Canadian cannabis grower Rubicon Organics (ROMJ.C) has its sights firmly set on domestic expansion.

On Wednesday, the Vancouver-based company confirmed it had secured additional financing to fund product and brand development in the organic cannabis market.

Cash infusion

In a Wednesday press release, Rubicon Organics announced it has secured an additional $5 million from an overseas fund to help finance a new 125,000 square foot cultivation facility in Delta, B.C.

With the loan, Rubicon has now secured upwards of $14.3 million in mortgage debt financing to expand operations.

Rubicon Founder and CEO Jesse McConnell commented on the latest financing round:

“We are very pleased to complete this third tranche of a broader financing package … This funding will enable us to build out Rubicon’s Delta facility in order to execute on our business plan of cultivating and developing super-premium, certified organic cannabis products and brands in the Canadian market.”

In connection with the loan, Rubicon issued one million common share purchase warrants at an exercise price of $4.50 until May 28, 2022. Warrants entitle the holder to purchase the underlying stock at a fixed price until the expiry date.

Rubicon’s share price responded positively to the news on Wednesday, having gained as much as 3.3% in Toronto trading The stock is holding well above $3.00, having gained a whopping 70% year-to-date.

ROMJ.C has a total market capitalization of $114.1 million. Despite its strong performance this year, the stock is trading well below its 52-week high. Bargain-hunters may find current levels attractive as the company rushes to fill the organic cannabis void left by some of the country’s biggest producers.

Organic cannabis: an even higher cause

Cannabis legalization has created a multi-billion-dollar industry that is expected to grow manifold over the next decade as businesses rush to capitalize on enormous pent-up demand. The once au naturel image of leafy green cannabis goes out the window once mass production enters the mix.

Cannabis for mass consumption requires indoor facilities that are extremely energy-intensive and rely heavily on fertilizers, pesticides, herbicides and rodenticides. When cannabis was the domain of the drug cartels, we rarely worried about this sort of stuff.

With legalization, the ecological impact of production cannot be ignored. Add Socially Responsible Investing to the mix and you have a new breed of investors who aren’t motivated solely by profit. Nah, they want to ensure that the company they are investing in supports environmental and social causes.

That’s where organic cannabis comes into play.

Rubicon has built its entire business on the mission statement that the future is organic. To that end, it has already secured 165,000 square feet of grow space focused exclusively on the super-premium organic cannabis market.

While there are no hard numbers on the size of the organic cannabis market, demand is likely to be huge.

For starters, more than half of Canadian marijuana consumers prefer an organically grown product, according to a December 2017 study by Hill+Knowlton Strategies. And a higher price tag won’t deter them, either.

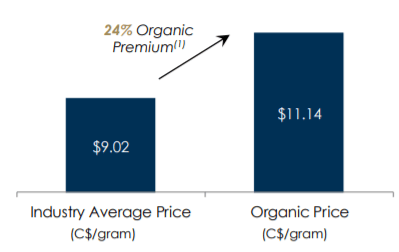

As Rubicon outlined in a 2018 investor presentation, organic marijuana products have a 24% price premium compared with the industry average.

On the supply side, Big Cannabis is already rushing to fill the gap. The Green Organic Dutchman (TGOD.T) raised a whopping $260 million through public and private proceeds largely on the assumption that it will address growing demand in the organic cannabis market.

Although Rubicon isn’t as big as some of Canada’s other marijuana growers, it’s one of only four certified organic cannabis producers in the country. That’s first-mover advantage in a segment that is likely to attract considerable attention moving forward.

Full disclosure: Rubicon Organics is an Equity.Guru marketing client.