Nexus Gold (NXS.V) is an aggressive ExplorerCo with considerable jurisdictional range. And the company continues to widen the extent of its robust portfolio of projects.

Let’s take stock of what the company’s got, so far:

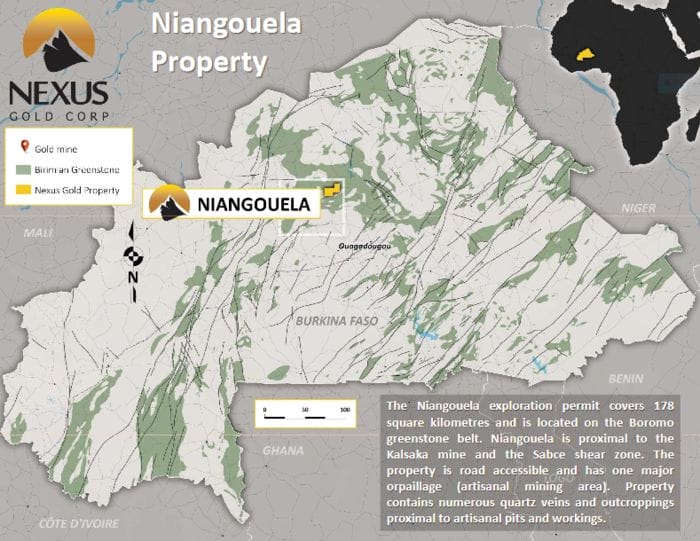

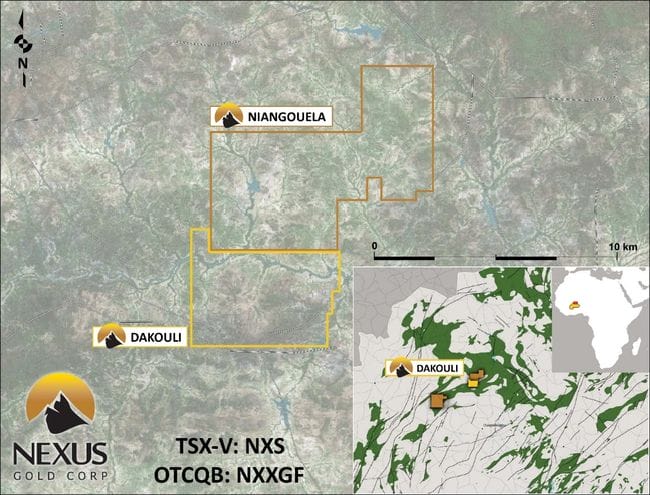

Nexus controls 560 kilometers of highly prospective ground in gold-rich Burkina Faso, West Africa.

The Burkina Faso project portfolio:

The Bouboulou – Rakounga project (288-sq kilometers) includes eight drill-tested gold zones along a 16 kilometer trend.

Drilling across the project – over 60 holes (historical and current) – has returned significant gold intercepts in both length and grade.

The high-grade Niangouela project (178-sq kilometers) returned several noteworthy drill intercepts highlighted by 26.69 g/t Au over 4.85 meters including 132 g/t Au over 1 meter.

Rock samples taken from artisanal shafts in and around the main quartz vein and associated shear zone include 2,950 g/t Au, 403 g/t, 49.8 g/t Au, 23.9 g/t Au and 14.3 g/t Au.

The Dakouli 2 Project (98-sq kilometers), a recent acquisition, is in a very good neighborhood.

A recent surface sampling program revealed abundant visible gold, including coarse nuggety samples grading up to 29.5 g/t Au.

Speaking of recent acquisitions…

As mentioned in the intro, Nexus is broadening the extent of its jurisdictional scope.

You might even think the company has been on a bit of a spending spree of late, having secured three key acquisitions in the past six months.

A spending spree?

Well, yes and no. The parties involved – the vendors of all three projects – have been adequately compensated for their real estate, but for the most part, Nexus used its own paper as currency to seal these deals.

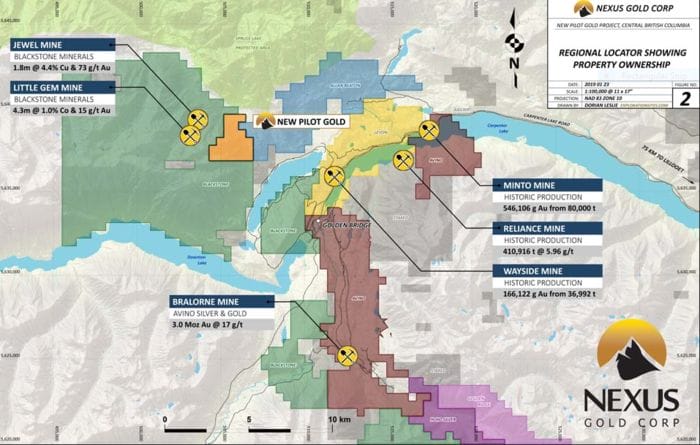

The New Pilot project, located in the Bridge River Mining Camp near the village of Gold Bridge, BC, was acquired for 3,500,000 Nexus common shares last November.

