Khiron Life Sciences (KHRN.V) is using its industry connections to take on the multi-billion-dollar U.S. skincare market.

You see, skincare is just one of the many industry verticals being disrupted by cannabidiol, or CBD. Khiron will enter the U.S. market in early 2020 through a joint venture with Dixie Brands (DIXI.U), a leading purveyor of THC- and CBD-infused products.

On Tuesday, Khiron announced that the joint venture has received conditional approval by the TSX Venture Exchange (TSX-V). Basically, it’s all-systems-go at this point.

The joint venture converges on Kuida, a line of cosmeceutical products developed by Khiron and distributed through Latin America. The new agreement will allow Khiron to commercialize Kuida in the United States using Dixie’s vast distribution network. In exchange, Khiron will help Dixie introduce its line of CBD-infused products into Latin America.

Conquering the Americas

Our first impression of the joint venture is that it is a win-win for both parties. Khiron gets to sell one of its leading products in one of the world’s largest skincare markets. Dixie gets a new product line that fits perfectly with its growing CBD distribution network.

Both companies have been in cahoots for several months to get this initiative underway. Kuida was launched in Colombia back in October and remains the only CBD skincare product widely available in the country.

Alvaro Torres, Khiron’s CEO and director, said the partnership is an important step in making Kuida a globally recognized brand.

“Bringing the full Kuida product line to U.S. consumers is an important development as we build capacity and market access to expand Kuida brand distribution into new jurisdictions globally.” – Alvaro Torres

Chuck Smith, president and CEO of Dixie Brands, says his company’s distribution network is on track to reach “several thousand brick-and-mortar locations in the U.S. by the end of the year in addition to a robust online presence.” Kuida will no doubt benefit from this massive presence.

Although the TSX-V approval is “conditional,” it’ll just take some paperwork to finalize the deal. Both companies are already pushing ahead to get Kuida in the U.S. skincare market. It’ll only be a matter of time before Dixie gets to manufacture and sell its products in Latin America thanks to Khiron’s grassroots in the region.

Targeting the U.S. skincare market

It’s no secret that Khiron has been expanding its cannabis network across Latin America, and has done a damn good job at it. (Oh, look, Khiron is still the only Colombian company with revenue from legal cannabis.) But it also knows there’s real money to be made in the U.S. as more states vote to end prohibition.

The U.S. skincare market is said to be worth USD$20 billion – at least, that’s the number Khiron quotes in its press release using a study from Euromonitor. We couldn’t find the source.

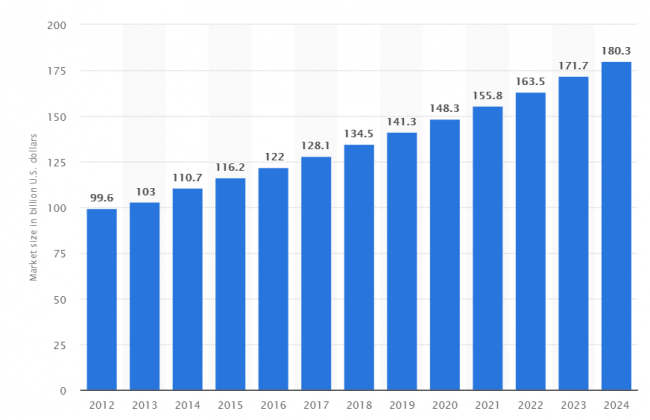

We found plenty of international data, though. The global skincare market is valued at $141.3 billion in 2019 and is expected to grow 27% over the next five years, according to Statista. As the world’s largest consumer economy, the United States probably eats up a big piece of that pie.

We already know that cannabis derivatives are leaving a big dent in the global wellness economy, of which skincare is a major constituent. I’ve written ad nauseum about how big this economy is today and how much it will grow in the future. With the cannabis industry vertical set to grow even faster, CBD will invade personal care products, health and nutrition and even the spa economy.

Khiron stock rises

Shares of Khiron Life Sciences opened sharply higher Tuesday, peaking at CAD$2.02 on the TSX Venture Exchange. The stock was last seen trading at $1.99, having gained 2.5%.

At current values, Khiron has a total market capitalization of $218 million.

In a rare accomplishment, KHRN.V is up sharply this year. The stock has returned 26% in 2019. At its highest point, KHRN.V was up a whopping 160%. Some of that has to do with a $25 million capital raise earlier this year.

Khiron is clearly looking beyond Latin America in its expansion efforts. Its joint venture with Dixie could go a long way in getting its products through the U.S. value chain. Keep an eye on this one.

–Sam Bourgi

Full disclosure: Khiron Life Sciences is an equity.guru marketing client.