Facebook’s (FB.Q) recently announced cryptocurrency, Libra, is the biggest thing in the cryptosphere right now.

One of the strengths of cryptocurrency include its ability to skip undetected over international borders without being effected by government intervention. The benefits to the global remittances market are obvious, as data from the World Bank states that over $148 billion was sent abroad from the U.S. in 2017.

Still, Bitcoin, Ripple and other coins that promised large scale remittance market access haven’t lived up to their potential and there’s room for the right company to break that space wide open.

It would allow for cross-border remittance payments using Whatsapp, Messenger and other extremely familiar Facebook properties. It’s like PayPal (PYPL.Q), but with more security against scammers.

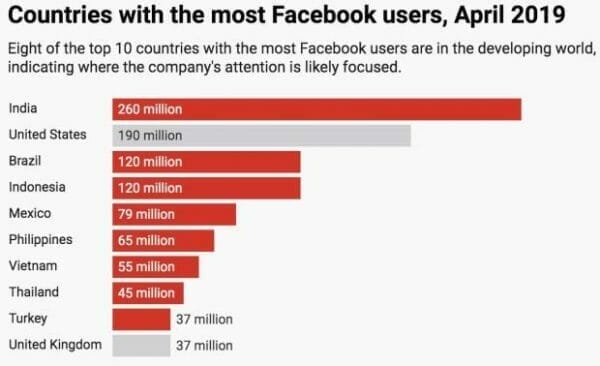

The above chart shows Facebook’s reach, and if we contrast that with the India remittance market alone, which brought in $79 billion in 2018, we can get an idea of the potential for this coin just in India alone.

“The Libra team has set its sights on achieving financial inclusion for the 2 billion adults worldwide who don’t have bank accounts. It’s a noble goal, and they are going about in an intelligent way – from a truly international, cross-border, cross-currency perspective. Bring all those people into the international economy and the payoffs could be huge, for them and for the rest of us,” wrote Michael Casey, chairman of CoinDesk’s advisory board.

We wrote about it in May when it was called Globalcoin, but now that we have new information it seems pertinent that we revisit the coin, and maybe this time auger down a bit more into the specifics of what Libra means for you, the investor, and the global system.

In summary, Libra has potential for massive disruptive change, but it will need to clear some roadblocks first.

The problem with centralized cryptocurrency

World governments aren’t quite sure what to do with cryptocurrency, and even if they did, they have no idea yet how to go about doing it.

The general consensus is a decentralized network is free from attack.

It’s the guerrilla war concept—you can’t fight an enemy you can’t see—and it’s somewhat clear cryptocurrency’s original raison d’être was as a monetary hedge against the entrenched power of global greedheads.

Libra comes onto the scene with a target on its back.

Centralization means that Libra can be reached, controlled and brought down. Circumstances could also play out that Libra could be better regarded than decentralized currencies, and stand a much better chance of developing a mainstream following. The first hurdle towards that end is gaining acceptance from world governments.

Many have made it abundantly clear that Facebook is going to have a lot of questions to answer on the road to full adoption.

Here are a few:

- How does Facebook plan on complying with every country’s rules for governing financial transactions?

- What security protocols are going to be in place regarding the protection of these transactions?

- What identification methods are going to be employed to ensure that Libra doesn’t become another medium of exchange used by terrorists, and other rogue actors?

- How much will Mark Zuckerberg be involved in the project going forward?

Crypto-politics

Regulators the world over have warned that Facebook’s entry into the cryptocurrency world could spell tighter controls and tougher regulations to protect consumers.

Mark Carney, the governor of the Bank of England, said that his central bank would support new entrants into the U.K. financial system, but only if Facebook could meet the highest regulatory standards.

“Last year one fifth of all sales in the UK were online. Next year it will be one quarter. Over the past decade the proportion of total payments made in cash has declined from two thirds to one quarter,” Carney said.

Meanwhile, across the channel, France’s finance minister Bruno Le Maire said he doesn’t have a problem with Facebook building a payment and remittance system, but scoffs at the idea of Libra becoming a “sovereign currency.”

For right now, Libra is being presented as an online currency, but Facebook’s VP of blockchain product development said there was potential for it to develop into more sophisticated financial instruments like credit.

Earlier this week, the Democrats requested for Facebook to put its plans on pause while regulators looked into the new cryptocurrency.

“With the announcement that it plans to create a cryptocurrency, Facebook is continuing its unchecked expansion and extending its reach into the lives of its users. Given the company’s troubled past, I am requesting that Facebook agree to a moratorium on any movement forward on developing a cryptocurrency until Congress and regulators have the opportunity to examine these issues and take action,” said Maxine Waters, democratic congresswoman and House Financial Services Committee Chairwoman.

The Swiss aren’t staying neutral on cryptocurrencies, either. The bank for international settlements stated that big tech firms using digital currencies could potentially risk the stability of the banking system.

Chris Hughes, a Facebook co-founder, agreed.