A couple of months later, Nexus made a move into The High-Grade Gold Capital of the World.

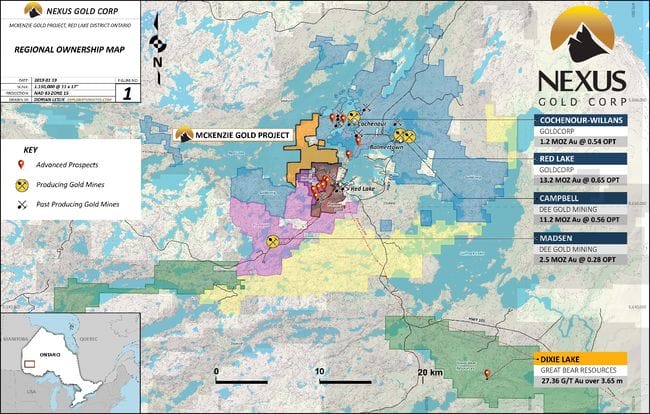

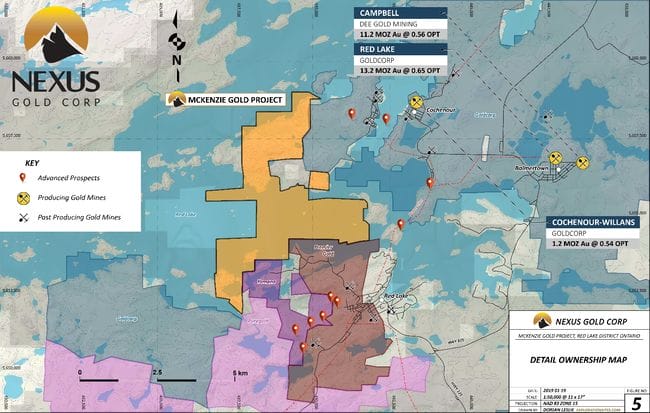

The McKenzie Gold project, located in the prolific Red Lake Mining Camp of northwestern Ontario, was acquired for 4,000,000 million Nexus common shares, plus a one-time cash payment of $150,000.

(This acquisition was a real coup in my view. McKenzie, which was being pursued by another company, suddenly popped loose when the deal fell apart. It took only one week for Nexus to home in, negotiate terms and lock McKenzie down)

Then, yesterday, May 28th, the company dropped the following piece of news:

Nexus Gold to Acquire the GB Copper-Gold Project in Central Newfoundland

The price of admission for the copper-gold project they call Gummy Bear: 4,000,000 Nexus common shares, plus a 2.0% net smelter royalty (NSR) should the project enter commercial production (a cash payment of $1,000,000 reduces the NSR to 1%).

Let’s take a look at what Nexus is getting for its 4,000,000 shares:

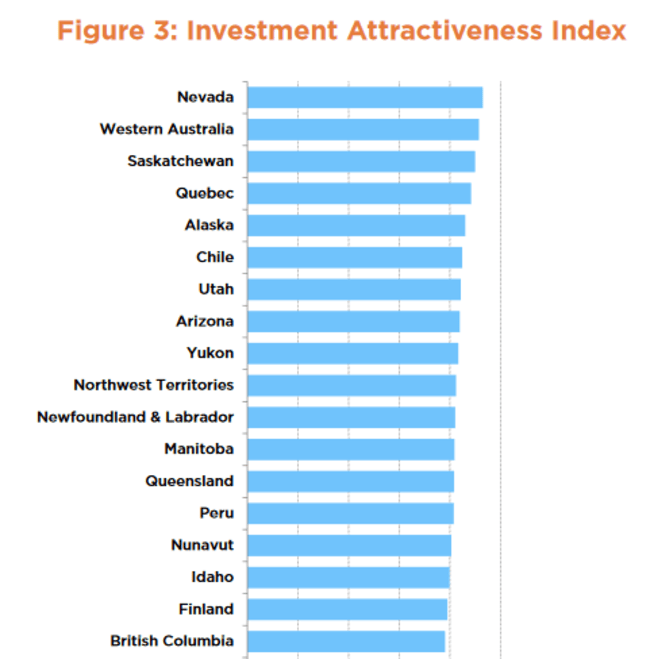

Newfoundland, home to a number of producing mines, is a world-class mining destination for a company looking to broaden its horizons.

As a jurisdiction, Newfoundland and Labrador fell just short of making the Fraser Institue’s top ten:

Incidentally, Canada’s Maritime provinces received a shot in the arm two weeks back when St Barbara (SBM.ASX) took out Atlantic Gold (AGB.V) in a deal valued at Cdn $802 million.

ST BARBARA TO ACQUIRE ATLANTIC IN FRIENDLY OFFER FOR C$802MILLION

Nexus’ foray into Canada’s Maritimes couldn’t be better timed.

Gummy Bear’s nitty-gritty

The Gummy Bear project is located in Central Newfoundland, 15 kilometers south of South Brook and 40 kilometers north of Badger on the Trans-Canada Highway.

Gummy Bear consists of seven claims totaling 2,525 hectares.

