On June 19, 2019, the Federal Open Market Committee (FOMC) concluded a meeting leaving U.S. interest rates unchanged, but signaled their intent to lower rates in the coming months should U.S. economic growth grind to a halt.

The FOMC’s message was decidedly dovish. And the market hangs on every damn word.

In their parting statement, the FOMC said they expect U.S. economic expansion to continue but “uncertainties about this outlook have increased.”

“Uncertainty” was the trigger word for the market action that followed.

This first chart shows the market’s reaction in the U.S. 10-year Treasury Note auction arena, where yields tagged the 2% level for the first time in three years.

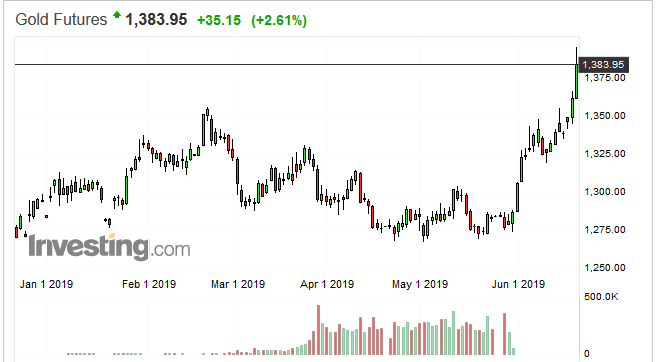

Looser monetary policy – the possibilty of the lower interest rates – lit up the gold arena, pushing the precious metal to a multi-year high (chart below).

Perhaps it really is different this time. We’ve suggested as much in a recent Guru offering.

Read: The overriding fundamentals underpinning the next upswing in gold

We may have reached a stage in the cycle when flashing the word ‘gold’ in your company headline doesn’t mean an automatic death sentence for your stock.

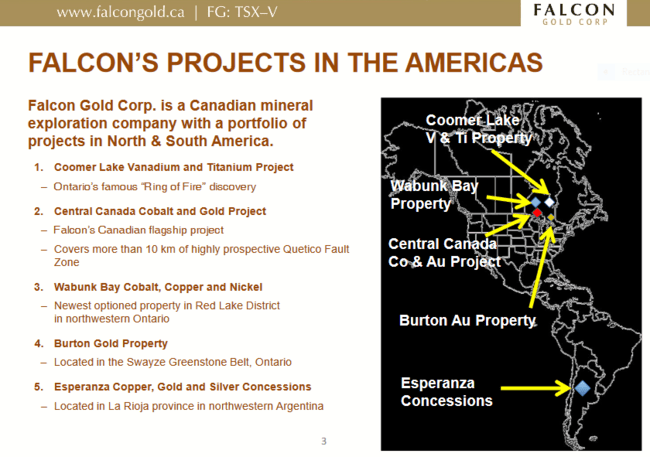

Falcon Gold (FG.V) has a number of gold, base and battery metals projects in its portfolio.

Homing in on the company’s gold potential, starting in South America and working our way north, the Esperanza project (ERSA) in La Rioja Province, northwestern Argentina, made headlines earlier this year:

A 2018 surface sampling and mapping campaign on three of the projects seven concessions yielded a number of impressive gold and base metal values.

Highlights from the ERSA program include:

- Three gold mineralized structures sampled and mapped

- Strike length exceeding three kilometers in a new gold structure

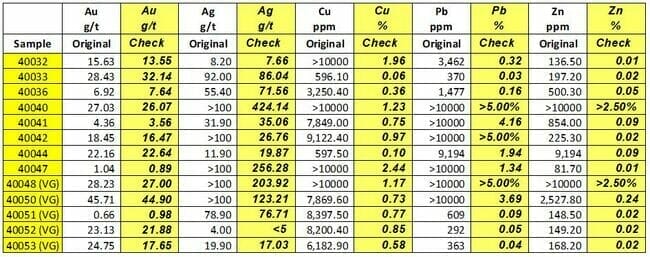

- Twenty-four samples sent for multi-element analyses and assay of which

21 samples returned greater than 50 ppb gold - 9 high grade samples showing gold grades that ranged from 15.63 to 45.71 grams per tonne gold (“g/t Au”)

- Gold is accompanied by significant silver (“Ag”), copper (“Cu”), lead (“Pb”), and zinc (“Zn”)

Thirteen samples from this program were selected for the checks where the original results included very high-grade gold analyses and in samples with visible gold. In addition, certain of the silver, copper, lead or zinc results were beyond the detection limits of the initial analytical method and required further definition.

