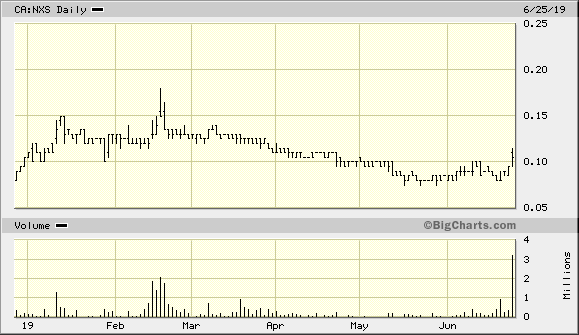

Nexus Gold (NXS.V) dropped news yesterday that turned a few heads. Judging by the volume, I suspect the market is waking up to the company’s latent discovery potential.

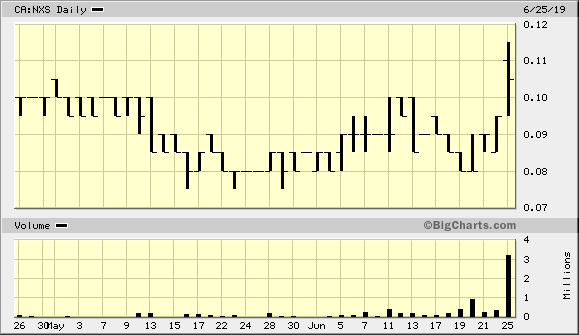

Yesterday’s 10% price gain was accompanied by the largest volume we’ve seen in the past six months.

A close-up of the action (volume is measured at the bottom)…

What does this price/volume spike mean?

Fair question. To a trader that tracks momentum, it means everything. It suggests that the stock is gaining favor and is under accumulation. A series of higher highs and higher lows over the next few weeks will confirm this hypothesis.

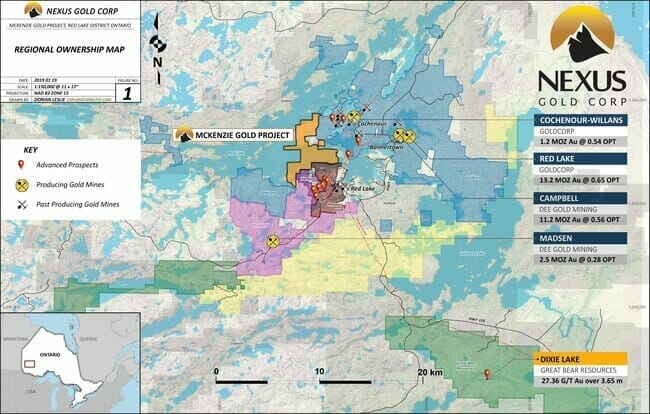

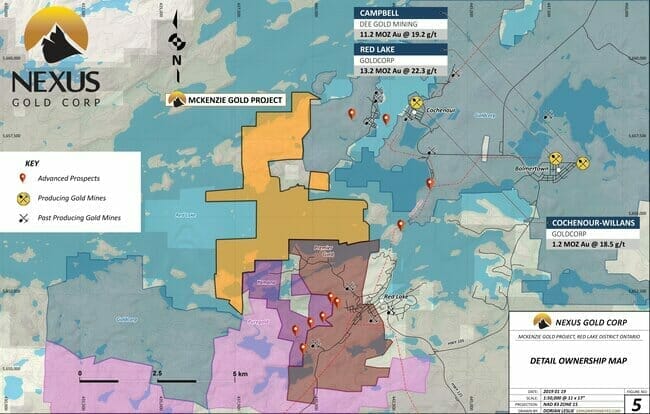

This frenzied trading activity was prompted by news out of the company’s McKenzie Gold Project, located in the prolific Red Lake Mining Camp of northwestern Ontario.

Red Lake, in case you are new to the gold mining arena, is known as “the high-grade gold capital of the world.” It’s where Goldcorp (now Newmont Goldcorp (NGT.TO)), once a lowly cash-starved ExplorerCo, gained prominence as a high-grade producer.

