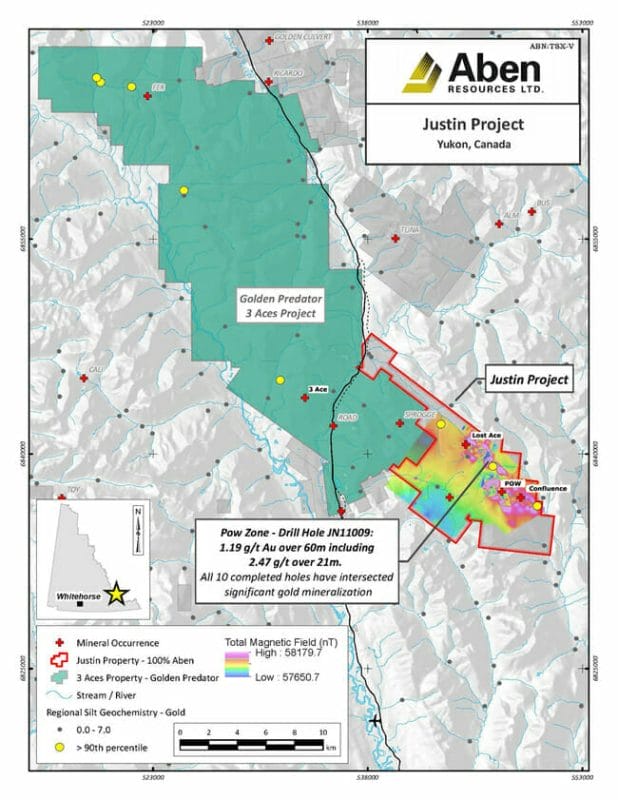

After weeks of anticipation, Aben Resources (ABN.V) has finally commenced drilling at its wholly owned Justin gold project in the eastern Yukon, setting the stage for a new era of precious metals exploration in Canada.

Justin is a highly ambitious project that spans a whopping 18,314 acres and features plenty of gold-bearing structures.

Aben digs deep

In an official press release on Monday, Aben Resources announced that it has initiated its 2019 exploration program at Justin. Located in the eastern Yukon, the Justin site entails prospect-generating fieldwork,1,350 metres of diamond drilling and 600 metres of rotary air blast drilling (RAB).

RAB is viewed as one of the most economical exploration techniques in the mining industry. It entails drilling a three-inch hole and evacuating the soil and rock samples through air. It’s cheap and highly effective.

The first phase of drilling in the resource-rich area will focus on the Lost Ace zone, which is located about two kilometres west of the POW zone. Lost Ace yields up to 20.8 grams per tonne of gold over 4.4 metres, according to a 2018 excavation of the region.

Concurrent with the Ace Zone drilling, Aben will conduct diamond drilling at the POW zone, a region that has already been mapped for mineralization.

Aben describes both drilling regions as “exciting targets” that could yield big results.