“If even modestly successful, Libra would hand over much of the control of monetary policy from central banks to these private companies. If global regulators don’t act now, it could very soon be too late.”

As improbable as that dystopian vision seems to the rest of us, it should give hardline Bitcoin aficionados a boost. That’s close to what they’ve always wanted.

But improbable speculations about a dismal future with every facet of economic life dominated by overwhelming corporate power are still the province of science fiction and not our reality. Yet.

So let’s return to the present.

What Libra has and could be

The Libra blockchain software is open source and anyone can build on it. Billions of people could someday use it for their financial needs. Also, it can be peeled apart like an onion to discover its internal workings, and therefore manipulated to meet ends that may not be in the best interests of the shareholders, company or investors.

From the white paper:

“This ecosystem will offer a new global currency—the Libra coin—which will be fully backed with a basket of bank deposits and treasuries from high-quality central banks. Over time, membership eligibility will shift to become completely open and based only on the member’s holdings of Libra ”

Libra will be a stablecoin. We knew that. What’s interesting here is that it sounds like Libra might use proof of stake.

Proof of stake is an alternative to the proof of work style mining commonly used by Bitcoin.

Instead of the wall-to-wall of supercomputers all concentrating on the fancy math needed to solve the equation that will close the block, and get the cryptocurrency reward, the concept states that a person can validate block transactions based on how many coins they already hold.

It rewards the rich with the ability to close blocks and earn more coins as a reward.

But there’s a huge problem with that.

Ever heard of the Pareto distribution? How about the Matthew principle?

They’re both different terms for the same core idea.

The Matthew effect comes from biblical phase, “For to him who has will more be given, and he will have abundance; but from him who has not, even what he has will be taken away,” and the Pareto distribution shows a mathematical relationship between success and more success, and failure and more failure.

Decentralized networks using proof of stake will eventually fall prey to centralization, because eventually only those with the greatest amount of coins will be able to derive more from the process.

Except by the time that comes around only institutional investors will own Libra, because if it manages to survive the next few years of regulators combing through the fine print, then it will be the first to be packaged up and sold off in ETFs.

There’s still one salient point to be made about any new blockchain.

A blockchain is only as reliable and as private as the code, and that code is only as reliable as the programmer who wrote it, who will undoubtedly inject their own political biases onto the project. If the code is written by people beholden, either ideologically or by monetary gain, to an untrustworthy company like Facebook, then how can you possibly expect to sleep well at night owning their coin?

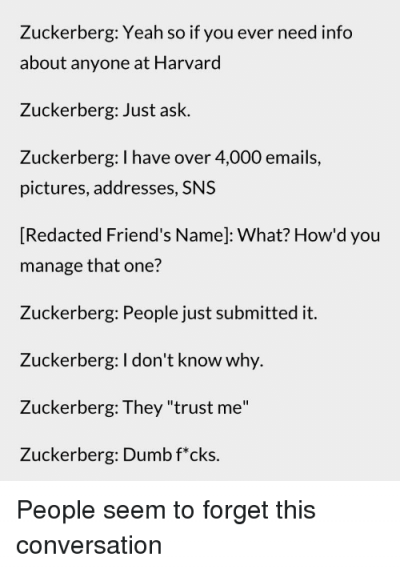

Remember this from the original article?

We need to remember at all times this is who we’re dealing with.

But Libra could be different.

Libra could be better.

The first step is for Calibra, Facebook’s mostly independent subsidiary in charge of the network, to get as far away from Mark Zuckerberg as possible.

The good news is that Facebook won’t have complete control over Libra, but instead be relegated to a single vote in its governance—the same as other founding members of the Libra Foundation.

The above image represents companies that have injected $10M into the project.

That’s a good start.

Another positive note is that Calibra has paid lip-service to the idea of eventually becoming a permissionless coin, which would mean that they can sever themselves from Facebook.

The model being used is quite different from that of Bitcoin.

Bitcoin’s exchange rate is driven by supply and demand, but the Libra Council would be competing in global currency markets against the currency of other nation states.

What it means for Bitcoin and altcoins

Here’s what we wrote about the effect on Bitcoin in the original article:

Facebook builds out a coin, and gets 20% adoption across its 2.7 billion subscribers. That’s 540 million people. Now if 10% of those people stumble onto Bitcoin during the early zealot phase of adopting a new technology, that spells out a potentially lucrative bounce for Bitcoin and all of its attendant altcoins.

That still stands, but it requires other qualifiers.

Libra stands as the biggest corporate endorsement of cryptocurrencies. If it does well it will have the spillover effect onto Bitcoin and attendant altcoins. But if it doesn’t do well, or worse, it fails abysmally, then the public could turn away from cryptocurrencies.

And if the world’s governments squash Libra like a leftover pumpkin on November 1, that will tell us all we need to know.

Either way, Libra’s future is going to have both interesting and unforeseen effects on the future of cryptocurrency.

At the very least, it’ll be entertaining to watch.

—Joseph Morton