Cypress Development (CYP.V) continues to de-risk its Clayton Valley Lithium project, setting sights on tabling a detailed, authoritative and high-quality economic study later this summer.

For those new to the battery metals space, lithium is all the rage in the revolution that is the E-Mobility (Electro Mobility) supercycle.

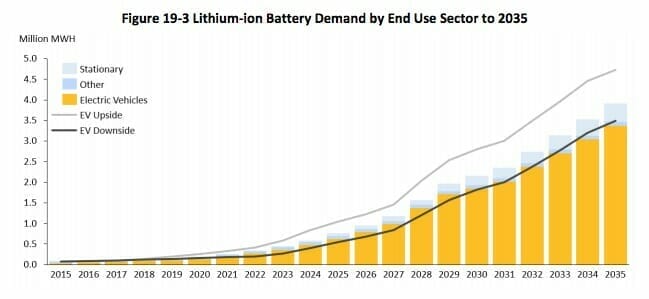

But there could be challenges matching supply with this burgeoning demand (note the steep slope on the above graph as we enter the next two decades).

U.S. lithium expert Joe Lowry expressed this very concern when he addressed delegates at a mining conference in Perth recently:

“Overall, the industry faces a lack of financing and needs to inject more than US$12 billion within five years to have a chance of meeting demand. This requirement is exacerbated further by known and emerging failures in lithium start-ups which have demonstrated a lack of necessary skillsets – high profile failures that have discouraged sector investment.”

You get the idea. There’s the potential for a serious crunch in the not-too-distant future.

A supply crunch, I mean.

The company, the resource, the economic studies

Cypress is strategically positioned to help meet this future demand.

The company boasts a world-class lithium-bearing claystone resource in mining friendly Nevada, a resource strategically located next to Albemarle’s Silver Peak mine, North America’s only lithium brine operation.

Thus far, Clayton Valley’s resource consists of:

- 3.835 million tonnes of LCE contained in 831 million tonnes of material at an average grade of 867 ppm lithium (Li) in the Indicated category

- 5.126 million tonnes of LCE contained in 1.12 billion tonnes at an average grade of 860 ppm Li in the Inferred category

In characterizing Clayton Valley’s unique geological setting, we stated in a recent Guru offering:

“It’s important to note that unlike salt lake extraction (salars) lithium projects, where production levels are difficult to predict due to a host of variables (rain, snow, etc), Clayton Valley is a sedimentary hosted lithium deposit, which is easier to scale and production rates can be tabled with much greater predictability and confidence. This is a key differentiator.”

The first link in the economic study chain is the preliminary economic assessment (PEA) or scoping study.

Cypress tabled a very positive PEA last September.

Highlights include:

- A net present value of $1.45 billion at an 8% discount rate

- An after-tax IRR of 32.7%

- Average annual production of 24,042 tonnes of lithium carbonate over a 40-year mine life

- Capex of $482 million, pre-production, and an operating cost estimate averaging $3,983 per tonne of lithium carbonate

- An estimated 2.7 year payback period

The next link in the study chain is the pre-feasibility study (PFS). This is where Cypress is currently focusing all of its energy.

Ausenco Engineering Canada was selected as the lead consultant for this critical study. Their involvement guarantees a high quality report.

Dr. Bill Willoughby, Cypress CEO:

“Ausenco’s extensive experience in plant design and construction of lithium projects will be a valuable asset as we move the Clayton Valley Lithium Project forward through our PFS.”

A positive PFS from the likes of Ausenco, one in line with the previously tabled PEA, could trigger a major share price catalyst. It would go a long way towards de-risking Clayton Valley, attracting interest from investors and institutions alike.

The PFS update, June 17, 2019

The company is keeping shareholders in the loop with its PFS update released on June 17, 2019.

Timing of the PFS, led by Ausenco Engineering Canada, Inc., was changed by minor variations in scope and completion of key components.

Drilling performed earlier this year – a critical step in the PFS as it upgrades Clayton Valley’s resource and provides fresh material for geotechnical and metallurgical testing – was delayed due to weather and a modest expansion in the program.