Positioned in the heart of the Red Lake Camp, the McKenzie Gold Project is surrounded by the likes of Newmont Goldcorp, Yamana (YRI.T), Pure Gold (PGM.V) and Premier Gold (PG.T).

The project has seen only limited exploration over the years.

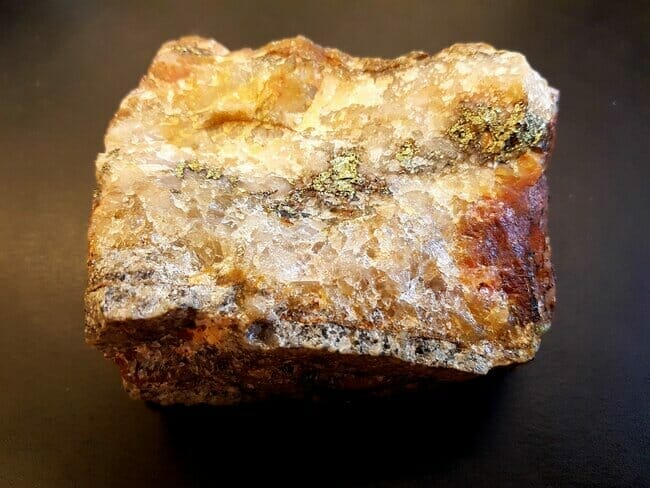

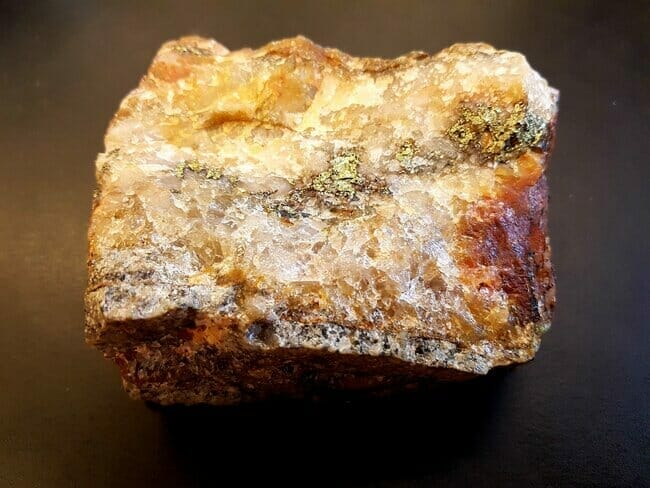

Previous drilling by Cypress Development (CYP.V) along the southern edge of the property encountered quartz veining accompanied by sphalerite, arsenopyrite, chalcopyrite, and free gold. The best hit from this limited drilling campaign cut 6.0 meters of 2.2 g/t Au.

Cypress’ 2005 drill hit occurred within an east-west-trending 600-meter long mineralized zone (the zone is open along strike and at depth).

During a 2017 ground reconnaissance campaign on McKenzie Island, grab samples returned values of up to 313 g/t Au.

On the southwest corner of the island, a more recent showing – a 12 cm wide, low-angle quartz vein exposed over a length of 2.0 meters – was discovered along the shoreline. High-grade samples from this vein ranged from 9.37 g/t Au to 331 g/t Au.

This 2017 discovery lies approximately 100 meters west of a historical showing that assayed up to 212.8 g/t Au.

Although this vein is narrow and the strike length is unknown, it demonstrates the untapped potential of the McKenzie project (Red Lake is known for its narrow high-grade veins).

The volume popping news

In the gold mining arena, particularly where the exploration companies (ExplorerCos) are concerned, market participants always have an appetite for high-grade gold discoveries. Discoveries of this nature are becoming increasingly rare.

Generally speaking, when it comes to early stage prospecting and surface sampling, showings of 0.5 to 1.0 g/t Au are good, and may be indicative of a significant ore body lurking nearby in the subsurface rock, but the market is looking for higher-grade values, say 5.0 g/t Au or better.