“The very high grades of gold, silver and copper found within Esperanza project have not only been confirmed but we are pleased the results are so well reproducible. The outstanding grades achieved for the base and precious metals are noteworthy. Our 2019 field programs will be adjusted and expanded to search for other like high grade zones within the laterally extensive host structures.” said Stephen Wilkinson, Falcon’s CEO.

The recommendations for a 2019 exploration campaign include:

- Continuing the examination of recognized historical structures with the intention of following strike with mechanized trenching and further sampling

- Prospecting of the newly identified lineaments to define lengths and grades of mineralized zones

- Defining priority drill targets.

The Burton Gold property, located in the Swayze Greenstone Belt of northeastern Ontario.

The project is located roughly 38 kilometers northwest of IAMGOLD Corp’s (IMG.T) Cote Lake Deposit (35 million tonnes averaging 0.82 g/t for 930,000 ounces in the indicated category + 204 million tonnes averaging 0.91 g/t for 5.94 million ounces in the inferred category).

The property is also located roughly 10 kilometers northwest of the past producing Jerome Gold Mine which produced 56,878 ounces gold between 1941 and 1943 from 303,966 tonnes of ore grading 6.72 g/t.

Historical diamond drill intercepts at the project include 9.34 g/t over 7.75 meters at the Shaft Zone and 12.47 g/t over 3.13 meters at the East Zone.

Diamond drilling completed by Falcon Gold back in 2011 tagged 3.74 g/t Au over 9.96 meters (including 10.98 g/t Au over 2.17 meters) and 3.25 g/t Au over 10.35 meters (including 5.65 g/t Au over 2.85 meters) at the Shaft Zone.

IAMGOLD holds a 51% interest in the project.

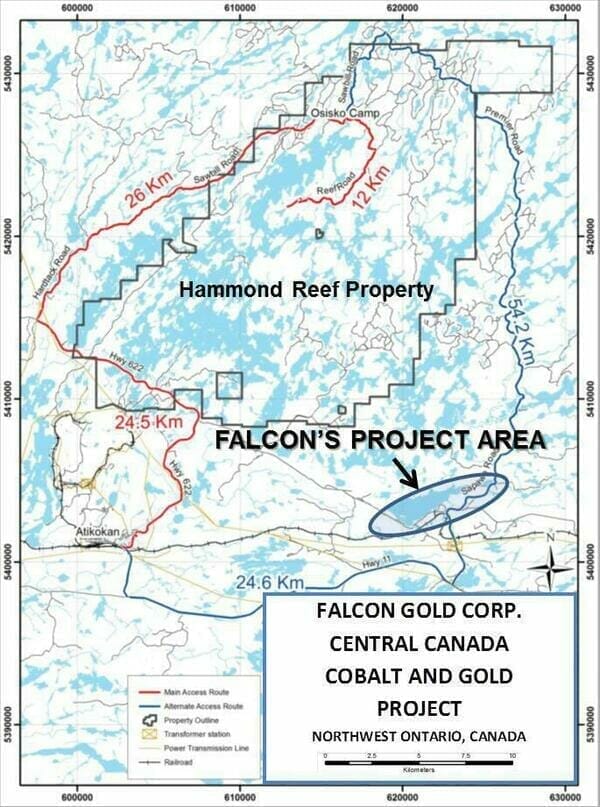

The company’s Central Canada Cobalt & Gold Project is located in the vicinity of Agnico Eagle’s (AEM.T) Hammond Reef gold deposit, an open pittable measured and indicated resource containing 4.5 million ounces of gold (208 million tonnes of material grading 0.67 g/t Au).