We mentioned in the intro that this PFS will be a detailed, authoritative and high quality economic study. That wasn’t just patter…

Work on the process flow sheet was extended and has required additional time to finalize and apply to plant design and cost estimates. Specific attention was given to the number of leach stages, and type of equipment needed for solid-liquid separation. Related studies are completed and supplementary testing is underway, with the goal of determining the most viable means of handling clay slurries during the leaching, washing, and purification phases.

Metallurgy, another key component in the PFS process, continues with work focused on the purification and concentration of lithium in the final leach solutions.

These met studies are nearing completion as the company awaits results from third-party tests focused on ion-exchange resins, and previous assumptions made regarding concentration via evaporation.

To provide slurry for rheology and filtration study, and pregnant leach solution (PLS) for the Phase II program, a 100 kg bulk-sample was prepared at Continental Metallurgical Services (CMS). The sample contained 1,256 parts per million (ppm) lithium and utilized material from drill holes DCH-15 and GCH-6. The sample was subjected to a single-stage leach under optimized conditions of time, temperature, solids ratio, and acid concentration. Leaching yielded approximately 300 liters of PLS grading 410 ppm Li, with an acid consumption of 124 kg/tonne and 84% extraction of lithium into the PLS. These results are similar to those from previous testing.

The passage highlighted above is important. Acid consumption (a major cost driver) and the 84% lithium extraction rate are well in line with those tabled in the PEA. This is a very positive outcome.

Other work conducted for the PFS is completed or nearing completion with results of the study anticipated this summer. The resource model was updated by Global Resource Engineers (GRE), who are also in the process of completing an optimized mine plan and production schedule. For the mine plan, geotechnical testing was done using drill core from the spring drill program. Results were consistent with GRE’s Preliminary Economic Assessment (PEA) assumption for pit slopes of 30-degrees, and range from 23-degrees in the upper clay unit to 45-degrees in the lower clay unit. The topographic base for the Project was expanded with an additional aerial survey. A Phase I environmental assessment is also underway.

The first highlighted sentence in the above quote has to do with engineering – the shape and design of the envisioned open pit.

The second highlighted sentence – the initiation of baseline studies concurrent with everything else going on – demonstrates the efficiency of this Cypress crew.

The company also touched on a trespassing issue that was the subject of a press release earlier this year:

Regarding legal proceedings, the Company’s lawsuit against Centrestone Resources, LLC (“Centrestone”), a Nevada limited liability company, in which Cypress is the Plaintiff, is continuing. A hearing was held on May 7, 2019 in Goldfield, Nevada, by the Fifth Judicial Court of the State of Nevada in and for the County of Esmeralda in which the Court heard Motions for Partial Summary Judgement by both sides. At issue are the contested ownership of claims in two sections at the southern end of Cypress’ Project, and the admitted trespass of Centrestone into two other sections of Cypress’ Project. Cypress continues to respond in a timely manner to the Court. The next hearing is scheduled for July 2, 2019.

Final thoughts

In a previous Guru offering we pointed out some recent acquisitions in the lithium space that demonstrate the appetite, and urgency, of resource hungry predators looking to secure supply.

Wesfarmers A$776M cash bid for Kidman was one example. Galaxy Resource’s $22.5M investment in Alliance Mineral Assets was another.

Then on May 20th, EV battery metals hoarder Ganfeng Lithium Co, with secured agreements to supply lithium to Volkswagen and Tesla, took aim at London listed Bacanora and its Mexican claystone deposit.

Ganfeng taking down a 30% interest in Bacanora adds heaps of validity to the type of deposit Cypress is developing.

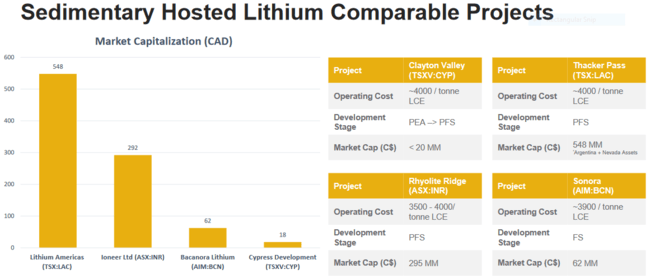

With a $15.61M market cap, based on its $74.35 million shares outstanding and $0.21 trading range, Cypress represents exceptional value, especially when matched against its peers…

END

~ ~ Dirk Diggler

Full disclosure: Cypress is an Equity.Guru marketing client. We own stock.