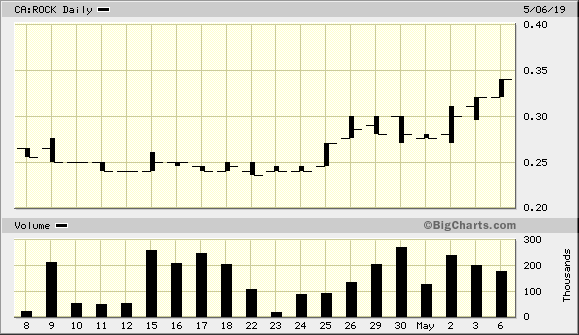

In the few short weeks that we’ve been covering Rockridge Resources (ROCK.V), the stock has put on a pretty good show, and rightfully so.

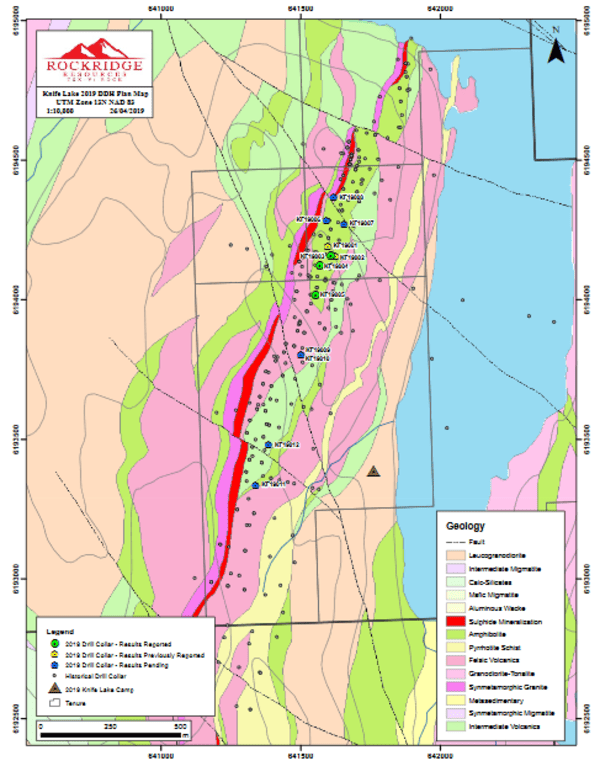

Last week the company released assays from its inaugural winter diamond drilling program at its flagship Knife Lake project located in Saskatchewan.

The first set of assays to come out of this project were impressive:

April 30th News: Rockridge Intersects High Grade Copper in First Two Drill Holes at Knife Lake Project including 1.28% Cu and 1.49% CuEq over 33.1m Starting from 7.5m Downhole

The headline numbers represented a fat hit – a thick interval that began within a few meters from surface.

A few pertinent details before we move on to today’s assays:

