Rockridge Resources (ROCK.V) is an exploration company focused on acquiring, exploring & developing mineral resource properties in Canada.

Its focus is copper & base metals; more specifically — base, green energy & battery metals — of which copper is all three. Not just in any place, only top-tier mining jurisdictions such as Saskatchewan. And, only in mining districts that have had significant past exploration, development or production. And, only projects in close proximity to key infrastructure. Rockridge’s management team, Advisors & Board expertly and methodically eliminate many risk factors, early on, that can kill projects. This is a tremendous team for a company with a market cap of just CAD$5.6M/USD$4.2M.

New CEO bolsters already strong team

Late last month, Rockridge appointed Grant Ewing, P.Geo, to be its new CEO. Jordan Trimble remains as president & a director. Grant has over 25 years of experience in the Metals & Mining space. His expertise covers the entire mine development cycle, from early-stage exploration through to production.

I spoke with Grant last week and was impressed with his extensive knowledge of base metals and his understanding of the district that hosts the Company’s flagship project, Knife Lake. Grant seems to be an ideal person to help advance the Project and make new discoveries. Please see more about CEO Grant Ewing, P.Geo here.

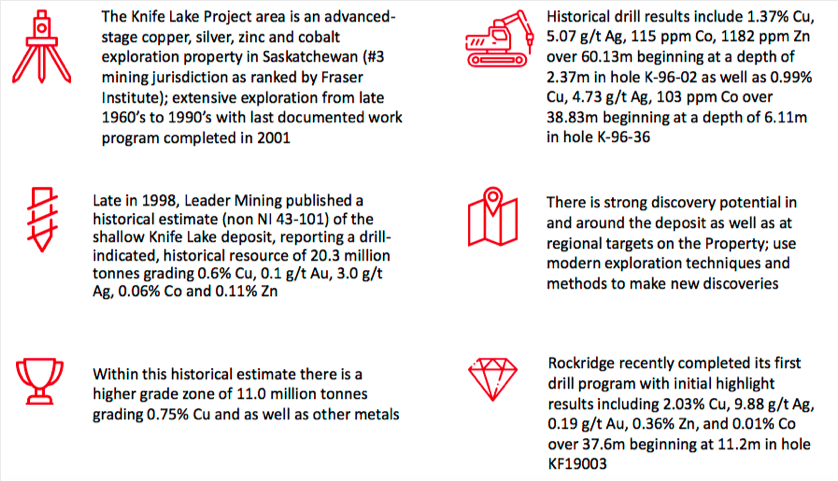

The Company’s primary project, Knife Lake, is in Saskatchewan, Canada, (ranked 3rd best mining jurisdiction in the world) in the Fraser Institute Mining Company Survey. The Project hosts a near-surface, (high-grade copper) VMS copper-zinc-silver-gold-cobalt deposit, open along strike and at depth.

Management believes that there’s strong discovery potential in and around the deposit area, and at additional targets on the roughly 85,200 hectares of contiguous claims. As a reminder, Rockridge has an option agreement with Eagle Plains Resources (EPL.V) to acquire a 100% Interest in the majority of the Knife Lake VMS deposit.

Flagship project, Knife Lake, 12 drill hole results are in….

The Project is within the famous Flin Flon-Snow Lake mining district that contains a prolific VMS base metals belt. Management believes there’s tremendous exploration upside. The goal? High-grade discoveries in a mineralized belt that could host multiple deposits, as VMS–style zones often contain clusters of mineralized zones.

However, no modern exploration, drilling or technology has been deployed at Knife Lake. It was discovered 50 years ago and last explored in the late 1990s. Airborne geophysics, regional mapping & geochemistry was done, but technologies have improved. Management believes that modern enhancements in geophysics; high resolution, deep penetrating EM and drone mag surveys covering large areas in detail, could make a big difference.

Earlier this year, Rockridge drilled 12 holes for a total of 1,053 meters. Importantly, this represents the first work on the property since 2001. Readers may recall from reading past articles & interviews on Epstein Research & Equity.Guru & Aheadoftheherd, and viewing videos of then CEO Trimble, that the Company’s primary goal is to explore districts that have been under-explored, never explored, or not recently explored.

Management’s highly skilled & experienced technical team & advisors deploy the latest exploration technologies & methods. A lot has changed in 18 years; a simple example would be the use of lower-cost, high resolution drones to fly various surveys.

These 12 assays, added to the historical database, will generate a new NI 43-101 mineral resource estimate in late July or early August. This will be a major milestone that will hopefully draw the attention of prospective strategic partners.

Subsequent to that de-risking event, Rockridge is funded for a Summer exploration program, that will likely stretch into Fall. The goal is to identify & refine targets at depth and regionally. Modern vectoring techniques will be deployed, using metal ratios & structural interpretation to identify “primary” VMS deposits.

Other modern methods include high-resolution geophysics, deep penetrating EM to identify conductors, and, as mentioned, drone mag surveys to cover large areas in detail. Finally ground work & sampling will be conducted, analyzing rock geochemistry to identify prospective VMS style hydrothermal systems.

Importantly, very limited previous drilling was done below 100m, but of the deeper holes, several intersected mineralization at around 300m. Could they be mineralized lenses?

Best intercept from first 5 holes; 37.6 m of 2.42% Cu Eq.

