The CPH circus looks to be leaving town after Canadian listed PharmaCielo (PCLO.V) made an all-scrip AUD $122M offer to acquire Creso Pharma (CPH.ASX), which equated to AUD 0.63 per share when the deal was announced.

The backslapping seems to have started on what is being described as “groundbreaking news.” The first acquisition of an ASX-listed pot stock. For a premium. Well done Creso and team, yada yada yada.

Let’s not forget last year the company declared a loss of $16.8 million on revenue of $578,222.

All we see when we look is a company which was running out of options to raise further capital.

A company where the interests of the board were never aligned with those of retail shareholders.

A company where ‘looking after your mates’ was paramount. Seed rounds and the IPO were for mates. Huge swathes of shares for ‘promotional activities’ – for mates.

They’ve done a great job in the capital raising department over the past years; not hard when you have a board member who also runs a corporate advisory firm.

It’s worth noting that PharmaCielo is providing a CAD$3.5M loan to Creso as part of the terms of the deal (which they call the ‘Share Scheme’). For working capital, of course. A slap-up dinner somewhere around Barangaroo perhaps? Or a final jaunt over to the continent?

Hey baggies – here’s the nitty gritty

Firstly – you don’t get 63c a share, that’s just what the deal was valued at when it was announced on June 6. This is an all-scrip deal meaning you get PharmaCielo shares which are currently listed on the TSX-V exchange under the code PCLO.

Subject to shareholder approval, here’s how it’s likely to play out:

- Creso Pharma shareholders will receive 0.0775 PharmaCielo shares for every Creso Pharma share held.

- Creso Pharma listed option holders will receive 0.0185 PharmaCielo shares for each Creso Pharma listed option held.

Retail baggies who have been averaging-down since CPH hit its lofty intraday high of a buck sixty are now running out of time to break even.

As it stands, you’ll receive shares in a Canadian company whose stock price has been falling over the past few trading days.

While there was a nice little pop when trading resumed on the ASX on Friday, that ‘premium’ could all but disappear soon as Monday, June 10 was a public holiday in Australia and we’ll need to wait and see how the Aussie traders and arb bots feel about the falling PCLO share price when they turn the machines back on.

Sansa Stark Alcohol GIF – Find & Share on GIPHY

Discover & share this Alcohol GIF with everyone you know. GIPHY is how you search, share, discover, and create GIFs.

The question retail traders are now asking is ‘should I sell or hang-on?’

That’s your call; we can’t help you there.

Many, however, will have their hands forced when it comes to selling their CPH holdings ‘on market’. We suggest you check with your broker to see if they have the ability to hold Canadian securities as we suspect many will not.

Although the agreement covers a sale facility, whereby Creso acts as an agent in selling your newly acquired PCLO stock and passing you the proceeds, this only appears to apply to shareholders whose new PCLO holdings are less than $500.

If our math is correct that’s a holding of 6350 CPH shares or less. Not a whole lot.

What do the cool kids over at ceo.ca think of the deal? Talk of paper acquisitions to expand your global footprint reeks of a Wayland (WAYL.C) type move.

The consensus seems to be it was a ‘sell the news’ event and that’s exactly what traders did to PCLO stock sending it down nearly 10% on Friday. While it’s not unusual for the predator’s stock price to take a hit on this type of news, the extent of the decline suggests the stink factor was attached.

As we go to press there is little change in the PCLO stock price from Friday’s close with shares changing hands at CAD$6.75 each.

CEO.CA #pclo Pharmacielo Ltd. (PCLO.V)

Real-time discussion about Pharmacielo Ltd. (PCLO.V)

Who are PharmaCielo? Time to do your DD..

Fair question – they are a Colombian-focused cannabis company which only listed on the TSX-V in January 2019, but their share price has held up well. If you read the following SeekingAlpha article you’ll understand why.

Pharmacielo (PCLO) : A Tsunami In The Cannabis Space. – Paul-Samuelson

The marijuana industry landscape is about to experience a tremendous reorganization of the supply chain. With his 15 million square feet and 0.05 $ per gram production capacity, Pharmacielo (TSX-V) brings ground breaking outputs: 5 300 000 kg production capacity per year.

They are also a constituent of the Horizons Marijuana Life Sciences Index ETF (HMMJ). As of June 7 2019, they represented 0.78% of the fund’s holdings.

Colombia is an emerging powerhouse in weed production with ideal growing conditions, serious agricultural street cred and access to cheap labour.

Here at Equity.Guru we’re well versed on the Colombian story with client Chemesis International (CSI.C) making moves in the space.

The music’s stopped. Who’s left standing?

Miri Halperin Wernli

Dr. Wernli has scored a directorship with PharmaCielo. The parties are still in discussion ironing out the finer details surrounding her salary package.

Adam Blumenthal

It was all going so well for Blumenthal until the ASX finally placed extra scrutiny on EverBlu over the Manalto “related party” share transactions. It’s not that others don’t use the same playbook:

It’s standard. They get a shell, option themselves up to buggery, get on the board, get cheap shares, ignore existing shareholders and pay themselves fees,” said one industry observer, who claims the Blumenthals understand this way of doing business better than most

Then things went from bad to worse when Blumenthal was charged with assaulting Manalto chairman Terrence Clee.

Everblu’s Adam Blumenthal charged with assaulting Manalto chairman

In a statement, NSW Police said the two men were known to each other. Which is putting it mildly. Clee is or has been a director or consultant at numerous Everblu-advised companies, including Rafaella Resources, Victory Mines, Hardley Resources, Creso Pharma, and Manalto, which he still chairs (and where Blumenthal is a 19.63 per cent shareholder).

Could this be the end of the line for Blumenthal’s association with Creso? If so he still walks away with all his performance rights vesting (if they hadn’t already done so) by virtue of the Scheme Implementation Agreement between the two parties.

And EverBlu pick up a 3% fee on the PharmaCielo deal. 😉

Assad Tannous

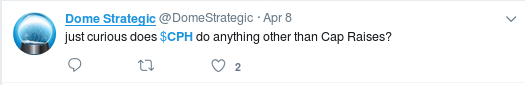

Assad Tannous was recently spotted in one of Bangkok’s red-light districts. He has spent the last year on sabbatical, which coincides with the breaking of the Twitter ‘cash-for-comment’ scandal.

Given that he sold down his stake in Creso, allegedly without alerting his followers, the kitty was well-primed for a year-long global jaunt.

Hey, bagholders, now you know where your money went – “That was us!”

Tweeting investor sells down Creso Pharma stake

Last month, Mr Tannous, told The Australian Financial Review he hadn’t been paid to promote Creso, or any other stock. Mr Tannous said he provided “corporate work”, and that he planned to ask the company to correct its statement.

–Craig Amos

FULL DISCLOSURE: Chemesis International are an Equity.Guru marketing client.