The project is comprised of two recent acquisitions:

The English Claims Option

- Six claims with 55 claim units

- Includes the historic Staines Cobalt Occurrence

Central Canada Gold Mine Property

- Seven claims with 25 units

- Covers historic producer with shaft and mill site

- Is contiguous with above English Claims Option

Historical drilling on English Claims Option, at the ‘Staines Occurrence’, tagged 0.64% copper, 0.15% cobalt, 1.1% zinc and 0.35 g/t gold over a true width of 40 meters. That’s a solid hit.

Historical drilling at the Central Cda Gold Mine Property tagged 37.0 g/t Au over 0.61 meters, 44.0 g/t Au over 2.13 meters, and 30.0 g/t Au over 1.16 meters.

The Wabunk Bay Cobalt Property occurs within the same same greenstone belt as the Red Lake Mining Camp.

The project is located immediately east of the past producing Uchi gold mine (114,467 ounces of gold and 14,345 ounces of silver)

Key attributes:

- Favorable host rocks have been traced for a strike length of roughly 900 meters

- Main cobalt showings on the property are composed of massive and disseminated sulphides in zones measuring approximately 200 meters by 7 meters

- Surface trench samples ran 0.33% cobalt over 1.5 meters and 0.15% cobalt over 7.6 meters with a separate historic 7-meter chip sample returning 1.08% copper and 0.40% nickel

- Historic drill results assayed 0.62% copper with cobalt values up to 0.33%

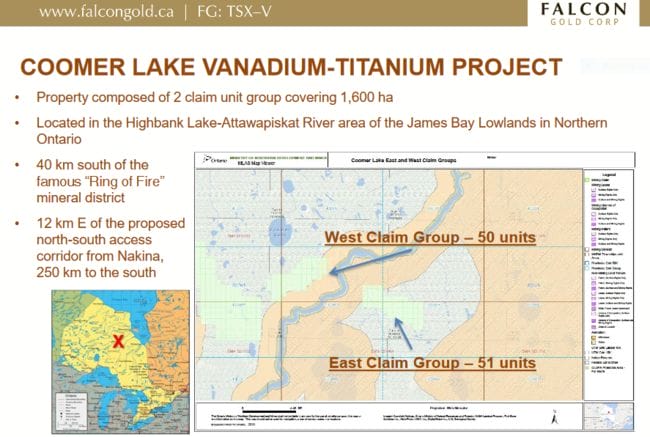

Over the past 10 months the company has been busy assembling a significant land package around its Coomer Lake Vanadium-Titanium Project in Northern Ontario.

We’re big fans of vanadium over here at Equity.Guru Some of the metals more compelling properties are highlighted in a recent guru offering on the subject.

The Sept. 5, 2018 Coomer Lake Vanadium-Titanium Project acquisition was followed by an aggressive staking campaign.

The project now boasts:

- 1,616 hectares of prospective terra firma

- Two subparallel geophysical anomalies indicating a strike length of at least 5 kilometres of favorable stratigraphy

- A historical diamond drill hole that tagged 4.9 meters of 0.75% vanadium (V2O5) and 7.56% titanium (TiO2)

Final thoughts

Falcon Gold is currently trading at an extremely modest market cap of $950K based on its 38.02 million shares outstanding and $0.025 share price.

All of the company’s projects are at an early stage of exploration. In order to move these projects forward the company recently announced an amended private placement (PP) financing.

Of the $500K they plan to raise, $282,425 is slated for “surface exploration and diamond drilling at their Ontario gold and copper properties.”

With a sub-one-million dollar valuation, success with the drill bit could have a profound impact on the company’s share price.

The closing of the PP and details regarding this summers exploration plans are the two news items I’ll be watching for in the coming weeks.

END

~ ~ Dirk Diggler

Full disclosure: Falcon Gold is not currently an Equity.Guru marketing client.