Keep in mind that when a company launches a surface sampling campaign, the techs in the field will almost always select the most promising (shiny) rock sample for lab analysis. These (grab) samples are biased. Having said that, the presence of surface gold in excess of 5 g/t is an indication that the company may be onto something.

These are early innings at McKenzie.

Today’s news shed light on assay results the company received from an initial ground reconnaissance program where a total of seven samples were collected covering areas on McKenzie Island and in the St. Paul Bay area of the property.

Significant results were obtained from localities on McKenzie Island with samples returning 135.4 grams-per-tonne (“g/t”) gold (“Au”) and 9.3 g/t Au, respectively. The 135.4 g/t Au value was obtained from a select sample on a quartz vein hosted in igneous rocks of the dome stock, while the 9.3 g/t Au value was obtained in a select sample of a quartz vein hosted in felsic meta-volcanic rocks on the northern portion of the property.

The company regards McKenzie as a flagship project.

Nexus is supplementing this detailed prospecting and reconnaissance program logically, with good science, incorporating ground geochemical and geophysical surveys over the entire property to home in on geologic trends and structures suitable for drill testing.

This phase one field work (including detailed mapping and sampling) falls under the direct supervision of Nexus’ senior geologist and vice president of exploration, Warren Robb. Work will continue throughout the summer months.

“We are extremely encouraged with what our prospecting has identified thus far. We look forward to hitting the ground a little harder over the summer months to identify new and delineate known mineralization,” Robb said.

One piece of advice for this field crew, from a battle-scarred bush warrior who has lived through and seen it all: prepare well for the thick ‘n hungry bloodthirsty swarms (stock up on bug dope).

The company has work to do, but it’s off to a great start.

“McKenzie represents a high-grade opportunity for Nexus in a prolific, world-class district. To date the project has now produced several bonanza-grade samples. We have just begun our work there so to add more of this type of result at the outset is certainly encouraging. McKenzie is a flagship property for us, one that we believe has considerable upside. We’re going to obtain as much data as we can in the next few months to best define our drill targets moving forward. With a handful of high-grade results having now been documented and obtained, McKenzie is trending in a very positive direction. We’re looking forward to the development work ahead,” Alex Klenman, Nexus president & CEO, said.

While we’re on the subject of CEO Klenman, this June 21 Equity.Guru podcast hosted by our very own Lukas Kane, digs deep into Nexus’ world:

Final thoughts

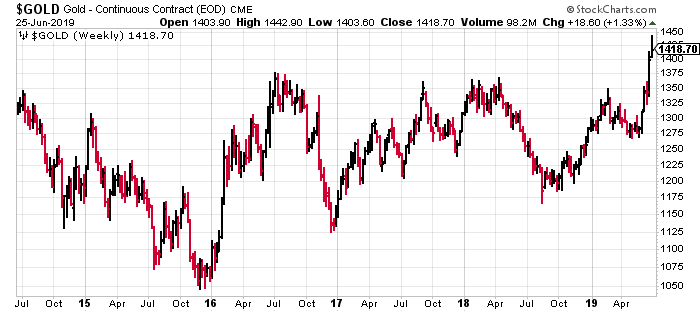

The recent trading action in gold, retracements notwithstanding, suggest we may be on the verge of a powerful and sustained move to the upside.

Recent price action represents a breakout to multi-year highs.

We’ve summarized the reasons why gold is so damn compelling, now, at this juncture:

Read: The overriding fundamentals underpinning the next upswing in gold

Though the short term could usher in a significant price correction, the medium to long term is looking, well…

Nexus Gold, with barely a tiny $6.5M market cap based on its 69.38 million shares outstanding and $0.095 share price, looks like outstanding value from where I sit. Keep in mind, ExploerCos like Nexus are best bought on weakness and held for the long term.

– Greg Nolan.

Full disclosure: Nexus Gold is an Equity.Guru marketing client.