Road access is excellent through and through.

Gummy Bear’s geology

The Project is underlain on the eastern side by mafic volcanics of the Roberts Arm Group, a steeply dipping, attenuated and deformed sequence of dominantly submarine volcanics and volcanogenic rocks. Much of the central part of the Project is underlain by the Gull Island Formation (Badger Group), comprising marine siliciclastics. A tectonized block of melange termed the Sops Head Complex occurs locally. Marine siliciclastics of the Pennys Brook Fm (Wild Bight Gp) occur to the north. Marine sandstones of the Crescent Lake Fm (Roberts Arm Gp) underlie parts of the NE section of the Project.

Based on a rock outcrop which assayed up to 4.2 g/t Au, Nexus management likes Gummy Bear’s gold potential.

The property also has copper. The discovery of several large boulders containing pyrrhotite, pyrite, and chalcopyrite (a copper iron sulfide mineral) returned assays ranging from 2.76 to 4.02% Cu.

Geophysics (aeromagnetic and electromagnetic surveys) conducted back in 1989 identified six parallel conductors several kilometers to the east of the boulder train.

Three additional showings – the Moose Brook Showing, Tommy’s Arm, and the Rocky Point Copper showing – occur in the western portion of the claim block (note the locations on the above map).

Mineralization is described as consisting of disseminated chalcopyrite, pyrite and possibly molybdenite in the mafic to felsic flows of the Roberts Arm Group (Elias, 1957). Alteration includes graphite and several narrow bands of hematite. Pyrite occurs with the graphite. Mineralization is interpreted as pre-to syn-tectonic. Elias (1957 estimate that 1-2% Cu is present). The Tommy’s Arm Fault runs through the mineralized area and may be a structural control for the mineralization.

Closing thoughts

This crew – a proven team boasting discovery and development success – has no intention of simply banking these new projects and waiting for the resource cycle to turn.

The second half of 2019 promises to be busy.

Having recently cashed-up, the company has boots on the ground at McKenzie…

Nexus Gold to Begin Exploration Work at McKenzie Gold Project, Red Lake, Ontario

The New Pilot project will also be getting the boots soon…

Nexus Gold Enters Into Letter of Intent for Exploration Financing of New Pilot Project

In Burkina Faso, the company is planning to drill their Niangouela and Bouboulou-Rakounga projects with the objective of delivering a 43-101 compliant resource estimate over the next year or so.

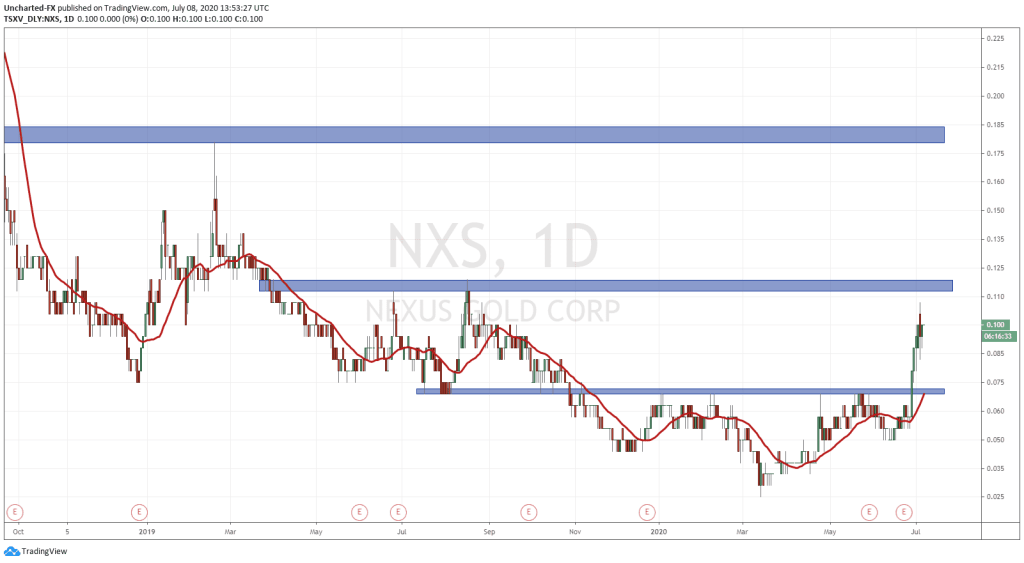

The company’s 62.49 million shares outstanding and sub-dime share price give this jurisdictionally diversified ExplorerCo a market cap of $5.31M. That strikes me as ridiculously cheap. Btw, Sandstorm Gold (TSX: SSL) is in for roughly 17% – that speaks volumes.

Greater insights into the company can be gleaned via the following Guru offerings:

Nexus Gold (NXS.V) puts boots on the ground at Red Lake

Updating our dirt-cheap Abitibi Greenstone Belt ExplorerCos

Nexus Gold (NXS.V): the messenger has arrived!

Gold: uncharted waters – the technicals, the peak of discovery, the opportunity

END

~ ~ Dirk Diggler

Full disclosure: Nexus is an Equity Guru marketing client. We own the stock.