueprint societies all around the globe will need to adhere to as the E-Mobility (electro mobility) supercycle kicks into a whole new gear.

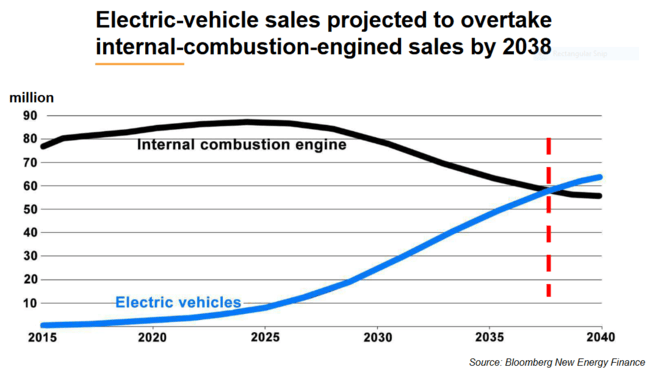

It’s difficult to imagine, but there will come a time when electric vehicles (EVs) overtake the internal combustion engine.

That date with destiny may not be that far off.

And EVs require a lot of copper (Cu):

- hybrid electric cars require 85 lbs of Cu.

- EVs require 183 lbs of Cu.

- electric buses will need between 500 and 800 lbs of Cu.

Even the charging-station infrastructure for EVs require significant quantities of the malleable metal.

As our species attempts to sustain the urbanization of our planet – there will be eight billion of us tripping over one another in only four more years – the demand for green metals, like copper, will go through the roof.

More examples of the role copper will play in a greener world:

- Flywheels (pumped hydro) will require .3 to 4 tonnes of Cu per megawatt (MW).

- Wind turbines will require 3.6 tonnes of Cu per MW.

- Solar panels will require 4 to 5 tonnes of Cu per MW.

According to the International Energy Agency, worldwide demand for air conditioning is expected to triple over the next 30 years. Sticking with that theme:

- 52 lbs of Cu go into each cool air unit.

- 8 billion cool air units are expected to be in use worldwide by 2050.

- China, India and Indonesia will account for roughly half of the global increase in electricity demand.

Global copper supply

This is where it gets dicey. And this is also where we need to focus our attention as the investment opportunity could be extraordinary:

The current supply deficit we’ll be facing in the not-too-distant future is shocking:

- The lions share of the worlds primary Cu supply comes from only 20 mines.

- The world has less than 20 years worth of (economic) copper reserves remaining.

- The 14 largest producers show an average reserve grade of .62% (large deposits running grades north of 1% are exceedingly rare).

- Future copper projects – the 19 largest development projects on deck – run grades averaging roughly 0.5%.

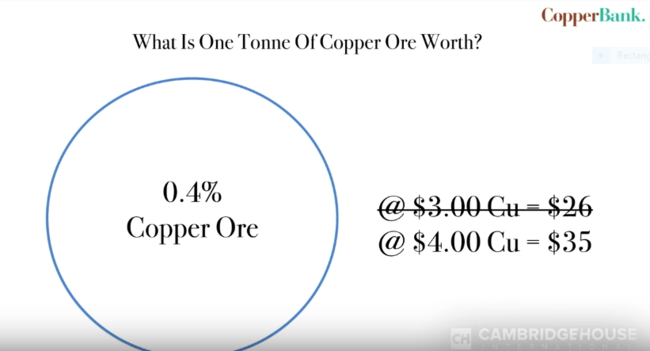

- Further down the foodchain, for the next group of large development projects, 0.4% will be the average.

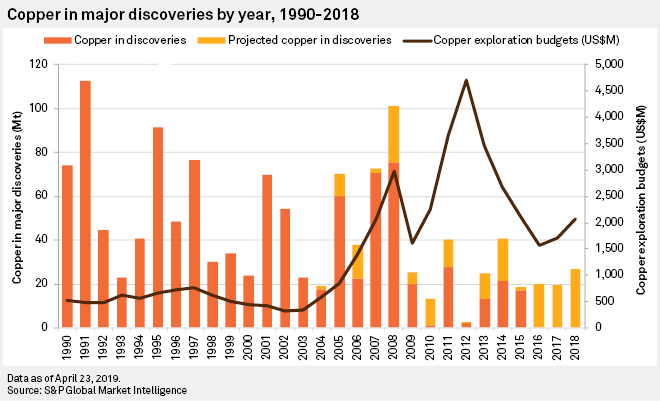

- A lot of money has been spent searching for the metal – very little in the way of large, economic ore bodies have been discovered.