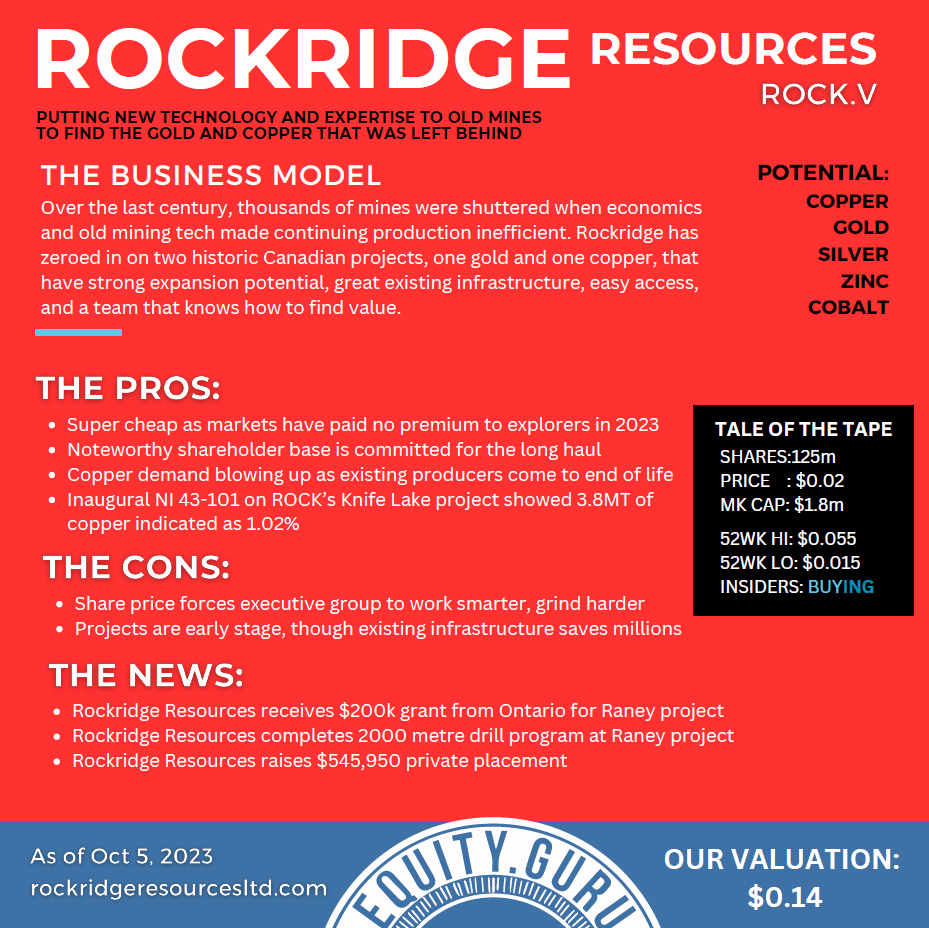

Rockridge’s focus is on the acquisition of advanced stage battery metals projects, specifically those in the copper space.

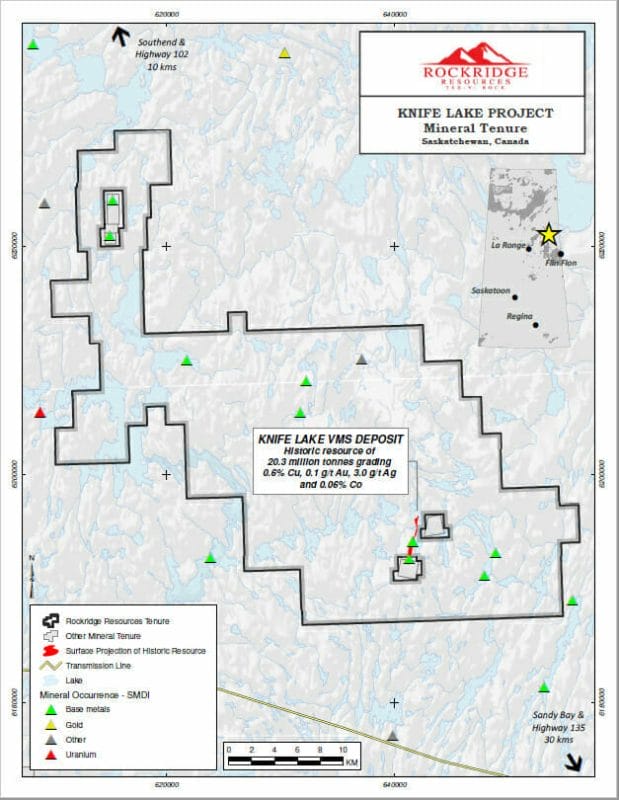

The company flagship asset – Knife Lake – is located northwest of Flin Flon, along one of the most prolific greenstone belts on the entire planet, in a province held in the highest regard by the Fraser Institute’s annual survey of mining jurisdictions.

Since the discovery of base metal mineralization in 1915, the Flin Flon camp has produced over 170 million tons of sulphide ore from 31 VMS deposits worth in excess of $25 billion dollars.

$25 billion?!

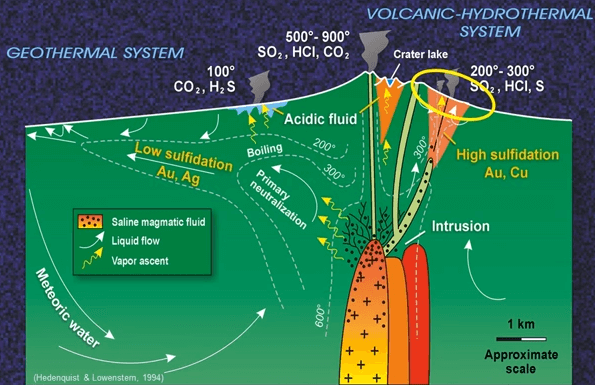

Those who know their rocks know that VMS deposits are unique, special – where there’s one, there are often others.

Now consider that ROCK’s 85,000 hectares – a VMS setting – is vastly unexplored. Historic conductors, alteration and mineralization at regional targets require follow-up boots to the ground sampling, geophysics, and a few well placed pokes with the drill bit. The exploration upside at Knife has to be considered excellent.