Golden Triangle hot again

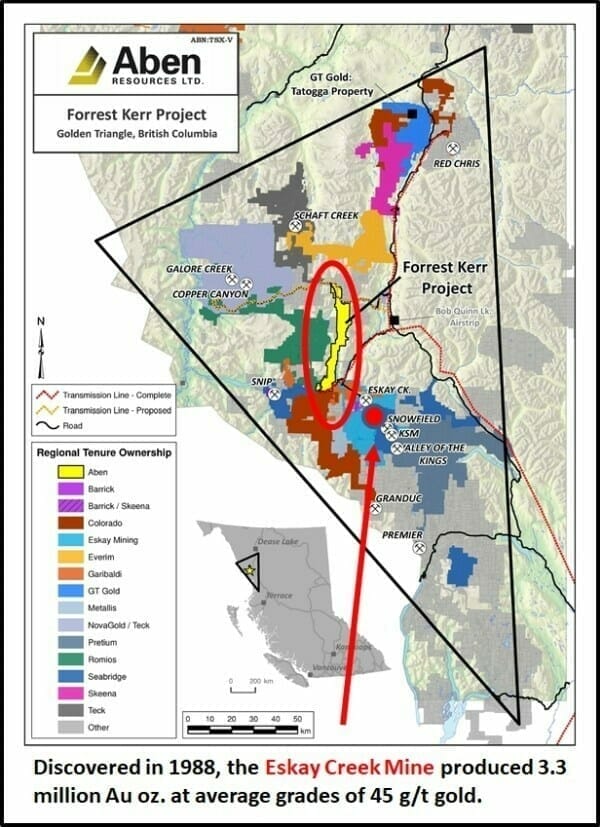

In addition to its Yukon operations, Aben Resources is active in another mineral-rich region: B.C.’s prolific Golden Triangle.

Aben has already made significant gold discoveries in the region at a time when exploration projects were few and far between. The Forrest Kerr Gold Project, which is located in the heart of the Golden Triangle, spans a massive 23,000 hectares in a favourable geological setting.

Geologists recently drilled the Golden Triangle to understand what created such a massive concentrated of bullion. They found 41,582 grams per tonne gold over a 0.5 metre drill site. Several intersections exceeded 1,000 g/t, “grades rarely seen in gold deposits,” according to Mining.com.

As far as Forrest Kerr is concerned, Aben recently secured a five-year exploration permit that will allow it to deploy resources across 55 drill sites and helicopter pads.

Value over volume

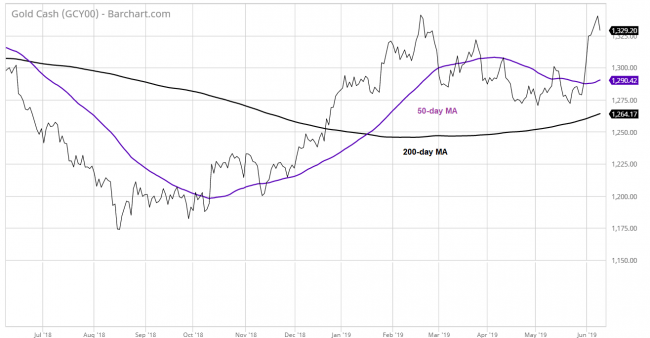

Gold miners have seen their market cap cut in half since 2012, just one year after bullion prices peaked near USD$1,900 a troy ounce on the Comex division of the New York Mercantile Exchange. The industry quickly shifted its focus to maximizing value over volume, as evidenced by the sharp drop in production.

The era of endless money printing by central banks created plenty of liquidity in the stock market, which drove equity prices to record highs. Demand for risk-on assets made traditional safe havens like gold less attractive to investors.

But things are radically changing.

Although low interest rates and money printing have become the standard for central banks looking to prop up their economies, demand for gold is increasing amid fears of a sharp slowdown in economic growth.

In other words, nobody is convinced that central banks can rescue economies anymore. Go look up what the European Central Bank and Bank of Japan are doing. And while you’re at it, read about the U.S. Federal Reserve’s epic capitulation on the topic of interest rates. It’s great stuff!

Hell, even central banks themselves are buying gold at a rapid pace. China recently added to its bullion reserves, buying an additional 61.61 million ounces in May. The People’s Bank of China has purchased around 74 tonnes of the yellow metal since the end of November.

Central banks around the world collectively added 651.5 tonnes of bullion to their coffers in 2018, the most in half a century, according to the World Gold Council.

The International Monetary Fund, World Bank and Organization of Economic Cooperation and Development have all lowered their global growth forecasts this year. Morgan Stanley recently said that a U.S. recession is possible within a year if the trade war with China gets worse.

Why does that matter? Because the U.S. is pretty much the best-performing advanced economy right now. Recession there paints a pretty bleak outlook for global economies and their stock markets. It’s hard to imagine a scenario where demand for gold doesn’t rise.

That’s a long-winded way of saying that companies like Aben Resources will garner more attention in the future as interest in precious metals heats up again.

Full disclosure: Aben is an Equity Guru marketing client, and we own the stock.