Note that the current numbers reflected on the far right of the above chart are only ‘projected copper discoveries.’

Things are incredibly tight in the copper arena folks.

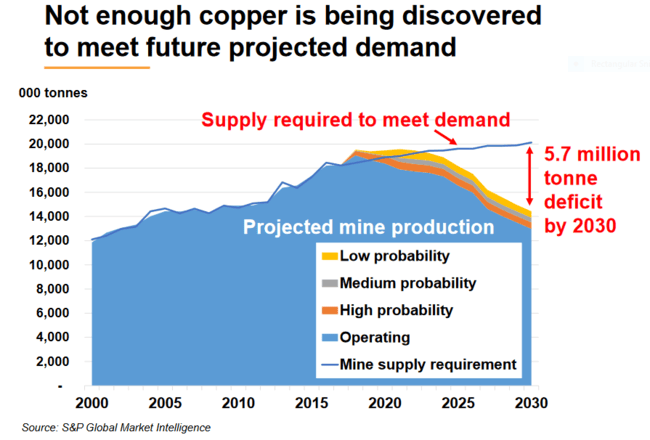

The following chart is a bit scary, and it begs the question, ‘why is copper not breaking out to new highs?’

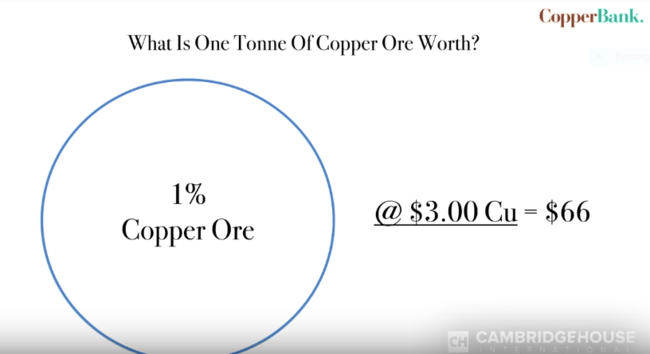

Grade is everything, whether it be gold, uranium or copper. A copper deposit with an average grade of 1% will work in today’s low price environment. But at $66.00 per tonne – depending on the scale and the volume of waste rock that needs to be removed to get down to the ore – it isn’t exactly a cash cow.

Future copper miners are unlikely to run anything near 1% through their mills. At current copper prices, the vast majority of these future sources of the metal are uneconomic.

It doesn’t take a math-major to grasp the concept that the copper price needs to move significantly higher in order to make these lower grade deposits work.

Something else to consider: over the next three years there are no new significant copper mines coming online. There’s nothing that will save the day should supply disruptions come into play. Major price shocks would be the consequence should anything threaten this flimsy supply balance.

This could be a very interesting time for copper bulls.

Kovacevic: “19% of energy today is electricity. In the next 30 years that number will climb to 50%.”

Kovacevic is your quintessential contrarian.

We’ve discussed the contrarian mindset in previous Guru offerings, and how critical it is to think like one. To paraphrase Rick Rule, one of the greatest resource investors of our age, ‘you are either a contrarian or you are going to be a victim.’

Kovacevic’s current strategy with CopperBank is fairly straight forward: acquire assets from pessimists, and when the world wakes up to the stark reality of just ill prepared we are to meet this surging demand… sell to the optimists at a fat premium to the acquisition price.

If you’re a contrarian at heart, that’s music to the ears.

The copper land bank

We covered CopperBank’s project portfolio in detail last summer in the following piece.

Since then, Kovacevic and crew made a significant new acquisition in Redhawk Resources.

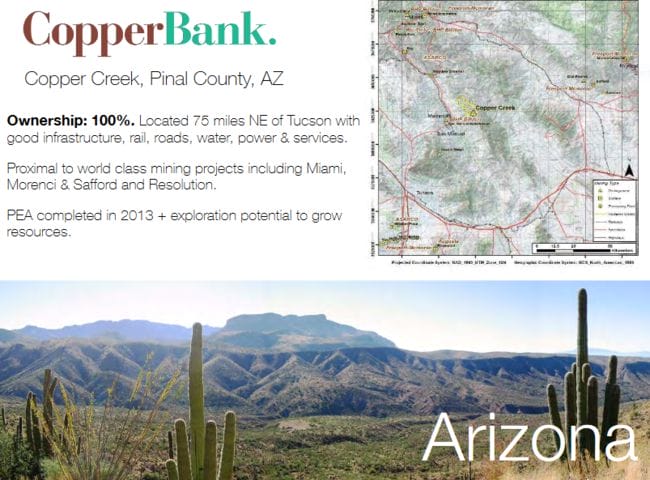

Redhawk’s Copper Creek Project was the prize, a large “Early Halo” porphyry Cu deposit located in a Tier 1 mining-friendly jurisdiction 75 miles northeast of Tucson, and just down the road from San Manuel. That would be Arizona y’all.

