Heritage Cannabis Holdings (CANN.C) has entered into a binding term sheet that will serve as the basis for a mutual supply and a services agreement with Zenabis Global (ZENA.V) on May 8th, 2019.

Purefarma Solutions, Heritage’s wholly owned subsidiary, will provide toll extraction services and oil extraction to Zenabis in exchange for supply of dried flower and trim for extraction.

The initial agreements will see Zenabis deliver a minimum of 500 kg of dried flower and trim to Heritage, and in return Heritage will supply Zenabis with a minimum of 150 kg of CBD or THC extracted distillate, both to be delivered by the end of 2019.

“This is a great opportunity to leverage the strengths of Zenabis and Heritage for the mutual benefit of both companies. We look forward to creating something special to bring to the market,” said Andrew Grieve, CEO of Zenabis.

The open ended term sheet includes options for both Heritage and Zenabis to pursue formulated CBD distillate, CBD isolate, Liquid oil THC distillate and THC and CBD concentrates. Scientists from the two companies will collaborate to create specialized products that should go on shelves in summer 2019 pending regulatory approval.

This arrangement includes both British Columbia and Ontario for extraction services, while Zenabis will supply the cannabis product from their facilities in New Brunswick, Nova Scotia and British Columbia.

Zenabis was formed via an RTO in January 2019 through the combination of propagator, Bevo Agro and Sun Pharm Investments, a large cannabis producer with established medical and recreational brands and distribution.

The company owns six indoor and greenhouse facilities across Canada, four of which are intended for cannabis cultivation. If all four of those greenhouses were completely built out and converted to cannabis production, they would bring in 479,300 kilograms of dried cannabis per year.

Zenabis also has access to an addition 700,000 square feet of greenhouse space that can be used to continue an existing plant propagation business.

This agreement comes only days after the company acquired $17.3 million in assets.

“The Company intends to use the net proceeds from the Offering to increase extraction capacity and follow-on investments in existing portfolio companies, new domestic and international opportunities, working capital and general corporate purposes,” according to execs.

The deal was announced May 7, 2019 and includes a full exercise by the underwriters for an additional $2.257 million worth of shares. The units were purchased at $0.53.

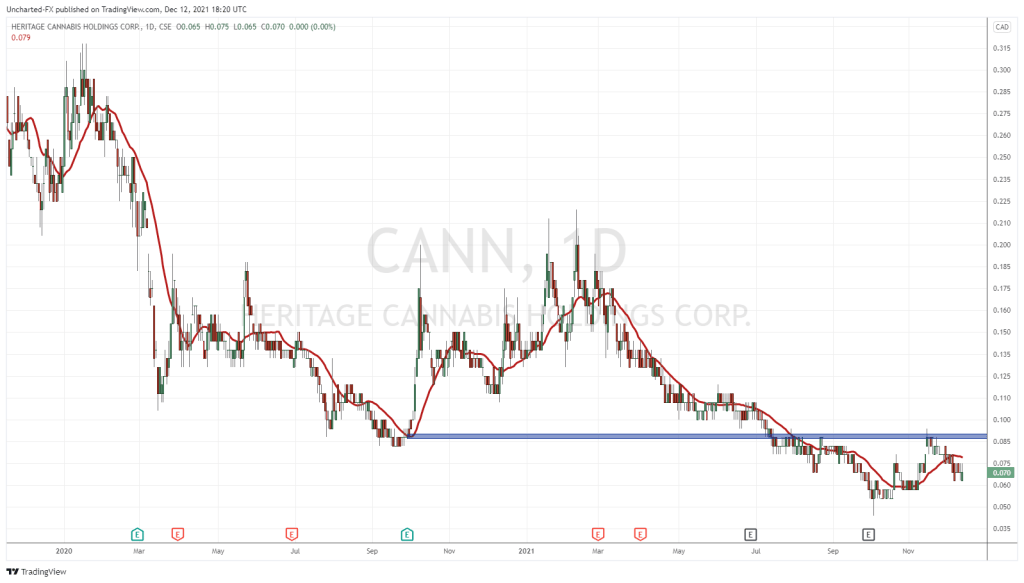

Heritage has had a great showing in 2019 so far, climbing up from a low of $0.18 in January to peak April 1 at $.70 and holding at $0.51 at the time of this writing.

They have 436,764,734 shares issued and outstanding and a market cap of $231.4 million.

—Joseph Morton

Full disclosure: Heritage Cannabis Holdings is an Equity.Guru marketing client.