Acquiring a ‘company maker’ project – one with the geological potential to turn a seven-digit market cap into nine – is the goal of every competent management team in the junior exploration arena.

The search is always on. Projects come to the surface in a number of ways. Some are offered privately. Some go up on the auction block when a large miner divests non-core assets. Some get coughed up when an overleveraged company hits the skids.

Some come the old fashioned way – connections.

If a management team is good, they’ll take advantage of a depressed market, acquiring assets for pennies on the dollar. If they’re really good, they’ll structure a deal where they use their own paper as currency.

The crew at Nexus Gold (NXS.V) is good. Really good.

Feb 12th news – Nexus Gold Acquires McKenzie Gold Project, Red Lake, Ontario

May 28th news – Nexus to Acquire the GB Copper-Gold Project in Central Newfoundland

Few management teams have demonstrated the acquisition savvy Nexus management has over the past seven months (note the way they structured the last three deals, using Nexus common shares to seal the deal).

Nexus now controls seven key projects in well established, geologically prospective mining jurisdictions, any one of which could be a company maker.

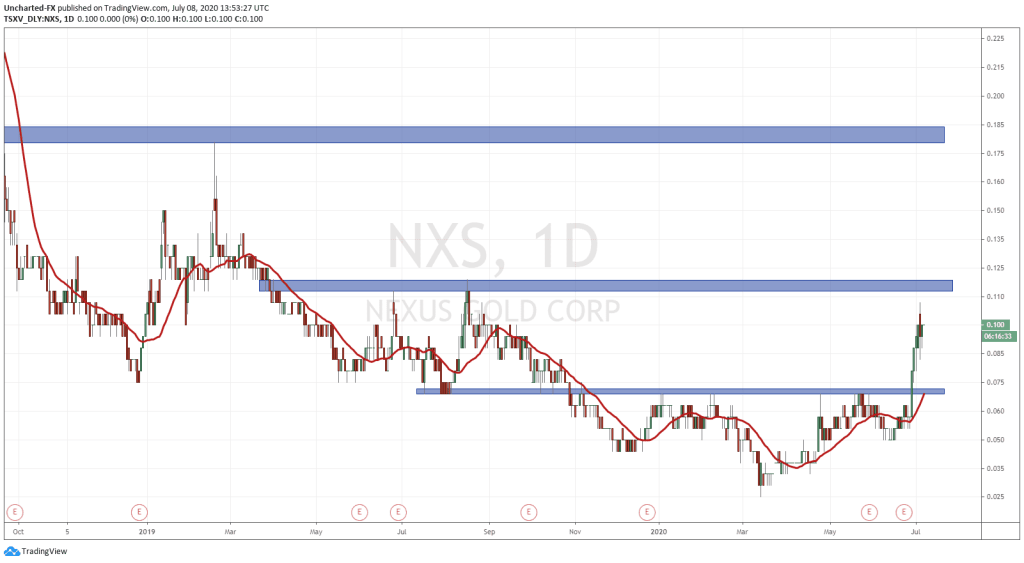

Nexus currently has 62.49 million shares outstanding giving it a low-seven-figure market cap of $5.62M based on it recent closing price of $0.09.

I see an opportunity here at current prices.

Recent developments

On June 11th, the company dropped news relating to its wholly owned, 98 square kilometer Dakouli 2 gold exploration concession located in central Burkina Faso.

Nexus Gold identifies Over 20Km of Gold Trends at the Dakouli 2 Project, Burkina Faso, West Africa

I’ve been waiting for the company to report progress out of West Africa.

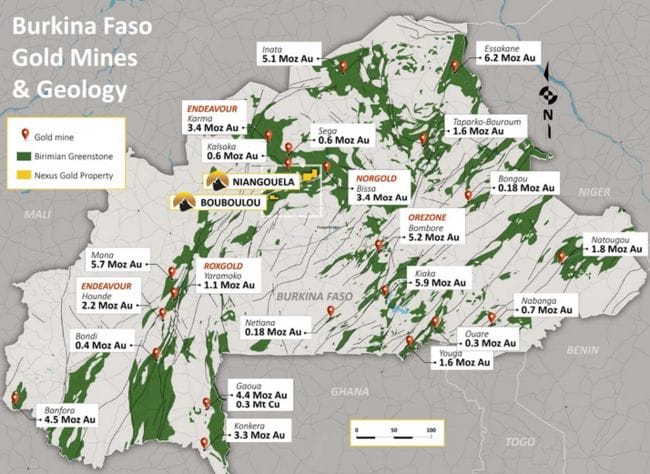

First, it’s important to understand that Burkina Faso is not without jurisdictional risk: A BBC article in May 2019 illustrated the government’s efforts to root out terrorists operating in the north along its border with Mali.

But gold plays a significant role in Burkina Faso’s economy.

Mining permits get issued.

Mines get built.

The following map aptly demonstrates the country’s pro-mining bias, and the appetite the mining industry has for Burkina Faso real estate.

Geologically, this tiny West African nation is prolific – there have been at least 15 significant gold discoveries in the country since 2006.