The project is proximal to significant mining projects in the region including Freeport-McMoRan’s Miami, Morenci and Safford projects, Rio Tinto’s Resolution project, Capstone’s Pinto Valley project, and Hudbay’s Rosemont project.

Copper Creek’s current resource area is roughly four kilometers in length and is open in all directions. Ongoing work programs have resulted in extensive geological, geochemical and geophysical databases.

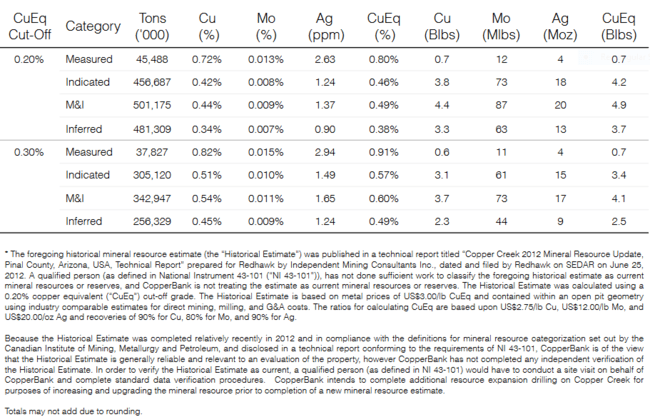

The resource at Copper Creek is extraordinary (keep in mind that the company classifies this resource as historic):

Significant copper resources: In addition to the estimated mineral resources on CopperBank’s current properties, the Copper Creek project hosts historic mineral resources, including estimated Measured & Indicated resources of approximately 4.4 billion pounds of copper (a total of 501.2 million tons at 0.44% copper, consisting of Measured resources of 45.5 million tons at 0.72% copper, and Indicated resources of 456.7 million tons at 0.42% copper) plus additional Inferred resources of approximately 3.3 billion pounds of copper (481.3 million tons at 0.34% copper).

Note the .72% Cu grade in the Measured category – not too shabby.

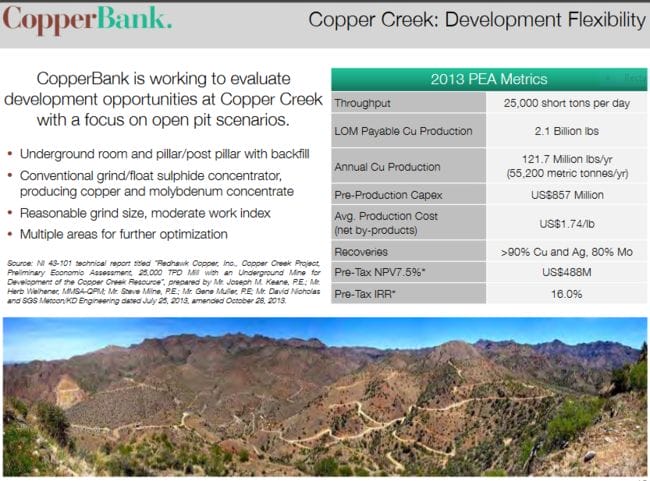

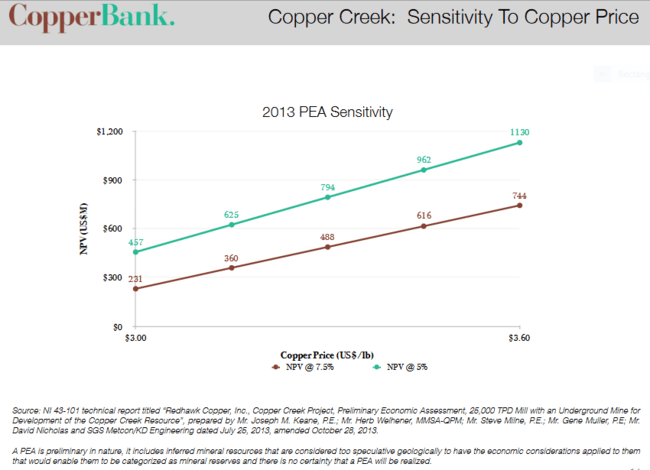

In 2013, the previous operator tabled a scoping study, a preliminary economic assessment (PEA):

Copper Creek’s leverage to higher copper prices is considerable. The following chart demonstrates the impact $3.60 copper will have on the projects economics (as we explored earlier, Cu will need to rise significantly beyond the $3.60 level if we are to bring new mines online).