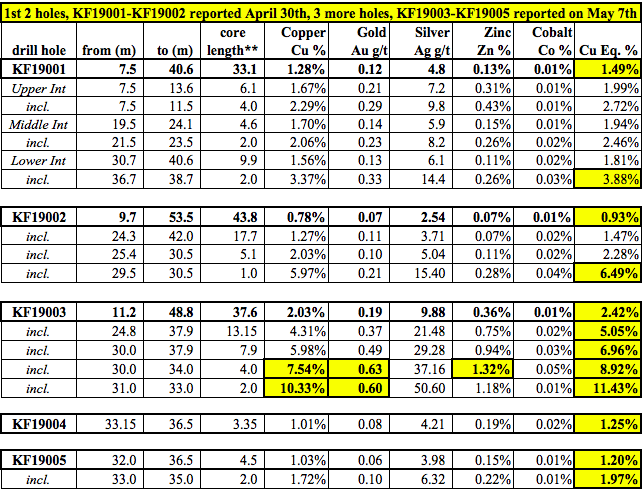

Last month Rockridge reported additional results from its Winter diamond drill program. The first 5 holes are shown in the chart above. Readers may recall that a key takeaway was that holes KF19001 & KF19002 largely confirmed historical grades, intercept widths & geological conditions. Hole KF19003, reported on May 7th, was a blockbuster, 37.6m of 2.42% Cu Eq., significantly better than the first 2 holes.

KF19003 had a grade (Cu Eq.) x thickness (in meters) value of 91, compared to 41 & 49. Importantly, it confirmed high-grade mineralization up-dip of KF19002 in an area where no historical drilling is known to have been done. Therefore, this assay, and perhaps nearby assays to follow, could potentially increase the size & grade of the upcoming mineral resource estimate.

Best intercept in last 7 holes: 15.2 m of 2.45% Cu Eq.

In the press release of June 10th, holes KF19006 thru KF19012 did not contain any blockbusters, but 6 of 7 were nicely mineralized with Cu Eq. values ranging from 0.46% to 2.45%. The interval widths averaged nearly 8 meters. The best intercept was 15.15 m at 2.45% Cu Eq. in hole KF19006. This intercept is a good one, like those found in holes KF19001 & KF19002, reported in the April 30th. press release.

Importantly, KF19006 tested the up-dip extension of the Knife Lake deposit in an area that had not been previously tested. Likewise, hole KF19007 tested the down-dip extension of the deposit near KF19006. KF19007 intersected a solid 2.95 m of 0.82% Cu Eq. grade. The latest property map provided from today’s press release is too large to fit comfortably within this article, please click on link here.

Rockridge’s CEO, Grant Ewing commented:

“The Knife Lake property package is highly prospective for new discoveries using modern exploration techniques & methods given the lack of recent field work. The known deposit is thought to be a remobilized portion of a presumably larger primary VMS deposit, and there is excellent potential for deposit expansion at depth which we plan to test in future programs. Furthermore, there are several high quality targets to test on the expansive landholding, and there have yet to be satellite deposits discovered in the vicinity as VMS systems often host clusters or stacked deposits.”

Something I found interesting was the 2 portions of the 15.2 m intercept in KF19006 that assayed 7.25 m of 0.72 g/t Gold, (from 8.75 to 16.0 m), and 5.0 m of 0.93 g/t Gold, (from 11.0 to 16.0 m), both within 16.0 m of surface. Those 2 grades (true widths undetermined) are the highest Gold values reported to date. The 0.93 g/t showing is nearly 50% higher, and 1.0 m longer, (5.0 vs. 4.0 m) than the next highest grade Gold showing, in blockbuster hole KF19003. While intriguing, these values in isolation may not amount to much. Still, it’s worth keeping an eye on.

Rockridge’s president & director, Jordan Trimble commented:

“The results from this first-pass drill program have exceeded our expectations with almost all drill holes having intersected high-grade copper mineralization, and in doing so, we have successfully confirmed the tenor of mineralization reported by previous operators, while expanding known zones of mineralization. We are working towards issuing a NI 43-101 compliant resource estimate as well as planning a regional summer field program, both of which will provide steady news flow and catalysts over the near term. We will continue to execute on our value creation strategy of going into overlooked but prospective projects in prolific mining jurisdictions and using modern exploration methodologies to test new ideas and make new discoveries.”

The deposit remains open at depth. Additional discoveries are very possible as the property is ~85,200 hectares in size and vastly under-explored. The winter drill program gives the Company’s technical team valuable information about geology, alteration & mineralization that will be applied to regional exploration targets.

The Company is now working towards completing an NI 43-101 compliant resource estimate for Knife Lake with the results from this drill program. A summer exploration program is also being planned, details to follow.

Conclusion

As mentioned, Rockridge Resources (ROCK.V) has a tremendous team — Management, Board & Advisors — for a company with a market cap of CAD$5.6M/USD$4.2M. Readers should take just 5-10 minutes to review the Company’s new June Corporate Presentation. And, the latest press releases can be found here.

The flagship Knife Lake project is large enough, at ~85,200 hectares, to keep the Company busy for years to come. Even if management were to farm out (get free-carried) a portion of the Property, there would still be tens of thousands of hectares remaining to explore in a top mining district in Canada.

Copper prices are down into the US$2.60’s/lb. from close to US$3/lb., but near-term fluctuations in the price are meaningless for anyone who believes that copper is needed for, 1) clean-green energy storage, 2) the global electrification of passenger & commercial vehicles, and 3) the surge of infrastructure building needed to accommodate a growing global middle-class population, migrating to ever-larger cities.

Not to mention the re-building of old and destroyed infrastructure like buildings, roads & bridges. Everything uses copper, everything will continue to use copper. The price of copper has to rise, or there won’t be enough copper, it’s that simple. Several experts believe that the copper price is headed to US$4-$5/lb. by 2020 or 2021. If so, a company like Rockridge Resources has a lot of leverage to that outcome.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] about Rockridge Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Rockridge Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Rockridge Resources and the Company was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.