Knife Lake has a historical resource (non NI 43-101 compliant) of some 20.3 million tonnes grading 0.6% copper, 0.1 g/t gold, 3.0 g/t silver, 0.06% cobalt and 0.11% zinc. Within this resource is a higher grade zone containing 11 million tonnes grading 0.75% copper.

This (historic) resource was acquired at less than one-half penny per lb of copper.

Something else: the Flin Flon camp is running out of ore. Mining infrastructure worth $1.6B – road, rail, power, and water – could use a significant new discovery or two. When you add this to the fact that the electric vehicle (EV) supercycle is intensifying, ROCK’s timing couldn’t be better.

(EVs use twice as much copper as internal combustion engines, in case you didn’t already know).

For a more rigorous examination of ROCK’s compelling fundamentals, follow the links below (be sure to vet management’s resumes):

Rockridge Resources (ROCK.V): one of Canada’s newest copper exploration companies

Rockridge Resources (ROCK.V) taps high-grade copper at Knife Lake

Today’s news

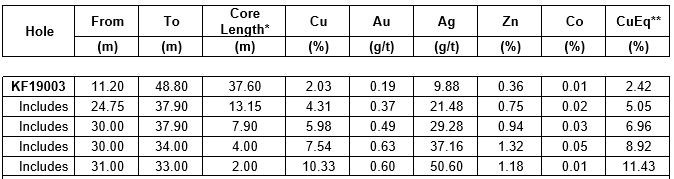

“The analytical results are summarized below and indicate high grade intercepts in all three holes including a broad intercept in KF19003. Drill hole KF19003 intersected net-textured to semi-massive sulphide mineralization from 11.2m to 48.8m downhole. This 37.6m interval returned 2.03% Cu, 0.19 g/t Au, 9.88 g/t Ag, 0.36% Zn, and 0.01% Co for an estimated 2.42% CuEq. Drill hole KF19004 intersected net-textured sulphide mineralization from 33.2m to 36.5m downhole. This 3.4m interval returned 1.01% Cu, 0.08 g/t Au, 4.21 g/t Ag, 0.19% Zn, and 0.02% Co for an estimated 1.25% CuEq. Drill hole KF19005 intersected net-textured sulphide mineralization from 32.0m to 36.5m downhole. This 4.5m interval returned 1.03% Cu, 0.06 g/t Au, 3.98 g/t Ag, and 0.15% Co for an estimated 1.20% CuEq. Anomalous gallium (up to 25.6 ppm) and indium (up to 15.2 ppm) were also intersected in the mineralized zones of all three holes.”

The included sections within the broader interval of 2.42% CuEq over 37.6 meters in hole KF19003 are exceptional. Below is a breakdown of these high-grade sections:

I can only imagine the onsite geo’s reaction when the core from this 11.43% CuEq interval came to the surface.

Rockridge president and CEO, Jordan Trimble:

“The results from drill hole KF19003, specifically 2.42% CuEq over 37.6m, have far exceeded our expectations and represents one of the best holes ever drilled on the project. It is important to note that this drill hole was collared in an area where no historical drilling has been reported. As such these drill results are expected to have a positive impact on the historical resource. Final results from the remaining seven drill holes are pending and will provide steady news flow and catalysts over the near term.”

The underlined sentences in the above quote are key. With these results, the company has successfully converted waste rock into ore.

Encountering 2.42% CuEq over 37.6 meters in an area that was once considered barren rock will add tonnage. I’m expecting the resource to grow.

Potential catalysts

There are seven additional holes to be released over the next two months. That takes us into summer. Then, in Q3, the company plans to release an updated NI 43-101 compliant resource.

Continued success with the drill bit is always a potent catalyst. There is potential for further mineralization below the current (historic) resource – we may see a few well-placed deep holes later in 2019.

The folks at TerraLogic are already crunching the numbers. A resource update, one that sports a high-grade zone of near surface copper, is another potential catalyst that could give the company a whole new gear.

We mentioned earlier that Knife Lake is a VMS type setting. The project’s 85,000 largely unexplored hectares are ripe for new discoveries.

A significant new discovery will definitely give ROCK a whole new gear.

Final thoughts

These are exciting times for the company, and shareholders.

The market knows good results when it sees them:

With 25.44 million shares outstanding, the company has a market cap of $8.65M based on its recent close at $0.34.

Additional drill results are due in the coming weeks. A resource estimate due in Q3.

We stand to watch.

END

~ ~ Dirk Diggler

Feature image courtesy of UpcomingWorldNews.

Full disclosure: Rockridge is an Equity.Guru client. We own stock.