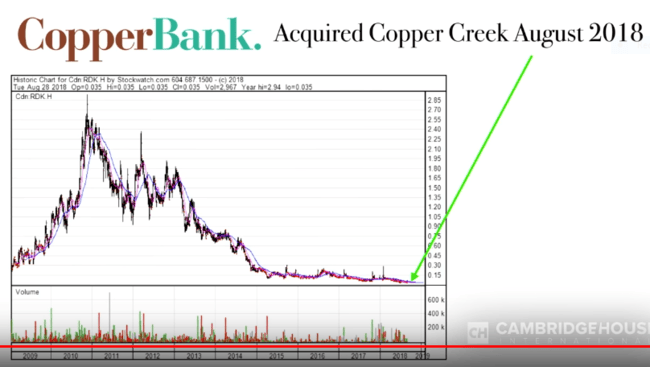

A few details regarding Redhawk are worth exploring:

- Redhawk’s previous market cap high was $120M.

- Total exploration dollars spent on the project = $85M

- Total meters of core drilled on the project = 220,000 meters

CopperBank’s price of admission? A pic is worth a thousand words.

Redhawk’s Copper Creek project was acquired for pennies on the dollar.

The other projects in the CopperBank’s Cu land bank portfolio also represent a significant growth pipeline of US-based assets. These include:

- The wholly-owned Contact Copper Project, a pre-feasibility stage copper oxide project located on private lands in Nevada.

- The wholly-owned resource-stage Pyramid Project located in Alaska (an updated resource estimate for the project was tabled in January 2018).

- The wholly-owned, highly prospective San Diego Bay Project, a high-priority copper-gold exploration asset in Alaska.

Importantly, all four assets in the company’s project portfolio possess significant untested exploration upside

Equally important: the CopperBank crew, on top of considerable capital market experience, have a proven track record of systematically advancing projects through various phases of permitting and development.

Final thoughts

This is a good exercise when performing due diligence on a company focused on a specific commodity:

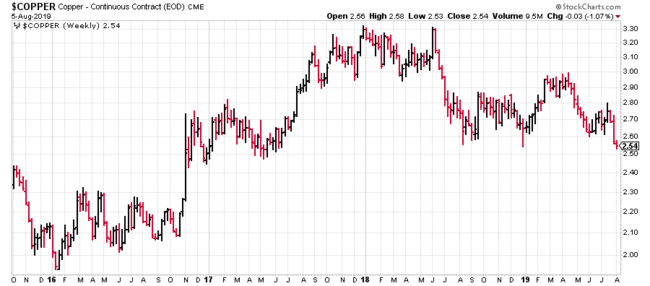

Note the correlation between the following three-year copper chart…

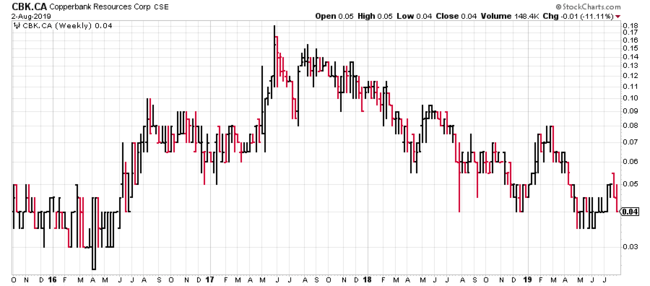

… and this three-year CopperBank chart:

When copper surged 40% between 2016 and 2017, Copperbank shares responded with as much as a 400% push higher, from its lows.

CopperBank is like a long term Call option on the price of copper (no expiry date y’all).

If you believe copper prices are headed dramatically higher – a scenario that is a lock in my mind – Copperbank shares could put on a really big show…

— Greg Nolan

Full disclosure: CopperBank is an Equity.Guru marketing client.