So you want to be an ethical investor, but soulless multinationals like Exxon Mobil and Walmart have you put off from the capital markets. If this is you, know you’re not alone.

But, dear investor, herein lies a problem: large successful companies, the safest stocks to invest in, are the most, for lack of a better term, problematic.

Amazon, for example, was the subject of numerous exposes which revealed their warehouse workers were required to skip bathroom breaks or urinate in water bottles as a means of meeting production quotas.

So what to do? If most blue chips are off the table, that leaves the small caps and those come with their own risks. Such is the life of an ethical investor.

Besides checking a company’s share count, management team and balance sheet before investing, its track record and ethics also have to factor into the decision making.

Environmental, social and governance (ESG) is a metric designed to make the appraisal of a public company’s ethics a quantifiable metric for investors. Although Facebook stock has had a great 2019, the company’s ESG score was impacted over user-data breaches, for example.

ESG is used to measure a company’s corporate social responsibility (CSR) guidelines. Essentially, ESG measures a company’s commitment to CSR.

Take Aphria (APHA.C) for example. On July 8, 2019, the company announced an addition to its CSR framework with the launch of its new social impact platform, Plant Positivity.

Plant Positivity is partnering with Canadian not-for-profit, Evergreen, to create six garden spaces at the Evergreen Brick Works in Toronto, a reclaimed industrial factory which now showcases green designs for urban landscapes.

The strategy here is textbook script flipping: a company left in tatters after accusations of mismanagement and the departure of its CEO, in an effort to regain control of the commanding narrative, embarks on a charitable undertaking involving the public relations trifecta of trees, puppies or children.

Transparent as Aphria’s announcement may be, there’s nothing like a little goodwill to improve sentiment, and the data supports the benefit of these kinds of expenditures.

The appeal

Social Impact Capital, a VC firm specializing in ethical investing, compiled data on ethical investing and who it appeals to. Unsurprisingly, two standout demographics are millennials and women.

- Women care greatly about impact investing. 76% of women say they want to invest in organizations promoting social well-being. 90% of inheriting women will become solely responsible for their wealth. Over 70% of women fire their financial advisors within one year of financial control.

- Millennials care greatly about impact investing. 93% of millennials believe that a company’s social and environmental impact is key to their investing decisions; this number is up from 74% only two years ago. 67% of millennials agree that “My investment decisions are a way to express my social, political, or environmental values.” 61% of millennials feel lower returns on an investment in exchange for having a positive impact on society or the environment are acceptable. 71% would turn down the opportunity to make a significant sum of money if it required investing in a company with a negative impact on society or the environment. U.S. Trust, Insights on Wealth and Worth, 2016; 2014.

It makes sense the inheritors of the Earth would invest their money differently than their parents. After all, it will be them who suffer the effects of climate change.

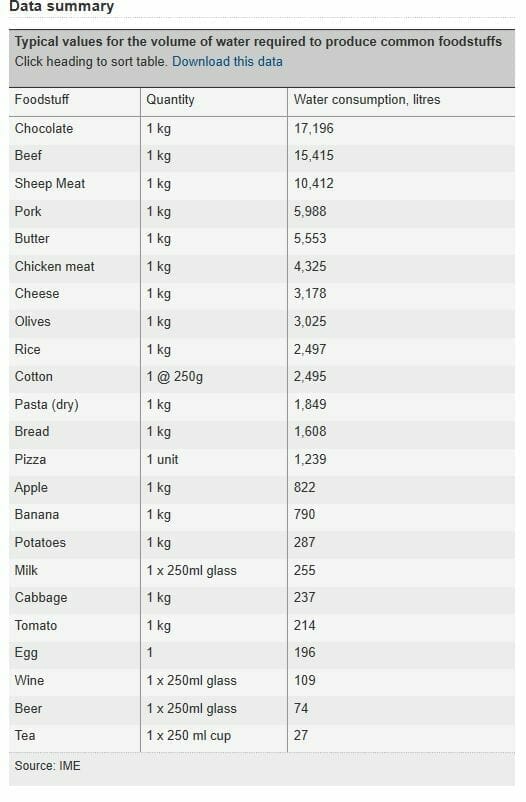

This rationale may explain the astounding performance of Beyond Meat (BYND.Q). Methane from livestock is a huge contributor to global warming, and the amount of water it takes to produce one kilogram of meat versus one kilogram of wheat can be as much as tenfold.

Instead of investing in an oil and gas company, an ethical investor can park their money in sources of green energy. In truth, however grim this outlook seems, this may be the most effective way in curtailing the harmful behaviours of powerful corporate entities.

In 2015, Kraft Foods (KRFT.Q) was confronted by shareholders over claims its supply chain resulted in deforestation and community exploitation. Over 30% of shareholders supported the shareholder proposal to Kraft for the adoption of policies to limit the company’s ecological footprint.

The company ended up opposing that motion, but the effort was far from wasted. Kraf now understands a significant portion of its shareholder base cares about environmental sustainability.

In an era when there seems to be no real political appetite to oppose harmful market forces, maybe it’s up to us–shareholders, activists and everything in between–to both support and reign companies in.

As for me, I’ll be grilling up a couple Beyond Meat burgers for dinner tonight. Sustainability never tasted so good.

–Ethan Reyes