Back to the June 11th news:

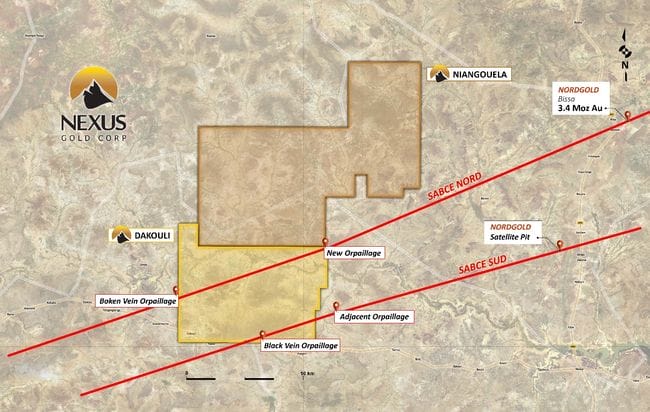

Dakouli 2 lies immediately south of the company’s Niangouela property where previous drilling encountered 26.69 g/t Au over 4.85 meters (including 1 meter of 132 g/t Au), and 4.0 g/t Au over 6 meters (including 20.5 g/t Au over 1 meter).

Those are some nice hits at Niangouela.

Dakouli 2’s June 11th highlights:

- Soil grid survey reveals three distinct gold geochemical trends

- New artisanal zone discovered, samples up to 11.3 g/t Au

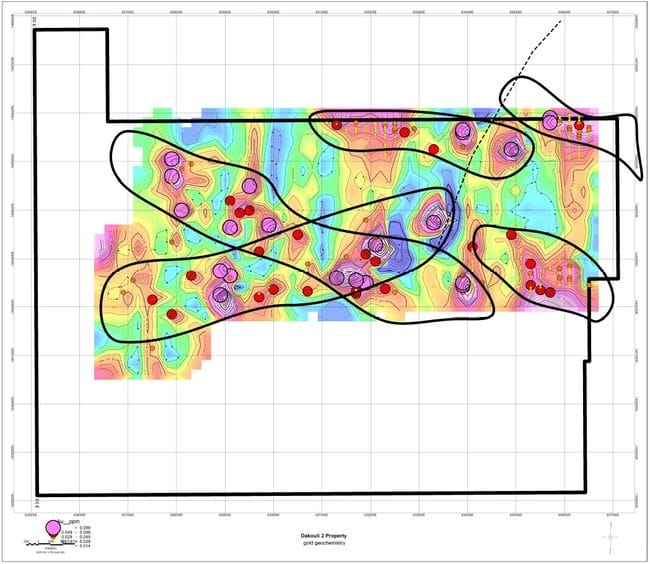

The 98 square kilometer Dakouli 2 project, located on the Goren Greenstone belt, was recently subjected to a 150-line kilometer soil geochemical survey.

The 150-line kilometer geochemical soil survey included line spacing of 200 meters with samples collected at stations established along the lines at intervals of 50 meters. A total of 3,358 samples were submitted to ACTLABS for analysis at their laboratories in Ouagadougou, Burkina Faso. The soil samples were analyzed utilizing the Au Cyanidation Atomic Absorption method.

This was an aggressive and disciplined soil sampling program. The upshot: three prominent geochemical gold trends were identified.

The primary gold trend parallels the Sabce fault zone and extends for roughly 10 kilometers in a northeast-southwest direction, bisecting the property from the north east corner to its western boundary.

The Sabce shear zone is the dominant geological feature underlying multiple gold deposits in the area, including the 3 million ounce-plus Bissa deposit currently being mined by Nordgold approximately 20-kilometers to the northeast.

Two secondary gold trends, both extending 6.5 kilometers in a northwest to southeast direction, bisect the primary trend.

All three gold geochemical trends correlate nicely with trends identified from earlier geophysical surveys.

This overlapping of sciences – geochem and geophys – adds validity to the prospective nature of Dakouli 2.

This is an interesting detail from the June 11th news:

During the survey a new area of artisanal workings was discovered, and rock samples collected from 40 meters depth at this new orpaillage returned gold values of 11.3 grams-tonne (“g/t”) gold (“Au”), 1.08 g/t Au, and 1.03 g/t Au, respectively. This orpaillage extends for some 200 meters and is located at the southern edge of the survey area.

The company is planning a detailed prospecting program to investigate these anomalous trends and new workings to identify and prioritize suitable drill targets.

The company is pulling out all the stops here, applying good science, and utilizing the knowledge and skillsets of locals working at ground level.

For those alarmed by the presence of artisanal miners operating at Dakouli 2, you need to rethink your concerns. First, their mere presence on the property confirms Dakouli has the right stuff.

Second, by scouring the immediate subsurface of the project, they provide invaluable insights regarding D-2’s underlying geology.

It’s inspiring to see this kind of cooperation between company and countrymen. It’s a win-win.

Alex Klenman, Nexus president and CEO:

“The recent grid work has produced excellent results. We have now established over 20 kilometers of gold trend, and with several areas already producing visible, nuggety gold from artisanal workings. We are anxious to drill Dakouli, and this work has given us a much better understanding of the areas we need to target. We feel Dakouli presents a higher-grade opportunity for us, and we intend to ramp up our exploration efforts there in the months to come.”

Ramping up exploration means mobilizing a drill rig. The drill rig, aka the truth machine, probes that all-important third dimension: depth.

If the company is successful in extending the high-grade gold found at surface to depth, the ounces will begin piling up in a hurry.

We stand to watch.

END

~ ~ Dirk Diggler

Feature image courtesy of Parallel Mining.

Full disclosure: Nexus is an Equity Guru marketing client. We own stock.